Bitcoin (BTC) has once again energized the cryptocurrency community, breaking through $111,000 and setting a new all-time high. However, this price surge appears quite different from previous cycles.

Based on market indicators and on-chain data, three notable differences stand out when compared to previous Bitcoin peaks. These differences suggest a more mature and less speculative market. Let's examine them in detail.

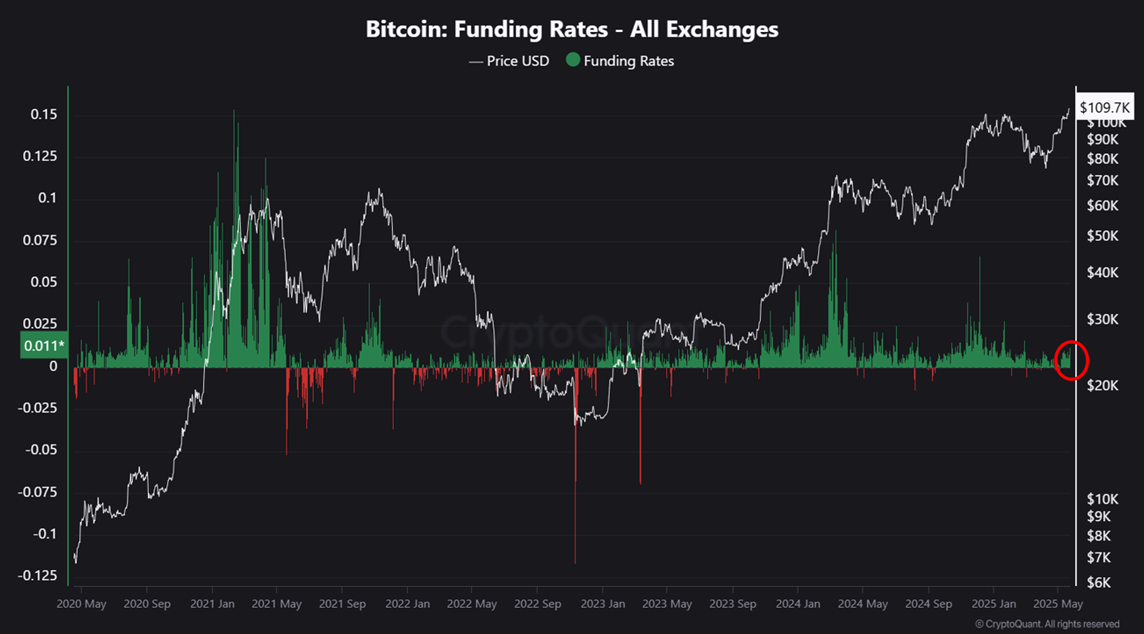

#1. Low Funding Rate, Futures Market Overheating Mitigated

One of the key indicators of market overheating is the funding rate in the perpetual futures market. This rate reflects the cost traders pay to maintain long or short positions and reveals overall market sentiment.

According to CryptoQuant data, when Bitcoin peaked in March and December 2024, the funding rate spiked, indicating excessive long positions and an overheated market. Such conditions often led to sharp price corrections afterward.

However, in May 2025, despite increasing long positions, the funding rate was much lower than previous peaks. This suggests that the current rally was not driven by excessive speculation in the futures market.

"The perpetual funding rate is much lower compared to March and December last year. This means the recent rally was spot-driven and not overheated. A sharp retreat is unlikely." – Nick, CEO and Co-founder of Coin Bureau

This stability is a positive signal, showing the market is evolving in a more sustainable direction.

