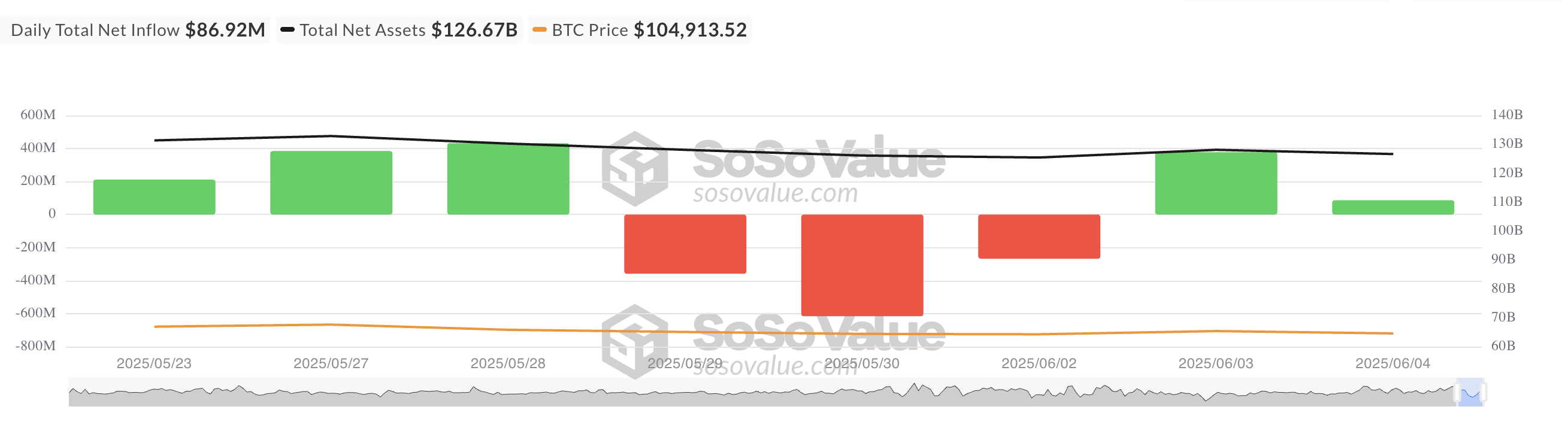

Bitcoin spot ETF recorded over $85 million in net inflows on Wednesday, indicating continued institutional interest in the asset class.

However, this figure has sharply decreased from $378 million registered on June 3rd, highlighting a waning investor interest.

Bitcoin Traders, ETF Inflows Decline… Retreat

On Wednesday, the net inflows of US-listed spot BTC ETF reached $86.92 million. While this figure indicates ongoing investor interest in these investment funds, it represents a 77% decrease from the $378 million posted on June 3rd.

This slowdown is primarily attributed to BTC price stagnation around $105,000 since May 30th. As the coin failed to break through this critical resistance level, investor sentiment weakened, and new capital inflows into US spot BTC ETFs were limited.

Yesterday, BlackRock's IBIT had the highest daily inflow of $283.96 million, with total historical net inflows reaching $48.78 billion.

In contrast, Fidelity's FBTC recorded the largest net outflow among these ETFs, with $197.04 million leaving the fund.

BTC Stagnates Below $105,000… Options Traders Eye Potential Rise

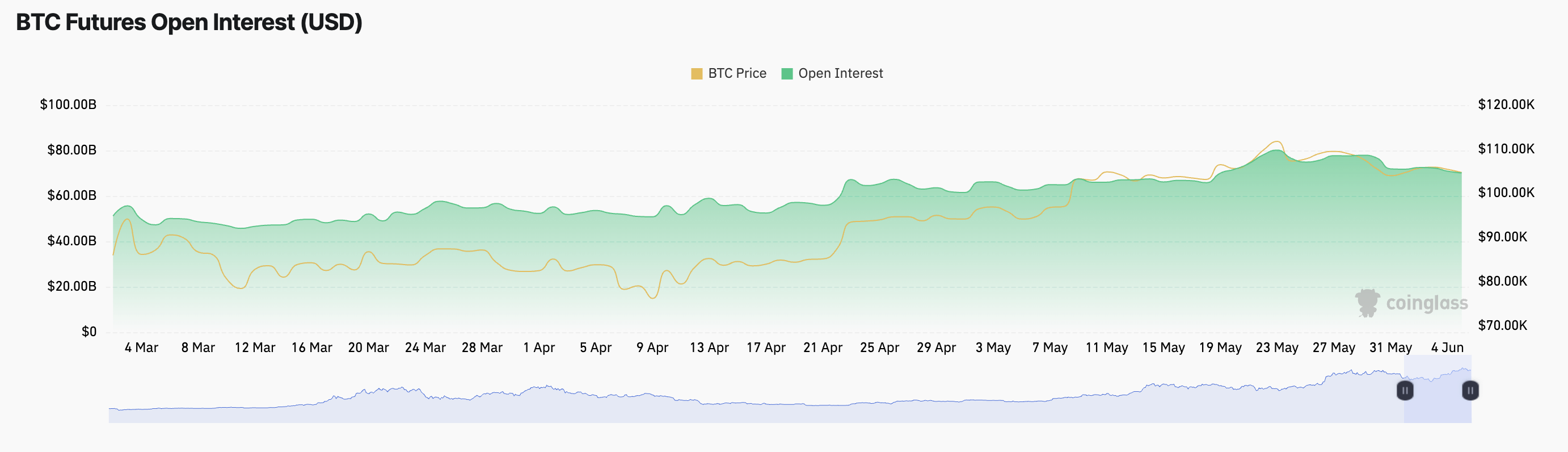

Currently, BTC is trading at $104,913, down 1% over the past day, reflecting the current sideways trend. Simultaneously, futures open interest slightly decreased, suggesting reduced activity and generally paused market participation.

