Written by: TechFlow

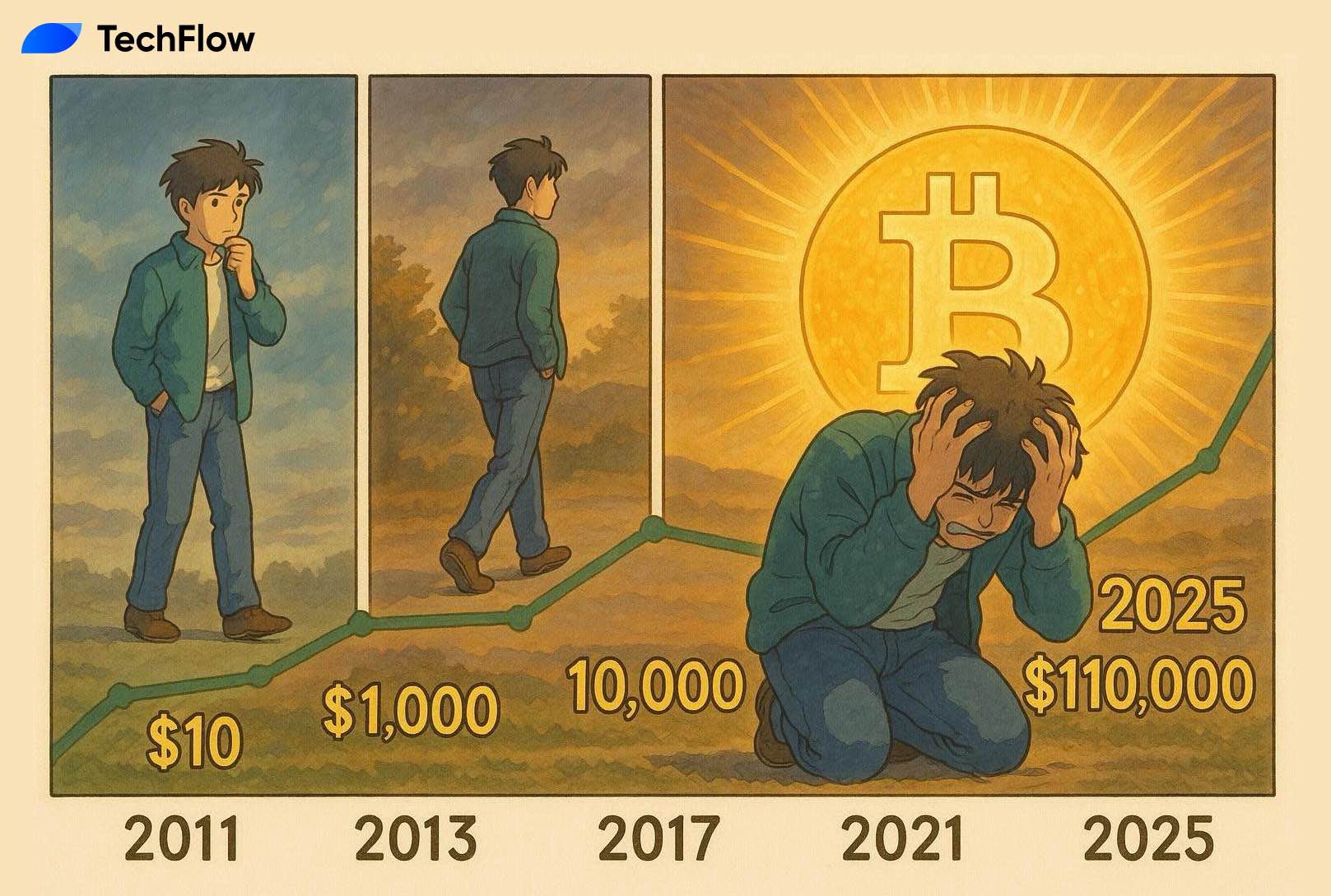

May 22 was the 14th anniversary of Bitcoin Pizza Day. On the same day, Bitcoin broke through $110,000, setting a new record high.

That is to say, in the 15 years after 2010, you will not lose money if you buy Bitcoin at any time. Bitcoin will not let anyone down.

I guess many of my friends are like me, and perhaps I have seen a lot of emotion and sighs on WeChat Moments, telling stories about how they missed out on Bitcoin and how they sold it at a loss.