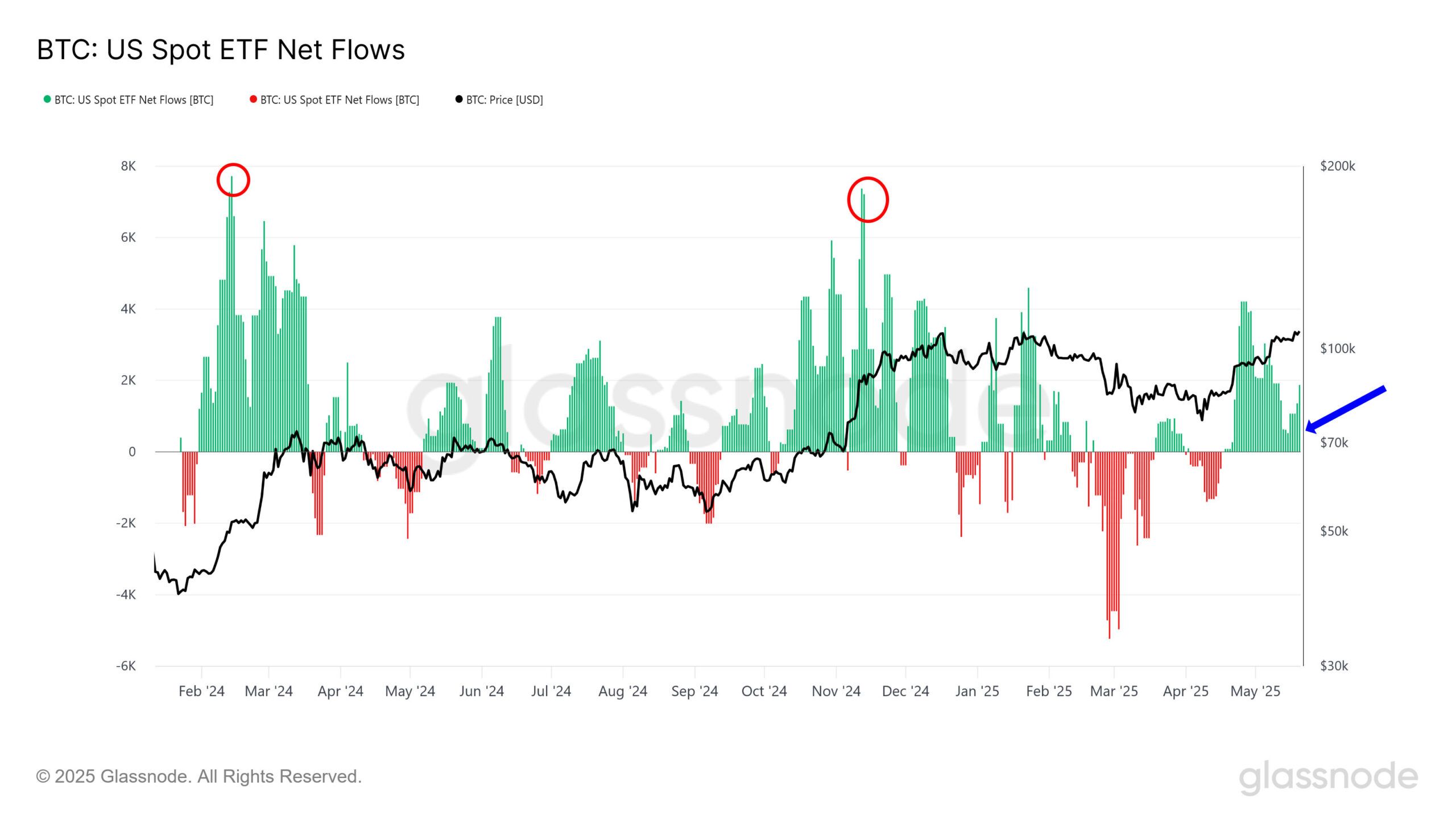

#2. Weak ETF Inflows... Where's the Buying Pressure?

In previous bull markets, especially in March and December 2024, US spot Bitcoin ETFs played a major role in price increases. According to glassnode data, these ETFs recorded billions of dollars in inflows during this period.

However, in the new peak of May 2025, ETF inflows were relatively minimal.

According to a recent BeInCrypto report, spot Bitcoin ETFs recorded $60.99 million in inflows, with investor confidence increasing for six consecutive days.

According to the glassnode chart, when Bitcoin's price recently passed from $70,000 to over $100,000, ETF inflows were much lower than previous peaks. According to Nick, this means ETF investors are not the primary drivers of the current rally.

"Recent ETF flows have been much more restrained compared to breaking previous all-time highs. This means ETF buyers (retail and institutional) are not the biggest contributors to this rally." – Nick

This raises a question: If not ETFs, who is buying Bitcoin?

Some speculate that large corporations like MicroStrategy or other funds might be quietly accumulating BTC. However, specific data remains unclear. This leaves room for potentially larger increases if institutional investors more actively return to the market.

