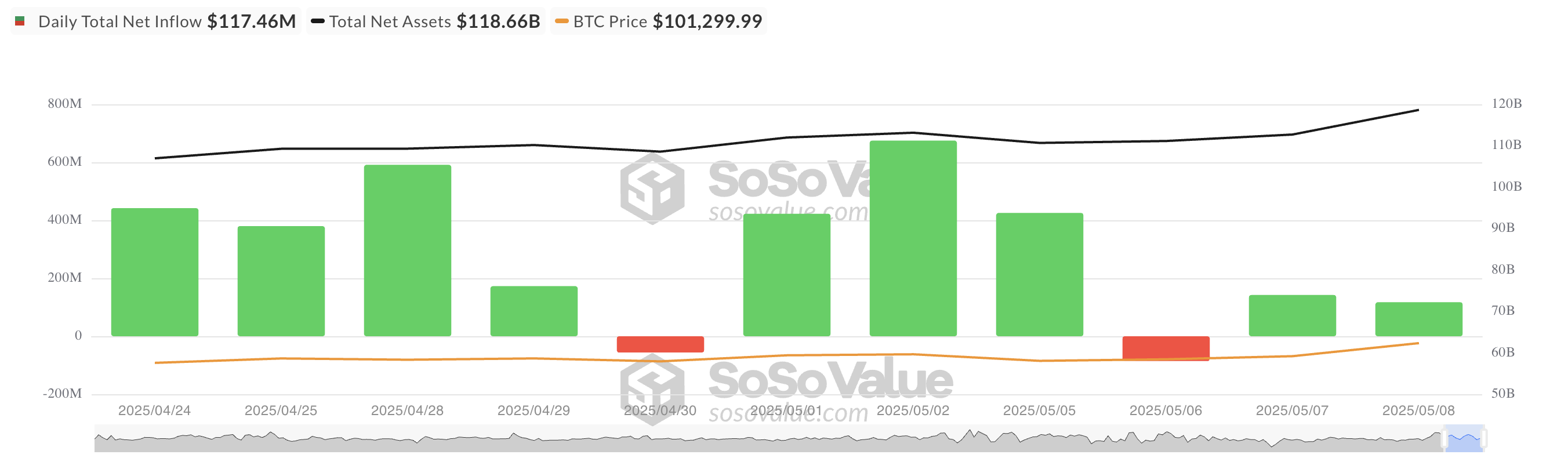

Spot Bitcoin ETF recorded another consecutive inflow on Thursday, coinciding with the coin breaking through $100,000 for the first time since February.

During yesterday's session, none of the major ETFs showed outflows. This confirms that institutional confidence in the long-term trajectory of the asset has been restored.

Bitcoin ETF, Funds Flowing in Again

Yesterday, the Bitcoin-based ETF recorded a net inflow of $117.46 million. This is a 17% decrease from the previous day's $142.31 million. While this may reflect profit-taking after BTC broke $100,000, the continued inflow indicates increasing investor confidence in the major cryptocurrency.

On Thursday, BlackRock's iShares Bitcoin Trust (IBIT) recorded the highest daily inflow among all ETF issuers. The fund recorded a net inflow of $69 million in a day, bringing its total historical net inflow to $4.35 billion.

Fidelity's ETF, FBTC, ranked second with a daily net inflow of $35.34 million. Its total historical net inflow now stands at $1.167 billion.

Notably, none of the 12 ETFs recorded a net outflow yesterday.

