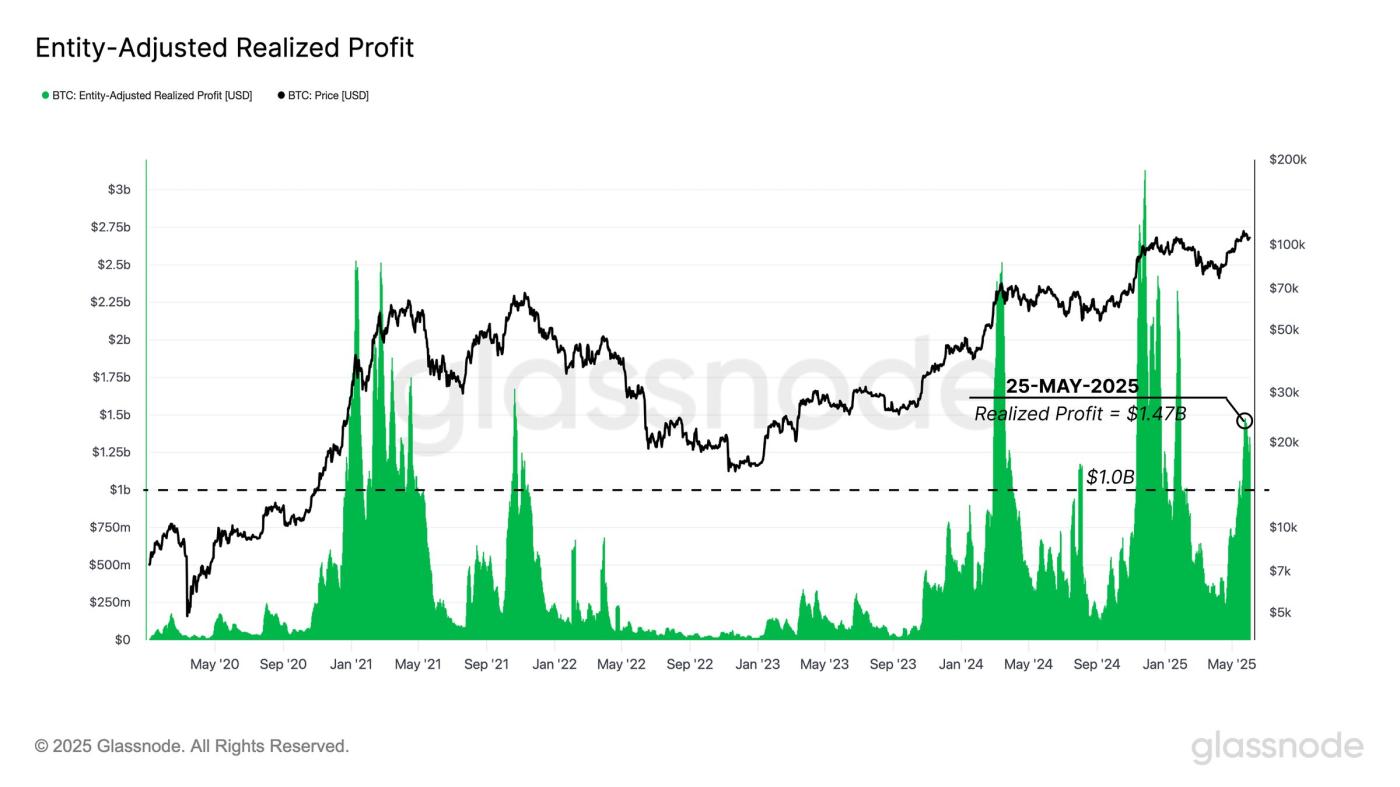

Investors holding BTC for at least 12 months realized over $1 billion in average daily gains last week.

Written by: 1912212.eth, Foresight News

The crypto market is volatile. Around 8 PM on June 5th, BTC nearly approached $106,000 but failed to break through and continued to decline. Around 4 AM on June 6th, BTC dropped to $100,372, almost breaking below $100,000, and has since recovered to around $102,000. ETH failed to break through $2,800 and dropped during the night, reaching a low of $2,381, with a 24-hour decline of over 7%, and Altcoins generally fell.

According to contract data from Coinglass, the network liquidated $983 million in the last 24 hours, with long liquidations accounting for $892 million. The largest single liquidation occurred on BitMEX - XBTUSD, valued at $10 million.

