Written by Daii

It’s not that you are not smart enough, or that you are not well-informed enough, but that we are too accustomed to looking at today’s world with yesterday’s eyes.

In 2011, when Nobel Prize-winning economist Paul Krugman reminded everyone that "buying Bitcoin is a good investment, at least for now," the price was only $7. In 2013, Zhihu user @Busch reiterated this view, and more than 10,000 people liked it. Unfortunately, we still didn't do it.

Today, I looked up my old article from 2020 and suddenly realized that the real reason for missing out on Bitcoin is that we always use "rationality" to disguise fear and use "arrogance" to cover up the unknown.

This article, which has been read 34,000 times and liked by 400 people, may serve as a mirror for us, reminding us that when the next "Bitcoin-level" opportunity comes, we should be less self-limiting and more courageous.

Maybe the past cannot be changed, but the future is still in our hands. After reading this, don't forget to share it with your friends who are still waiting like us.

Bitcoin should be a mirror for us!

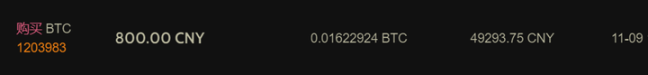

I can't remember when I knew about Bitcoin, but it was late. It must be much later than Wu Gang who knew about Bitcoin in June 2009. At that time, I seemed to be young and frivolous, and everything around me was still thriving. The first Bitcoin transaction was on November 9, 2017, with the price at $7,250. More than a month later, on December 17, Bitcoin reached a historical high of more than $19,000, more than double the price when I bought it. You must feel sorry for me, why didn't you buy more? In fact, it seems that it was not the best time to buy Bitcoin at that time, just like it is not the best time to buy it now. For the reason, please see the previous article "Be careful! Don't be fooled! Bitcoin has never had a bull market!"

My first transaction screenshot

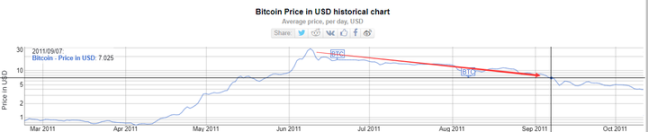

What I regret more now is why I didn’t buy Bitcoin earlier? This is not a pipe dream, it is really possible, because as early as September 11, 2011, a Nobel Prize-winning economist recommended that everyone buy Bitcoin. At that time, the highest price of Bitcoin was only $7.025.

Economists recommend buying Bitcoin?

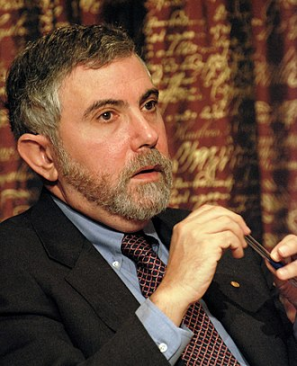

He is the economist who recommended buying Bitcoin, Paul Krugman, winner of the 2008 Nobel Prize in Economics and a New York Times columnist. He won the Nobel Prize for his research on "international trade" and "geographical distribution of economic activities." Krugman is an advocate of globalization, and his theory of international trade is now being challenged by reality. I will talk about this later when I have the chance.

In 2008, Krugman

Next, let's take a look at his article recommending the purchase of Bitcoin. This is Krugman's earliest article on Bitcoin, titled "Golden Cyberfetters", a blog post published on September 7, 2011. You can't be annoyed, this time will appear repeatedly in this article, I want to tell you that opportunity is actually time.

September 7, 2011, Krugman published his first article on Bitcoin, “Golden Cyber Shackles”

"Golden Cyperfetters", when you first saw this name, were you also confused? It's not your fault. This is a term coined by Krugman. The original name was Golden fetters, which was used to criticize the gold standard from 1919 to 1939. Many people in the economics community believe that the gold standard caused the Great Depression in the 1830s. The "milk down the drain" you saw in textbooks was from that time. It is generally more complicated. You just need to remember that the gold standard caused the Great Depression, which is bad enough. Here, Bitcoin is likened to cyber gold. Because Bitcoin is also issued in limited quantities, with only 21 million coins, it implies that Bitcoin will also cause deflation and the Great Depression. The reason is simple, because the limited issuance of Bitcoin will encourage hoarding. Bitcoin is a new, Internet-era gold standard that will eventually lead to "hoarding, deflation and the Great Depression."

