Written by: Liu Jiaochain

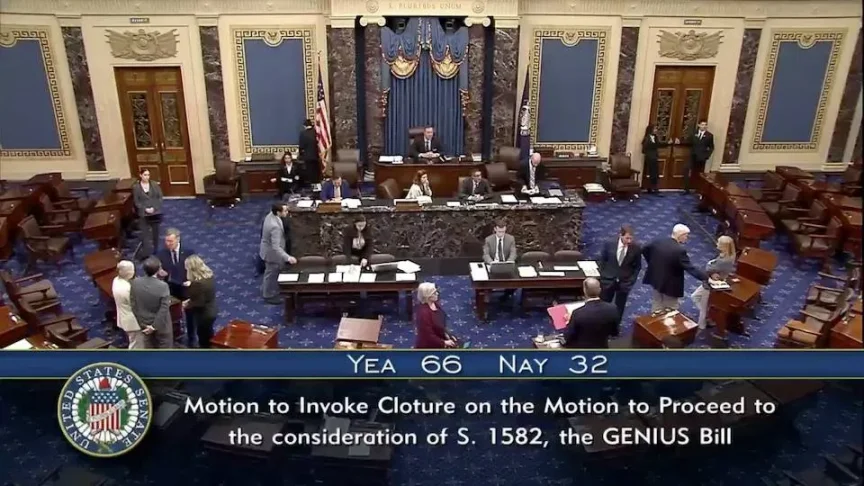

Recently, a significant event in the crypto circle was the US Senate passing the so-called dollar stablecoin bill procedure motion with 66 votes to 32, entering the federal legislative stage.

This bill, with the full title "National Innovation Act for Guiding and Establishing Dollar Stablecoins", has an acronym that conveniently spells GENIUS, hence the nickname "Genius Act".

The global financial and economic circles are buzzing with discussions about whether this so-called Genius Act is the last struggle before the total collapse of the US dollar and US debt system, or a truly genius solution to resolve the US debt crisis and upgrade the US dollar hegemony to version 3.0.

As is well known, the original US dollar was merely a gold voucher. The United States established its dollar hegemony 1.0 through World War II. The gold dollar, as part of the post-war world order, was fixed by the Bretton Woods system, World Bank, and international monetary financial organizations. The Bretton Woods system stipulated that the dollar was pegged to gold at a fixed exchange rate, with other countries' currencies pegged to the US dollar.

However, just 25 years after the war, the United States could no longer maintain the dollar-gold anchor. American economist Robert Triffin discovered that for the dollar to become an international currency, the US needed to continuously export dollars, but since the dollar was pegged to gold, exporting dollars meant exporting gold, which would inevitably reduce US gold reserves and unable to support the increasingly numerous dollars, thus necessarily decoupling.

Specifically, the following three goals cannot be achieved simultaneously in the Blockchain Trilemma: First, the US maintains a surplus in international payments, with the dollar's external value stable; second, the US maintains sufficient gold reserves; third, the dollar's value can be maintained at a stable level of 35 dollars per ounce of gold. These three goals are impossible to achieve simultaneously in the Blockchain Trilemma.

This inherent bug is also known as the "Triffin Dilemma".

When President Nixon unilaterally tore up the agreement on television in 1971, announcing that the dollar would no longer be pegged to gold, he declared that dollar hegemony 1.0 had fallen into a collapse crisis. Without gold's support, the dollar's value was precarious.

Heaven bestows great responsibilities on those chosen. In 1973, Kissinger became Nixon's Secretary of State. He proposed the "Petrodollar" strategy. He convinced President Nixon to fully support Israel during the Yom Kippur War (4th Arab-Israeli War). Under the strong military pressure of the United States, Saudi Arabia secretly reached a key agreement with the US to bundle "oil - dollar - US debt":

Saudi oil would be priced and settled only in dollars, with other countries needing to reserve dollars to purchase oil.

Saudi Arabia would invest its oil revenue surplus in US Treasury bonds, forming a dollar recycling mechanism.

Many people were misled by the surface meaning of the "petrodollar" term and said that dollar 2.0 shifted its anchor from gold to oil. What a currency can buy has never been its anchor. The anchor of a currency is what constrains and supports its issuance.

From the perspective of commodity production, the capital process of the petrodollar is: oil -> dollar -> US debt.

From the perspective of capital movement, this process becomes a pure capital proliferation process: dollar -> US debt -> dollar. Oil production is merely a by-product of the capital movement process.

