Bitcoin's price has recently risen strongly but experienced a correction in early last week. Recently, circumstances have been captured that suggest Bitcoin's price can recover its losses and continue its upward trend.

This rebound seems possible thanks to investors' strong support. This helps stabilize the market and build new confidence.

Bitcoin Investors Still Strong

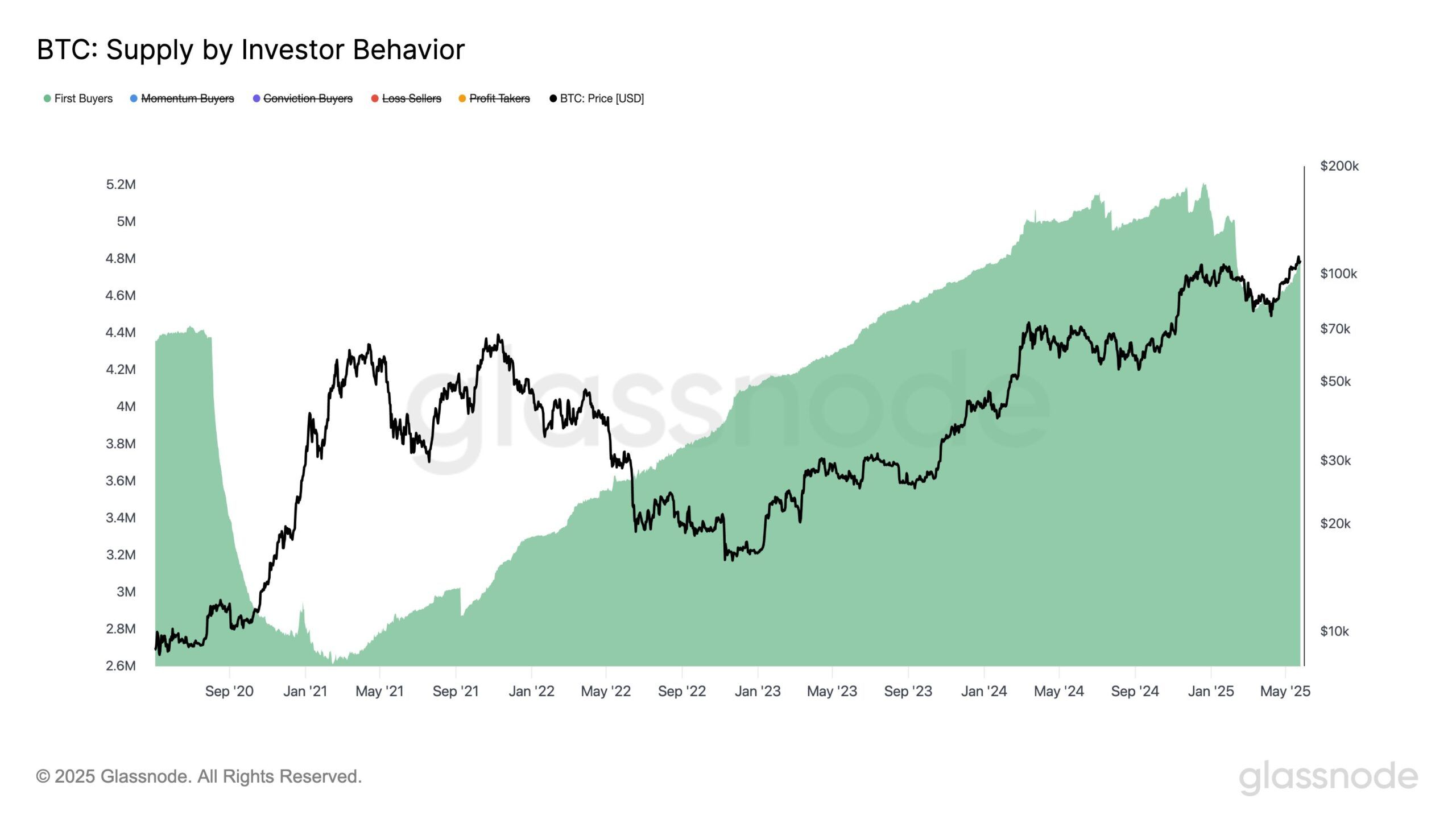

Supply based on investor behavior shows an increase in Bitcoin. New BTC buyers sharply increased from July to December 2024, and from March to May 2025. Both periods coincide with significant price expansions, indicating that new capital inflows are strengthening market structure.

These new investor inflows suggest growing confidence in Bitcoin's future. This capital inflow can sustain price growth due to increased demand. Combined with limited supply, it creates upward price pressure. Investors are optimistic about Bitcoin's long-term potential.

