The cryptocurrency market is preparing for a big move as Bitcoin and Ethereum options expire with over $3 billion today.

With significant contracts and maximum pain points identified, how will these expiring options impact the market's volatility?

Cryptocurrency Market Prepares for $3 Billion Options Expiry

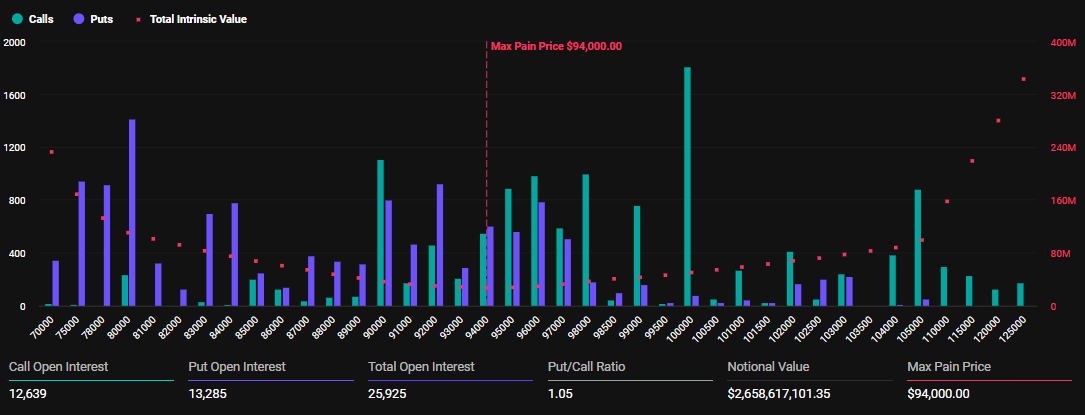

According to Deribit data, approximately $2.65 billion in Bitcoin options are set to expire today. The maximum pain point for these options is $94,000, with a put-call ratio of 1.05.

This expiration includes 25,925 contracts, slightly fewer than the 26,949 contracts from last week.

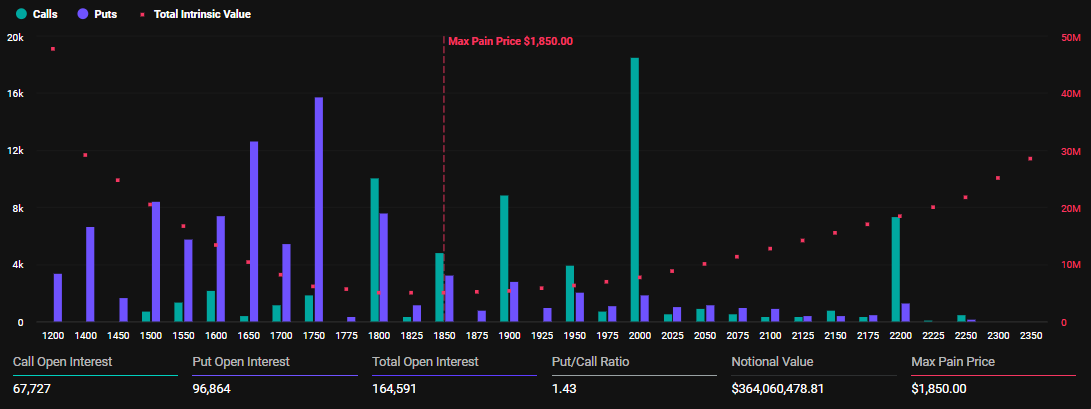

Ethereum also has 164,591 contracts expiring, less than the 184,296 open contracts from last week. The nominal value of these expiring contracts is $364.06 million. The maximum pain point is $1,850, with a put-call ratio of 1.43.

With Bitcoin and Ethereum sell calls exceeding buy calls, Greeks.live analysts primarily cite bearish market sentiment.

"The group seems to be leaning bearish in preparation for a potential downward move." – Greeks.live wrote.

For Bitcoin, this sentiment becomes clearer as the maximum pain level is much lower than the current price of $102,570. According to the maximum pain theory, prices tend to be drawn to these strike prices as options approach expiration.

Accordingly, Greeks.live analysts mention that some traders are watching the Bitcoin price range between $93,000 and $99,000. They also point out the lack of enthusiasm for Bitcoin exceeding $100,000.

"The market is described as a dull sideways movement, with traders maintaining downside exposure while utilizing time decay." – Analysts added.

Positions Leaning Bearish... Below Max Pain Price

Meanwhile, both Bitcoin and Ethereum have put-call ratios above 1, meaning put options (bearish bets) outnumber call options (bullish bets). More traders are betting on price declines.

The histograms in the images confirm this. The BTC open interest chart shows option contracts concentrated at strike prices lower than the current BTC price of $102,570, especially between $93,000 and $100,000.

The concentration of option contracts at these lower strike prices indicates that traders are preparing for potential price drops, suggesting a bearish bias.

This could threaten Bitcoin's upside potential amid an expected volatile weekend. According to BeInCrypto, envoys from China and the US are scheduled to hold trade talks in Switzerland over the weekend.

However, concerns remain about the risk of trade talks collapsing. This meeting will be the first official trade talks since former President Trump raised tariffs on Chinese imports to 145%.

However, Treasury Secretary Scott Bessent stated that the US does not intend to separate. Meanwhile, in a Thursday announcement, the Chinese Embassy in Washington said it would not allow pressure or coercion against China.

China promised to protect legitimate interests and uphold international fairness and justice. The general sentiment is that Beijing harbors deep suspicions about US intentions.

"In any potential dialogue or talks, if the US does not rectify its wrong unilateral tariff measures, it will demonstrate a complete lack of sincerity and further erode mutual trust. Differences between words and actions, or even attempts to use talks as a means of coercion and intimidation, will not work with China." – Chinese Embassy in the US statement.

With neither side presenting specific concessions ahead of the talks, cryptocurrency traders worry the summit might end in another diplomatic deadlock.

In this context, any signs of escalation could act as a volatility catalyst, potentially undermining Bitcoin's upside potential. Conversely, positive developments in the talks could provide tailwinds for Bitcoin, similar to when Trump announced a major deal with the UK.

"Donald Trump has struck a massive new trade deal with the UK. First since global tariffs. Markets are exploding. Bitcoin broke $100,000 for the first time since February." – One user observed on X (Twitter).