I just finished chatting with several industry leaders, and everyone is discussing the same thing...

The "four-year cycle" theory is completely outdated!

If you are still holding onto the fantasy of getting rich and dreaming about "ten or hundred-fold opportunities in a bull market", you may have been completely abandoned by the market. Why?

Because smart money has long discovered a secret: Current Crypto no longer applies to one set of strategies, but is running 4 completely different gameplay cycles simultaneously:

The rhythm, gameplay, and profit logic of each cycle are completely different.

Bitcoin Super Cycle: Retail Investors Eliminated, Ten-Year Slow Bull May Become Inevitable

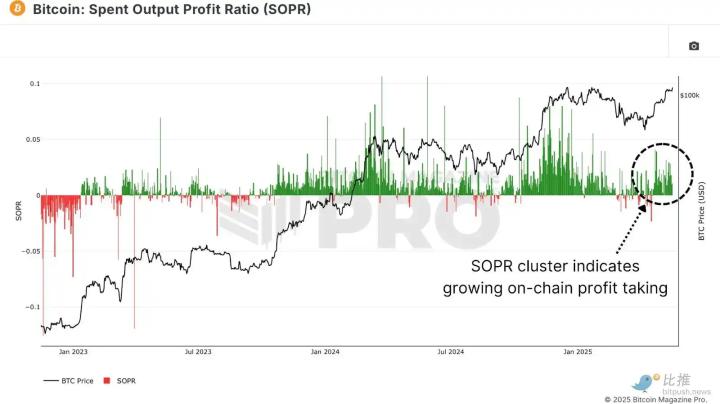

The traditional halving cycle "script"? Completely invalidated! BTC has evolved from a "speculative target" to an "institutional asset allocation". The capital volume and allocation logic of Wall Street, listed companies, and ETFs are completely different from retail investors' "bull-bear switching" approach.

What's the key change? Retail investor chips are being massively transferred, while institutional funds represented by MicroStrategy are frantically entering the market. This fundamental restructuring of chip structure is redefining BTC's price discovery mechanism and volatility characteristics.

What are retail investors facing? A double squeeze of "time cost" and "opportunity cost". Institutions can afford a 3-5 year holding cycle to wait for BTC's long-term value realization, but retail investors? Obviously, they cannot have such patience and capital layout capabilities.

In my view, we are likely to see a BTC super slow bull lasting over ten years. Annual returns stabilizing in the 20-30% range, but with significantly reduced intraday volatility, more like a steady-growing tech stock. As for BTC's price ceiling, it's even difficult to predict from the current retail investor perspective.

MEME Attention Short Wave Cycle: From Slum Paradise to Professional Harvesting Ground

The MEME long bull theory actually still stands. During the technical narrative expression gap, MEME narrative will always fill the market's "boredom vacuum" in sync with emotions, funds, and attention.

What's the essence of MEME? It's a speculative vehicle of "instant gratification". No whitepaper needed, no technical verification required, no roadmap necessary - just a symbol that can make people smile or resonate is enough. From cat and dog culture to political MEME, from AI concept packaging to community IP incubation, MEME has evolved into a complete "emotion monetization" industrial chain.

The deadly part is that MEME's "short, fast, and quick" characteristics make it a barometer of market sentiment and a reservoir of funds. When funds are abundant, MEME becomes the first choice for hot money; when funds are scarce, MEME becomes the last speculative safe haven.

However, the reality is cruel. The MEME market is evolving from "grassroots carnival" to "professional competition". The difficulty for ordinary retail investors to profit in this high-frequency rotation is rising exponentially.

The legendary stories of P sitting and creating miracles might become increasingly rare. The entry of studios, scientists, and big players will make this once "slum paradise" intensely competitive.

Technical Narrative Leap-Forward Long Cycle: Buy the Dips in Death Valley, 10x Minimum in 3 Years?

Technical narrative disappeared? Impossible. Truly innovative technologies with technical barriers, such as Layer2 scaling, ZK technology, AI infrastructure, etc., require 2-3 years or even longer build time to see actual results. Such projects follow the technology maturity curve (Gartner Hype Cycle), not the capital market's emotional cycle - there's a fundamental time misalignment between the two.

The reason technical narrative is criticized by the market is entirely due to overly high valuations when projects are still in the conceptual stage, and then undervaluation during the "death valley" phase when technology actually starts to land. This determines that the value release of technical projects presents a non-linear, leap-forward characteristic.

For investors with patience and technical judgment, deploying truly valuable technical projects during the "death valley" phase might be the best strategy for obtaining excess returns. But the premise is that you must be able to endure a long waiting period, market torment, and potential ridicule.

Short Innovation Hotspot Cycle: 1-3 Month Window, Brewing Major Narrative Uptrend

Before the main technical narrative forms, various small narratives quickly rotate, from RWA to DePIN, from AI Agent to AI Infra (MCP+A2A), with each small hotspot possibly having only a 1-3 month window.

This narrative fragmentation and high-frequency rotation reflect the dual constraints of current market attention scarcity and fund rent-seeking efficiency.

In fact, it's not difficult to find that typical small narrative cycles follow a six-stage model: "Concept Verification → Fund Probing → Public Opinion Amplification → FOMO Entry → Valuation Overdraft → Fund Withdrawal".

Want to profit from this pattern? The key is to enter between "concept verification" and "fund probing", and exit at the "FOMO entry" peak.

Competition between small narratives is essentially a zero-sum game of attention resources. However, there are technical correlations and conceptual progressive relationships between narratives. For example, MCP (Model Context Protocol) and A2A (Agent-to-Agent) interaction standards in AI Infra are actually a technical underlying reconstruction of the AI Agent narrative. If subsequent narratives can continue the previous hotspot, forming a systematic upgrade linkage, and truly precipitate a sustainable value closed loop in the linkage process, it's likely to give birth to a super big narrative with a main uptrend similar to DeFi Summer.

From the current small narrative pattern, the AI infrastructure layer is most likely to achieve a breakthrough first. If underlying technologies like MCP protocol, A2A communication standards, distributed computing power, reasoning, and data networks can be organically integrated, they indeed have the potential to build a super narrative similar to "AI Summer".

That's all.

In summary, understanding the essence of these four parallel gameplay cycles is the key to finding appropriate strategies within their respective rhythms. Undoubtedly, the single "four-year cycle" thinking can no longer keep up with the current market complexity.

Adapting to the new normal of "multiple gameplay cycles running in parallel" may be the real key to profiting in this bull market.