For example, one of my colleagues once sold 10 bitcoins to pay the rent, and then he sighed and said, "I wish I had bought bitcoins back then, I wish I had held on to them..."

At times like this, many people attribute the wealth of early Bitcoin investors to pure luck, saying that they just "knew it earlier," as if "knowing it earlier" necessarily means "getting rich overnight."

Today, I would like to talk to you through two stories about what it means to miss out on Bitcoin and why you missed out on Bitcoin?

The first story is about Zhihu girl and Bitcoin.

You should have seen this answer on Zhihu. On December 21, 2011, a female college student asked a question on Zhihu: "As a junior student with 6,000 yuan on hand, what good financial investment advice do you have?"

On the same day, a netizen named “blockchain” replied: “Buy Bitcoin, save the wallet file, and then forget that you ever had 6,000 yuan. Check again in five years.”

The answerer is Chang Qia, an early Bitcoin evangelist and founder of Babbitt.

Since then, whenever Bitcoin has risen sharply, netizens have flocked to the comment section, tirelessly telling the questioner how much Bitcoin is worth now if they had bought it at the time. The latest data is that if the questioner had bought all 6,000 yuan in Bitcoin at the time, he could have bought more than 300 coins, and the total value is now 33 million US dollars, 230 million yuan.

So, the question is, did the questioner buy Bitcoin in the end?

Hehe, actually I know what happened next. In 2018, when I was working in Beijing, I happened to get in touch with the questioner on Zhihu, let’s call her Zhuzi, and then my colleague did an exclusive interview with her.

The final answer is no.

She did not make any investments. In the spring of 2012, she took a 6,000 yuan scholarship and went to Hangzhou and other places with her friends for a week.

From then on, every time Bitcoin rose sharply, the constant stream of comments under this question seemed to always remind her that she had missed the opportunity to get rich.

But Zhuzi still has not bought any Bitcoin, although she regretted it later. She believes that "if I were still the same person I was then, I would still make the same choice as I did seven years ago." In Zhuzi's view, people's personalities are there, just like the characters in novels. Their behaviors are derived from their characters and will not change much.

So the question is, do you think Bamboo missed Bitcoin? If you were Bamboo, would you regret it late at night?

Let’s not talk about that for now and share the second story with you.

The protagonist of the second story is also an internet celebrity. Some people who like stock trading may have heard of him. His name is Lao Duan.

Lao Duan, whose real name is Duan Hongbin, is a financial columnist and one of the earliest Bitcoin players in China.

In 2010, he first saw Bitcoin on Google Reader and was immediately attracted to it. He once described Bitcoin as "a powerful weapon for losers in the geek world to counterattack."

Lao Duan recalled the scene at that time. He felt that geeks had created new inventions in the virtual world. He compared Bitcoin to "stones on the Stone Coin Island". Here is a knowledge point to add. Everyone should take notes. The Stone Coin Island refers to Yap Island in the western Pacific Ocean. On this island, the currency is stone. These stones are a few centimeters in diameter, a few meters in diameter, and weigh several tons. Therefore, it is impossible to carry them with you. They are simply placed there. The ownership is recorded through oral communication, and the transaction is based on consensus and collective memory. It is considered to be one of the earliest "virtual currency" systems. The currency system of the Stone Coin Island demonstrates an important economic principle: the value of currency does not lie in its physical form, but in social consensus and trust system.

Back to Lao Duan, at the beginning of Bitcoin's birth, Lao Duan became one of Bitcoin evangelists in China.

In July 2011, Lao Duan wrote his first article about Bitcoin, titled "What can appreciate 3,000 times in a year?" In this article, he mentioned that as a currency system independent of the government's will, the value of Bitcoin depends entirely on the trust and demand of the market. He believes that the total limit of 21 million can effectively prevent counterfeiting and duplication, while the set output rate can avoid inflation.

Lao Duan called on everyone to buy at least one Bitcoin in the article. He said at the time, "The current price of a Bitcoin is only 100 RMB. Even if you lose all of it, it's only enough to buy a meal. But if the number of Bitcoin users expands to tens of millions in the next few years, then on average each person won't even get one Bitcoin. At that time, if you have one Bitcoin, you'll be considered rich."

Now in 2025, when Bitcoin has broken through $110,000, such expressions can indeed be regarded as golden advice.

