According to the new policy, the core role of the Ethereum Foundation (EF) treasury is to support the foundation's long-term autonomy, sustainability, and legitimacy. Although the foundation is expected to continue as the long-term ecosystem manager, its scope of responsibilities will gradually narrow. This is a key signal indicating that the foundation will focus more on maintaining and developing the core protocol. More specifically, the foundation plans to reduce annual operating expenses in a roughly linear manner over the next five years, ultimately reaching a long-term benchmark level of 5%. This clear spending reduction plan is undoubtedly a proactive response to potential past inefficiencies in resource allocation.

In terms of asset management, the new policy also demonstrates unprecedented proactivity and flexibility. The foundation will frequently reallocate funds between different protocols based on market changes, asset diversification needs, or new revenue opportunities. Regarding the much-discussed ETH selling issue, the foundation will periodically assess the deviation of fiat-denominated assets in the treasury relative to the operating expense buffer target and decide whether to sell Ethereum and the quantity in the next three months accordingly, typically through fiat off-ramps or on-chain exchanges for fiat-denominated assets. This mechanized decision-making process enhances the transparency and predictability of financial operations to some extent. Additionally, the foundation clarified its ETH holding strategy, including independent staking and providing wETH to mature lending protocols, stating that core deployment will continue to be evaluated but overall positioned as a long-term hold. The foundation might even borrow stablecoins and seek higher yields on-chain. These measures mark the foundation's transition from a relatively passive fund manager to a more active and professional asset operator, attempting to preserve and increase the treasury's value while maintaining its core mission.

Dawn or Long Road Ahead?

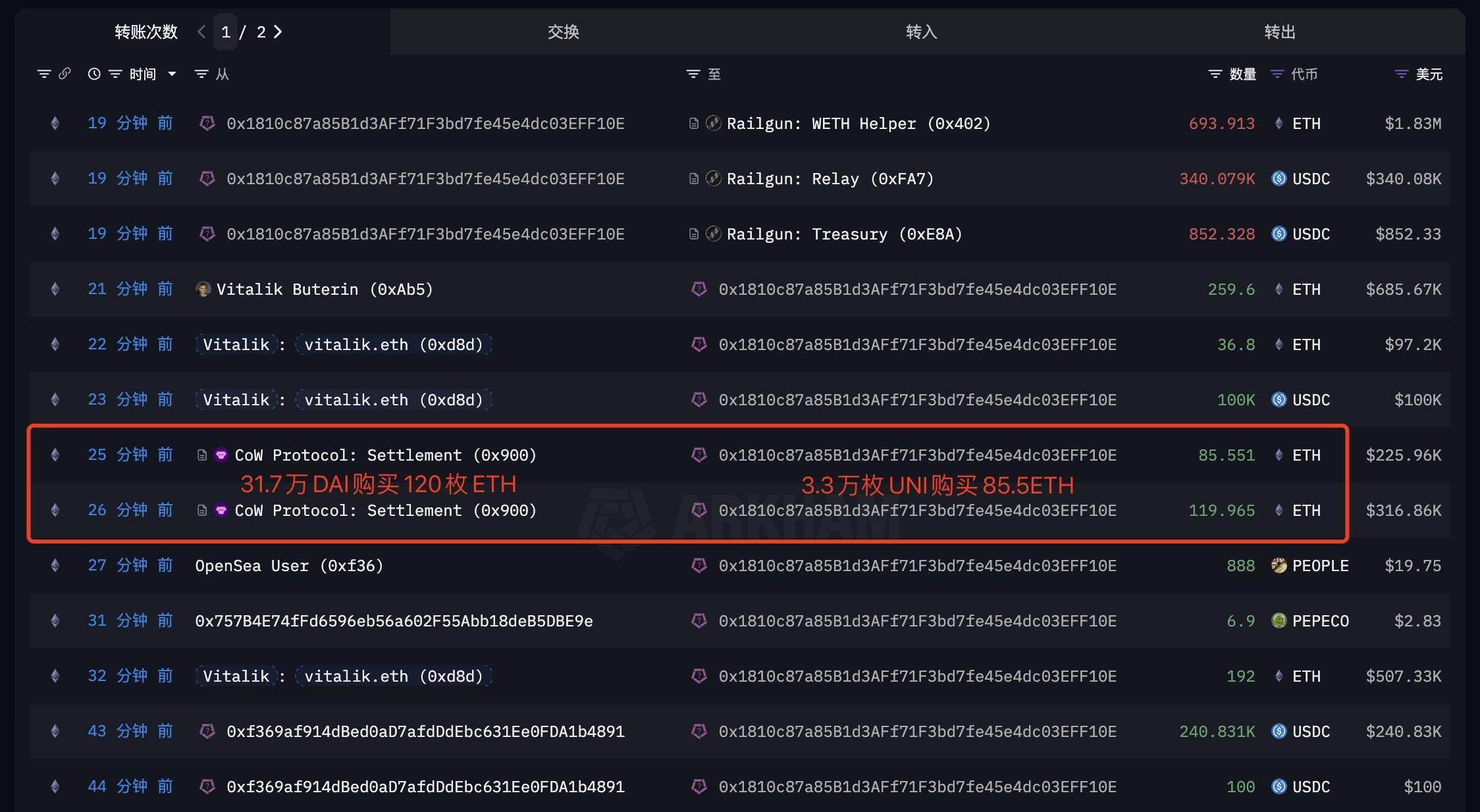

Almost simultaneously with the foundation's announcement of restructuring and new fiscal policy, some subtle positive signals emerged in the market. On June 4th, Ethereum co-founder and ConsenSys CEO Joe Lubin revealed that the company is negotiating with a sovereign wealth fund and bank from a "major country" to explore infrastructure building possibilities in the Ethereum ecosystem. On the same day, on-chain data showed that Vitalik also purchased ETH through a personal address. These events, along with the foundation's clear reform roadmap, seem to inject a long-missed warmth into the market.

However, these "green shoots" are not enough to declare that Ethereum has overcome its challenges. The foundation's "painful treatment" path is destined to be rough. Whether the new strategic direction and fiscal austerity policy can be effectively implemented, whether "KPI-based" management can truly be grounded, and how to ensure key ecosystem areas are not overlooked after narrowing responsibilities remain to be tested by time. The issue of information disclosure transparency, while somewhat addressed by the new fiscal policy, still requires continuous observation of implementation details and effects. Finding a lasting balance between decentralized development concepts and centralized management efficiency remains an unresolved challenge in Ethereum's ecosystem development.

Conclusion: Seeking Rebirth in a "Midlife Crisis"

The Ethereum Foundation's current layoffs, restructuring, and major fiscal policy adjustments collectively constitute a comprehensive approach to addressing its "midlife crisis". The former glory and honor now burden it with heavier historical baggage when facing new challenges. However, crisis also breeds opportunity. If this bold reform can truly drive the foundation towards a more transparent, efficient, pragmatic, and financially sustainable direction, the short-term pain might yield long-term health.

For the entire Ethereum ecosystem, this is both a severe test and a valuable opportunity for reflection. It reminds all practitioners that even a behemoth like Ethereum must always be wary of "castles in the air" risks, continuously adjusting course to adapt to unpredictable market waves. To completely reverse market expectations, beyond external benefits and token price boosts, the Ethereum Foundation needs more continuous and profound self-innovation, rebuilding trust with tangible actions and achievements. The road ahead is long, but painful treatment is often a necessary path to rebirth.