So to the extent that the experiment tells us anything about monetary regimes, it reinforces the case against anything like a new gold standard – because it shows just how vulnerable such a standard would be to money-hoarding, deflation, and depression.

However, Krugman separates theory from practice. Although he is not optimistic about the future of Bitcoin, he does not add insult to injury. He simply acknowledges the sharp fluctuations of Bitcoin and believes that "buying Bitcoin is a good investment so far."

So how's it going? The dollar value of that cybercurrency has fluctuated sharply, but overall it has soared. So buying into Bitcoin has, at least so far, been a good investment.

By the way, in that blog post, Krugman also talked about another truth: the monetary system we want cannot make people rich just by holding the currency, but the monetary system should be able to promote transactions and make the entire economy rich. He believes that "Bitcoin" is a currency that can make people rich just by holding it, which is unreasonable. So, is this true? This is not related to this article, but it is interesting, so we will talk about it another day.

What we want from a monetary system isn't to make people holding money rich; we want it to facilitate transactions and make the economy as a whole rich.

Let's get back to the point. You might say, wait, you will definitely miss this opportunity because your English is not good. It doesn't matter, we have Zhihu. On November 22, 2013, @Busch brought the news that Nobel Prize winner Krugman recommended Bitcoin to the Chinese world for the first time in the form of Zhihu Q&A. How about it, our Zhihu is awesome. Moreover, @Busch also told everyone a story. What's more amazing is that this answer actually received 12,000 likes.

Answers about Bitcoin with 12,000 likes

This is the Zhihu Q&A. The question is: How does the economics community view Bitcoin? The answerer @Busch has received 12,805 likes so far. 12,000 likes, which is really impressive.

The story in it contributed greatly to the 12,000 likes. We should also put aside our utilitarianism for the time being and appreciate this good story carefully.

The story is true, and it's about the "Capitol Hill Nanny Cooperative". It started with a group of young parents working in Congress who wanted to solve the problem of no one to take care of their children when they were socializing. So, they set up this mutual aid organization. When joining, everyone receives a 20-hour nanny voucher, and each voucher corresponds to a certain period of childcare service. Parents who provide services can get nanny vouchers, and then give the vouchers to others when others help them take care of their children. Of course, there are more management details. In short, they have considered many issues.

Capitol Hill Nanny Co-op in 2000

Half-hour babysitting vouchers issued by the babysitting cooperative

However, reality is very harsh, and problems eventually occurred. Not long after it started, the cooperative was on the verge of collapse. This is because people were unwilling to spend coupons to hire someone else to take care of their children, but were willing to earn more coupons for their own emergency needs.

@Busch believes that the recession is caused by insufficient output, and the reason is that there are not enough babysitting vouchers.

If we regard this childcare cooperative as an economy and the nanny service as its output (GDP), this is the classic definition of a recession. The cause of the recession is deflation in the economy, that is, the number of nanny vouchers is not enough.

@Busch used this story to criticize Bitcoin's anti-inflation feature. Because of it, there will be a lot of hoarding behavior, which will eventually lead to deflation and thus the Great Depression. This is also the core idea of Crockett's "Golden Cyperfetters". You should know that the limited supply of 21 million is the most vulnerable point of Bitcoin and the first point to be attacked.

If it really becomes the "currency of the future" and "global currency" as some fanatical speculators advocate, the fate of the global economy will be the same as that of the Capitol Hill nursery.

In fact, the conclusion is just the opposite. The reason for the recession is not the lack of nanny vouchers, not the lack of output, but the lack of demand. Economists have already clearly stated this in papers. @Busch compares the certainty of the number of nanny vouchers with the limited total amount of Bitcoin, allowing people to easily understand complex economic principles. The conclusion is also simple. If Bitcoin becomes an international currency, its fate will be the same as nanny vouchers, leading to deflation and the difficulty of maintaining nanny cooperatives, that is, the Great Depression. Indeed, the answer is very concise, vivid, and vivid, and it deserves 12,000 likes.

However, this story has been misused. The shortcomings of @Busch's answer are not relevant to this article. We will talk about it another day. You can find it on the WeChat public account.

