Source: Financial Times

Compiled and Organized by: BitpushNews

Trump's family media company (TMTG) plans to raise $3 billion to purchase Bit and other cryptocurrencies, betting on the digital assets he advocates.

According to six people familiar with the matter, Trump Media & Technology Group, the mastermind behind the "Truth Social" app, controlled by the presidential family, plans to raise $2 billion through new equity financing and an additional $1 billion through convertible bonds.

TMTG's financing plan may be announced before a large cryptocurrency investor and advocate conference in Las Vegas this week, where Vice President JD Vance, Trump's sons Donald Jr. and Eric, and Trump's cryptocurrency czar David Sachs are expected to speak.

The financing terms, timing, and scale of TMTG are still subject to change.

Two sources told the Financial Times that TMTG's financing scale has expanded in recent weeks due to strong demand.

TMTG stated in a statement that "obviously, the foolish authors of the Financial Times are listening to even more foolish sources," but made no further comment.

Donald Trump Jr.'s representative did not respond to a request for comment. The White House spokesperson declined to comment.

The plan is the latest example of the Trump family's foray into the cryptocurrency field, raising concerns about conflicts of interest. Trump has vowed to make the United States the "cryptocurrency capital of the world".

His interest in cryptocurrencies has sparked a wave of transactions aimed at seizing the opportunity of cryptocurrency recovery.

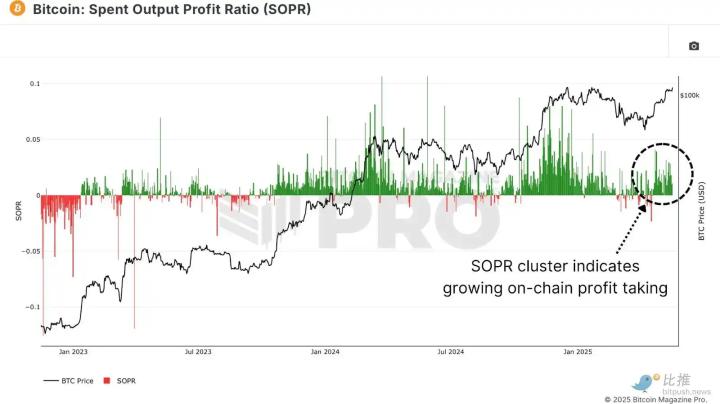

Last week, the Bit price surged to a historical high of $109,000.

TMTG's financing method is similar to Strategy (formerly MicroStrategy), a former software company whose market value has soared to over $100 billion after purchasing billions of dollars worth of Bit using debt and equity issuance.

This secondary issuance will be conducted at market price, meaning stocks are expected to be sold at a price close to Friday's closing price. TMTG's stock closed at $25.72 on Friday, with a market value of nearly $6 billion.

The Trump family has already ventured into the cryptocurrency field, including Non-Fungible Token trading cards, two memecoins, and stakes in cryptocurrency mining enterprise American Bitcoin and stablecoin supporter World Liberty Financial. TMTG also plans to launch an Exchange Traded Fund (ETF) focused on cryptocurrencies.

Last week, Trump hosted a private dinner at a at his in Washington suburbs, treating the top investors of his meme.

Two sources said brokers such as ClearStreet and BTIG might serve as underwriters for the transaction.

After being re-elected president last year, Trump transferred his 53% stake in TMTG (currently worth about $3 billion) to a revocable trust managed by his son Donald Jr., who has sole investment and voting rights for the shares held by this entity.

Last month, a listed blank check company led by Brandon Lutnick, son of Commerce Secretary Howard Lutnick, reached an agreement to create a Bit acquisition company called Twenty One Capital for $3.6 billion, And Softthe transaction.

>Industry executives told the Financial Times that a wave cryptocurrency-focused transactions the in the coming weeks especially among blank check companies.