Deng Tong, Jinse Finance

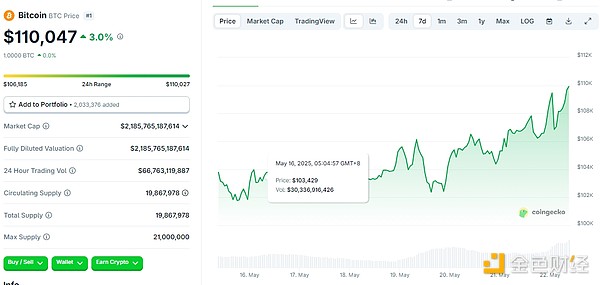

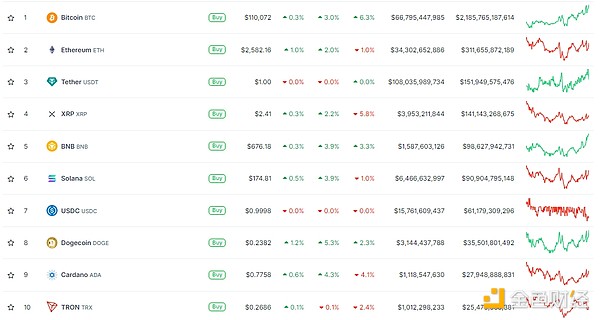

On May 22, 2025, Pizza Day came again. During this important holiday in the cryptocurrency industry, BTC once again set a new milestone - BTC price broke through $110,000 after more than 4 months, creating a new historical high. The new BTC high also drove the entire crypto market up. Trump posted on Truth Social platform to celebrate this historic moment: "BITCOIN ALL TIME HIGHS, ENJOY!!".

What factors have helped BTC reach a new high of $110,000? How much higher can it go in the future?

I. Hong Kong Legislative Council Formally Passes Stablecoin Ordinance Bill

On May 21, 2025, the Hong Kong Legislative Council formally passed the Stablecoin Ordinance Bill. Once the Chief Executive signs and publishes it in the Gazette, the bill will officially take effect. This means Hong Kong will formally implement stablecoin regulation. Anyone issuing fiat stablecoins in Hong Kong, or issuing fiat stablecoins claiming to be pegged to the Hong Kong dollar inside or outside Hong Kong, must apply for a license from the Hong Kong Monetary Authority. According to the current progress, a compliant Hong Kong stablecoin may be born by the end of 2025.

The Stablecoin Ordinance Bill paves the way for establishing a regulated framework that can make the region a global leader in digital assets and Web3 development.

Details can be found at: 《Compliant Hong Kong Stablecoin is Coming, Quick Overview of Its Course and Main Content》

II. US GENIUS Act Passes Cloture Debate

On May 20, the US Senate passed the cloture debate for the GENIUS Act with 66 votes in favor and 32 against, with 16 Democratic lawmakers crossing party lines to vote in support. The bill provides a solid regulatory framework for stablecoins in the United States.

Apart from the Bitcoin spot ETF approved in January 2024, this is the most important regulatory development in cryptocurrency history, and possibly even more significant.

The bill gives federal government support for stablecoins, allowing large banks to issue stablecoins and merchants to accept them.

Bitwise CIO Matt Hougan believes that once we achieve normal transfer of US dollars on blockchain networks - with the world's largest financial institutions participating - moving stocks, bonds, and other financial assets on the same track is just a small step.

Details can be found at: 《Bitwise: GENIUS Act Impact Comparable to BTC Spot ETF, Wall Street and Cryptocurrency are Marrying》

[The translation continues in the same manner for the rest of the text]Eight, How High Can BTC Go in the Future?

- <>

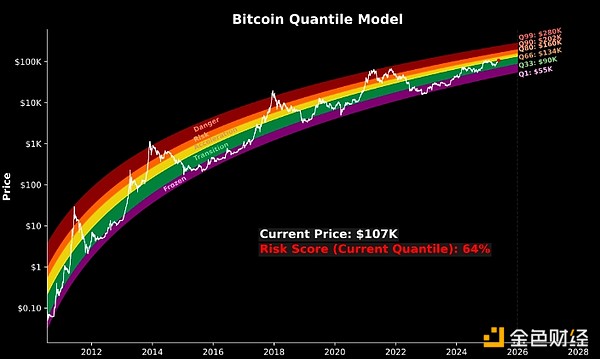

The Bitcoin quantile model update shows that the Bitcoin market reflects the same "heat" as when Donald Trump was elected president and during the spot ETF push in Q4 2024. The model uses quantile regression to map Bitcoin's price stages on a logarithmic scale, indicating that the cryptocurrency is in in a transition zone, a critical moment before the acceleration phase. In Q4 2024, Bitcoin rose 45% after entering a price discovery period above $74,500. Once entering the acceleration phase, it could trigger BTC's next stage or medium-term trend, typically within the 33% to 66% range. According to the model, BTC is expected to gradually reach target prices of $130,000 and $163,000 in the coming months.

BitMEX founder Arthur Hayes: I believe Bitcoin may approach $200,000 in the next modest rise. Then the Altcoin season will come, and we'll see some see interesting. By the end of this year, Bitcoin's price target is around $250,000. By the end of Trump's presidential term, which is the end of 2028, Bitcoin's price will reach around $1 million.

For details, see: 《Interview with Arthur Hayes: BTC Target Price $250,000 ,of, EthereumherWill Outperform Solana, When Will Altcoin Season Start》

MN Capital founder Michael van de Poppe: BTC's price could rise to $200,000, "because more and more people are tired of the continuous devaluation of the dollar."

<>Bitcoin32 <32 states: strong>price$200,000 in is a ""reasonable" expectation.<>AnalystystMags says: Bitcoin price is is entering the "largest bull market of all time", and based on the Bitcoin four-year halving cycle, the reach around $215,000.