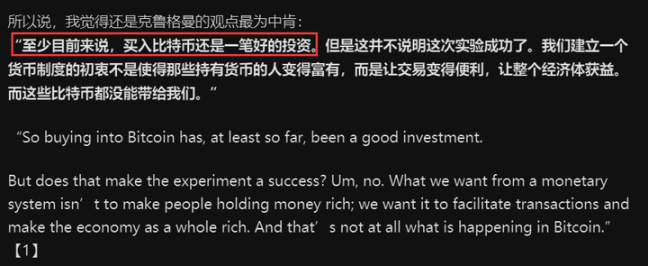

Now let's talk about what you care about most. Don't think that @Busch wants to make everyone give up buying Bitcoin through Q&A. The real situation is completely the opposite. He specifically quoted Krugman's words in that article in full paragraph, "At least for now, buying Bitcoin is still a good investment", and even bolded it to remind everyone.

Screenshot of Krugman's recommendation to buy Bitcoin in a Zhihu Q&A answer with 12,000 likes

Well, please note that there are two time points here, representing the opportunity for you to buy Bitcoin. One is the time when Krugman’s article was published, September 7, 2011; the other is the time when @Busch quoted his article in the Zhihu Q&A, around November 22, 2013.

A Nobel Prize-winning economist recommends buying Bitcoin, which is a very rare signal. However, even if you have the opportunity and see such a signal, you still won’t buy it. Why is that? This is what this article wants to tell you. Let’s analyze them one by one.

Why might you not buy it?

If you were lucky enough to see Krugman's recommendation to buy Bitcoin on September 7, 2011, you might not necessarily buy it. Just look at the price trend at the time and you will understand. At that time, the price of Bitcoin was $7.025, just down from the historical high of $29 a month ago. Note that the reason why the figure below does not show a cliff-like drop is because it is a logarithmic scale, a scale that allows you to pay attention to trends. If you want to learn about the logarithmic scale, please also read the previous article "Be careful! Don't be fooled! Bitcoin has never had a bull market!" Don't blame me for repeatedly recommending this article, because now is what many people think is a bull market, and I don't want my readers to be fooled.

Bitcoin price trend before September 2011 (logarithmic scale)

Looking at the price chart below on a normal scale, you will not buy it. The steepness of the decline is much greater than that of the logarithmic scale above. It is more intuitive and more frightening. This is a typical "bear market". As the saying goes, there is no bottom in a bear market. You decide to wait a little longer. Sure enough, as you expected, the price continued to fall. On November 11, 2011, Bitcoin was only $2.1. At this time, you will believe Krugman's prediction that Bitcoin will not succeed. You will feel very lucky that you did not listen to him at the time, otherwise you would have lost a lot.

However, looking back today, you actually missed an opportunity.

From September 2011 to January 2020, the price of Bitcoin has been falling

Let's talk about the second time point, November 22, 2013. This is also the time when you, as a Chinese reader, are most likely to see Krugman's recommendation to buy Bitcoin through Zhihu. Will you buy it? Not necessarily. Look at the picture below. Two years later, the price of Bitcoin has risen nearly 100 times, from $7 to $675. This is an unprecedented increase in history. If this is not a bubble, what is it? What's more terrifying is that the price at that time continued to rise. Within 20 days, on November 30, it reached $1,052, a new historical high. The drastic price fluctuations make you begin to doubt Krugman's words. The risk is too great. The greater possibility is that you will give up. Forget it. There are many opportunities in the world. Why bother with Bitcoin?

The second chance to buy Bitcoin was gone.

On November 22, 2013, when Krugman’s ideas reached China, the price of Bitcoin was $675.

In order to let you understand how difficult it is for an economist, a Nobel Prize-winning economist, to recommend buying Bitcoin, you need to understand the current mainstream views on Bitcoin. From this, you can also understand how precious these two opportunities are.

Is Bitcoin a bubble?

