Written by: TechFlow

Stablecoins have undoubtedly been the hot topic in the crypto market over the past week.

With the U.S. GENIUS Stablecoin Bill passing through Senate procedural voting and the Hong Kong Legislative Council passing the "Stablecoin Regulation Bill" on third reading, stablecoins have now become an important variable in the global financial system.

In the United States, the future development of stablecoins not only concerns the prosperity of the digital asset market but may also have far-reaching implications for government bond demand, bank deposit liquidity, and U.S. dollar hegemony.

A month before the GENIUS bill passed, the Treasury's "think tank" - the Treasury Borrowing Advisory Committee (TBAC), delved into the potential impacts of stablecoin expansion on U.S. fiscal and financial stability through a report.

As an important component of the Treasury's debt financing plan, TBAC's recommendations directly influence the U.S. Treasury bond issuance strategy and may indirectly shape the regulatory path for stablecoins.

So, how does TBAC view stablecoin growth? Will this think tank's perspective influence the Treasury's debt management decisions?

We will use TBAC's latest report as an entry point to decode how stablecoins have evolved from "on-chain cash" to a critical variable influencing U.S. fiscal policy.

TBAC, the Fiscal Think Tank

First, a brief introduction to TBAC.

TBAC is an advisory committee that provides economic observations and debt management advice to the Treasury, with members comprising senior representatives from buy-side and sell-side financial institutions, including banks, broker-dealers, asset management companies, hedge funds, and insurance companies. It is also an important part of the U.S. Treasury's debt financing plan.

TBAC Meetings

TBAC meetings primarily provide financing recommendations to the U.S. Treasury and are a crucial component of the Treasury's debt financing plan. From the financing plan process, the U.S. Treasury's quarterly financing process includes three stages:

1) Treasury debt managers seek advice from primary dealers;

2) After meeting with primary dealers, Treasury debt managers seek advice from TBAC; TBAC will issue a formal report to the Treasury Secretary regarding the questions and discussion materials proposed by the Treasury;

3) Treasury debt managers make decisions on debt management policy changes based on research analysis and recommendations from the private sector.

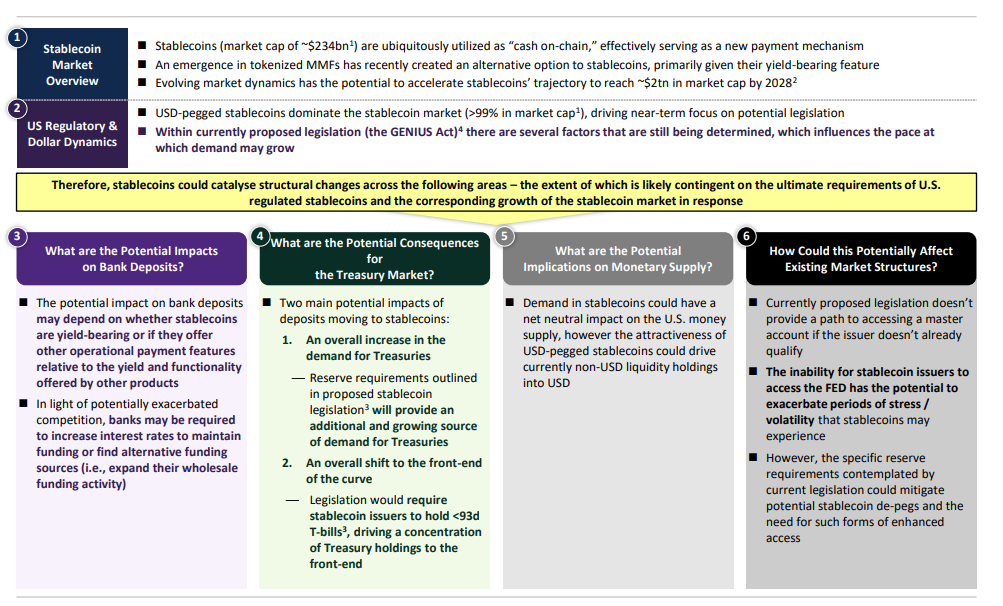

Report Summary: Impact on U.S. Banks, Treasury Market, and Money Supply

Bank Deposits: The impact of stablecoins on bank deposits depends on whether they have earning capabilities and payment characteristics compared to other financial products. In an increasingly competitive landscape, banks may need to raise interest rates to maintain funds or seek alternative funding sources.

Treasury Market: Overall increase in Treasury demand; reserve requirements in stablecoin legislation will provide an additional and growing source of demand for Treasuries; overall shortening of Treasury holding periods, with legislation requiring stablecoin issuers to hold Treasury bills with maturities less than 93 days, leading to concentration of Treasury holdings in the short term.

Money Supply: Stablecoin demand may have a net neutral impact on U.S. money supply. However, the attractiveness of U.S. dollar-pegged stablecoins may shift current non-U.S. dollar liquidity towards the U.S. dollar.

Impact on Existing Market Structure: Current legislative proposals do not provide access to main accounts for non-qualifying issuers. Stablecoin issuers' inability to access the Federal Reserve may exacerbate risks during stress or volatile periods.