In the same year, Lao Duan, together with two other early Bitcoin players, Chang Jian and QQagent, co-founded the Bitcoin Chinese community "Babbitt", which had a profound impact on subsequent blockchain participants. It is worth mentioning that QQagent was the earliest translator of the Bitcoin white paper and the co-founder of Bitmain, Jihan Wu, who rewrote the history of cryptocurrency to a certain extent.

In July 2012, the price of Bitcoin was hovering around $7, and Lao Duan decided to set up a Bitcoin fund, "Lao Duan Bitcoin No. 1", which was also the first Bitcoin fund in China. Due to legal and market risks, this fund did not raise funds from the public. The total scale of the first phase of funds was RMB 100,000, 40% of which came from Lao Duan himself and the remaining 60% from his friends.

Lao Duan publicly promised that if Bitcoin disappears or its value drops to zero, he will fully compensate investors. As a fund manager, he does not charge management fees, but only 20% of the profit as commission.

So, why was Lao Duan so firmly bullish on Bitcoin at that time?

The reason he gave was simple: the value of a thing is given by the market. If more and more people believe it is valuable, it will be valuable. Unlike randomly printed paper money, Bitcoin will not cause inflation, so you can consider allocating some of your paper money to Bitcoin.

Moreover, according to the Bitcoin halving mechanism every four years, November 28, 2012 is exactly the expiration date of the first four years. According to the law of economics, increased demand and reduced supply will inevitably lead to price increases.

However, Bitcoin, an "uninvited guest" native to the virtual world, has developed much faster than the old end expected, driven by black swan events in the real world.

In early 2013, the President of Cyprus made a speech, announcing that in order to obtain emergency aid loans from the European Union, the government would impose a deposit tax on local bank depositors. As soon as the news came out, people rushed to banks and rushed to exchange their currencies for Bitcoin, causing the price of Bitcoin to soar from more than US$30 to US$265 in just a few months.

Lao Duan felt tremendous pressure in this storm. Every morning when he woke up, he found that the net value of the Bitcoin fund was constantly setting new highs, and it had skyrocketed more than 10 times in 8 months. Friends who participated in the investment called him one after another, urging him to "sell it quickly and stop while you are ahead." Under such pressure, Lao Duan chose to liquidate the Bitcoin fund in advance in April.

In an interview with the media, Lao Duan mentioned that the reason for his early liquidation was: "I think this round of Bitcoin's rise is coming to an end."

After experiencing this fluctuation, Lao Duan began to doubt Bitcoin. He believed that “only when new people continue to pour in, the price will continue to rise. Once no new people come in, it will immediately collapse.”

In the end, Lao Duan made a promise, saying that he would "never buy any more Bitcoin."

In November 2013, five months after Lao Duan liquidated his Bitcoin fund, Bitcoin soared again to everyone's surprise.

However, at this time, Lao Duan gradually changed from a Bitcoin evangelist to a critic. He published a landmark article this month titled "How many more people will Bitcoin, the faceless man, devour?" In the article, he publicly "broke up" with Bitcoin.

Lao Duan bluntly stated in the article: "Bitcoin has gone crazy! We are witnessing the birth of a giant bubble."

He believes that the biggest difference between the Bitcoin bubble and other bubbles in history is that it is a global bubble, and the future increase will shock everyone, and once it collapses, a large number of people will be trapped. He emphasized that this is not a prediction, but something that is bound to happen.

He further pointed out that the essence of Bitcoin is very similar to "pyramid selling", where the upper party constantly eats the lower party, and the lower party must find a new lower party to make a profit. If no new lower party is found, the whole system will collapse. Lao Duan compared Bitcoin to the "faceless man" in "Spirited Away", and believed that its greatest value lies in satisfying people's fantasy of "getting rich overnight".

In the article, Lao Duan summarized two truths about Bitcoin.

First, for the vast majority of people, reasoning is useless, and the real driving force is "jealousy." People will think: "Why can you get rich quickly, but I can't?" So they take out their savings and buy Bitcoin without hesitation.

Second, for Bitcoin, whether it has practical applications is not important, what is important is how many buyers are willing to participate in this game. Whether it is good news or bad news, it is good news for Bitcoin. The most feared thing is no news.

Just like that, Lao Duan parted ways with the Bitcoin world, turned to promoting some Altcoin, and took root in the stock circle, becoming a financial columnist.

For a long time afterwards, Lao Duan did not publicly mention Bitcoin on social media, and the crypto gradually forgot about him, so that later when people thought of Bitcoin evangelists in China, they would think of Wu Jihan, Li Xiaolai and others.