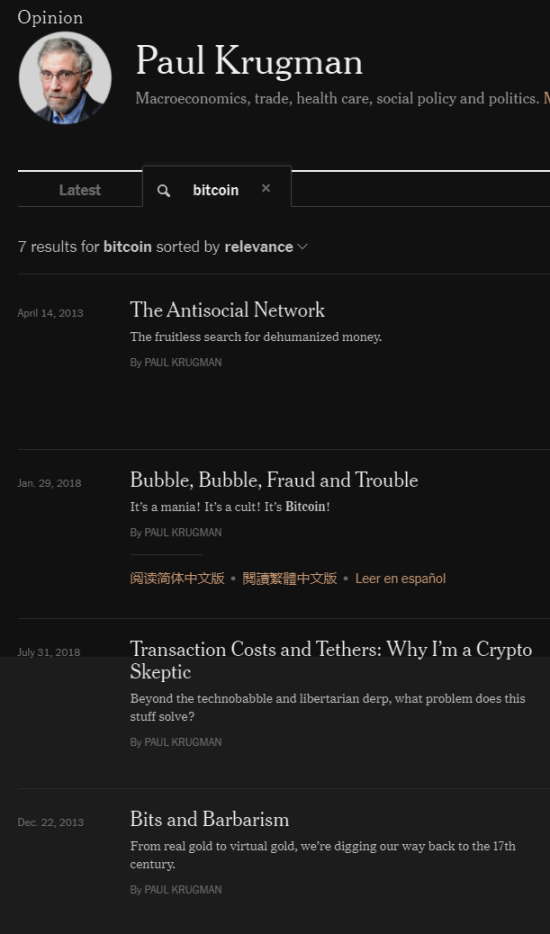

Economists are common, but recommendations are rare, and it is even rarer for a Nobel Prize-winning economist to recommend buying Bitcoin. That recommendation can be seen as an accident, and it has never happened again since then. Instead, Krugman began to denounce Bitcoin.

Since September 7, 2011, Krugman's attitude towards Bitcoin is no longer ambiguous, and he has begun to clearly oppose it. The following is a list of his articles on Bitcoin published in the New York Times. From the titles of the articles, we can clearly understand how resolute he is in opposing Bitcoin. April 14, 2013 "Anti-Social Networks"; January 29, 2018 "Bubbles, Bubbles, Scams and Problems"; July 31, 2018 "Why I am a Cryptocurrency Skeptic".

Krugman's New York Times column, a list of some articles related to Bitcoin

In particular, in the article on January 29, 2018, he said that when he was getting a haircut, a barber asked him if he should buy Bitcoin. He was so angry that he wrote an article with two "bubbles" in the title, "Bubble, Bubble, Fraud and Trouble". The end of the article vividly showed his anger towards Bitcoin: Yes, my barber should not buy Bitcoin. This will end badly, the sooner the better.

So no, my barber shouldn't buy Bitcoin. This will end badly, and the sooner it does, the better.

I'm going to make a wild guess. On January 29, 2018, the price of Bitcoin was more than $11,000, which was a drop of more than $8,000 compared to the historical high of more than $19,000 a month ago. Maybe Mr. Ke was trapped, otherwise, why would he be so angry? It's just a joke, don't take it seriously, but it might be true.

On January 29, 2018, the price of Bitcoin was more than $11,000.

Bitcoin will not be sold to economists just because they are generally against it. There is an anonymous forum where American economics graduates, teachers and job seekers often post messages. Because of anonymity, you may hear true news or false news. The forum is called "Economics Job Market Rumors" (EJMR), and the website is: econjobrumors.com. There is a post in the forum from 3 years ago with a very bold title: Not buying Bitcoin now is the biggest mistake of your life. Disclaimer again, because it is a rumor, it cannot be used as evidence that any economists buy Bitcoin. I am telling you as gossip.

A post from the EJMR anonymous forum 3 years ago: Not buying Bitcoin now is the biggest mistake of your life

Back in China, Jack Ma, a successful Chinese businessman, has also joined the ranks of those denouncing Bitcoin. He said Bitcoin is a bubble, very seriously and seriously. It was the Second World Intelligence Conference on May 16, 2018. This conference is very important. Just look at its organizers and you will know: the National Development and Reform Commission, the Ministry of Science and Technology, the Ministry of Industry and Information Technology, the Cyberspace Administration of China, the Chinese Academy of Sciences, the Chinese Academy of Engineering, the China Association for Science and Technology, and the Tianjin Municipal People's Government.