BTC Rally, Futures Enthusiasm

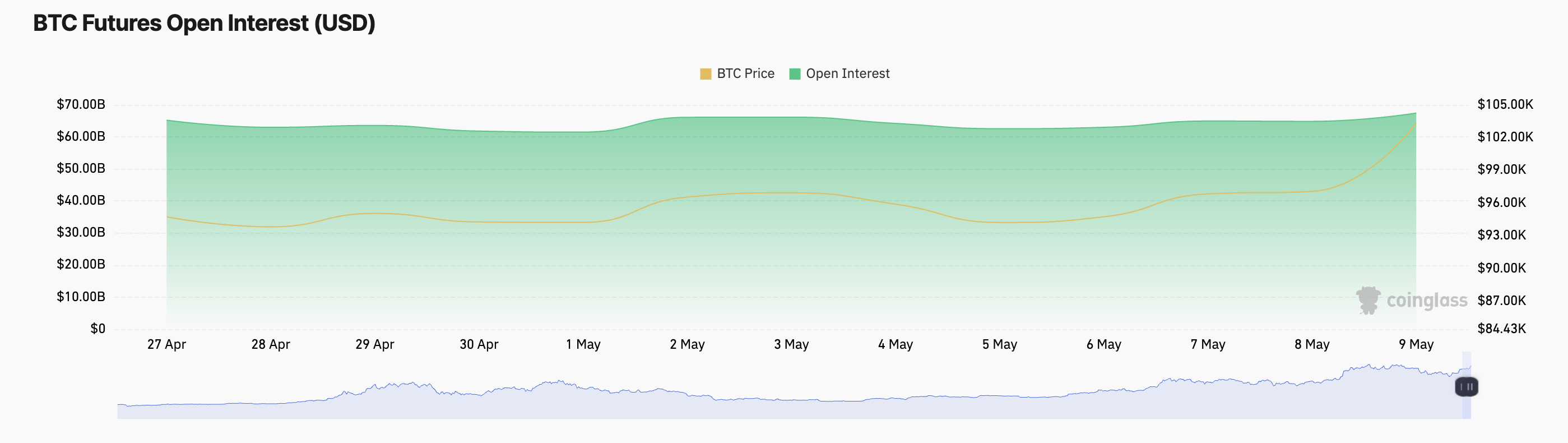

During Thursday's trading session, BTC breaking the psychological six-digit mark reignited momentum across the market.

This is reflected in the coin's futures open interest, which now stands at $67.45 billion and increased by 5% over the past day. When an asset's open interest rises along with its price, it indicates new funds entering the market, supporting the trend and showing strong bullish momentum.

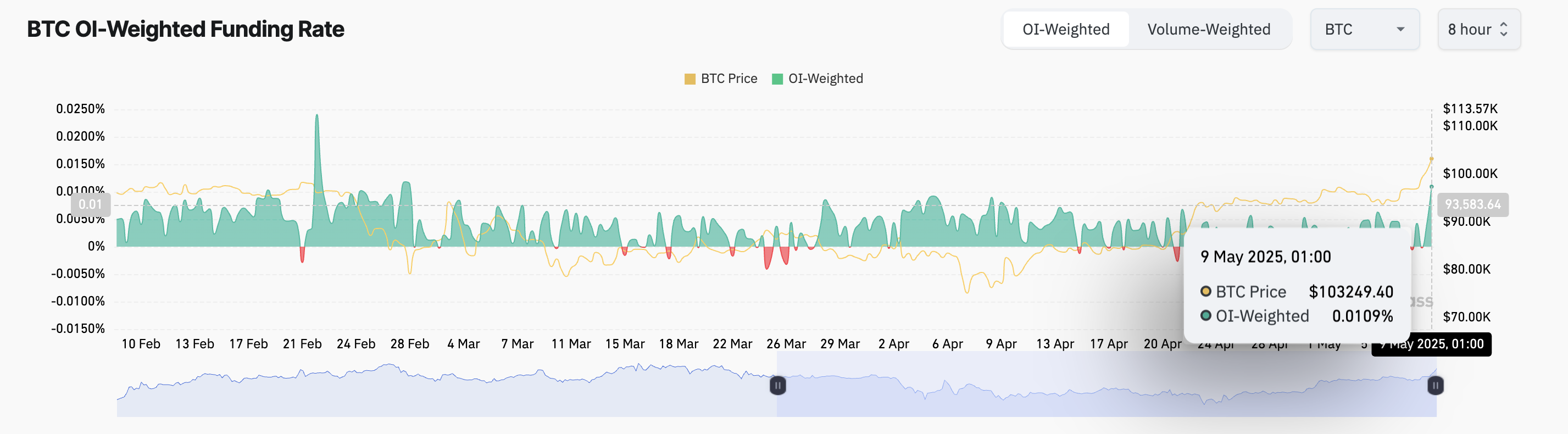

Moreover, BTC's funding rate has surged to its highest level since February 28th. This reflects that long position demand among futures traders has reached its highest point in months. Currently, this indicator is at 0.0109%.