When China began reform and opening up in the late 1980s, the dollar and US debt capital movement was similarly applied to drive Chinese manufacturing to produce a large number of industrial goods, achieving remarkable results. For this capital circulation, whether the by-product is oil or industrial goods is actually irrelevant. Financial capital only wants continuously extracted profits in high-speed circulation.

Now the United States no longer fears exporting dollars. Previously, exporting dollars meant exporting gold, and the US did not master alchemy to create gold out of thin air, quickly depleting gold reserves. Now, massively exporting dollars is simply exporting US debt, which is essentially just IOUs from the US Treasury Department that can be printed at will.

This is the dollar hegemony 2.0 era. From the 1970s to the 2020s, approximately 45 years. In this stage, the dollar is essentially a debt dollar, or an IOU dollar, rather than a petrodollar or any other type of dollar.

The key point of the debt dollar is to firmly anchor the dollar to US debt. To achieve this, there are two prerequisites:

US debt issuance, interest payment, and trading must be globally first-class, with the strongest discipline, most reliable mechanism, most credible repayment, and strongest liquidity.

The US must possess the world's top military deterrence, forcing countries that have earned large amounts of dollars to actively purchase US debt.

To this end, the dollar 2.0 system is designed as a decentralized dual-helix structure: the Treasury Department issues debt "with discipline" based on the debt ceiling approved by Congress, but cannot directly issue dollars; the Federal Reserve is responsible for monetary policy, issuing dollars and controlling interest rates through open market trading of US debt.

However, while dollar 2.0 solved the gold shortage problem, it introduced an even bigger bug: any artificial constraints ultimately cannot truly constrain the desire to print money. Congressional approval is not an insurmountable obstacle. The dollar thus embarked on an uncontrollable path of infinite debt expansion, inflating to a staggering 36 trillion dollars in just a few decades.

When Alaska happened in 2020, the entire dollar 2.0 system was about to collapse. The reason was simple: China slammed its hand on the table.

The massive US debt is like a towering domino stack, with just a few small dominoes supporting the precarious giant. Any action sufficiently causing vibration could trigger a collapse above.

Even without external shocks, such a massive US debt scale is gradually unable to continue rolling, falling into an inevitable collapse expectation.

Thus, a genius solution emerged. This is the emerging dollar hegemony 3.0 - the dollar stablecoin. We might as well call it the blockchain dollar or crypto dollar.

One must admit that the United States leads in financial innovation. Evidently, if the on-chain dollar or stablecoin strategy succeeds, we may see the following five earth-shattering changes in the near future:

The Federal Reserve's monopoly on dollar issuance will be deconstructed. Dollar stablecoins will become the "new dollar", with the issuance rights of these "new dollars" dispersed among numerous stablecoin issuers.

US debt assets on the Federal Reserve's balance sheet will be digested. Stablecoin issuers will compete like sharks to seize US debt as legal reserves supporting stablecoin issuance.

As more traditional dollar assets are mapped to Tokens on the blockchain through RWA (Real World Assets) or other means, the massive RWA assets combined with crypto-native assets (like BTC) will create huge demand for dollar stablecoins, driving explosive growth in stablecoin scale.

As the "RWA assets - dollar stablecoin" trading scale explodes, the "traditional assets - dollar" trading scale will gradually be surpassed, becoming obsolete.

As the US dollar's role as a medium in asset transactions gradually diminishes, becoming a vassal in the "US Treasury - US Dollar - US Dollar Stablecoin" closed loop.

The traditional US Treasury and US dollar issuance mechanism is: the Treasury issues US Treasuries in the market, absorbing US dollars. The Federal Reserve issues dollars by purchasing US Treasuries from the market. This achieves a remote linkage, supporting dollar issuance with US Treasuries.

The issuance mechanism for US dollar stablecoins is: stablecoin issuers receive dollars from customers and issue US dollar stablecoins on the blockchain. Then, stablecoin issuers use the received dollars to purchase US Treasuries from the market.

Let's derive this with semi-quantitative numerical assumptions.

Traditional method: The Federal Reserve issues an additional $100 million, purchasing $100 million worth of US Treasuries from the market, injecting $100 million in liquidity. The Treasury issues $100 million worth of US Treasuries in the market, absorbing $100 million in liquidity.

