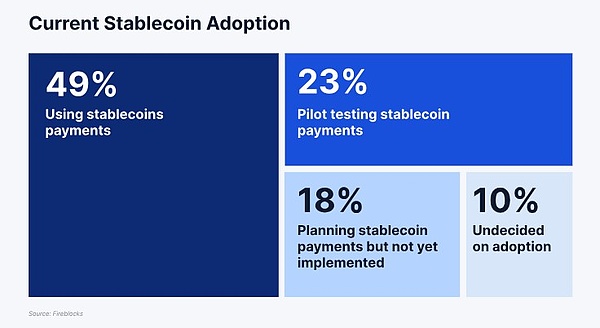

A report from the enterprise-level digital asset platform Fireblocks shows that90% of institutional participants are using or exploring the use of stablecoins in their operations.The report, released on May 15th, surveyed 295 executives from traditional banks, financial institutions, fintech companies, and payment gateways.Nearly half (49%) of the respondents said they are already using stablecoins in payments, 23% are conducting pilot tests, and another 18% are in the planning stage.

Only 10% of the surveyed institutions indicated that they have not yet decided whether to adopt stablecoins.

Fireblocks wrote: "With accelerating customer needs and maturing use cases, the stablecoin race has become a matter of avoiding obsolescence."

Current stablecoin adoption among institutional respondents. Source: Fireblocks

Traditional Banks Prioritize Stablecoins for Cross-Border Payments

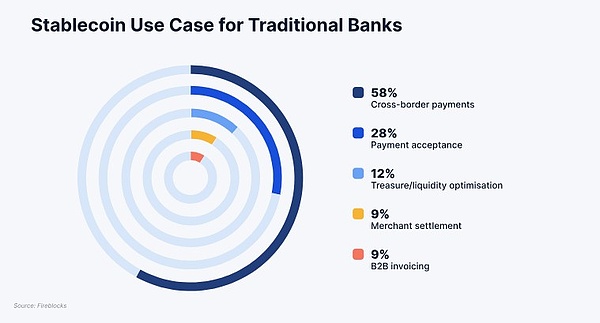

Due to high costs, delays, and other inefficiencies in traditional cross-border systems, stablecoins have become a strategic solution in emerging business-to-business (B2B) environments.

The report found that financial institutions, especially traditional banks, list cross-border payments as their primary task for using stablecoins. Banks use stablecoins to gain a competitive advantage, reduce friction, and meet customer expectations.

The report found that 58% of traditional banks use stablecoins for cross-border payments, 28% use them for collections, 12% use them to optimize liquidity, 9% use them for merchant settlements, and another 9% use them for B2B invoices.

Fireblocks stated that banks view stablecoins as a "path to modernization". The company noted that since these assets are pegged to fiat currencies, they are easier to integrate into existing financial workflows. Additionally, stablecoins provide a lever to help banks reclaim market share from fintech companies and reduce fund lock-up.

Stablecoin use cases for traditional banks. Source: Fireblock

Transaction Speed Considered the Biggest Advantage of Stablecoin Use

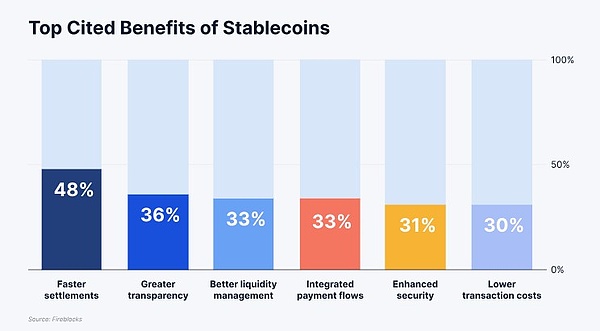

Survey results show that banks are using stablecoins to regain cross-border transaction volume while maintaining existing infrastructure. Fintech companies and payment gateways are using digital assets to generate profits and revenue.

Key advantages of stablecoins. Source: Fireblocks

Among the benefits mentioned by survey respondents, faster settlement speed was the most common, with 48% of respondents citing this.

Other benefits include higher transparency, better liquidity management, integrated payment processes, enhanced security, and lower transaction costs.

Ran Goldi, Senior Vice President of Payments and Network at Fireblocks, stated that stablecoin adoption is no longer just about cost savings, but is now viewed as a strategic growth driver.

Goldi said: "Our research shows that 90% of companies are advancing stablecoin implementation because they see it as a key lever for growth."

The executive noted that key motivating factors include expanding into new markets, responding to direct customer demands, and exploring new revenue opportunities. "Stablecoins have become a driver of business innovation, rather than just improving efficiency," he added.