At market close, the Dow Jones Industrial Average fell 108.00 points to 42,319.74, a 0.25% decline; the S&P 500 dropped 31.51 points to 5,939.30, a 0.53% decline; the Nasdaq fell 162.04 points to 19,298.45, an 0.83% decline. Tesla plummeted over 14% due to a conflict between Musk and Trump, creating a historical single-day drop.

After BTC reached a new all-time high, Altcoins did not continue to rise as expected, and the market momentum was once again disrupted. What are the reasons for this significant pullback?

Musk and Trump Clash Remotely

On June 4th, Musk rarely publicly criticized, calling a core bill pushed by the Trump administration a "disgusting, deformed product". The world's richest man wrote: "Sorry, I can't stand it anymore. This massive, ridiculous, and self-serving congressional bill is simply disgusting and deformed!" He even called on lawmakers to "kill the bill". Subsequently, Musk even reposted and commented "Yes" on a discussion about "Trump should be impeached and replaced by JD Vance".

Trump was not to be outdone, posting on his personal social platform, "I don't mind Musk opposing me, but he should have done so months ago. This is one of the greatest bills ever submitted to Congress. It's a record-breaking spending cut of $1.6 trillion and the largest tax cut in history. If this bill doesn't pass, taxes will increase by 68%, and there are worse things. I didn't create this mess, I'm here to fix it. This bill will push our country towards greatness. Make America Great Again!"

Due to Musk and Trump's clash last night, Tesla dropped over 14%, with its market value shrinking by $153 billion, creating the largest single-day market value decline in history. Musk, who owns about 12.8% of Tesla's stock, saw the value of this portion of stocks shrink by over $19.5 billion.

The most wealthy and powerful people on Earth clashing remotely has caused turbulence in US stocks and the crypto market.

After Bitcoin Breaks New High, Investors Are Taking Profits

Recently, Bitcoin broke its all-time high (ATH), leading to significant profit-taking, with an average profit of about 16% per Bitcoin. Less than 8% of trading days can bring higher profits, indicating that investors are clearly entering a profit-taking phase.

According to glassnode data, BTC holders for at least 12 months realized over $1 billion in average daily gains last week - the fifth-largest increase in this cycle.

Well-known analyst Willy Woo also posted that whales holding over 10,000 Bitcoins have been selling since 2017. Most of their Bitcoins were bought between $0 and $700, held for 8 to 16 years.

Whales and traders' profit-taking undoubtedly create significant selling pressure, and price decline is inevitable if buying pressure is weak.

Summer Performance Typically Poor, June Average Return Only 1.9%

The crypto market often shows seasonal trends similar to the stock market. For example, summer performance is typically poor, while performance is better at the end and beginning of the year.

Since 2020, BTC has often declined in June. Historical data shows the average return in June is only 1.9%, with a 50% probability of increase.

Under market mysticism, some investors and traders choose to stay on the sidelines.

Fed Rate Cut May Be Postponed to September

The Federal Reserve's delayed rate cut has added a hint of gloom to the crypto market's already tight liquidity. After last week's initial jobless claims data, federal funds rate futures linked to the Fed meeting showed a dovish market sentiment, with a 100% expectation of a 0.25 percentage point first rate cut at the September meeting. Looking further ahead, the market's expectation for total rate cuts this year has increased to 60 basis points, previously 56 basis points.

Federal Reserve Governor Christopher Waller said in a speech on Sunday that he tends to believe tariff-induced inflation might be a one-time shock, and the Fed might still cut rates by the end of the year. However, other Fed officials believe it's not yet certain and that rate cuts should be cautious.

Austan Goolsbee, this year's voting member and President of the Chicago Federal Reserve Bank, said at an event in Iowa on Tuesday that it cannot be definitively stated that the tariff's impact on inflation is temporary. Current inflation data may not yet reflect the tariffs' impact, which complicates the Fed's task of assessing future inflation trends.

Subsequent Trend

On May 30th, Willy Woo posted that if Bitcoin doesn't show a rebound in the next two and a half days, it will form a bearish divergence on the weekly chart, potentially leading to a prolonged period of low, volatile market.

Weiss Crypto tweeted that BTC's short-term support range is $98,000 to $94,000, with a main support/resistance level at $89,500.

Trader Eugene Ng Ah Sio posted on his personal channel, "Currently long on Ethereum, with a stop loss set at this morning's lower shadow low of $2,380 (which is also a mid-term time frame range bottom retest), with a clear technical structure."