On May 16, 2018, at the Second World Intelligence Conference, Jack Ma said that blockchain is not a bubble, but Bitcoin is a bubble.

Jack Ma’s original words were, “Blockchain is now a hot word. First of all, blockchain is not a bubble, but today’s Bitcoin is a bubble. Bitcoin is just a very small application of blockchain.”

The key issue is that the price of Bitcoin had just fallen from its peak of more than $19,000 to just over $8,200, a further drop of $3,000 from when Krugman published his angry column “Bubble, Bubble, Scam and Problem.” This also seems to prove that what Jack Ma said was right, that Bitcoin is a bubble that is bursting.

On May 16, 2018, the price of Bitcoin was $8,291, less than half of its historical high.

Think about it carefully, whether you don’t buy Bitcoin or Krugman and Jack Ma say that Bitcoin is a bubble, it all makes sense and is the result of rational decision-making.

However, 11 years later, our rationality hurts our eyes (watching the price rise), and our rationality hurts our pockets (not making any money). We can't always deceive ourselves every day. Bitcoin is still a bubble now, and eventually, everything will disappear. Then won't we become Xianglin Sao (brother)? We have to ask ourselves: Is rationality wrong? Should we be as crazy as gamblers to have a chance to get Bitcoin dividends? No, it's because we may have done something wrong.

What did we do wrong?

There is nothing wrong with rationality. The fault lies with us. We use rationality in the wrong place. Our survival instinct requires us to put safety first and not take risks. We are very likely to deny a new thing because new things mean immaturity and risk.

In the final analysis, we lack tolerance for new things. More often than not, we are filled with fear. Think about how scared the first person to try something new must have been. Otherwise, we wouldn't be using the phrase "the first person to try something new" to praise those heroes who dare to be the first in the world. Eating something new is still a personal choice, but once it rises to the level of society, the problem becomes more complicated.

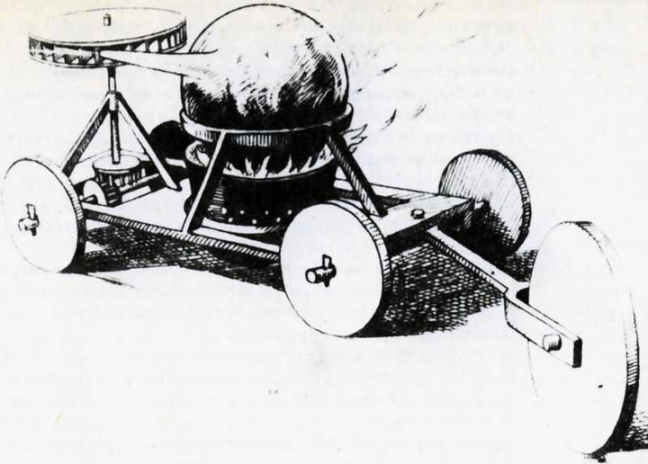

Take a look at the "Red Flag Act" in Britain in the 19th century, and you will understand that the "condemnation" of cars at that time was no less than that of Bitcoin today. When cars were first invented, they were generally inferior to horse-drawn carriages. In other words, horse-drawn carriages were opposed. Horse-drawn carriages, of course, cannot speak, and they are opposed to us humans. In the beginning, cars had poor comfort and stability. The following prototype of a car from 1678 is simply an "ugly monster". These are secondary. The key is that the sound is loud, and when a car suddenly passes by you, it often scares you. In 1865, the British enacted a "Red Flag Act" to "regulate" car driving. Because, at that time, the biggest advantage of cars was that they might only be "fast".

The car of 1678

The "Red Flag Act" of 1865 stipulated that the maximum speed of cars should not exceed 4 miles per hour, equivalent to 6 kilometers per hour. In urban areas, the speed limit was halved, and a fine of 10 pounds was imposed for speeding. What's more, the Act required that each car must have at least 3 people on the road, and one of them must be 60 yards in front of the car, about 55 meters away. This person was responsible for directing traffic, reminding passers-by, and assisting the passage of horses and carriages. The person in front would hold a small red flag in his hand, which is also the origin of the name of the "Red Flag Act".