Such a high funding rate means traders holding long positions are paying a premium to maintain their trades. This can strengthen bullish sentiment in the BTC market in the short term.

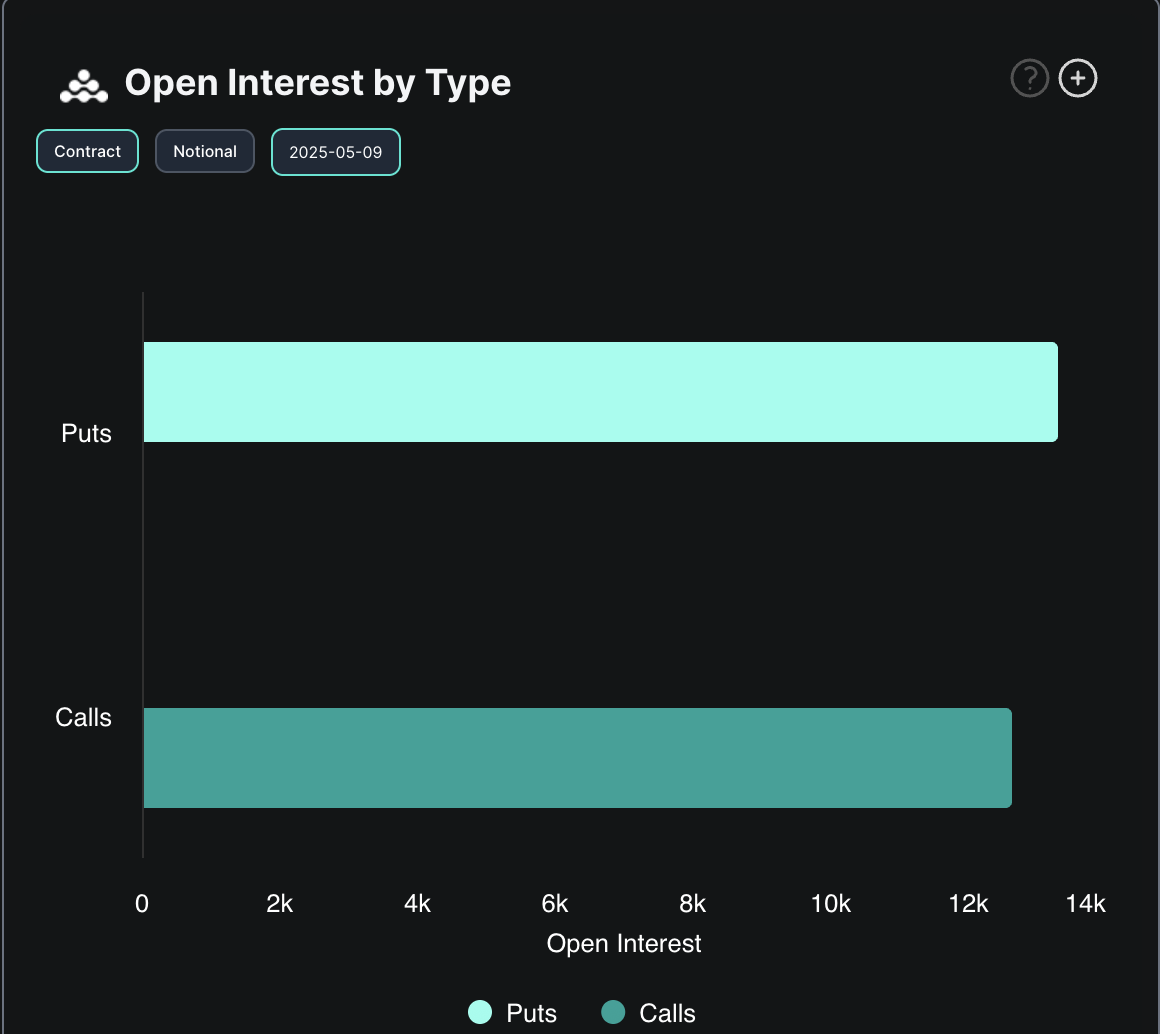

However, while ETF investors and futures traders show bullishness, the options market remains cautious. Data indicates increasing demand for downside protection, with put option activity rising.

The mixed sentiment could impact short-term price movements as the market digests BTC's breakthrough of $100,000 and assesses its sustainability.