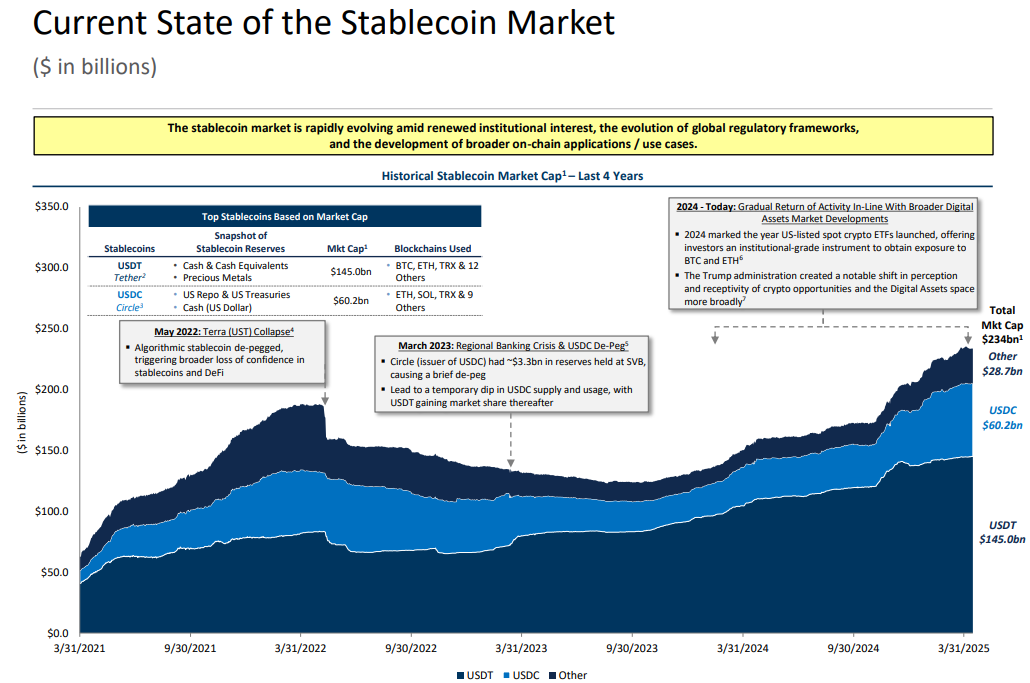

Despite experiencing multiple crises, the stablecoin market is gradually recovering in 2024 and keeping pace with the broader digital asset market development. In 2024, the United States launched the first spot crypto ETFs, providing institutional investors with tools to access BTC and ETH.

Currently, the growth of the stablecoin market is primarily driven by three aspects: increased institutional investment interest, gradual improvement of global regulatory frameworks, and continuous expansion of on-chain application scenarios.