The problem is: If the Federal Reserve insists on so-called policy independence and refuses to purchase US Treasuries to inject liquidity, it will put great pressure on the Treasury's debt issuance, forcing US Treasury auction rates to be relatively high, which would certainly be very unfavorable for the US government's future debt repayment.

Assuming sufficient US dollar stablecoins: Stablecoin issuers absorb $100 million and issue $100 million in stablecoins. Stablecoin issuers use $100 million to purchase US Treasuries, injecting $100 million in market liquidity. The Treasury issues $100 million worth of US Treasuries in the market, absorbing $100 million in liquidity.

Note that circular leverage is possible here. If most tradable assets become RWA assets in the future, the $100 million absorbed by the Treasury will ultimately flow to various RWA assets. Specifically, the Treasury spends $100 million, and institutions receiving dollars exchange the entire $100 million with stablecoin issuers for US dollar stablecoins (note the issuance of $100 million in stablecoins), used to purchase various RWA assets or simply hoard BTC, thereby returning $100 million to the stablecoin issuer.

With this $100 million, stablecoin issuers can continue to purchase $100 million in US Treasuries, injecting market liquidity. The Treasury can then issue an additional $100 million in US Treasuries, absorbing this $100 million. And so on, continuously cycling.

By this point, we can see that in the entire cycle, using just $100 million as a tool can almost infinitely issue US Treasuries and US dollar stablecoins. One cycle increases US Treasuries by $100 million, correspondingly increasing US dollar stablecoins by $100 million. After N cycles, both US Treasuries and US dollar stablecoins have increased by N hundred million dollars.

Of course, in reality, the cycle cannot be 100% lossless. Some dollars will not flow back to stablecoins. Assuming a loss rate of 20%, it can be easily calculated that the total leverage ratio would be 5 times. This seems similar to the money multiplier in the fractional reserve banking system.

Currently, with US Treasury scale at $36 trillion, and in a situation where the Federal Reserve cannot continue printing money, that is, with a fixed dollar supply, through the circular issuance of US dollar stablecoins, assuming a 5-fold leverage expansion, the US Treasury's expansion space could suddenly open up to 36 trillion multiplied by 5, equaling $180 trillion.

The US Treasury, or the US government, can now continue issuing US Treasuries without caring about the Federal Reserve's mood!

The additional $144 billion in US Treasuries is not backed by dollars printed by the Federal Reserve, but by US dollar stablecoins printed by stablecoin issuers across various chains.

The Federal Reserve's dollar coinage rights have been deconstructed and replaced by stablecoin issuers' US dollar stablecoin coinage rights.

And when US dollar stablecoins are widely used in cross-border or daily payments, the US dollar can truly cool off, completely becoming a auxiliary role in the "US Treasury - US Dollar Stablecoin" cycle.

What role does BTC play in this entire process?

Jiao Chain made an analogy: a black hole.

Black holes in the universe have powerful gravity, absorbing light in an inescapable manner.

BTC is like a black hole in the blockchain universe, with powerful gravitational pull on US dollar liquidity, absorbing value inescapably. Thus, US dollar liquidity is continuously drawn into the blockchain universe, converted to US dollar stablecoins. Then dollars are re-released as liquidity by replacing US Treasuries, continuously cycling.

However, if the massively issued US dollar stablecoins cannot be sold to countries worldwide, at least matching the corresponding economic scale, it can be imagined that the actual purchasing power of US dollars or US dollar stablecoins will depreciate.

Today, the total volume of US dollar stablecoins is far from one times the US Treasuries, estimated at less than $200 billion. $200 billion needs to multiply 5 times to reach $1 trillion, then expand 36 times to reach the US Treasury scale, and then continue to double on this basis to provide greater help for US Treasury expansion.

Even calculating based on the 5-fold leverage rate mentioned earlier, multiplying these multiples results in 5 * 36 * 5 = 900 times, nearly 1000 times.

Based on the current relationship of stablecoins at $200 billion and BTC market value at $2 trillion (10 times), if stablecoins successfully expand 1000 times, BTC's market value might grow 1000 * 10 = 10,000 times, from $2 trillion to $20 trillion. Correspondingly, one BTC might grow from $100,000 to $1 billion, with 1 satoshi equal to $10.

Considering that future liquidity might be diverted by RWA assets, not concentrating on BTC like current markets, taking a 1/10 to 1/100 discount on these numbers would mean BTC market value of $200 trillion to $2,000 trillion, with one BTC valued at $10 million to $100 million, or 1 satoshi equal to $0.1 to $1.