In the history of DeFi derivatives, few protocols have captured more than half of the on-chain perpetual contracts market, but Hyperliquid has achieved this. What is its secret?

Data shows that within 24 hours, the total trading volume of on-chain perpetual contracts was $14.37 billion, with @HyperliquidX accounting for an astonishing $9.3 billion, representing 64.71%, demonstrating Hyperliquid's absolute market dominance.

However, most DEXs have struggled to match these metrics, typically relying on:

·AMM design (leading to high slippage for large orders, such as GMX);

·Partial off-chain solutions (like dYdX v3), which affect transparency or increase user complexity.

Hyperliquid recognized this issue: if user experience is poor or liquidity is insufficient, users won't migrate to on-chain platforms. Therefore, the team is committed to providing "CEX-level speed and liquidity, but fully on-chain."

Hyperliquid's success proves the possibility of DEXs facing giants like Binance. Binance's 24-hour perpetual contract trading volume is $97.22 billion, while the overall DEX trading volume is only $14.637 billion, of which Hyperliquid contributes $9.532 billion.

With Hyperliquid, DEX trading volume can reach 15% of Binance's; without it, this ratio would drop to 5%, leaving only $5.105 billion. This demonstrates Hyperliquid's driving force in DeFi trading.

This performance fulfills Hyperliquid's core promise—providing a CeFi-level trading experience on a fully decentralized Layer-1.

(The translation continues in the same manner for the rest of the text, maintaining the specified translations for technical terms.)·HIP-2: Liquidity solution that provides market-making strategies for tokens issued by HIP-1, ensuring liquidity without relying on external platforms like Raydium (different from Pump.FUN).

Core features:

·HIP-1 tokens can be directly used for spot and perpetual contract trading on Hyperliquid.

·HIP-2 is custom market-made by the Hyperliquid team, utilizing its quantitative trading capabilities to provide liquidity support.

Example: PURR has a native ledger, spot order book, built-in oracle, and perpetual contract trading, demonstrating how these standards build a composable trading ecosystem.

Hyperliquid's Technical Core

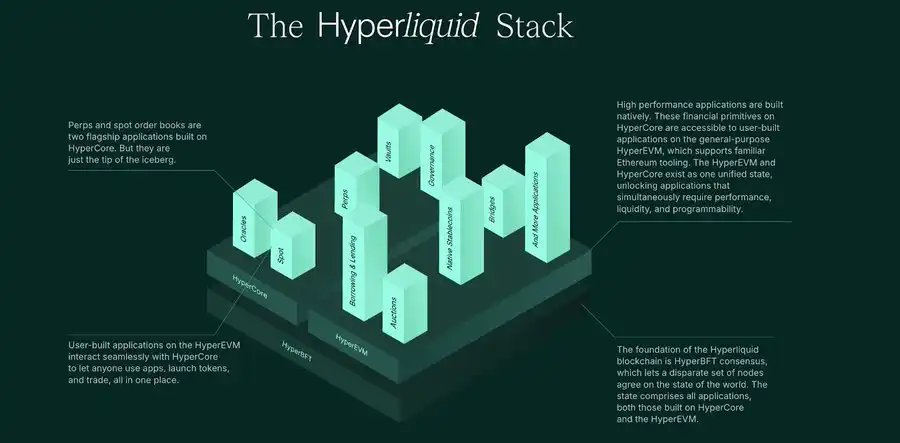

From perpetual contracts to spot trading, all of Hyperliquid's products are built on its custom blockchain - Hyperliquid Layer1. On February 18, 2025, HyperEVM was officially launched on the mainnet.

Hyperliquid's blockchain currently can process over 20,000 transactions per second (TPS), supporting a powerful ecosystem including perpetual contract trading and BTC spot markets. Based on HyperBFT consensus, its L1 has evolved from an initial specialized trading platform to a general-purpose blockchain.

HyperBFT Key Optimizations

Significant TPS Improvement: Previously limited by Tendermint to 20,000 orders/second, the upgrade can now process 200,000 orders/second.

