Original Title: It's Rising! BTC Hits a New Historical High Again! Besides Trading, What Advantages Are Hidden in Mining?

The crypto market welcomes a historic moment,

BTC price breaks through $110,000!

Binance platform data showsreaching a high of 111,880 USD.

Total market value soars to $2.20 trillion.

Surpassing Amazon, ranking fifth in global assets

This "digital gold"epic surgehas once again made BTCa global focus.

Besides the secondary market trading frenzy, more people are turning their attention toBTC mining.

This seemingly "ancient" yet still charming field,

what hidden advantages does it hold?

This digital gold epic surge is not accidental:

Institutional wave

Traditional capital's "crypto arms race"

Listed companies have become important BTC holders, with a total holding of $349 billion, accounting for 15% of circulation.

Among them, Strategy company alone holdsover $50 billionin position.

JP Morgan, Cantor Fitzgerald and otherfinancial giants are following the "MicroStrategy model":

Byaccumulating BTCto optimize their balance sheets, and even launching dedicated funds to attract high-net-worth clients.

This trend marks a historic leap for crypto from "marginal asset" to "mainstream allocation".

ETF and index inclusion butterfly effect

BTC ETF weekly capital inflowexceeds $40 billion, and the inclusion of Coinbase in S&P 500 allows passive investors to indirectly hold "crypto assets".

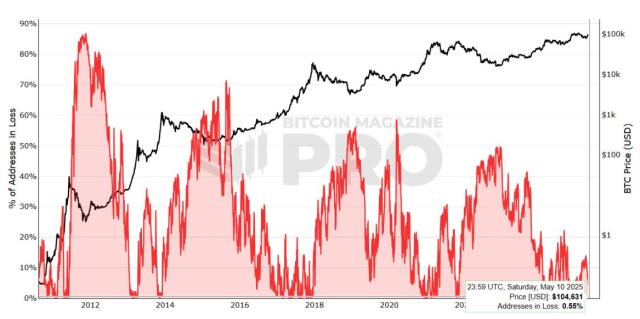

Glassnode data shows that BTC non-liquid supply has reacheda historical peak, with retail selling and institutional absorption forming a clear "scissors difference".

Market chips are accelerating concentration among long-term holders.

Compliance opens capital gates

USGENIUS Stablecoin Actpassed procedural voting, paving a compliant channel for traditional capital entry.

The Trump administration's "Strategic BTC Reserve" plan prevents bank deposit outflows while preserving development space for crypto enterprises.

This "balancing act" breaks the long-standing regulatory deadlock, releasing a policy-friendly signal.

Since rebounding from the price volatility low of $74,500,

it has shown green candles for seven consecutive weeks.

If BTC closes above $106,500 on May 25,

it will be the longest consecutive closing rise

since October 2023

Glassnode points out,

Besides hitting a historical high, BTC's market value and actual market value have also reached new highs of $2.17 trillion and $91.15 billion respectively.

BTC Mining: An Underestimated "Value Mining Technique"

While the masses focus on price fluctuations

Smart investors have long been eyeing mining

this core link that canobtain BTC from the source.

Compared to the high volatility of the secondary market, mining hasunique advantages:

A "fixed investment tool" that crosses bull and bear markets

·Fixed cost locking:

By pre-deploying mining machines and power resources, miners can lock the cost of obtaining a single BTC at arelatively low level.

For example, some efficient mining machines have electricity costs of only $20,000 per coin. Even if the price drops short-term, long-term continuous mining can dilute costs.

·Accumulation during bear markets:

Historical data shows that in BTC's four-year halving cycle, bear markets are often thegolden period for miners to accumulate coins at low prices.

When the market panics and sells off, miners can still continue to produce atfixed costs, waiting for the bull market to arriveto enjoy the asset appreciation dividend.

