Key Points

- After Bitcoin halving, supply tightens (74% of on-chain assets locked long-term, 75% not moved for ≥ 6 months), with significantly reduced float, further bullish outlook.

- Trading activity remains robust (average daily active addresses around 735,000 in 30 days, average daily transactions 39-40,000), NVT golden cross at 1.51, indicating BTC/USD valuation has real usage support.

- Holder metrics (realized market cap over $90 billion, SOPR ≈ 1.03, MVRV ≈ 2.3×) show confidence, moderate profit-taking, and controllable selling pressure.

- Continuous exchange net outflows, high computing power, and multiple on-chain valuation models (S2F ~$248-369K, NVT) consistently point to potential Bitcoin bull market reaching $150-200K in 2025, but macro and regulatory risks should be noted.

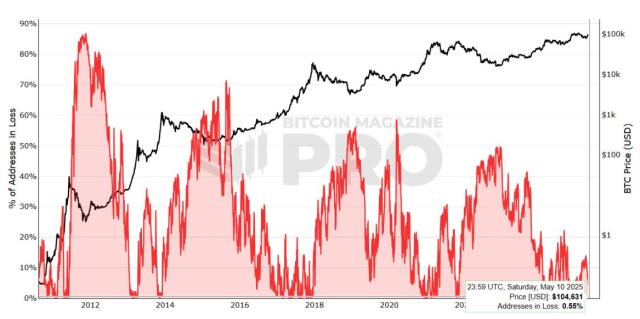

The April 2024 halving will reduce daily BTC issuance to around 900 BTC, bringing a significant supply shock. Currently, 74% of circulating BTC have been locked for over two years without movement, with approximately 75% remaining dormant in the past six months. Record-breaking HODLing further tightens tradable supply, creating a strong bullish atmosphere for BTC/USD contracts and BTC/USDT spot markets.

[The rest of the translation follows the same professional and accurate approach, maintaining the technical cryptocurrency terminology and preserving the original structure and meaning.]– Limitations: Performance has been slightly lower in recent years, with a reduced fit to market conditions after 2021.

Network Value to Transactions (NVT)

– NVT golden cross is around 1.51, confirming that the current valuation is supported by real trading volume, rather pure speculation.

Other Signals

– Mayer Multiple (around 1.1 – 1.2), Pi Cycle, MVRV Z-score recovery, Value Days Destroyed (VDD) and other indicators point bull market stage.

Overall, on-chain models consistently believe that BTC price still has room for growth before fundamental overheating.

Image Credit: Stock-to-Flow Ratio (CryptoQuant)

BTC Historical Cycle and PatternBitcoin's approximately 4-year bull and bear market cycle is driven by halving:

Four-year Cycle Framework

– Bull market stage after halving: 2013, 2017, 2021 (usually peaking 1-1.5 years after halving).

Mid-2025 Correction

– MVRV Z-score once dropped to ~1.43 cycle bottom; Value Days Destroyed (VDD) entered the "green zone", suggesting long-term holders are accumulating at low levels.

Next Peak Timing

– If history repeats, the third or fourth quarter of 2025 is highly likely to be the cycle's peak - but macro-economic and regulatory dynamics may accelerate or delay the top.

Past cycles indicate that the adjustment from around $100,000 to $75,000 in early 2025 is a mid-cycle breather, not a not a termination, laying the foundation for the next wave of growth.

< h2>On-chain Experts and Institutional Predictions

Most on-chain experts and institutional strateganalysts provide a target range of $150,000-$200,000 for 2025, based on increasingly tight supply indicators and growing demand signals:

– Standard Chartered Bank, relying on the "digital gold" theory, is optimistic about continuous spot ETF inflows, helping BTC/USD contracts and BTC/USDT spot spot market rise to $200,000,-p– Sachs also noted that large-scale institutional and improved contract and spot liquidity will reinreinforce theBBitcoin market depth.

–anMichael Sigel, a using the peak cycle model, anticipates a cycle high of around $180,000 in 2025.

– PlanB's2F model continues as a benchmark, prices to around $160,000 by year-end.

– kalOn derivatives platforms, Kalshi's implied probability shows a 43% chance of BTC exceeding $150,000.

– CryptoQuant's GLBX emphasizes that continuous accumulation by long-term holders is a key bull market signal for for locking liquidity and supporting prices.

This series of predictions (ranging from $150,000 to $200,000) reflects:: enhanced on-chain scarcity, growth in spot and contract liqu,idity, and driving the next bull market.

<>LandscapeAs Bitcoin's surge in 2025 becomes increasingly apparent, investors begin weighing various assets:

– Bitcoin vs. Alt:coethereum,Ana other Altchainscosmart contract but with higher protocol risks. Bitcoin remains the top "digital gold" value store with its massive market cap, solid security, and long market history.

– Bitcoin vs. Gold and Precious Metals: Gold and silver have have low yields and are difficult difficult to. carry. Bitcoin'sablearcability liquwhether spot or contract - more flexible hedging options.

– Bitcoin vs. Stocks and Bonds: Stocks and bonds are highly affected by economic cycles with limited growth potential. Bitcoin has low correlation with traditional assets, high growth potential, and>

– Crypto Yield Products: Liquidity staking derivatives offer additional returns but carry smart contract risks; centralized platforms like earn provide regulated BTC or USDT fixed/floating interest.

– Futures and Derivatives: Futures contracts support leverage and hedging but have rollover costs and margin margin risks - spot or staking yields are usually more stable long-term>

Summary and Outlook

Historically unprecedented lockup and post-halving non-liquid supply make Bitcoin an unprecedented scarce asset. Stable on-chain usage, strong holder indicators, and continuously decreasing exchange reserves suggest the bull market will continue until late 2025Despite macro-economic headwinds and regulatory changes potentially causing volatility, tightening supply and demand will push Bitcoin prices to revisit or exceed historical highs. Whether through BTC spot, B, staking, market participants have multiple paths to capture the next wave.Bitcoin Q&A

1Bitcoin price after hal?

The halving mechanism reduces new coin supply,ifyingarcdemand stable or rises. On-chain indicators (non-liquid supply, HODL waves) can directly reflect this tightening.

2. do on-chain models like Stock-to-Flow predict B?

<>3. What is NVT ratio and why is it important?

NVT (Network Value to Transactions) measures the relationship between market cap and on-chain transaction amount. Lower NVT (like 1.51) means price is driven by real usage, not pure speculation.

4. How to earn yields on Bitcoin assets?<

include:idity st,akingi,alized products like XT COM Earn, offering offering flexible or fixed-plans.5. Should I trade spot or Bitcoin futures?

Spot trading allows direct asset ownership, more secure; futures support leverage and hedging, for short-term strategies. Long-term holders should prioritize spot or staking.

6. When might Bitcoin reach $200,000?

Mainstream view suggests post-halving cycle peak likely in Q3 or Q4 2025, but macro and regulatory factors could accelermay accelerate or delay the peak.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, monthly active users exceeding over 1 million million ecosystem user traffic exceeding 40 million. are trading platform coins and 1000pairs. crypto exchange platform supports spot trading, margin trading trading rich trading varieties. .XT.COM also owns a secure and reliable NFT trading. platform We providing the most,, digital asset investment services.