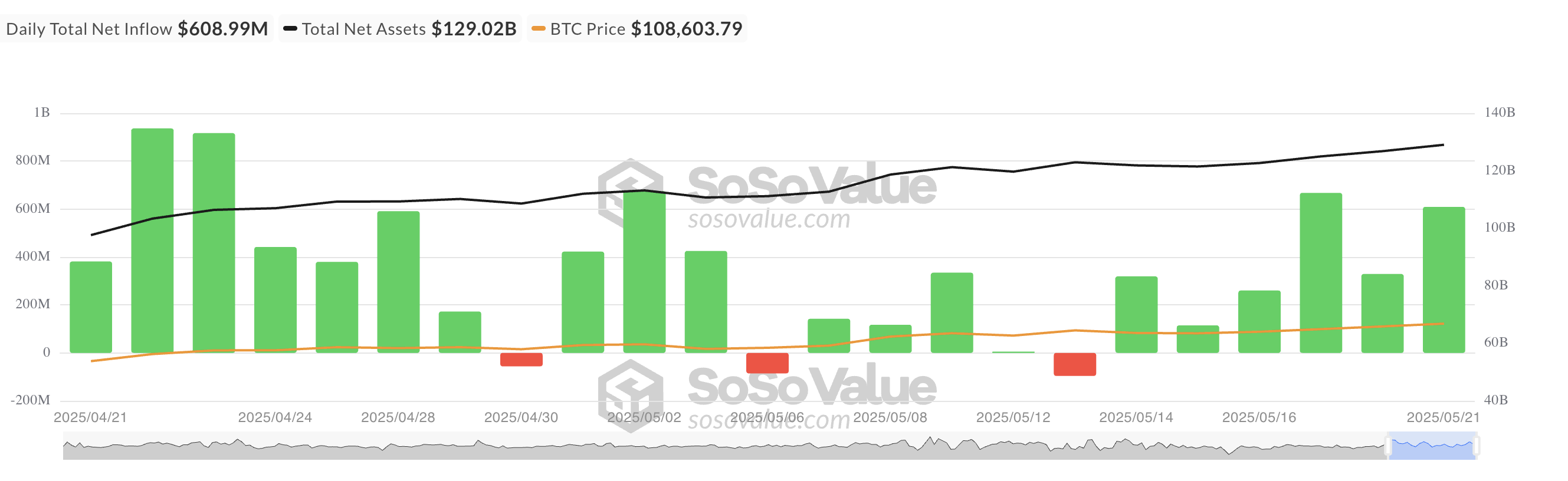

Bitcoin Spot ETF Recorded Significant Inflows Exceeding $600 Million on Wednesday

Yesterday's figures indicate that BTC Spot ETF net inflows continued for six consecutive days, showing increasing investor confidence in major digital assets.

Bitcoin ETF Inflows Increase by 85%... Surpassing $110,000

As BTC broke through the psychological price of $110,000 yesterday, spot ETF inflows increased. According to SosoValue, investors newly invested $608.999 million in this fund, raising the total net asset value of all BTC spot ETFs to $12.902 billion.

Wednesday's inflows were 85% higher than the $329 million recorded on Tuesday. This marks six consecutive days of net inflows into BTC spot ETFs, indicating increasing investor optimism about the coin.

BlackRock's ETF IBIT recorded its highest daily net inflow of $530.63 million, bringing its total cumulative net inflow to $46.68 billion.

Fidelity's ETF FBTC recorded the second-highest daily net inflow of $23.53 million. The total historical net inflow of this ETF now stands at $11.83 billion.

Bitcoin All-Time High... Option Traders Cautiously Optimistic

In the early Asian session on Thursday, BTC reached a new all-time high of $111,880. After a slight decline, it was trading at $111,618 at the time of reporting, but technical indicators suggest continued upward pressure in the market.

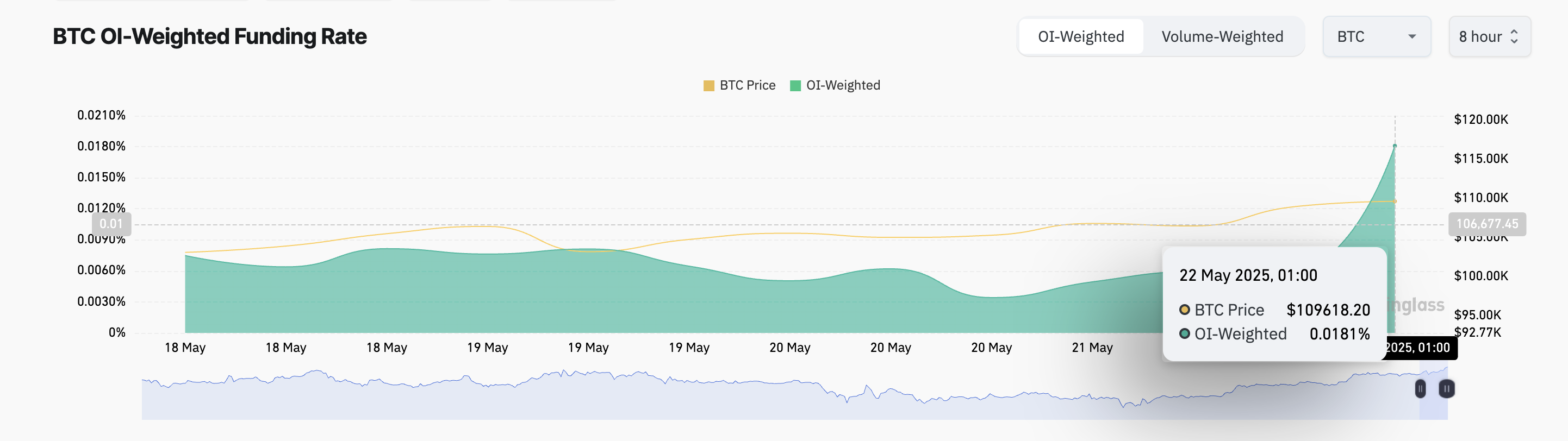

The price increase was also reflected in the derivatives market, with a surge in demand for long positions. According to CoinGlass, BTC's funding rate is currently 0.018%, the highest intraday value since February 22.