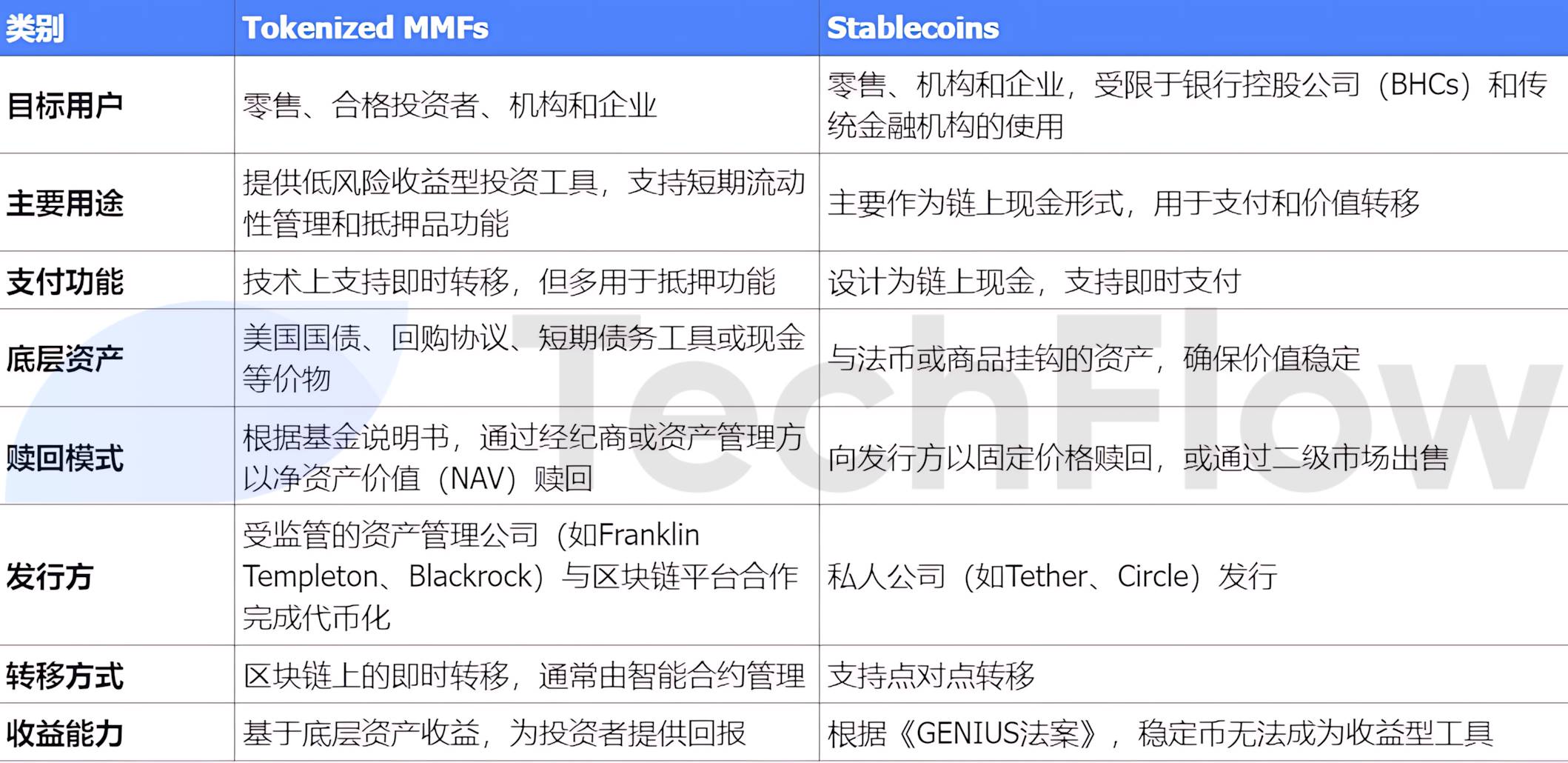

Digital Currency Market Funds and Stablecoins: A Comparison of Two On-Chain Assets

With the rapid growth of Tokenized Money Market Funds (MMFs), a narrative of alternative stablecoins is gradually forming. Although both have similar use cases, a significant difference is that stablecoins cannot become yield-generating instruments under the current GENIUS Act, whereas MMFs can generate returns for investors through underlying assets.

Market Potential: From $230 Billion to $20 Trillion

The report suggests that the market capitalization of stablecoins is expected to reach approximately $20 trillion by 2028. This growth trajectory depends not only on natural market demand expansion but is also driven by multiple key factors that can be summarized into three categories: adoption, economic, and regulatory.

[The translation continues in the same manner for the entire text, maintaining the specified translations for specific terms.]The growth of stablecoins may not directly change the total US money supply, but it will lead to fund transfers from M1 and M2, which could affect bank liquidity and the attractiveness of traditional deposits.

International Impact:

Stablecoins, as a means of obtaining US dollars, may increase the demand for dollars among non-US dollar holders, thereby increasing inflows into the US money supply. This trend could promote the use and acceptance of stablecoins globally.

Although the growth of stablecoins will not immediately change the total US money supply, their potential as a value storage and currency acquisition method may have far-reaching effects on capital flows and international dollar demand. This phenomenon requires attention in policy-making and financial regulation to ensure the stability of the financial system.

Possible Directions for Future Stablecoin Regulation

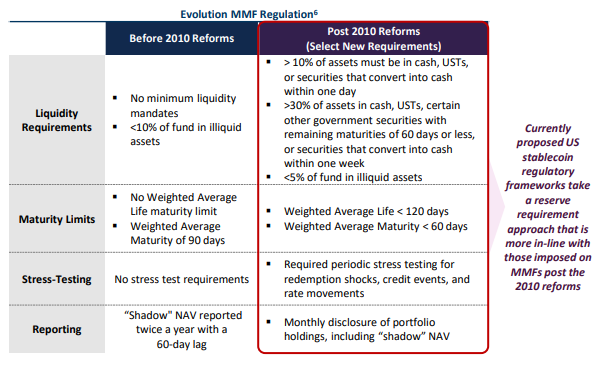

The current US stablecoin regulatory framework is similar to the MMF reform requirements after 2010, focusing on:

Reserve Requirements: Ensuring high liquidity and safety of stablecoin reserves.

Market Access: Discussing whether stablecoin issuers can obtain support from the Federal Reserve (FED), deposit insurance, or access to a 24/7 repurchase market.

These measures aim to reduce the risk of stablecoin de-pegging and enhance market stability.

Summary

Market Size Potential

The stablecoin market is expected to grow to approximately $2 trillion by 2030 under continuous market and regulatory breakthroughs.

US Dollar Anchor Dominance

The stablecoin market is primarily composed of US dollar-anchored stablecoins, focusing recent attention on potential US regulatory frameworks and their legislative impact on stablecoin growth.

Impact and Opportunities for Traditional Banks

Stablecoins may impact traditional banks by attracting deposits, but also create opportunities for banks and financial institutions to develop innovative services and benefit from blockchain technology usage.

Far-reaching Implications of Stablecoin Design and Adoption

The ultimate design and adoption of stablecoins will determine their impact on the traditional banking system and potential driving force for US Treasury demand.