Stipulated that self-propelled vehicles should be accompanied by a crew of three; if the vehicle was attached to two or more vehicles an additional person was to accompany the vehicles; a man with a red flag was to walk at least 60 yd (55 m) ahead of each vehicle, who was also required to assist with the passage of horses and carriages. The vehicle was required to stop at the signal of the flagbearer. (Section 3) Additionally vehicles were also required to have functional lights, and not sound whistles or blow off steam whilst on the road. (Section 3) A speed limit of 4 mph (2 mph in towns) was imposed for road locomotives, with a fine of £10 for contravention. (Section 4)

You may not be able to understand the speed limit of the bill just by reading the text. If you think about it carefully, you will find that this rule is too harsh, even a bit "vicious". Because the car is moving, but there must always be a person in front of the car, not far away, and the person is required to walk. Just think about it and you will know how fast this car can go.

There is a person holding a red flag in front of the car. The origin of the Red Flag Act

The photo above was taken in 1896, the year the Red Flag Act was repealed after 31 years of implementation. The driver was Charles Rolls, one of the co-founders of Rolls-Royce. This photo was probably taken specifically to leave a memory of that era. The standard configuration of driving a car is 3 people, 1 person is walking in front, holding a small red flag. If you are interested in this period of history, you can read "When the Car Appeared, the Horse-drawn Carriage Was Opposed".

Science fiction writer Liu Cixin

Science fiction writer Liu Cixin said in "The Three-Body Problem": Weakness and ignorance are not obstacles to survival, but arrogance is. Our intolerance is seen as arrogance by other species. Arrogance is the social gene of human beings. Because we do have the wisdom to look down on other creatures on Earth. Arrogance is not something we deliberately pursue; arrogance is sometimes our meanness; arrogance is more often expressed through our intolerance of new things.

The "Red Flag Act" has become history, and the "Bitcoin is a bubble" continues...

Conclusion

Fortunately, The Economist, a well-established economic publication founded in 1843, has put aside its arrogance. On October 29, 2020, they published an article that won praise. The title of the article is "Getting down with the cool kids on bitcoin", and the subtitle is "How investors might learn to stop worrying and love crypto", and the illustration of the article also includes a symbol of Bitcoin. The cool kids here refer to the "Blitz Kids". From 1979 to 1980, they often participated in the Tuesday club nights in Covent Garden, London. They were praised for launching the New Romantic subculture movement. This may require people who understand the history of British culture to understand the significance of their existence. You just need to know that this group of cool kids is not simple. They are a group of people who have contributed to British culture, and there are also a large number of celebrities among them.

Illustration from The Economist article “Bitcoin with the cool kids”, October 29, 2020

The article says: Bitcoin is a tiny club. Next to it, gold looks as spacious as Wembley Stadium. The market value of all Bitcoins is only 1-2% of the value of all the gold in the world. Scarcity is a characteristic of many things that are considered valuable.

Bitcoin is a pretty tiny club. Beside it, gold looks as capacious as Wembley Stadium. The market value of all bitcoin is just 1-2% of the value of all the gold above ground. Scarcity is a trait of many things that are perceived to have value.

The article ends with a quote from cool kid Steve Strange: "The best move I ever made was pushing Mick Jagger out of the door."

Steve Strange, who sadly died in 2015, understood this fully. "The best move I ever made was turning Mick Jagger away at the door," he said.

Mig Jagger, who was pushed away by him, was a famous British rock singer, while Steve Strange, the cool kid who pushed him away and prevented him from entering the club, was still unknown and had not grown up yet. The author wants to hint to us that we should not be abandoned by the cool kids who are playing Bitcoin now. We should take the initiative to join. The Bitcoin Club will not die because of our failure to join.

Yes. Cars are our friends, and horse-drawn carriages have long gone into history. We have almost forgotten the arrogance of the "Red Flag Act". Now, Bitcoin has come, and because of our past arrogance, we have lost the opportunity to reap the benefits of Bitcoin again and again.

Benefits are always temporary. If we cannot learn to put down our arrogance when facing new things, we will lose more "Bitcoin-level" opportunities. In this sense, remembering the missed Bitcoin opportunities will make us less arrogant, make us humble, and give us more new opportunities.

Bitcoin should be our "mirror of thought".