The funding rate is a recurring fee paid between traders in the perpetual futures market to align the asset's spot price with the contract price. A sharp increase in the funding rate indicates more traders are betting on long positions, signaling heightened bullish sentiment.

However, this also increases the risk of potential price correction, which option market traders seem to be aware of.

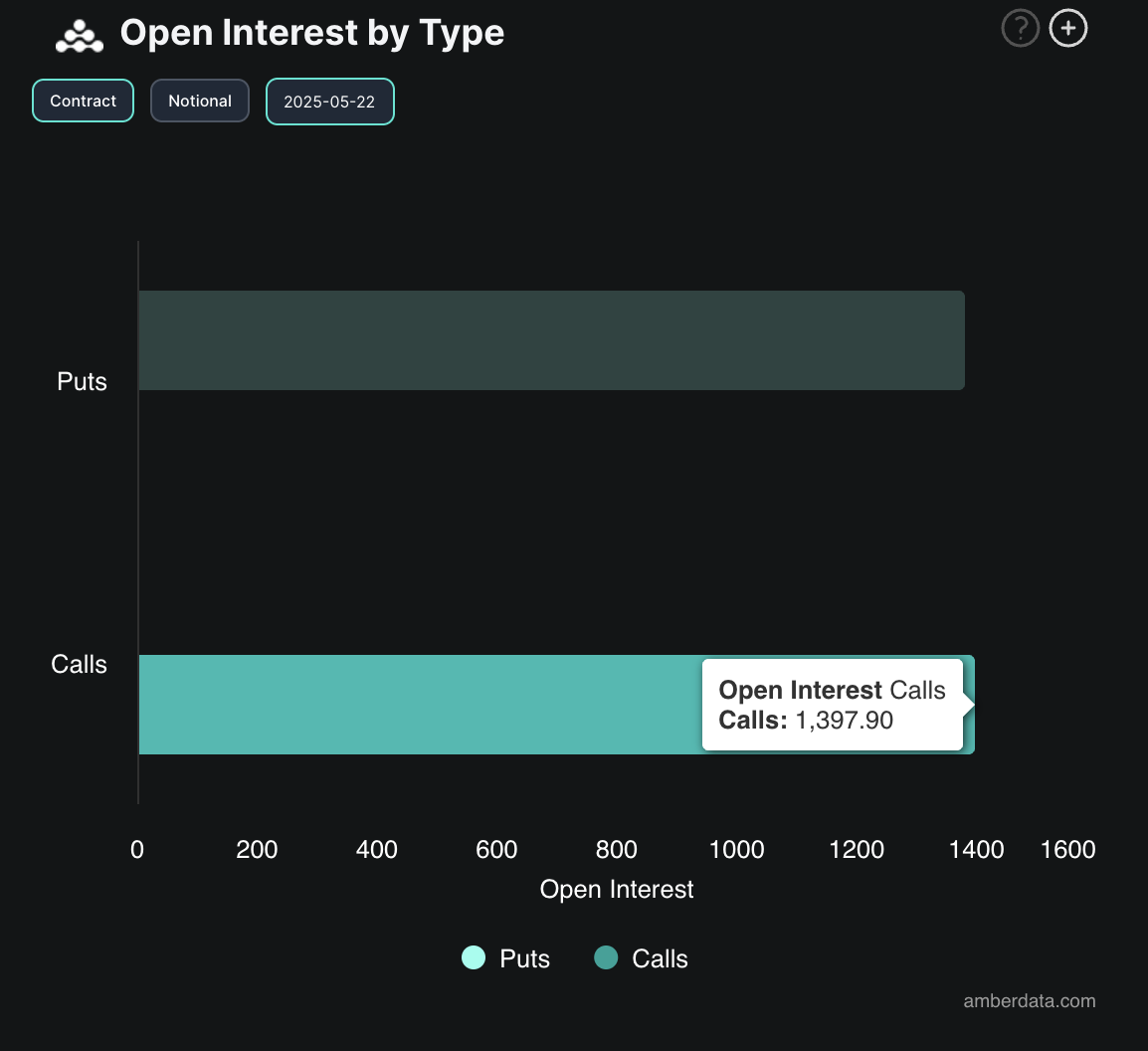

According to data from Deribit, a cryptocurrency derivatives exchange, BTC option traders maintain a balanced sentiment with nearly equal demand for calls and puts. This reflects a "wait and see" approach, with traders wanting to observe whether the coin will maintain levels above $110,000 or if the recent breakthrough is a bull trap.

Nevertheless, call options, which bet on asset appreciation, are slightly dominant, indicating continued upward pressure despite increasing downward activity.