Despite Bitcoin reaching an all-time high last week, it remains at around $110,000. On-chain data suggests that the lack of additional breakthrough momentum is due to profit-taking by new whales.

Since April 20, Bitcoin's price has risen by more than 30% from $84,000. However, the upward trend stopped after reaching a record peak of $111,970 on May 22. Analysts say that selling pressure from recently formed whale addresses could be the cause of the price stagnation.

New Whales, Limiting Bitcoin Price?

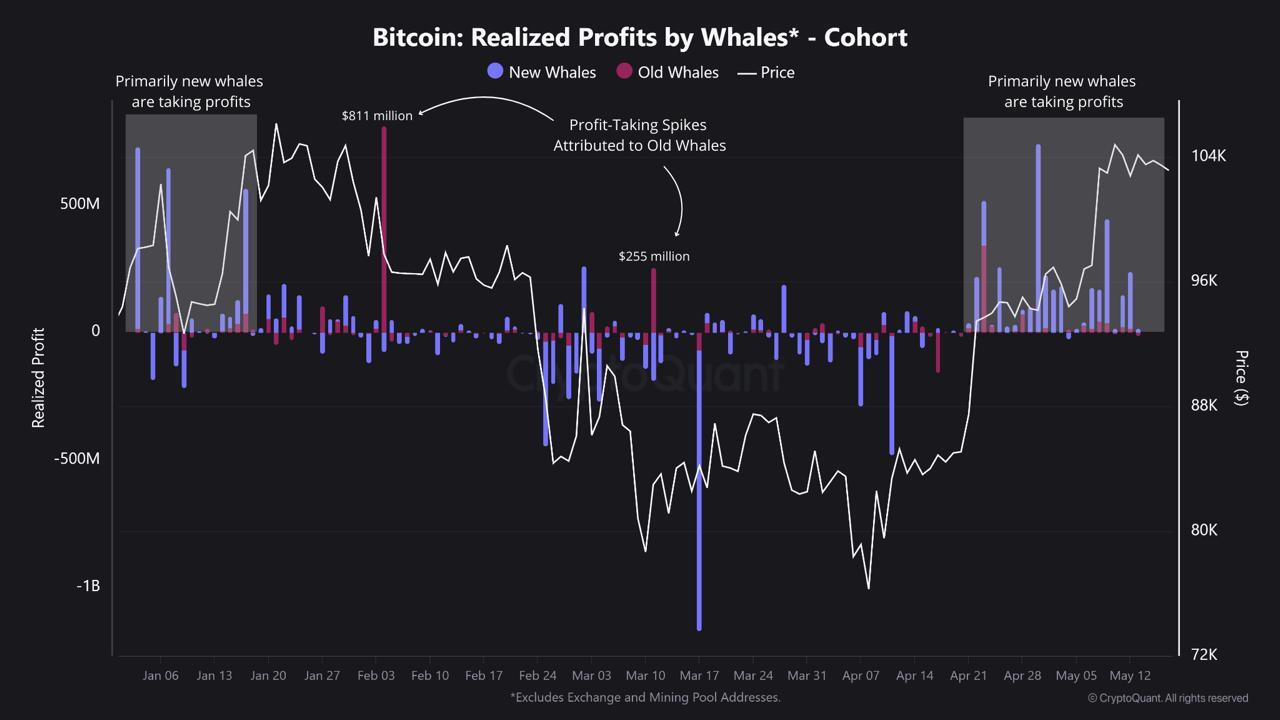

CryptoQuant's cohort analysis shows a clear pattern. Most of the profit-taking over the past month came from new whales who used the upward trend to lock in profits.

Specifically, these are investors who purchased BTC at an average of $91,922.

"It's important to monitor whether new or old whales are realizing profits during this rally. Surprisingly, 82.5% of profit-taking since April 20 came from new whales." – J.A. Maartun, CryptoQuant

The data also shows that new Bitcoin whales have realized profits of about $3.21 billion, which is significantly larger than the $679 million from old whale wallets.

The profit rotation appears to be creating resistance below $112,000.

Additionally, the following CryptoQuant chart reflects how this trend was formed before BTC reached its all-time high last week. Since late April, the blue bars representing new whales have dominated the profit-taking column.

The most recent gray-shaded section highlights the increased activity of these new market participants.

In contrast, the profit-taking spikes of $811 million in February and $255 million in March were attributed to old whales.

Meanwhile, the profit-taking trend continues this week.

New whales, in particular, have been realizing profits during this latest pump pic.twitter.com/IoJrBToFnQ

— Maartunn (@JA_Maartun) May 25, 2025

This behavioral change suggests that new whales are using the recent peak to liquidate positions entered during the first quarter's downturn. These liquidations create continuous selling pressure, hindering further increases.

Simultaneously, old whales remain largely inactive. Their selling hesitation indicates confidence in Bitcoin's long-term trajectory and may limit downside risks in the short term.

Bitcoin may find it difficult to definitively break through current levels until the selling by new whales subsides. Market observers will carefully track whether this cohort continues to sell or stops, allowing the price to find new momentum.