Introduction

On May 20, 2025, the U.S. Senate passed the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) with a vote of 66 to 32, marking the first federal regulatory framework for payment stablecoins in the United States. The bill was introduced by Senator Bill Hagerty on February 4, 2025, and received bipartisan support from Tim Scott, Kirsten Gillibrand, Cynthia Lummis, and others. It aims to regulate the stablecoin market through reserve requirements, consumer protection, and anti-money laundering (AML) compliance measures. As of May 2025, the global stablecoin market had reached $232 billion, with the United States seeking to balance financial security, technological innovation, and geopolitical considerations through the GENIUS Act.

This report will delve into the definition and classification of stablecoins, the provisions of the GENIUS Act, the motivations behind the bill, its controversies, and potential impacts on centralized exchanges (CEX), ordinary users, and other stakeholders.

I. Stablecoin Definition and Classification

Stablecoins serve as the "stable anchor" in the cryptocurrency market, with their value typically pegged to fiat currency, commodities, or algorithmic mechanisms. Based on the type of collateral assets and operational mode, they can be classified into four categories:

1. Fiat-Collateralized Stablecoins

Definition: Such as Tether (USDT), USD Coin (USDC), backed 1:1 by the U.S. dollar or other fiat currencies, with reserves typically held in banks or trust institutions.

Mechanism: Issuers hold an equivalent amount of fiat currency (such as U.S. dollars) as reserves, allowing users to exchange stablecoins at a 1:1 ratio.

Advantages:

- High stability with minimal price fluctuations, suitable for payments and trading.

- Easy to understand, widely used on centralized exchanges and DeFi platforms.

- Higher regulatory transparency (e.g., periodic reserve audits for USDC).Disadvantages:

- Dependent on the issuer's credit and operational transparency (e.g., Tether has been questioned due to reserve controversies).

- Centralized management leads to single point of failure risks.

- Subject to strict regulatory requirements with high compliance costs.Case: USDT market cap exceeds $110 billion, USDC market cap around $55 billion (2025 data).

2. Crypto-Collateralized Stablecoins

Definition: Such as Dai from MakerDAO, generated by over-collateralization with cryptocurrencies like Ethereum, typically running through smart contracts.

Mechanism: Users deposit cryptocurrencies (such as ETH) as collateral to generate stablecoins, with value maintained through algorithms and over-collateralization.

Advantages:

- Decentralized, no need to trust a single issuer, strong censorship resistance.

- Suitable for DeFi ecosystem with high flexibility.

- High transparency with all transactions recorded on the blockchain.Disadvantages:

- Collateral asset price volatility may lead to liquidation risks.

- Smart contract vulnerabilities may cause systemic risks.

- High complexity requiring technical knowledge from users.Case: Dai widely used in DeFi, but partial liquidation occurred during ETH price crash in 2022.

3. Algorithmic Stablecoins

Definition: Such as TerraUSD (UST, collapsed in 2022), maintaining value stability through dynamic supply adjustments via algorithms, without direct asset collateralization.

Mechanism: Adjusting supply and demand through arbitrage mechanisms or token burning/minting, such as UST balancing value through Luna tokens.

Advantages:

- No reserve assets required, low operating costs.

- Fully decentralized, theoretically unlimited expansion.

- Suitable for rapidly growing crypto markets.Disadvantages:

- Poor stability, easily affected by market sentiment and bank runs (e.g., UST collapse causing billions in losses).

- Complex algorithms with low market trust.

- High regulatory difficulty, potentially viewed as high-risk assets.Case: UST's failure highlights the fragility of algorithmic stablecoins, with currently small market share.

4. Hybrid Stablecoins

Definition: Combining fiat or crypto collateralization with algorithmic mechanisms, attempting to balance stability and flexibility, still in experimental stages.

Mechanism: Such as partial reserve support combined with algorithmic regulation, or dynamically adjusting collateralization ratios.

Advantages: Potentially balancing stability and decentralization benefits, high innovation potential, adaptable to various scenarios.

Disadvantages:

- Technically complex, risks not fully verified.

- Low market acceptance with limited application scenarios.

- High regulatory uncertainty, potentially facing dual compliance requirements.Case: Frax Finance's FRAX attempts a hybrid model but with a small market scale.

Stablecoins are widely used for cross-border remittances, DeFi, payment settlements, and value storage due to low costs, fast transactions, and low volatility. The market size reached $232 billion in 2025, with 30% of cross-border payments completed through stablecoins. The market expansion and risk events (UST collapse, Tether's opaque reserves) have prompted U.S. regulation.

