In the Ethereum options market, open interest is maintained around the $3,000 call option, with short-term bullish expectations continuing. However, trading volume has significantly decreased, with some adopting a wait-and-see approach.

According to CoinGlass as of 10:25 AM on the 19th, the total Ethereum options open interest is approximately $7.48 billion, a 3.17% increase from the previous day ($7.25 billion).

Over the past 24 hours, Ethereum options open interest was recorded as $5.35 billion on Deribit, $1.04 billion on OKX, $457.24 million on Binance, $387.91 million on Bybit, and $251.70 million on CME.

The Ethereum options contract with the most open interest is the $3,000 call option (June 27) traded on Deribit, with 44,419 ETH accumulated.

Following this are ▲$6,000 call option (43,858 ETH, December 26) ▲$3,000 call option (42,962 ETH, December 26).

- $2,000 call option (37,209 ETH, December 26)

- $1,800 call option (35,454 ETH, June 27)

- $3,200 call option (34,265 ETH, May 30)

- $3,000 call option (31,624 ETH, May 30)

- $2,400 call option (31,244 ETH, September 26)

Call option open interest is 1,846,381.67 ETH (63.45%), while put options are 1,063,782.21 ETH (36.55%), showing a further strengthened bullish sentiment.

The most traded option contract in a day was the $2,000 put option (May 20) on Deribit, with 12,190 ETH traded.

Following this were ▲$3,400 call option (8,402 ETH, July 25) ▲$1,200 put option (7,468 ETH, June 27).

- $3,200 call option (7,223 ETH, July 25)

- $2,050 put option (5,249 ETH, May 23)

- $1,300 put option (4,668 ETH, June 27)

- $2,300 put option (3,279 ETH, May 19)

- $2,300 put option (3,012 ETH, May 23)

Call option trading volume is 163,081.04 ETH (45.85%), while put options are 192,606.89 ETH (54.15%), with the put proportion increasing compared to the previous day (call 53.16%). This suggests an expanded hedge demand in preparation for potential price adjustments.

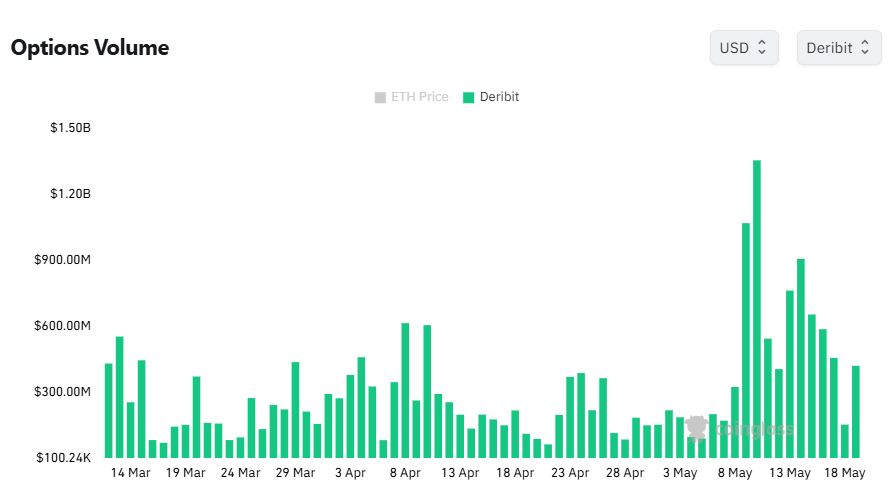

Over the past 24 hours, Ethereum options trading volume was recorded as ▲Deribit $151.73 million ▲CME $2.25 million ▲OKX $140.02 million ▲Binance $95.53 million ▲Bybit $68.59 million. The total is approximately $608.85 million, a 64.47% decrease from the previous day ($1.74 billion), reflecting short-term profit-taking and a wait-and-see attitude.

According to CoinMarketCap, Ethereum was trading at $2,427 as of 10:25 AM on the 19th, a 2.28% decrease from the previous day.

[This article does not provide financial advice, and the investment results are the sole responsibility of the investor.]

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>