In March 2021, Lao Duan mentioned Bitcoin again. He said that at most he had four-digit Bitcoins, worth billions of RMB, but most of them were sold after making dozens of times the profit. Now, he still has three-digit "fragments" left, and these Bitcoins are in a bankrupt exchange - Mentougou.

Mentougou was once the world's largest Bitcoin exchange, and lost more than 850,000 Bitcoins in a hacker attack in 2014. Since 2019, Mt. Gox has begun to implement a liquidation compensation plan, but this plan has been postponed again and again. It was not until July this year that the compensation work of Mentougou was officially launched, and some creditors have received compensation one after another.

Unexpectedly, the stolen and bankrupt Mt. Gox became the last Bitcoin steward of the early Bitcoin evangelists.

As Bitcoin surges again, newcomers continue to pour into the market. What they remember are today’s industry leaders and their legendary stories: Wu Jihan, Wu Gang, Shenyu, Star Xu, Li Lin, CZ… And Lao Duan, the former Bitcoin pioneer, has been submerged in the long river of Bitcoin history.

Okay, the second story is finished.

Both of them knew about Bitcoin in 2021. Between Zhihu girl Zhuzi and Lao Duan, who really missed out on Bitcoin?

In my opinion, there is no such thing as Bamboo missing out on Bitcoin.

This is also a misunderstanding of many people. Many people will mistake the information they have heard for investment opportunities that they can grasp. For example, when you attend a party, you hear someone recommend buying Bitcoin and Nvidia, but you don’t buy them...

Later, when Bitcoin and Nvidia stocks skyrocketed, you felt that you had missed the chance to get rich, and then lamented in your circle of friends that "there was once an opportunity for financial freedom in front of you, but you didn't cherish it."

I can only say that you think too much and this is not your opportunity.

In fact, this information is only part of the many pieces of information you receive every day. You have not studied them in depth. What's more, there is a lot of wrong investment information that you have also forgotten. This is the survivor bias - you only remember those successful cases afterwards.

So, what is the real missing out? It is when you spend a lot of time and energy on research, invest a huge amount of money, but still don’t get any benefits.

For example, Lao Duan once studied Bitcoin in depth and obtained dozens of times of returns, but he got off early and turned against it, missing out on Bitcoin's subsequent dozens of times of returns.

This is a miss.

Why did Lao Duan, a former believer, suddenly break away from Bitcoin?

I would like to venture to express my immature opinions here.

After Lao Duan liquidated the Bitcoin fund in 2013, he firmly believed that the rise of Bitcoin had come to an end. In order to maintain the rationality of his judgment, he began to look for various reasons to prove that his decision was correct. This psychological defense mechanism prevented him from looking at the subsequent development of Bitcoin objectively, just like after you break up with your lover, you hope that he or she will not have a good life.

But later, when the price of Bitcoin continued to rise, he could not admit that he had sold it at a high price, and he did not dare to buy it back at one or two times the price or even higher, which caused serious cognitive dissonance.

In order to ease this psychological conflict, he chose to rationalize his decision to withdraw by criticizing Bitcoin, describing it as a "bubble" and a "pyramid scheme" to alleviate his regret, just like a person who starts attacking his ex after breaking up to rationalize his decision to break up.

As an early evangelist and opinion leader, his "miss the pump" made him lose his voice in the circle. Buying again means admitting his previous misjudgment, which is a huge blow to his self-esteem.

Moreover, after he transformed from preacher to critic, he gained new supporters and formed a new identity. This identity change made it more difficult for him to admit his mistakes and change his position.

The new identity has become his "cognitive shackles".

I think this may be the weakness of human nature, and also a self-protection mechanism. When we face major errors in judgment, we often choose to maintain our self-esteem by denying the other party rather than admitting our mistakes.

But in the investment market, there is no human sentiment, the market is always right. It is more important to keep an open mind than to stick to prejudices, and it is wiser to admit mistakes in time than to persist in them.

This is why I always believe that when investing, you should never blindly believe in the advice of certain experts. Compared with ordinary people, their weaknesses are more obvious.

The more professional one is, the more likely one is to fall into certain cognitive biases and the more difficult it is to admit mistakes, especially when a person publicly expresses a position, which becomes part of his identity and the cost of changing his position becomes extremely high.

So, please remember that the market is always right and dare to admit your mistakes.