Faster Processing Speed: Consensus process is not blocked by execution, transactions can be continuously ordered without waiting for the current block to complete.

Lower Latency: Confirmation time is faster and more stable, only affected by network latency.

Optimistic Response: Block generation speed depends on validators' communication efficiency.

HyperEVM: Complete Layer-1 Capabilities

HyperEVM integrates the general EVM network into the Hyperliquid blockchain state, forming a dual VM architecture:

Native VM: Optimized for high-performance transactions.

EVM Layer: Supports permissionless third-party development.

With the upgrade of HyperBFT and the introduction of BTC spot trading, Hyperliquid is gradually becoming a more powerful and versatile trading platform.

(Translation continues in the same manner for the rest of the text)·Intuitive Interface: Designed to cater to both beginners and advanced traders, with an interface similar to centralized exchanges (such as Binance).

·Near-Instant Settlement: Sub-second block time supports real-time trading.

·High Throughput: Processing over 200,000 transactions per second, with no delays even during peak activity.

·Easy Fund Deposit: Recharge USDC through Arbitrum (with future plans to support native multi-chain).

·Gamified Design: Leaderboards and competitive rewards (such as airdrops for top traders), creating a highly sticky and active community.

Decentralization Path

Although Hyperliquid's L1 is initially run by team-operated validators (to optimize performance and enable rapid iteration), it is gradually moving towards a multi-validator network and distributed node framework:

·Expanding Validator Set (increasing from 16 to over 100 nodes).

·Read-Only Nodes: Third parties can already run nodes to verify the chain's state and block production.

·Long-Term Deployment Plans: As the ecosystem develops, the team plans to introduce stronger staking and validator entry mechanisms, moving towards a trustless mode, similar to leading proof-of-stake networks.

·Team Incentive Alignment: Since fees currently flow to the protocol treasury and LP providers (not the founding team), the team's future compensation is tied to an upcoming token, thus aligning with long-term chain performance and decentralization goals.

Looking ahead, Hyperliquid is evolving from a focused perpetual contract DEX to a complete exchange ecosystem, with its ambitions evident through the addition of BTC spot trading, HyperEVM's mainnet launch, and expansion of the validator set, aiming to become the "on-chain Binance".

Combining CeFi's high performance with DeFi's transparency, it has already captured 64.71% of on-chain perpetual contract trading volume, proving how a successful community-driven approach can drive DEX challenges to even the largest centralized platforms.

What Are Hyperliquid's Success Secrets?

1. No VC, Self-Funded Model: Ensuring user token ownership, reducing private sale selling pressure, prioritizing genuine trader interests over short-term investors.

2. User-Centric Token Distribution: Generous airdrops (31% of supply allocated to early users, approximately 76% to the community), dynamic points program to prevent Sybil attacks, and a help fund that benefits holders through token buybacks.

3. High-Performance Layer-1 (HyperBFT + HyperEVM): Sub-second confirmation, 100k+ order throughput, and EVM compatibility, offering a combination of speed and future DeFi composability.

4. Fully On-Chain CLOB: Transparent order matching and minimal slippage, bridging the liquidity gaps that typically bind traders to CeFi.

5. One-Stop Spot and Perpetual Contracts: Seamless access to core markets: newly launched BTC spot and powerful perpetual products. Users can manage spot and leveraged positions on a single platform.

6. Community-Driven Feature Development: Direct feedback loops (user requests for Vault, HLP enhancements, cross-chain bridging) engage traders in continuous improvement.

7. Long-Term Decentralization Vision: Gradually expanding validator set, opening read-only nodes, fee structure without team profits, ensuring incentive alignment and progressive de-trusting.

By combining technological excellence, community-first incentive mechanisms, and uncompromising user experience, Hyperliquid has outlined a blueprint for DeFi success.

Its "secret" is essentially a perfect blend of institutional-grade performance and grassroots user engagement—a combination that redefines on-chain trading and paves the way for a broader decentralized financial future.