Written by: 1912212.eth, Foresight News

The author previously wrote an article titled "Severe Loss of Wealth Effect, Can Ethereum Survive the 'Midlife Crisis'?", detailing the huge challenges Ethereum faces in this cycle, with issues such as lack of innovation, direction, and bloated teams leading to harsh criticism from the community. Vitalik has also been knocked off his pedestal and heavily criticized. However, the market has rebounded after extreme pessimism. In April this year, ETH rose from $1,400 to nearly $2,800.

Is Ethereum's fundamentals improving? What notable changes has the heavily criticized Ethereum undergone recently?

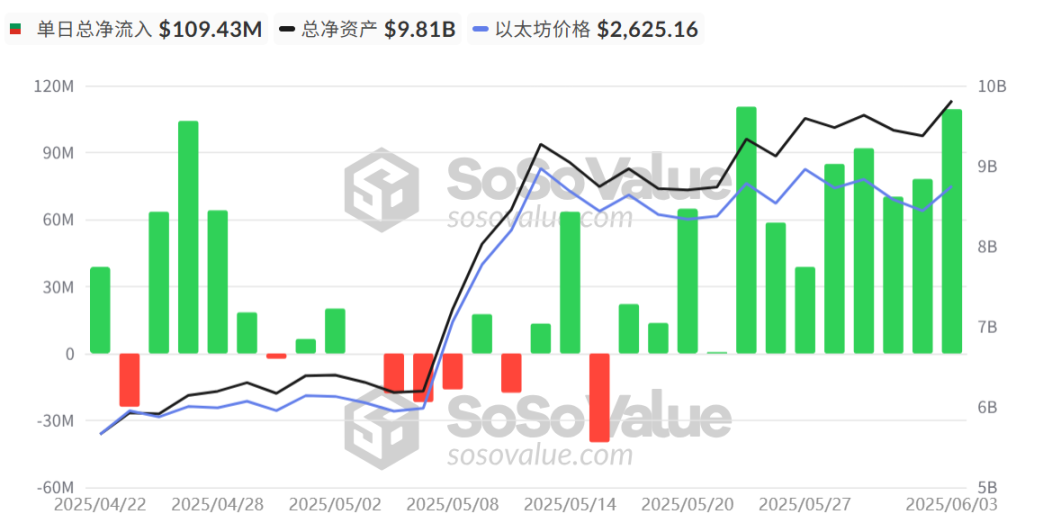

Continuous Net Inflow of ETH Spot ETF

Once, the Ethereum spot ETF was long in a state of net outflow. However, since April 22 this year, market funds have been continuously flowing in. As of June 5, only seven days saw net outflows, with the rest being net inflows net with even four days experiencing single-day net inflows exceeding $90 million, and seven instances of single-day net inflows over $$$60 million.

SoSoValue data shows that the cumulative net inflow of US Ethereum spot ETF has risen to $3.23 billion, with no signs of slowing down.

Negotiating Ethereum-Based Cooperation with Sovereign Wealth Funds

Ethereum co-founder and ConsenSys CEO Joe Lubin stated on Tuesday that his company is negotiating with the "main sovereign wealth fund and bank" of a "very powerful" country about potentially building on Ethereum, involving layer one and layer two infrastructure. However, the cooperation details have not been disclosed disclosed, and the market's reaction is more based on expectations. If this news is ultimately confirmed and announced, it would undoubtedly provide a significant boost to market confidence.

Additionally, ConsenSys led the $425 million financing for SharpLink Gaming, with Joseph Lubin set to become SharpLink's board chairman after this round.

<>>a Nasdaq-SharpLink plans to use financing to purchase ETH native native assets and them primary treasury reserve asset.

According to Bloomberg, Joe Lubin said that about six months ago, influenced by the most famous digital asset accumulation advocates, he decided to establish a company inEthereum's native token.. "I had dinner with Michael Saylor, did some research, and started discussing with colleagues how cool this idea was," said Lubin, founder and CEO of Ethereum software infrastructure company ConsenSys, in an interview. "No one in our company had previously deeply studied this direction. Later, we discovered that found this strategy didn't seem particularly dangerous."

