As the Bitcoin net outflow continues at exchanges, the trading volume decrease is smaller during the US trading hours compared to Asia and Europe, showing signs of a shift in the short-term liquidity center.

According to CoinGlass at 4:45 PM on the 14th, the total Bitcoin balance at major global exchanges is approximately 2,176,292 BTC.

A total of 8,179 BTC was net outflowed in a day, and 13,725 BTC has been withdrawn over the past week, maintaining the long-term holding trend.

Coinbase Pro holds 678,259 BTC, the largest amount. It saw an outflow of 7,593 BTC in a day, 8,592 BTC on a weekly basis, and 42,430 BTC on a monthly basis, showing the largest outflow.

Binance holds 538,423 BTC. It experienced a net outflow of 1,156 BTC in a day and 231 BTC over a week. On a monthly basis, it decreased by 50,405 BTC.

Bitfinex holds 399,855 BTC, with a net inflow of 858 BTC in a day, but a net outflow of 229.73 BTC on a weekly basis.

Largest Daily Net Inflow ▲Bitfinex (+859 BTC) ▲Bybit (+517 BTC) ▲Gemini (+365 BTC)

Largest Daily Net Outflow ▲Coinbase Pro (-7,594 BTC) ▲Binance (-1,157 BTC) ▲Kraken (-954 BTC)

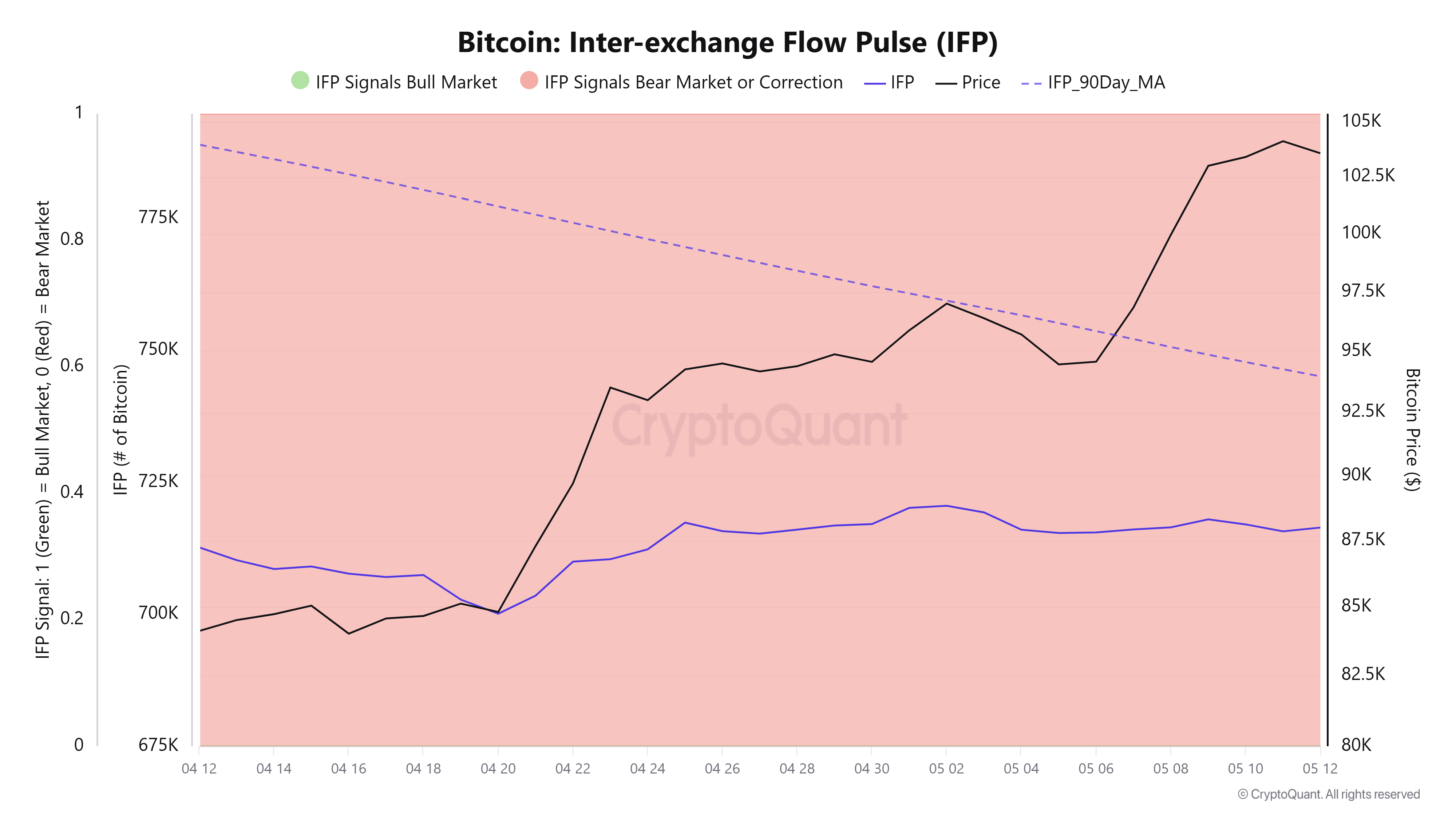

According to CryptoQuant, the IFP (Inter-exchange Flow Pulse) as of the 12th was 716,478 BTC, slightly increased from the previous day (715,761 BTC). Although Bitcoin has entered the $100,000 range, the IFP is still below the 90-day average of 745,169 BTC.

The IFP is an indicator that can indirectly assess market buying and selling sentiment based on Bitcoin movement between exchanges. There have been cases where a full-fledged mid to long-term bull market emerged when the IFP recovered above the average, so at the current point, it is difficult to see that buying pressure has been structurally strengthened.

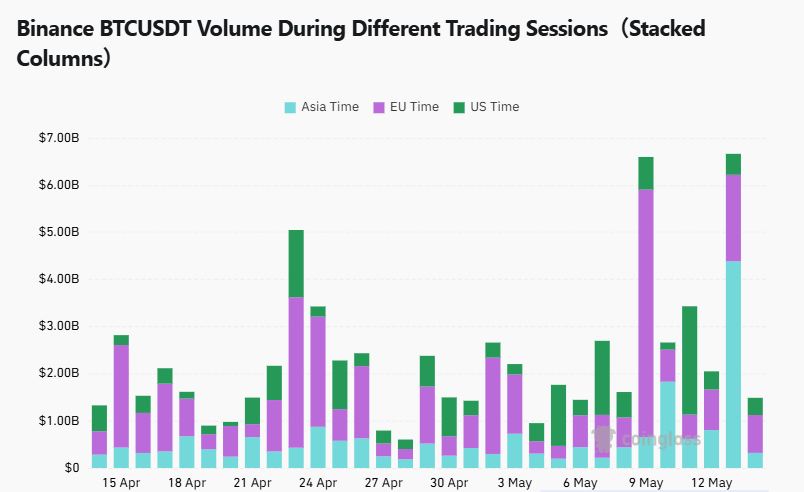

According to CoinGlass, the Binance BTCUSDT trading volume on the 13th was $148.86 million, a sharp decline of about 77.7% from the previous day ($666.9 million).

By region, Asia decreased by 92.7% to $32.03 million, Europe by 56.3% to $80.35 million, and the US by 18% to $36.47 million.

The total trading volume has decreased for two consecutive days, with significant declines in Asia and Europe, while the US showed a relatively mild decrease, expanding its trading proportion.

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>