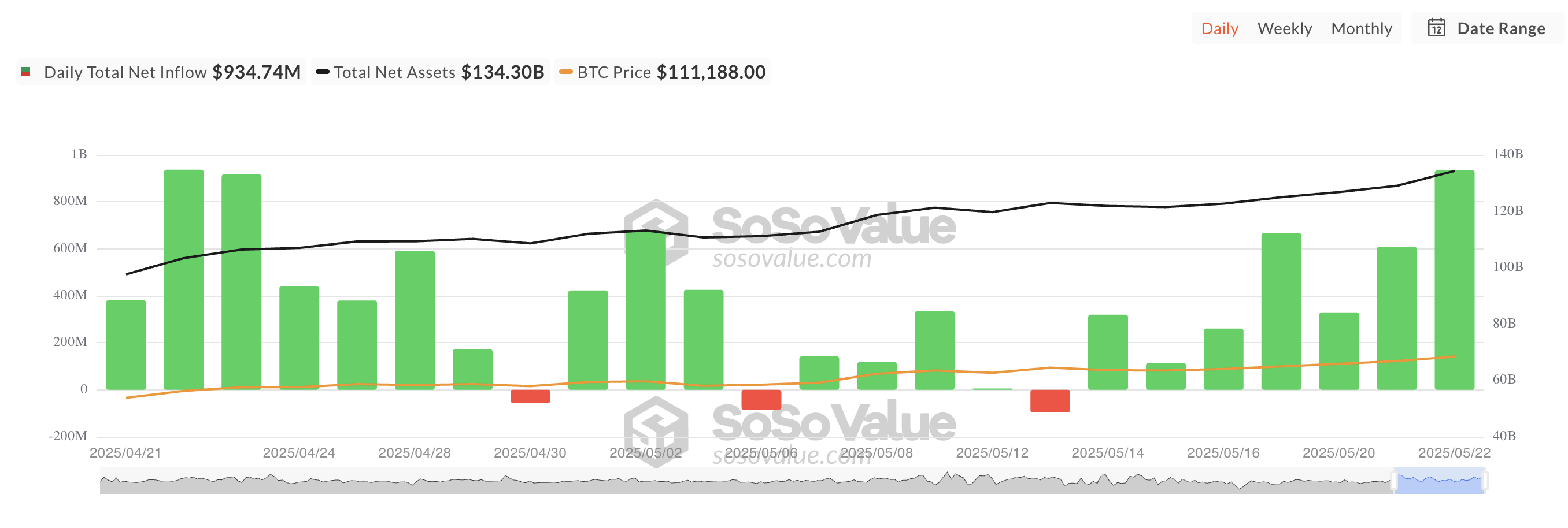

The major cryptocurrency Bitcoin continued its rally yesterday, recording a new all-time high of $111,968. The price increase sparked investor enthusiasm and triggered over $900 million in capital inflows into spot Bitcoin ETFs.

This marked the largest single-day inflow since April 22.

$934 Million Inflow into Bitcoin ETF in One Day

Yesterday's inflow into BTC-based funds totaled $934.74 million, the highest daily inflow since April 22. According to SosoValue, this also represents seven consecutive positive inflows, indicating a strong recovery of institutional confidence this week.

BTC's positive price performance this week has reignited interest in ETFs. Continuous inflows suggest that investors are not only reacting to short-term momentum but also gaining confidence in the asset's long-term potential.

On Thursday, BlackRock's ETF IBIT recorded its largest single-day net inflow of $877.18 million, with total cumulative net inflows reaching $4.55 billion.

That day, Fidelity's ETF FBTC recorded the second-highest net inflow, attracting $48.66 million. The total historical net inflows of ETFs now stand at $11.88 billion.

BTC Slightly Drops… Traders Realize Profits

BTC is currently trading at $110,752, recording a slight 1% drop over the past 24 hours. There has been a minor correction following yesterday's all-time high, primarily driven by a wave of profit-taking.

As the cryptocurrency reached a new all-time high, many short-term traders seized the opportunity to realize profits, triggering the current price decline.