Passive Income Low-threshold participation in the crypto economy **·No need to monitor constantly:** Compared to trading crypto that requires real-time market attention, mining is more like a "digital gold miner" - once the mining machine is deployed, it can **run automatically 24 hours** a day, steadily obtaining BTC earnings, especially suitable for **investors lacking time and energy**. **·Fragmented participation possible:** With the popularity of cloud computing power platforms, ordinary people do not need to purchase physical mining machines, only need to lease computing power, with the lowest threshold of just a few hundred dollars, truly achieving "**mining BTC with pocket money**" **Anti-inflation Attribute** **Hedging Fiat Currency Depreciation Risk** **·Scarcity Boost:** BTC total supply is fixed at 21 million, and mining difficulty increases over time, ensuring its natural **anti-inflation characteristics**. In the context of global central bank liquidity, mining is equivalent to advance "**hoarding**" scarce assets, **hedging fiat currency depreciation pressure**. **·Physical Asset Attributes:** Mining machines, as physical equipment, have dual attributes of "**production tool**" and "**fixed asset**". Even if future crypto prices fluctuate, high-quality mining machines can still be transferred in the second-hand market or upgraded, **reducing investment risk**. **Technical Dividend** **Blockchain Underlying Growth** Mining essentially provides **computing power support** for the BTC network, participating in maintaining the blockchain's decentralized ecosystem. As BTC market value rises and application scenarios expand (such as Lightning Network payments, DeFi protocol integration), **computing power demand will continue to grow**. Miners can not only obtain **token rewards** but also deeply participate in the **technological revolution** of the Web3.0 era. **Technical Analysis: Will the Bull Market Trend Continue?** From the price trend, BTC has **rebounded after the 74,500 USD low point and has been rising for seven consecutive weeks**. Market value and actual market value **synchronously** refresh high points, showing that **market fundamentals and price form resonance**. **Bull Target** **135,000 to 300,000 USD imagination space** Crypto trader Titan of Crypto uses Fibonacci extension tools to predict that **BTC's 2025 target price is 135,000 USD**. Technical charts show that the 1.618 Fibonacci level corresponds to the 135,000 - 140,000 USD range, forming a **short-term key resistance level**. Veteran trader Peter Brandt believes that **the bull market's essence is a continuous process of creating new highs, expecting prices to potentially break through 125,000 - 150,000 USD by late August**. Technical analyst Gert van Lagen's prediction is more aggressive, pointing out that **BTC breaking through the four-year bullish "megaphone" pattern suggests potential significant increases after breaking through upper resistance**. **Supporting BTC rising 170% to 190%**. **Risk Warning** **Rational Voice Behind the Frenzy** Despite high market sentiment, Alphractal CEO João Wedson warns investors to be wary of the "**high leverage trap**": BTC heat map shows price is approaching a high leverage area where market makers might liquidate overconfident traders. He emphasizes: **"Public obsession with historical highs can create traps for both bulls and bears. Never forget position management."** **From Trading to Mining** **Redefining Crypto Investment** BTC breaking 110,000 USD is both a market vote for decentralized finance and an accelerated embrace of crypto assets by traditional financial systems. When trading becomes a public frenzy, mining is attracting **investors seeking long-term value** with a more stable approach. Whether it's the **cost-controllable "fixed investment attribute"** or the **low-threshold passive income model**, mining provides ordinary people with a "safe entry" to the crypto revolution. Of course, mining is **not risk-free** - factors like electricity cost fluctuations, mining machine depreciation, and policy regulations need careful assessment.However, it is undeniable that in this era of "digital gold,"those who know how to mine from the source often go further.

Conclusion

In 2025, BTC reached a historical high of $110,000, driven byinstitutionalization,liquidity, andregulation.

Besides trading crypto,miningwith advantages such as controllable costs, passive income, inflation resistance, and technological dividends, has become another way of crypto investment.

Despite the optimistic bull market prospects,high leverage risksandmarket volatilitystill need to be vigilant.

In the world of cryptocurrency

No strategy is absolutely perfect

Only by choosing a path suitable for one's own goals can one stand firm in the tide.