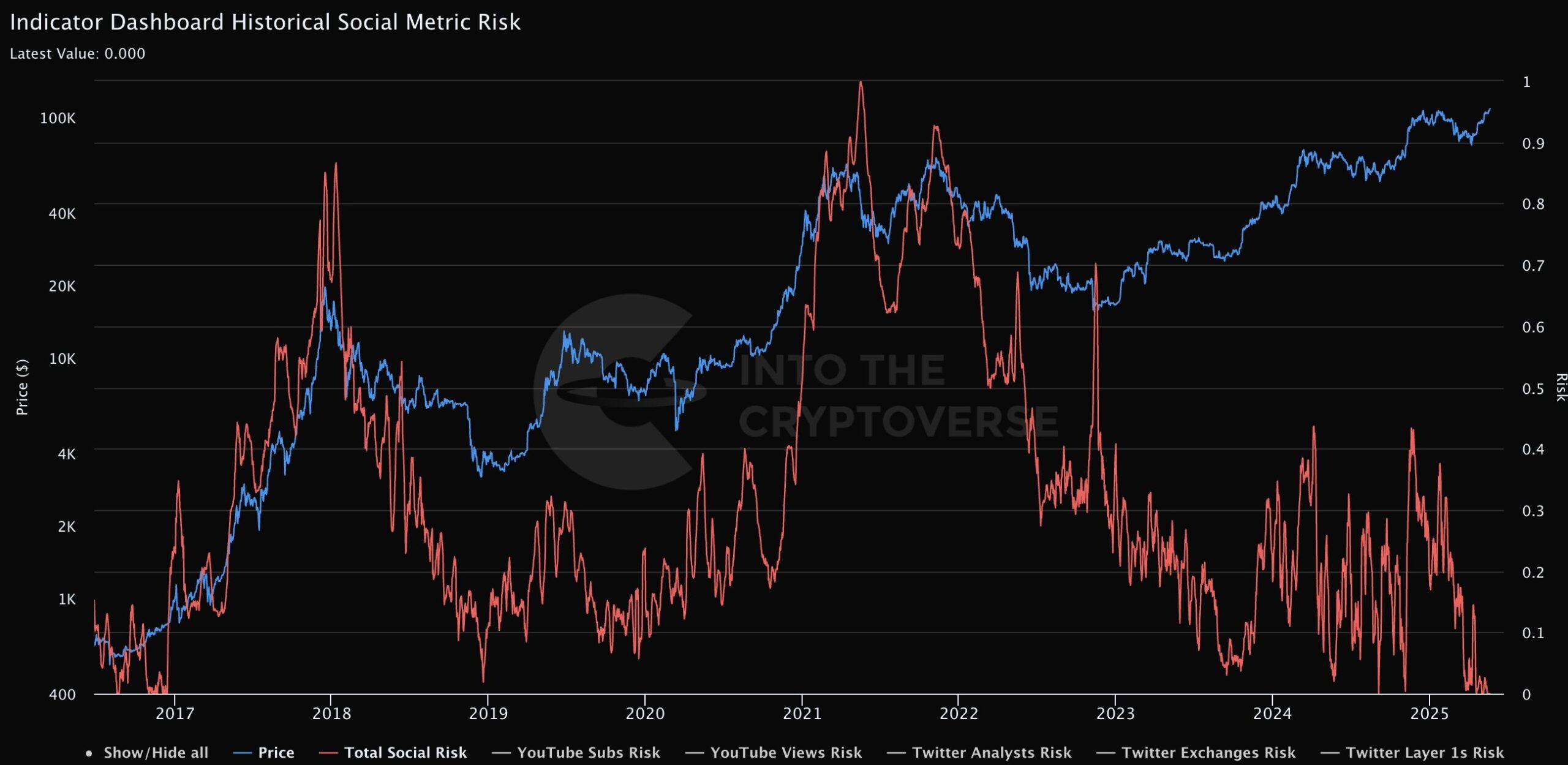

#3. Absence of Retail Investors... Lowest Social Media Indicators

Another key difference in this cycle is the absence of retail investors.

In previous bull markets, each Bitcoin peak was accompanied by a surge in public interest, reflected in high social engagement indicators. However, this time, Bitcoin-related social indicators are historically low.

Notably, Google searches for "Bitcoin" in May 2025 barely increased compared to previous peak periods. This suggests retail investors have not entered the market en masse.

Additionally, CryptoQuant data shows that wallet addresses classified as "shrimp" (holding less than 1 BTC) have dropped to their lowest level since 2021.

This lack of retail activity could be a positive signal. It suggests the current rally is not driven by FOMO (fear of missing out), which is typically a catalyst for bubbles and crashes. Instead, organic demand from long-term investors seems to be playing a major role.

All these factors indicate a mature market with potential for sustainable growth.

Can Bitcoin reach $120,000 as many analysts predict? Only time will tell. But this is certainly a cycle worth watching carefully.