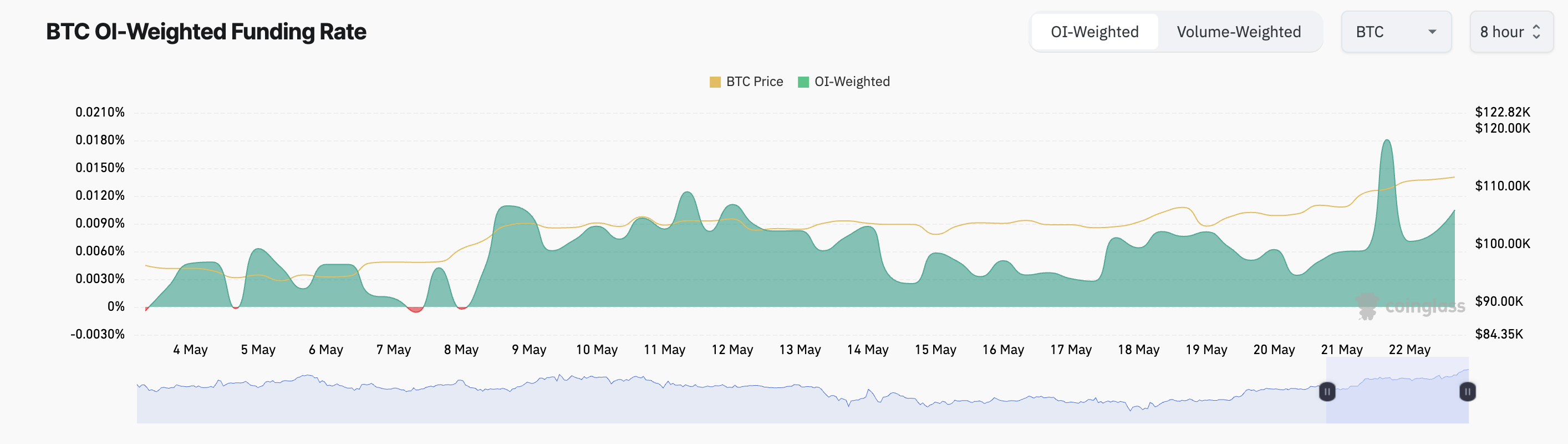

However, despite the brief correction, futures market participants show strong resilience and confidence in further increases. This is reflected in BTC's consistently positive funding rate, indicating that traders are still willing to pay a premium to maintain long positions. At the current point, this is 0.0105%.

Continuous leverage demand suggests that market participants are expecting further increases, reinforcing that the recent drop is a healthy correction rather than a trend reversal.

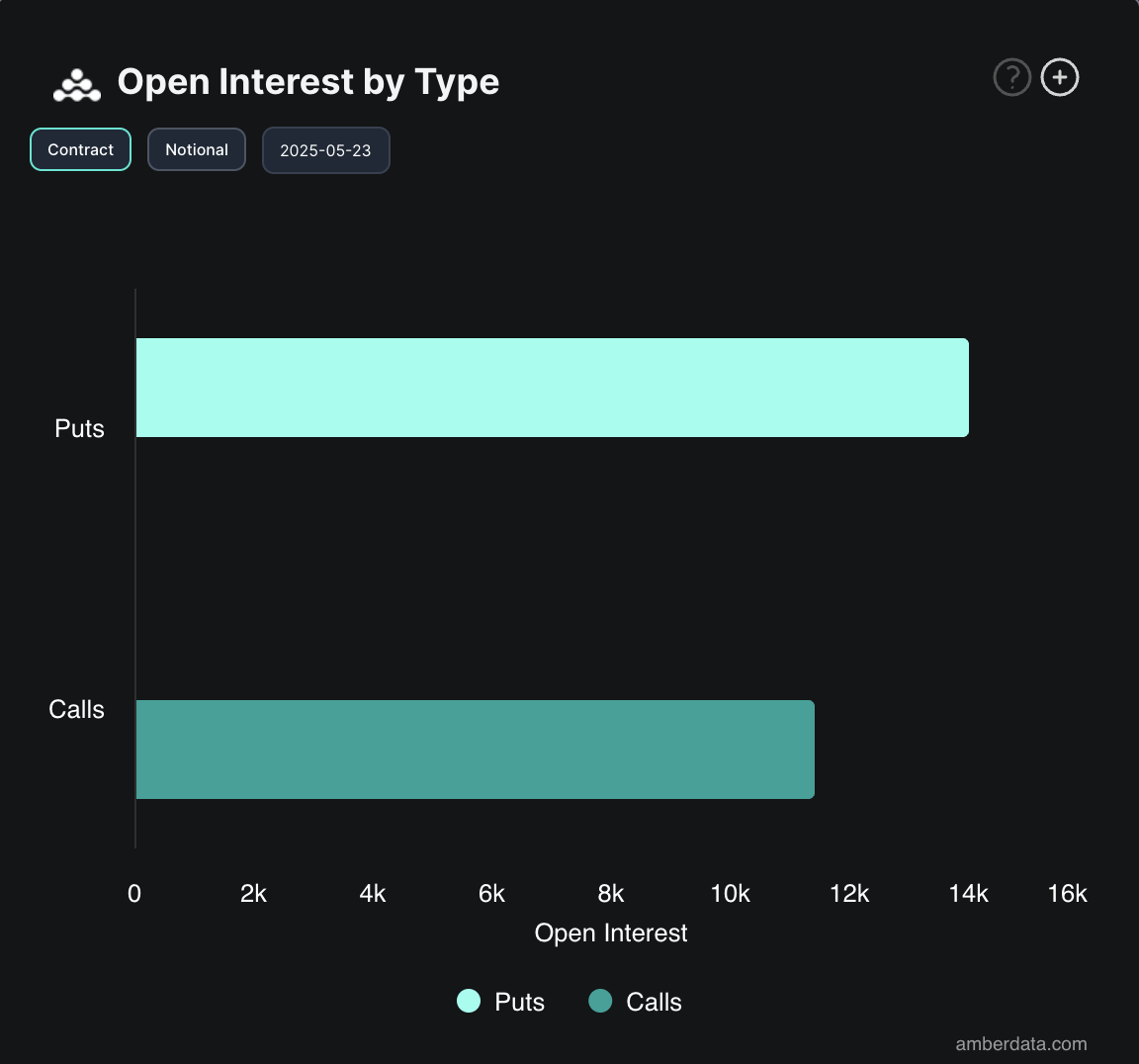

However, the options market sentiment presents a more cautious picture. On-chain data shows more put option trading volume than call options today, indicating that many investors are preparing for or hedging against downside risks.

This trend presents a situation where short-term caution coexists with long-term institutional optimism.