Ethereum has recovered more than 50% in May. On-chain data is showing the changed sentiment of Ethereum investors after the Pectra upgrade. Accordingly, many analysts are expecting higher price levels.

This on-chain data includes ETH withdrawals from exchanges, exchange holdings, and ETH whale accumulation. All these indicators have achieved impressive milestones over the past month.

Over 1 Million ETH Withdrawn from Exchanges Last Month

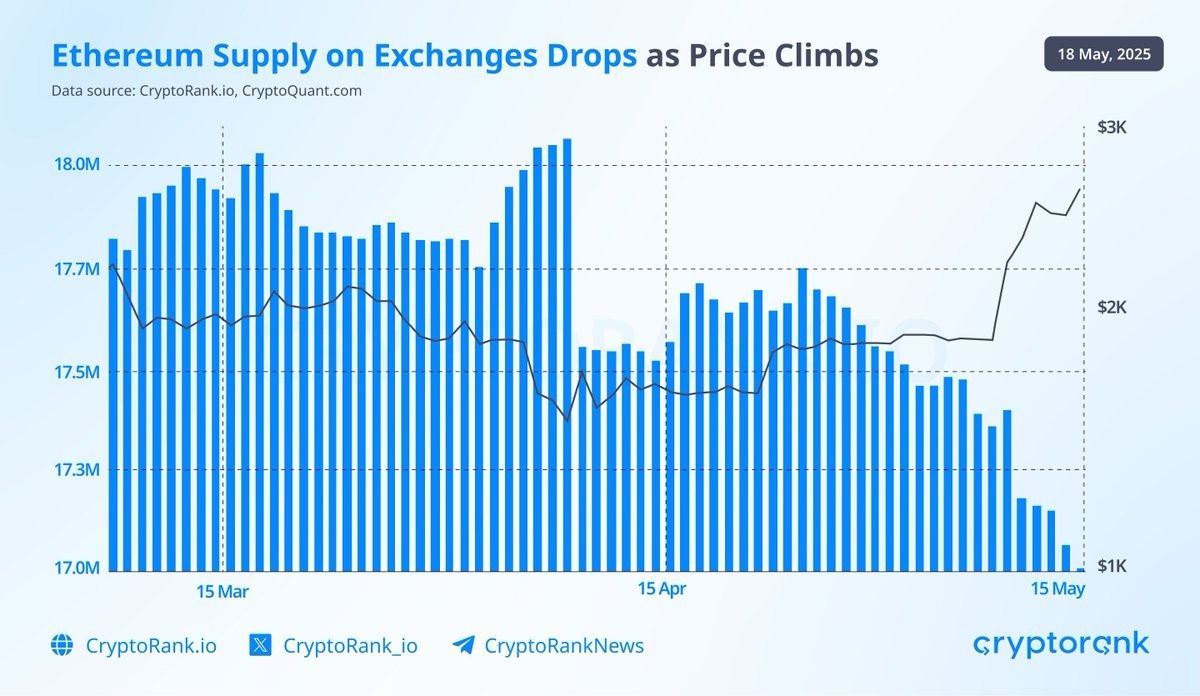

According to Cryptorank, the amount of ETH available on centralized exchanges has decreased from nearly 18 million to almost 17 million in a month.

"Over 1 million ETH has been withdrawn from centralized exchanges in the past month, representing about 5.5% of the total ETH held on these platforms. This trend suggests that users prefer to accumulate Ethereum rather than trade it. The recent Pectra upgrade, which went live on May 7th, could further support this behavior and potentially create upward pressure on Ethereum's price." – Cryptorank

Cryptoquant data shows that over 300,000 ETH were withdrawn from Binance alone in the past month. Since the beginning of the year, more than 800,000 ETH have been withdrawn from the platform.

This withdrawal activity accelerated not only when ETH price dropped below $1,400 in early April but also when ETH rebounded above $2,400 in May.

Additionally, Cryptorank's chart shows that ETH price surged as exchange holdings decreased, reinforcing the correlation between supply and price.