At the time of reporting, the coin's futures open interest was $79 billion, decreasing by approximately 1%. This slight decline indicates that some traders are reducing positions amid price stagnation at the $105,000 level.

This suggests market participants are restraining heavy trading while waiting to either break through the major psychological resistance or anticipate further decline.

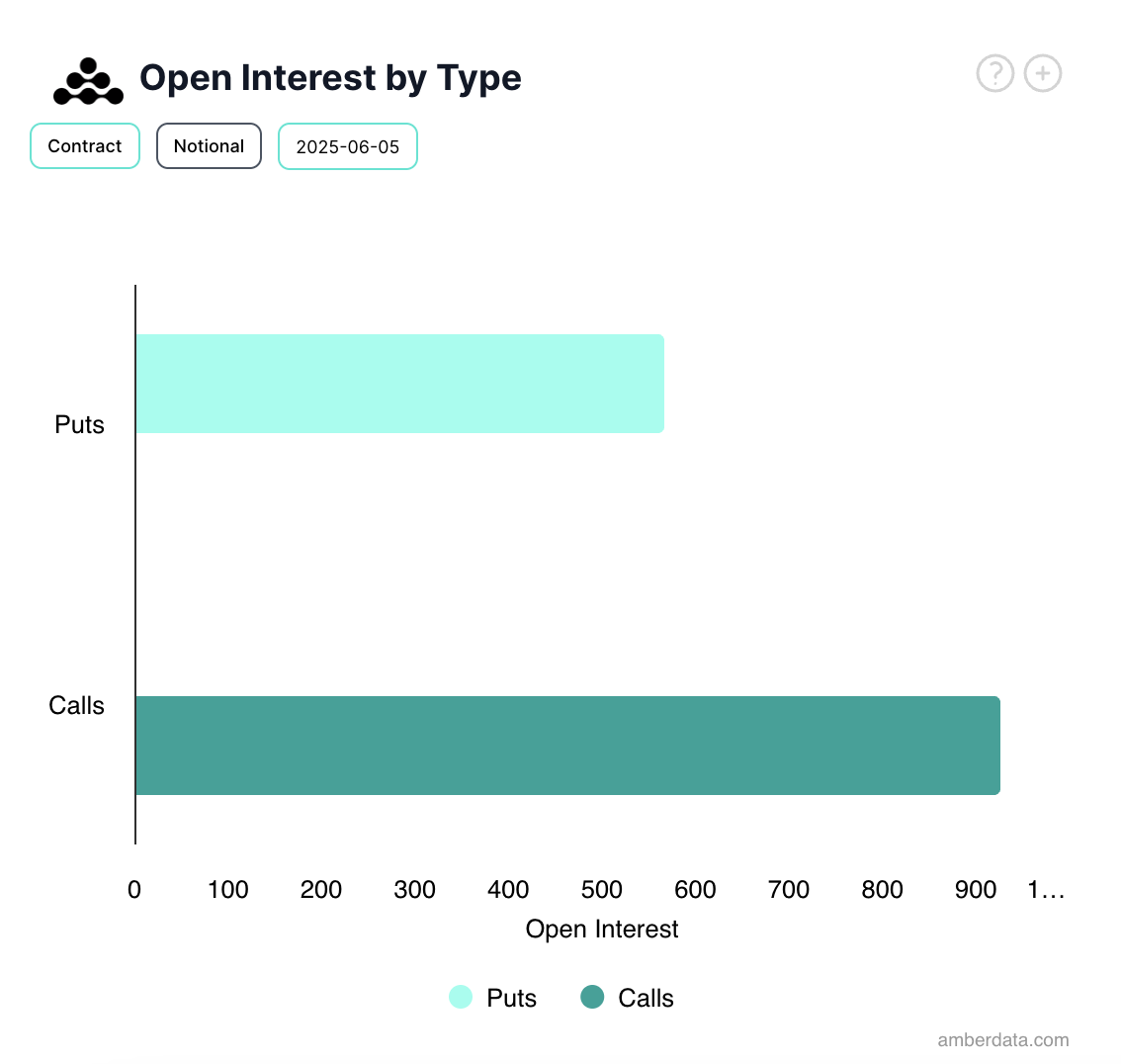

Interestingly, despite BTC's lackluster performance over the past day, the options market remains optimistic. According to Deribit, demand for call options is increasing, implying that some traders are positioning themselves for a potential upward breakout.

The decline in ETF inflows reflects short-term caution due to BTC's recent underwhelming price performance. The overall market trend suggests investors are either waiting for a catalyst to trigger a rally beyond $105,000 or anticipating further decline at this price level.