Written by: cyclop

Compiled by: Tim, PANews

Everyone believes $140,000 is the next target, but things may not develop that way.

After studying all historical scenarios and market data, why do I think Bitcoin is about to experience a slight decline?

Is the Golden Cross a Blessing or a Curse?

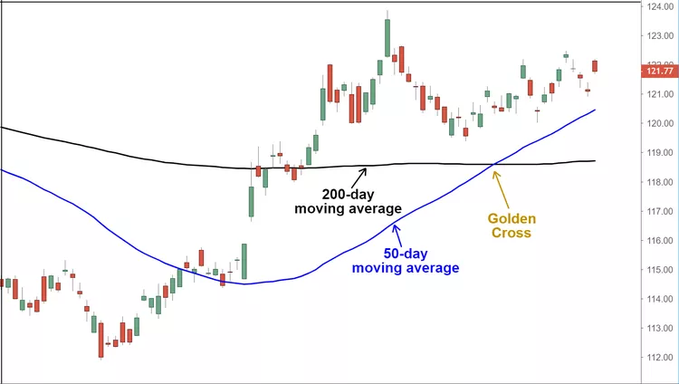

The golden cross is a technical indicator formed when the 50-day moving average crosses above the 200-day moving average, typically viewed as a buy signal or bullish indicator in technical analysis.

But what if I tell you it's not that simple, and the golden cross might actually lead to a sharp decline?

Let me explain.

Yes, fundamentally, the golden cross indicates that short-term momentum is overtaking long-term momentum (usually presenting a bullish trend).

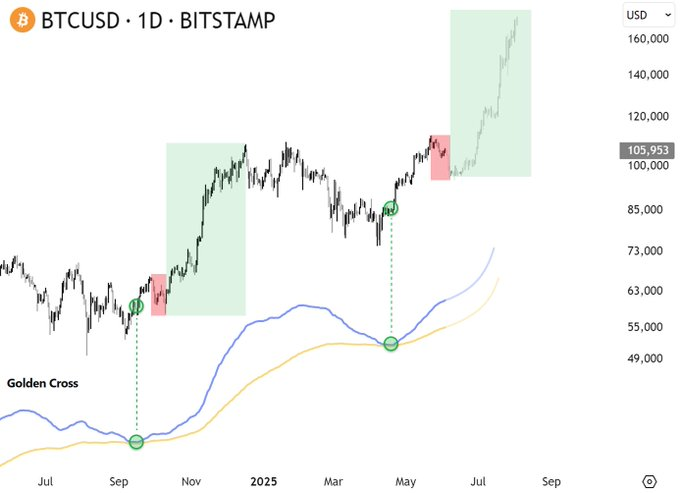

However, historical data shows that after each golden cross, Bitcoin always experiences a subsequent 10% drop, followed by a strong rebound and new all-time high.

Let's delve into specific cases:

In February 2021, after Bitcoin's 50-day moving average crossed above the 200-day moving average, it dropped 10% within 7 days

In March 2024, Bitcoin dropped 11% before violently rebounding to a new high

It turns out that the golden cross is merely the ultimate wash-out method before the main force drives prices up, designed to shake off floating shares (paper hands and retail investors) to facilitate a true price breakthrough.

Everything becomes clear now; this breakthrough triggered a massive capital chase.

Those who left the market re-entered due to FOMO, further fueling a more intense upward trend.

This is the mechanism of the golden cross pattern.

This week, Bitcoin experienced about an 8% pullback, consistent with past conventions. It has already rebounded, indicating strong buying pressure around $104,000 to $105,000.

On the other hand, it's evident that the upward momentum above $110,000 has been exhausted.

(This may lead to "news overconsumption" phenomenon, where positive news fails to trigger any reaction)

What's Next?

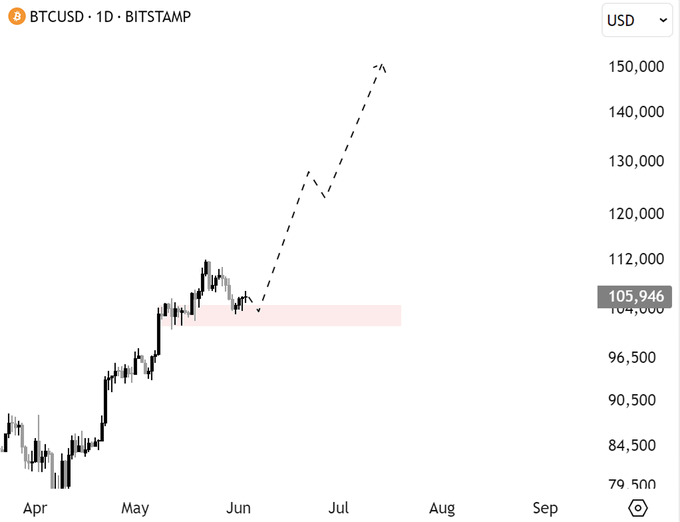

If we can hold $105,000 (which we will likely do), we'll directly target $150,000, repeating the golden cross pattern.

If it breaks below $100,000, a slight pullback to the $90,000 to $95,000 range is expected.

If you don't have a position yet, now is a good time to enter; I'm strongly bullish in the short term.

However, I'm currently in a more risk-averse state: only holding blue-chip cryptocurrencies like Bitcoin, Ethereum, Solana, and carefully selecting a few promising Altcoins with investment value, such as Cookie, W, and IOTA.

If you already have a position and are unsure whether to sell or add, stick to your strategy.