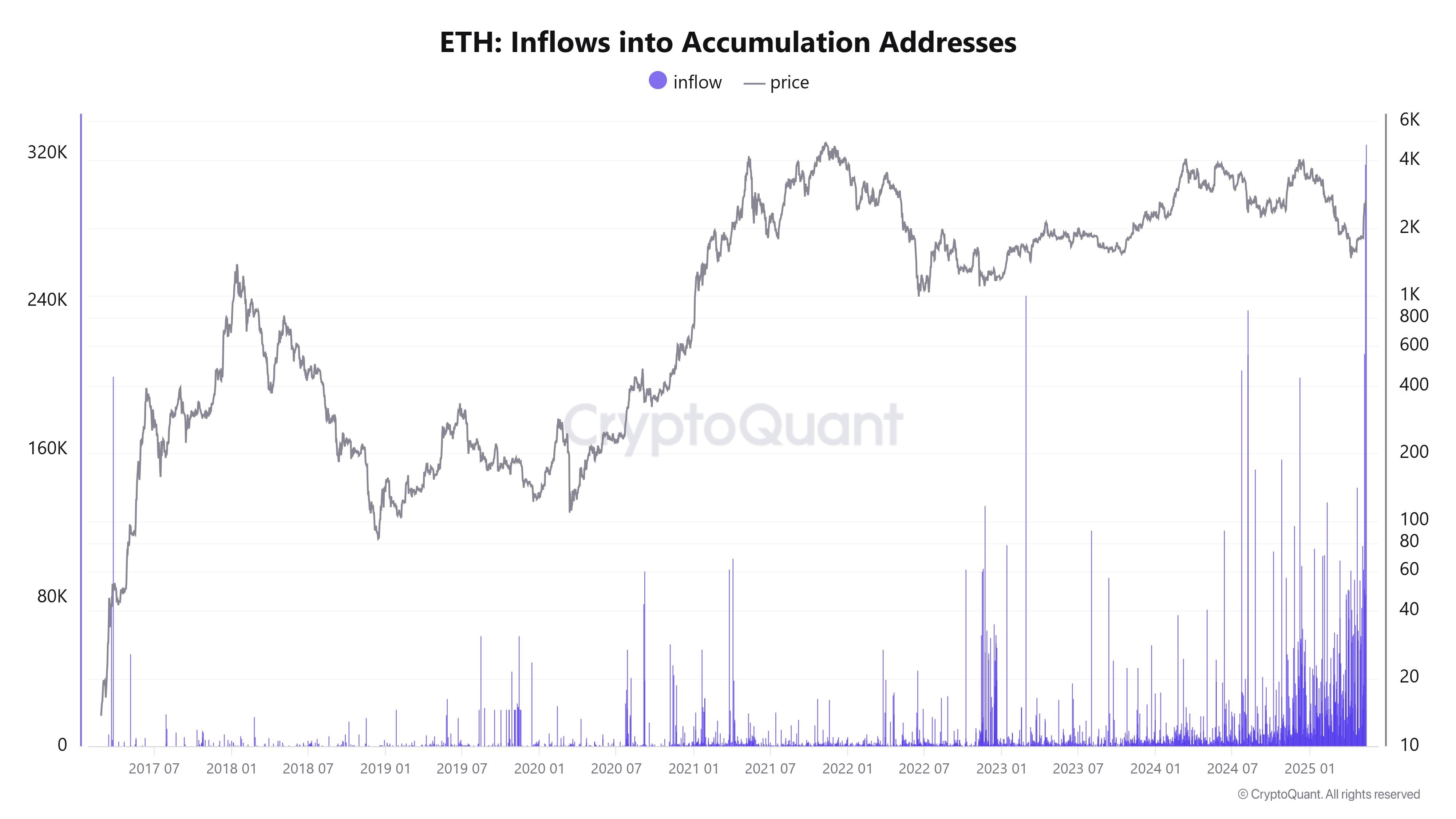

Moreover, large accumulation addresses recorded the highest inflows in history. Specifically, Cryptoquant reported that whale wallets accumulated over 325,000 ETH on May 12th, the highest single-day figure.

When whales accumulate, they often withdraw ETH from exchanges and store them in cold wallets. This reduces circulating supply and creates upward price pressure.

Based on the rare bullish technical pattern observed in May, analyst TedPillows predicted that ETH could soon return to the significant psychological level of $3,000.

"ETH golden cross has been confirmed. $3,000 Ethereum is coming next." – TedPillows

Arthur Hayes Expects Ethereum to Outperform Solana

Despite these positive on-chain indicators, ETH's price remains far from its peak. To surpass the 2024 high, it needs to rise over 70%, and to achieve a new all-time high, it needs to more than double.

Bitcoin analyst Plan B recently evaluated Ethereum as "centralized" and "pre-mined". Meanwhile, Jack Raines argued that ETH lacks a consistent economic narrative.

However, in an interview on May 18th, Arthur Hayes presented a different perspective. He acknowledged that ETH is often criticized but remains the safest blockchain with the highest Total Value Locked (TVL). He believes ETH could soon outperform Solana.

"I think Ethereum has better performance prospects because it's so criticized. Everyone thinks Ethereum does nothing, and they think they haven't done anything right. But it still has the most TVL, the most developers, and the safest proof-of-stake blockchain. Yes, the price hasn't risen well from 2020 until now. Solana has definitely done very well from $7 to $172. But if I were to inject new fiat capital into the system, I think Ethereum could outperform Solana in the next 18-24 months' bull market." – Arthur Hayes, explained.

Furthermore, many industry experts go even further in their predictions. They forecast that Ethereum could eventually surpass Bitcoin, especially as Ethereum becomes increasingly central to real-world assets (RWA) and the broader DeFi ecosystem.