In the past 24 hours, approximately $228.56 million (about 333.8 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

According to the currently compiled data, short positions accounted for a significantly larger proportion of liquidated positions due to the rise in cryptocurrency prices. Among the total liquidations, Bitcoin-related positions were the largest, totaling $130.72 million.

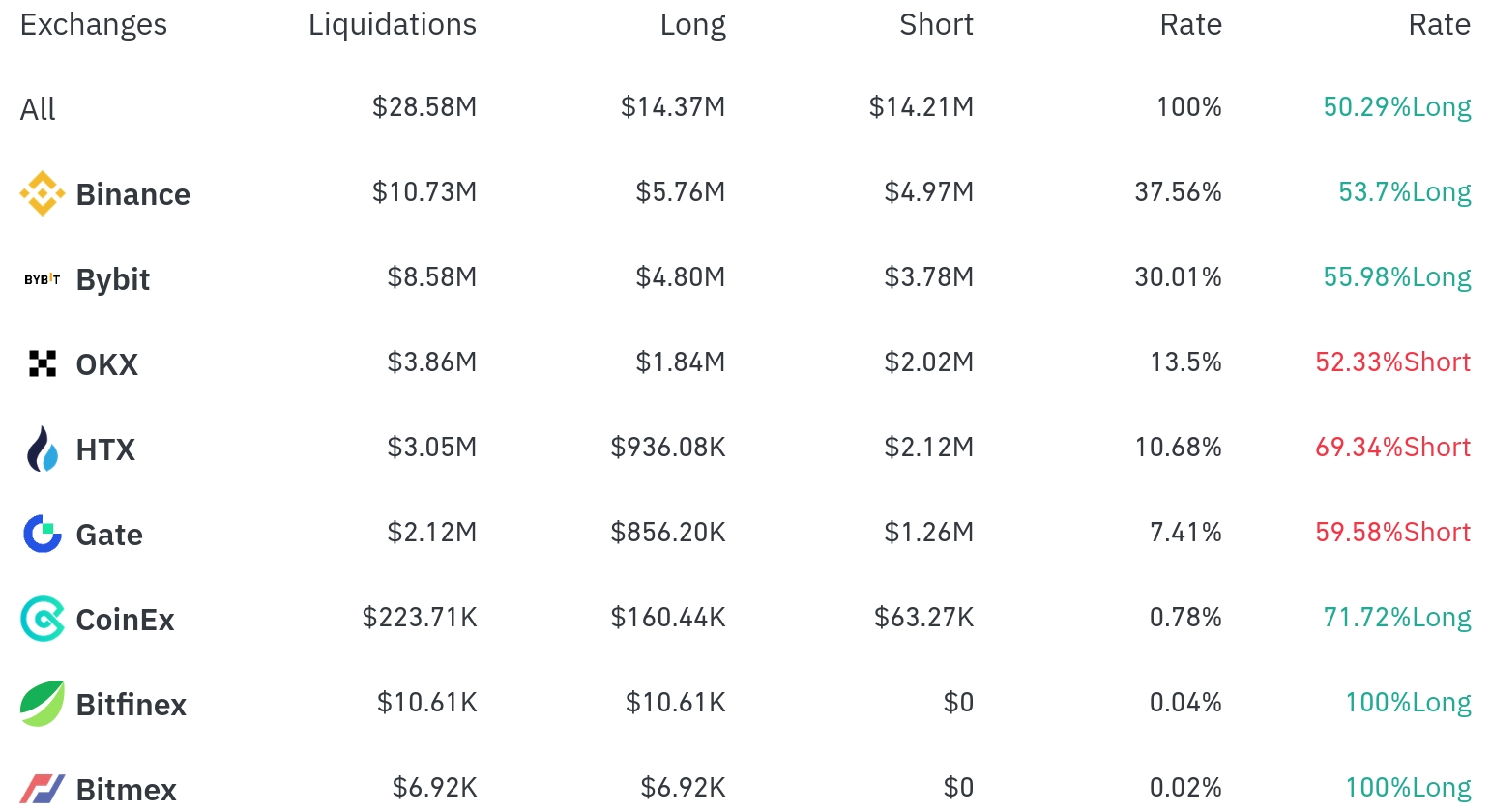

Binance experienced the most position liquidations in the past 4 hours, with a total of $10.73 million (37.56%) liquidated. Among these, long positions accounted for $5.76 million, or 53.7%.

Bybit was the second-highest exchange with $8.58 million (30.01%) of positions liquidated, with long positions making up $4.80 million (55.98%).

OKX saw approximately $3.86 million (13.5%) in liquidations, with short positions slightly higher at 52.33%.

Notably, HTX and Gate exchanges showed high short position liquidation rates of 69.34% and 59.58% respectively, highlighting short position liquidations due to price increases.

By coin, Bitcoin (BTC) positions were the most liquidated. Approximately $130.72 million in Bitcoin positions were liquidated in 24 hours, with the current Bitcoin price at $110,943.5, up 2.54% in 24 hours. Notably, Bitcoin short position liquidations were much higher than long positions, reaching $115.19 million.

Ethereum (ETH) saw about $76.17 million in positions liquidated, with its price at $2,637.38, up 5.18%. Ethereum also had significantly more short position liquidations at $52.35 million compared to long position liquidations of $23.83 million.

Solana (SOL) had approximately $9.72 million liquidated, with its current price at $178.33, up 5.13%. Among other major altcoins, Sui (SUI) experienced substantial liquidations of $12.05 million in 24 hours but saw a price decline of -1.63% to $3.8188.

Doge (DOGE) saw about $7.98 million in liquidations while its price rose 4.3% to $0.2394.

Notably, the TRUMP Token had $6.51 million in liquidations, with its price slightly increasing (0.42%) to $14.304. The HYPE Token saw a significant 18.14% price surge with prominent short position liquidations, and the FARTCO Token also rose 12.21%, resulting in substantial short position liquidations.

Overall, with the market showing an upward trend, short position liquidations were predominant, particularly driven by price increases in Bitcoin and Ethereum. This trend suggests that the cryptocurrency market's upward momentum is being reinforced.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>