Author: Sanqing

🇺🇸 Stablecoin Legislation Breakthrough: GENIUS Act Passes Senate Procedural Vote

[Washington, May 19, 2025] - The U.S. Senate passed the procedural vote for the "National Innovation Guidance Act for Stablecoins" (GENIUS Act) on Monday night with 66 votes in favor and 32 against, clearing the biggest obstacle for the bill's final passage. The act establishes a comprehensive federal regulatory framework for stablecoin issuance, reserves, redemption, compliance, and consumer protection in the United States.

The bill originally faced political resistance due to potential conflicts of interest involving the former President Trump family's crypto business interests and failed to enter the voting procedure in early May. After revising the terms, including new restrictions on foreign issuers and prohibiting large tech companies from dominating stablecoin issuance, some moderate lawmakers shifted their support, allowing the bill to overcome the Senate's 60-vote procedural threshold. The final Senate vote is expected this week, followed by review in the House of Representatives.

Bill Overview: Regulation Under the Guise of "Stability"

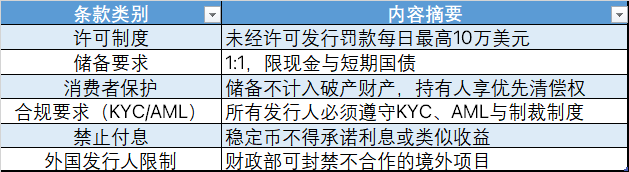

The GENIUS Act specifically defines stablecoins as "digital assets promising redemption at a fixed amount, used for payment settlement", excluding central bank digital currencies and bank deposits.

The GENIUS Act Core Provisions Overview

After the bill's passage, compliant stablecoin issuers like Circle (USDC) and PayPal (PYUSD) will benefit, while Tether (USDT) and most DeFi structural stablecoin projects (such as RAI, USDe) may face a legal crisis in the U.S. market.

Deeper Background: The Moment of Confirming On-Chain Dollars

Structurally, the GENIUS Act is not a tolerance of stablecoins, but an institutionalized confirmation of U.S. dollar sovereignty in the blockchain space, representing a digital currency expansion in the American style. By legalizing compliant stablecoins, it extends the dollar issuance rights to the Web3 ecosystem: although on-chain settlement units are issued by Circle, they essentially function as an "on-chain dollar clearing bank".

This means:

The U.S. dollar becomes the pricing benchmark for all on-chain assets, with dominance continuing to be held by the Federal Reserve system;

Compliant stablecoins gain clearing privileges, while other algorithmic stablecoins and structural financial tokens will be marginalized or exit the U.S. market;

Web3 is losing its potential as an "independent value system", gradually being incorporated into the digital extension of U.S. dollar hegemony.

The GENIUS Act is transforming blockchain from a "monetarily neutral platform" to a "settlement subsidiary of the U.S. dollar".

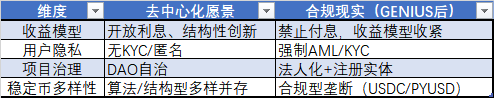

Deep Impacts on Web3 and Decentralized Finance

Decentralized Vision vs. Compliance Reality

1. DeFi Yield-Generating Assets Marginalized:

The prohibition on "interest payment" means structural stablecoins will struggle to exist. Designs like sDAI and USDe will face limitations and potential securities risks, eroding the core business logic of DeFi.

2. KYC Compliance Forcing DApp Centralization:

Stablecoin usage compliance will force DApps to introduce AML/KYC mechanisms, contradicting the original decentralized design, potentially requiring DAOs to establish legal representative entities.

3. Highly Concentrated Stablecoin Market:

Stablecoins like USDC and PYUSD with U.S. regulatory "passports" will absorb market liquidity, increasing entry costs and innovation barriers for new projects.

4. Challenges in Forming Closed-Loop On-Chain Economies:

Projects like PAYFi attempting to build non-anchored value units will struggle to gain mainstream user trust due to lack of fiat currency exit, facing credit bottlenecks in closed-loop economies.

5. "Financial Resistance Laboratory" Being Incorporated as "Digital Dollar Interface":

The GENIUS Act represents Web3 no longer being seen as a threat to the old order, but being forced to become a submodule of its infrastructure. This is not the overthrow of hegemony, but its "protocol-based extension".

Conclusion: From Gray Area Currency to Permissioned Finance, Is Web3's Next Step Compromise?

The GENIUS Act is a milestone in stablecoin legislation and a confirmation of the "U.S. dollar as a global value anchor" on-chain. In the short term, it enhances regulatory clarity and opens a green light for institutional entry; in the long term, it builds a firewall of value systems, making Web3 increasingly similar to TradFi and less like the world it originally aimed to replace.

If Bitcoin once dreamed of breaking the monopoly of sovereign currencies, the GENIUS Act declares:

Currency has not been reconstructed, it has just gone on-chain; Web3 has not gained freedom, it has only changed its regulator.