Welcome to the US Cryptocurrency Morning Briefing. We will briefly summarize today's key cryptocurrency developments.

While drinking coffee, we continue to observe how Bitcoin (BTC) might be significant for Ireland amid global economic uncertainty. The European island nation is taking El Salvador's President Nayib Bukele's achievements as an example. This is the opinion of MMA star Conor McGregor.

Today's Cryptocurrency News: Conor McGregor, Bitcoin Blueprint for Sovereign Ireland

Recently, BeInCrypto reported in US cryptocurrency news that McGregor showed interest in creating a Bitcoin strategic reserve for Ireland.

He particularly wants Ireland to adopt El Salvador's Bitcoin success case. McGregor believes this can eliminate Ireland's financial corruption and secure long-term stability.

"The Irish Bitcoin Strategic Reserve will empower the people's money," McGregor said on X.

Recently, an Irish presidential candidate proposed a decentralized blueprint for Ireland's sovereignty using Bitcoin.

I want to build on the amazing feats president @nayibbukele has achieved in El Salvador.

— Conor McGregor (@TheNotoriousMMA) May 29, 2025

Germany dropped the ball – Ireland will not.

Using crypto, I plan on establishing a decentralised blueprint for sovereignty.

One that others can also adopt to reclaim their nations.

I…

The former UFC champion praised Bukele's transformative achievement of adopting Bitcoin as legal tender.

McGregor aims to imitate Bukele's success by lowering crime and corruption rates in Ireland. He wants to empower Irish citizens and reclaim national autonomy using Bitcoin.

McGregor announced his presidential candidacy in March 2025 and proposed inviting Bukele to discuss this.

However, he received sharp feedback on X from supporters for using "cryptocurrency" instead of "Bitcoin".

Meanwhile, while the presidential candidate focuses on Bitcoin in Ireland, Panama and El Salvador are advocating for Bitcoin adoption in Latin America.

At a Bitcoin conference, Panama City Mayor Mayer Mizrachi urged a Panama-El Salvador alliance to lead global financial freedom using Bitcoin.

"Panama and El Salvador are driving Bitcoin adoption in Latin America," Mizrachi shared on X.

US Bank Revenues Increase... How Will FDIC's Commercial Real Estate Weakness Affect Bitcoin?

Elsewhere, the FDIC report shows the US banking sector recorded a slight earnings rebound in the first quarter of 2025.

FDIC-insured institutions reported $70.6 billion in net income and a 1.16% return on assets (ROA), up from 1.11% in the fourth quarter of 2024.

However, underneath the surface, increasing stress in commercial real estate (CRE) portfolios is attracting attention from regulators and cryptocurrency investors.

The FDIC's quarterly banking profile pointed out the continued weakness in non-owner-occupied CRE loans. Delinquency and non-performing (non-accrual) rates are rising sharply.

Large banks with over $250 billion in assets reported a 4.65% CRE non-accrual rate, significantly higher than the pre-pandemic average of 0.59%.

While these banks have lower CRE exposure relative to total assets, mid-sized institutions with high CRE concentration are becoming increasingly vulnerable.

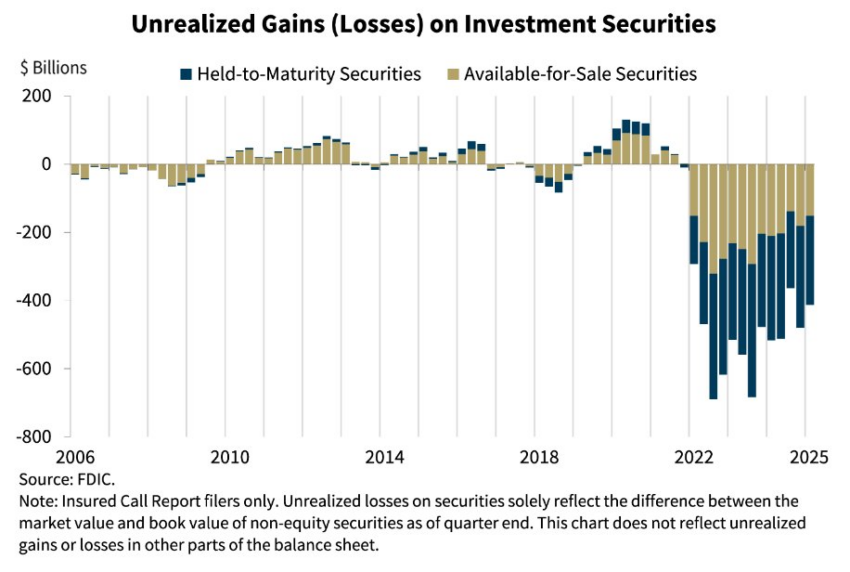

These structural pressures are occurring amid tightened credit conditions, high interest rates, and high unrealized losses in securities portfolios. As economic stress expands, these factors risk limiting lending and liquidity.

Impact on Cryptocurrency

CRE stress could suggest both risks and opportunities for Bitcoin and digital assets. CRE-related defaults spreading to mid-sized banks could weaken investor confidence in the traditional financial (TradFi) system.

These results could trigger movement towards decentralized alternatives like Bitcoin, similar to the banking turmoil in March 2023.

Moreover, continued stress on banks' long-term assets could reignite speculation about interest rate cuts or liquidity support. Historically, such macroeconomic changes are positive for cryptocurrency markets.

With unrealized securities losses still close to $413 billion, future sales could accelerate policy shifts.

In short, while bank earnings show resilience, increasing commercial real estate risks might revive Bitcoin's "safe asset" narrative, especially if financial fractures expand.

Indications are already emerging, with Bitcoin holdings in ETFs and public companies surging.

Specifically, institutional Bitcoin holdings are rapidly increasing, with BlackRock's ETF holding 663,000 BTC. MicroStrategy continues to buy Bitcoin.

Today's Chart

Today's Key News

Summary of today's notable US cryptocurrency news:

- SEC has clarified that certain proof-of-stake blockchain staking activities are not securities transactions under federal regulations.

- Arkham revealed 97% of Michael Saylor's Bitcoin holdings, raising concerns about centralization and market collapse of his cryptocurrency influence.

- Technical analysts have discovered multiple bearish divergence signals, suggesting Bitcoin's uptrend could reverse in June 2025.

- Chinese AI company Webus International plans to invest up to $300 million in XRP to improve cross-border payment systems.

- Solana only saw institutional inflows of $500,000 during May, lagging behind competitors like SUI ($23.9 million), Cardano, and Chainlink.

- PancakeSwap dominates the DeFi sector with a 66.9% trading share and $149 billion monthly trading volume, surpassing Uniswap and Pump Fund.

- Thailand's SEC will block access to 5 unauthorized cryptocurrency exchanges from June 28, 2025 to curb money laundering and protect investors.

- After months of negotiations, Binance and SEC filed a joint application today to resolve their ongoing legal dispute.

Cryptocurrency Stock Market Overview

| Company | Closed on May 29 | Pre-market Overview |

| MicroStrategy (MSTR) | $370.63 | $368.46 (-0.59%) |

| Coinbase Global (COIN) | $248.84 | $247.25 (-0.64%) |

| Galaxy Digital Holdings (GLXY.TO) | $27.05 | $26.79 (-0.95%) |

| Marathon Holdings (MARA) | $14.61 | $14.47 (-0.96%) |

| Riot Platform (RIOT) | $8.18 | $8.13 (-0.61%) |

| Core Scientific (CORZ) | $10.69 | $10.71 (+0.19%) |