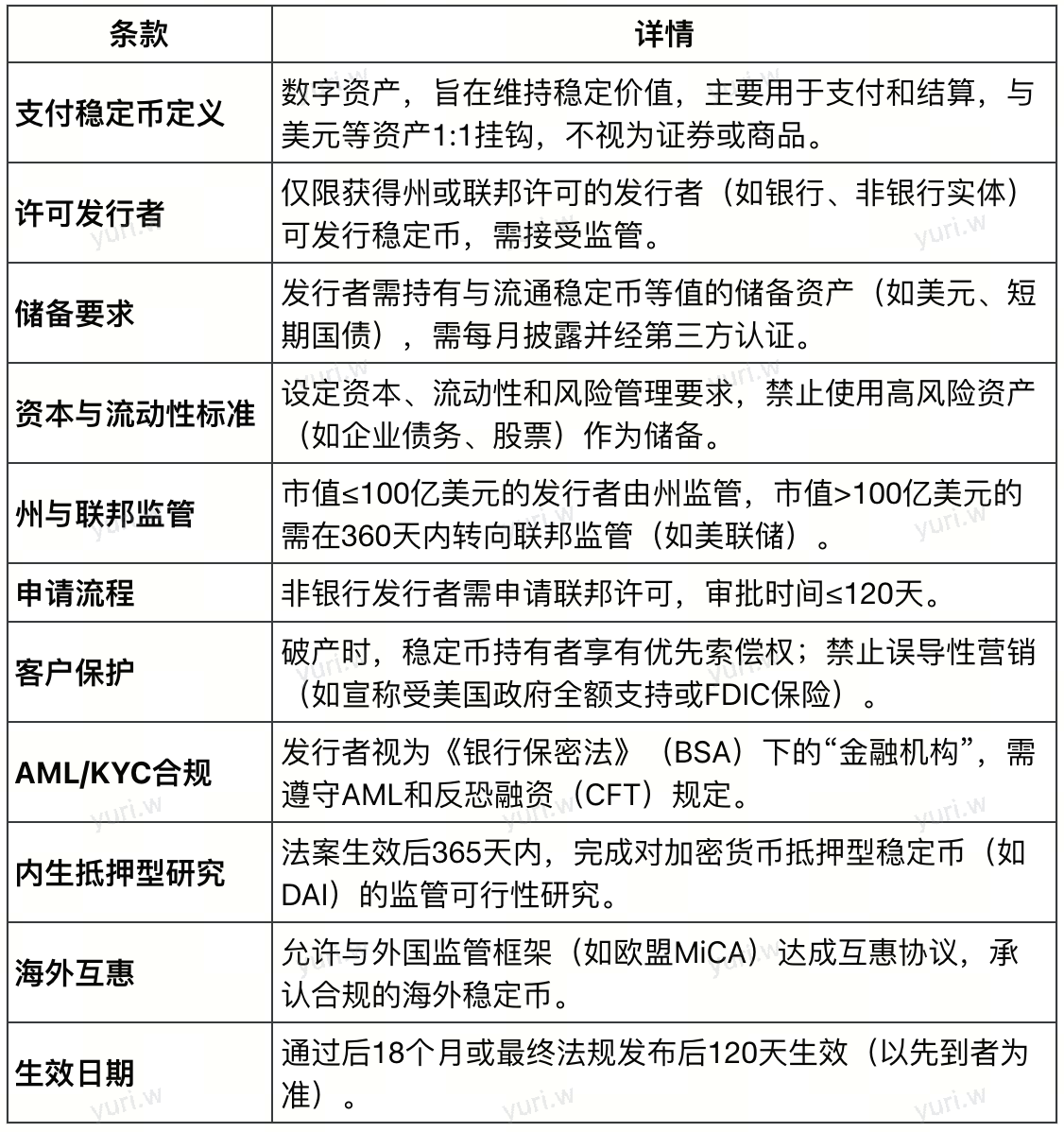

II. Main Provisions of the GENIUS Act

The GENIUS Act establishes a federal and state-level regulatory framework to regulate payment stablecoins (defined as digital assets primarily used for payments and settlements, pegged to a fixed currency value). Here are its main provisions, integrated from public information:

The bill passed the Senate Banking Committee 18-6 and the full Senate 66-32, showing bipartisan support.

FACT SHEET: The GENIUS Act Protects Consumers

III. Legislative Motivations: From Financial Security to Digital Dollar Hegemony

Financial Security and System Stability: Regulation as a Foundation

Consumer Protection is Urgent

In recent years, stablecoins have frequently experienced "de-pegging" events, especially the TerraUSD (UST) collapse in 2022, causing billions in retail investor assets to evaporate.

The GENIUS Act requires all payment stablecoins to undergo monthly audits and maintain 1:1 liquid reserve assets, and grants users priority claim rights in case of issuer bankruptcy, significantly enhancing user protection.

Anti-Money Laundering and Financial Crime Prevention

The widespread use of stablecoins in anonymous transactions has raised law enforcement concerns.

Senator Elizabeth Warren pointed out that over 40% of ransomware ransoms are paid through stablecoins.

The bill mandates issuers to implement KYC (identity verification), AML (anti-money laundering), and CFT (counter-terrorism financing) procedures to combat illegal fund flows.

Digital Continuation of Dollar Dominance: Financial Geopolitical Strategy Upgrade

Digital Dollar Demand-Side Binding: "Cryptocurrencies" Anchored to the U.S. Dollar

As of 2025, over 99% of global stablecoins are denominated in U.S. dollars, with the dollar becoming the core value anchor for digital assets.