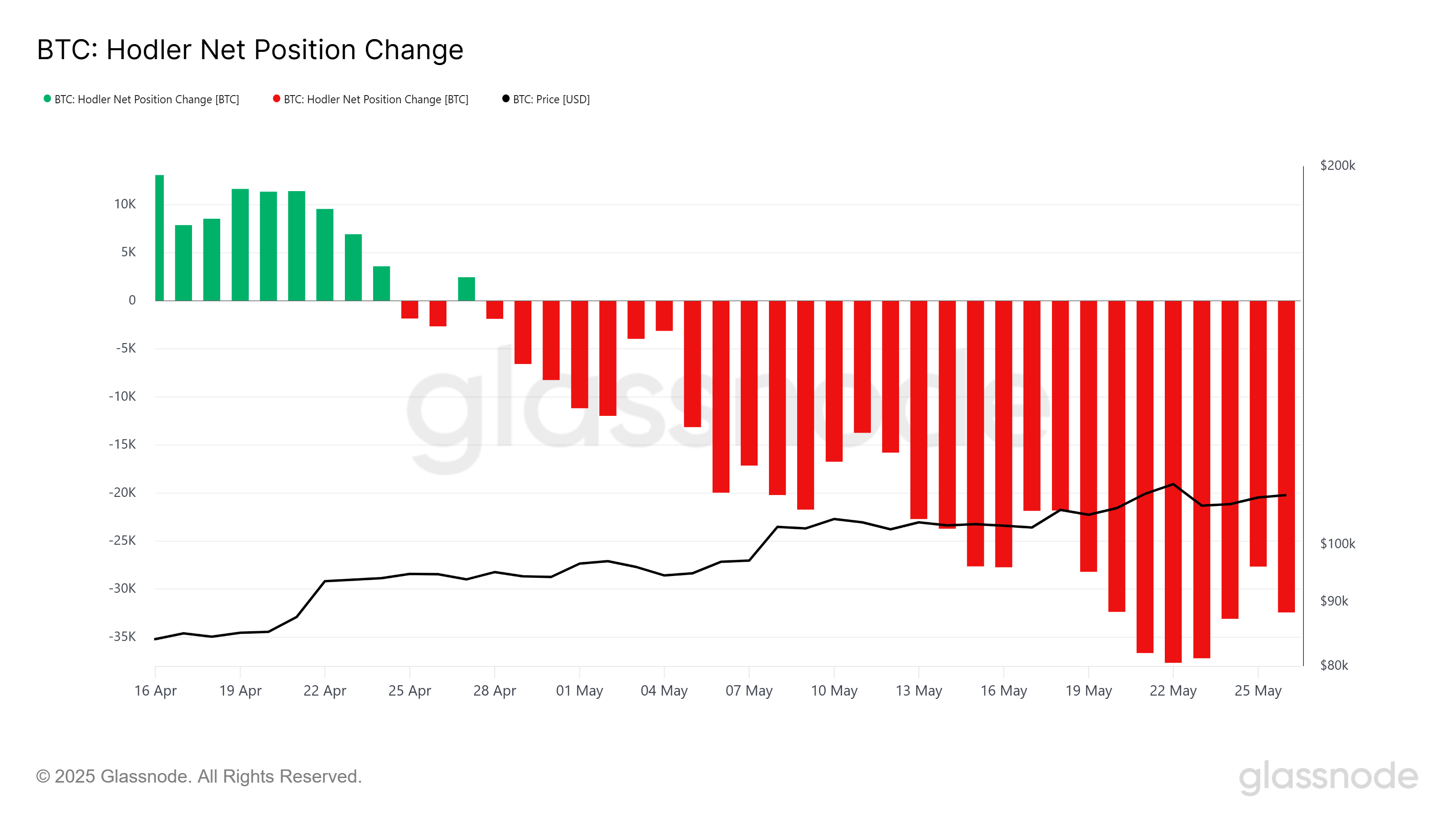

HODLer net position change emphasizes that long-term holders (LTH) remain consistently strong. LTH is crucial in supporting prices by holding coins and reducing circulating supply. The expanded red bars in the indicator show active accumulation, which supports prices.

This steady LTH accumulation reflects strong conviction and helps Bitcoin maintain resilience against short-term market volatility. The continuous buying pressure from these holders provides a foundation for sustained price increases.

BTC Price Needs Support

Current Bitcoin price is located at $109,160, just below the key resistance level of $110,000. Transforming this psychological barrier into support is essential for Bitcoin's continued rise. Securing this level can restore bullish momentum and attract additional buying interest.

If Bitcoin maintains above $110,000, the path to surpassing the all-time high of $111,980 seems clear. This breakthrough could trigger a rally to $115,000 within days, driven by new investor enthusiasm and favorable market conditions.

However, if LTH accumulation slows or is offset by selling pressure, Bitcoin could face downward pressure. Falling below $106,265 could see the price drop to $105,000, potentially invalidating the current bullish outlook and signaling caution to traders.