Ethereum Foundation Reduces Staff and Operating Expenses

The Ethereum Foundation has long been criticized for its bloated team. On June 3, the foundation finally took action to reduce some staff and reorganize its research and development team, renaming the department to "Protocol" to focus on the core challenges of protocol design. This adjustment aims to address the community's continuous criticism of the foundation's management and strategic direction. The foundation stated that the reorganized Protocol team will work around three priority areas: expanding the scalability of Ethereum's underlying network, advancing blobspace expansion in data availability strategies, and improving user experience.

The foundation's announcement mentioned that "some R&D team members will no longer continue," and encouraged other teams to absorb these talents. The number of layoffs was not disclosed. Additionally, the foundation stated that the reorganizedized team be dedicated to improving upgrade timelines, technical documentation, and research transparency. Joint Executive Director Hsiao-Wei Weng on social media X that hopes the new structure can will drive core projects to move forward more efficiently efficiently.

However, some believe key issues remain. Example,, Instance,, Multicoin Capital co-founder Kyle Samani commented on X, "Note that the definition of 'focus' usually means less, not more, especially when goals should not conflict with each other. But when we look from the perspective of goal 3 (L1,, L2 network expansion, improving user experience), goal 1 (layoffs) and goal 2 (clarifying responsibilities) are contradictory."

The Foundation a a Policy in June 2025,iming-. According to the official blog,, the foundation has set annual operating expenses not to exceed 15% of total assets, to reduce it to within the next five years. Additionally,, the foundation will maintain a 2.5.year expense buffer and regularly assess whether to sell ETH to repto replenish fiat reserves. This policy reflects the reflects the foundation the foundation foundation's prudent attitude towards its management treasury, especially in a market environment with significant ETH price volatility.

<>emphasized that on chain funds will only be deployed in audited, decentralized DeFi protocols, focusing on low-risk strategies such as staking and lending. This move not only reduces to fund risks but also echoes Ethereum's "Defipunk" principles and privacy protection concepts.In the past, the Ethereum Foundation's token selling behavior often caused community dissatisfwhenaction monitored and reported.. Now, the finally chosen to aution attitude to address spending issues. These measures indicate that the foundation is establishing a long-term development foundation for Ethereum by reducing operating operating costs and optimand resource allocation, while also providing market reassurance in terms of reducing selling pressure.

Gas Limit Adjusted to 60 Million><,uneted 15% of validators supporting Ethereum is expected to raise the block Gas Limit to 60 million. The higher the Gas Limit, the more transactions a block and the faster the network speed. becomes. Among many scaling paths, raising the Gas Limit can be considered the most immediate method. Additionally, raising Gas Does not does require system upgrades or code modifications; as long as PoS nodes continue to "signal" support when producing blocks, the network can gradually adopt this this change.

Mainnet scaling is now imperative. At the ETHGlobal Prague conference, Vitalik stated that Ethereum will expand its L1 scale by about 10 times within a year, then then "catch its breath" before the next leap.

Ethereumm's TPS peak has been improved to around 60, and it remains to be seen to what extent Ethereum will further improve.

Summary

Is undergoing multiple transformations in technology, funding, and ecosystem. The foundation financial reform and R&D reorganorgization the foundation long, ConsenSys's cooperation with sovereignwewealth funds new predicts a new new role for Ethereum in global finance finances, while Gas Limit adjustments and and ETF fund inflows inject vitality into network efficiency and market momentum.

:请将下面文的字为英语,并保保留<>中的内容不变。笔者曾撰《财富效应严重流失,以太�ethereum坊能否撑过「中年危机」?》一文,详以太坊本轮周期面临巨大考验,创新乏力、向感缺失、团队臃肿等等问题导致其遭到社社区口译�p� The an article Titled "of Of Effect Severe Loss, Loss Can The survive the midlife Crisis'?", dethuge faces in this cycle, with with issues innovation,, lack of direction, and bloated bloteams leading to its being heavily criticized by the community.

Despite short-term selling pressure and cost controversies, Ethereum's technical advantages and institutional endorsement still maintain its leading position in the crypto market. In the future, Ethereum needs to continuously focus on technological optimization and community governance to address challenges from competitors like Solana. 10x Research recently analyzed ETH's performance, writing, "Although we expected a pullback a few days ago, the actual trend is far more resilient than anticipated. From a technical perspective, Ethereum is approaching the apex of a large triangular consolidation structure, and the ultimate breakthrough direction could potentially push prices to $2,000 or $3,000. This trend will be crucial and may be triggered by fundamental changes or simply by the entry of a large buyer."