The GENIUS Act clearly strengthens the dollar's foundational position in the crypto financial system through regulatory measures, ensuring continued dollar dominance in global payment and reserve systems.

Reserve Asset Structure Design: Stablecoins "Feeding" the U.S. Treasury Market

The bill requires issuers to concentrate reserve assets in U.S. Treasuries, bank deposits, or physical cash.

Republican Senator Bill Hagerty noted that by 2030, stablecoin issuers may become one of the largest U.S. Treasury holders, providing support for U.S. fiscal deficits.

With the current U.S. national debt reaching $36 trillion, the stablecoin reserve mechanism is viewed as a "quasi-hidden purchasing power".

Curbing Foreign Currency Expansion: Countering the Digital Rise of the Renminbi and Euro

The EU has launched the MiCA regulation, and China is also promoting cross-border circulation of the digital renminbi.

The GENIUS Act is an important means for the United States to seize the high ground of global digital currency sovereignty, aimed at preventing foreign digital currencies from threatening international settlement rights.

Technology and Political Power Balance: Interest Conflicts Behind Legislation

Trend of Tech Giants' Financialization Hindered

Meta's Libra (later renamed Diem) stablecoin project, proposed in 2019, was forced to terminate due to regulatory pressure.

The GENIUS Act's revised provisions explicitly prohibit tech companies from issuing stablecoins without federal or state permits, and impose higher requirements on their data privacy, financial risks, and platform monopolistic behaviors.

Deutsche Bank analysis points out that this aims to prevent platform tech giants from monopolizing financial infrastructure using their "data + channel" advantages, thereby threatening the traditional banking system and US dollar dominance.

Trump's Interest Chain Controversy Resurfaces

The bill's legislative process is questioned for potential "political interest exchange".

The Trump family-supported stablecoin project USD1 (issued by World Liberty Financial) was launched in March 2025, and by May its market value had exceeded $2 billion, ranking among the global top seven.

Critics point out that the bill may create a "compliance channel" to facilitate funds bypassing the traditional banking system towards specific political figures.

Democratic Senator Warren strongly criticized, saying the currency could become a "shadow banking tool for anonymous foreign funds to be transferred to Trump".

Foreign Stablecoins (such as Tether) Face Integration

New provisions clearly state: Foreign issuers must register in the US and accept equivalent regulation, otherwise they cannot circulate in the US market.

Deutsche Bank comments that this "plugs previous regulatory loopholes" by bringing offshore currencies like Tether into a unified regulatory framework, helping to weaken their "gray settlement tool" attributes.

IV. Stakeholder Impact Analysis

Compliant Centralized Exchanges (CEX)

Enhanced compliance requirements: Need to delist non-compliant currencies, increase audit/KYC costs

Fierce competition for licensed stablecoins: Banks and tech companies may issue their own stablecoins, CEX needs to enhance user stickiness

Reduction in stablecoin types: Beneficial for operational simplification, but reduces asset diversity

Capital flows may become more compliant/transparent, attracting institutional investors

Ordinary Users

For ordinary users, the GENIUS Act's impact is mainly reflected in the following aspects:

Enhanced consumer protection: The bill requires stablecoin issuers to hold 1:1 reserve assets and ensure priority claim rights for holders in case of bankruptcy. This reduces the risk of stablecoin de-pegging or issuer bankruptcy.

Expanded stablecoin use cases: The establishment of a regulatory framework may encourage more traditional financial institutions and enterprises to accept stablecoins as a payment tool, expanding their application scenarios.

Potential restrictions and uncertainties: While the bill aims to protect consumers, strict regulations may also limit the use of certain stablecoins.

Stablecoin Issuers

Large issuers (such as Circle, Tether): They may benefit from the bill's legitimacy and market recognition, but also need to bear higher compliance costs.

Small issuers: They may exit the market due to high capital and liquidity requirements, leading to market concentration.

Regulators

The GENIUS Act provides clear authorization for regulators to more effectively oversee the stablecoin market, reducing systemic risks and illegal activities.

Traditional Financial Institutions

Banks and financial companies may see opportunities to enter the stablecoin market. Critics warn that the bill may allow big tech companies like Amazon, Walmart, or Meta to enter the banking sector with insufficient restrictions.

V. Criticisms and Controversies

Despite support, the GENIUS Act faces ongoing controversies:

Federal bailout risks

Potential conflicts of interest

Insufficient AML/KYC measures

Innovation suppression

Regulatory loopholes

These criticisms reflect the tension between consumer protection and market freedom.

VI. Summary and Outlook

The GENIUS Act's passage is a significant milestone in US stablecoin regulation. By establishing reserve requirements, consumer protections, and AML compliance measures, it provides a clear framework for the stablecoin payment market. This not only consolidates US dollar hegemony but also lays the foundation for global stablecoin promotion and application.

However, the bill still needs to balance consumer protection and innovation development, avoiding excessive suppression of small issuers and decentralized ecosystems while preventing systemic risks.

As an important tool in digital finance, stablecoins' development prospects will be profoundly influenced by the GENIUS Act, warranting continued attention.