ETH is under pressure due to whale activity, with large holders significantly selling their holdings.

These continuous sales are occurring during a difficult time for cryptocurrencies, and Ethereum is struggling with poor price performance.

Ethereum Price Problem Deepens, Whales Are Leaving

According to BeInCrypto's data, ETH has fallen 51.3% since the beginning of the year. While macroeconomic factors have significantly impacted the entire cryptocurrency market, Ethereum's difficulties have been particularly prominent. In fact, this altcoin plummeted to its lowest level since March 2023 last week.

Nevertheless, tariff suspension triggered a slight recovery for ETH. At the time of reporting, Ethereum was trading at $1,623, increasing by 0.3% over the past day.

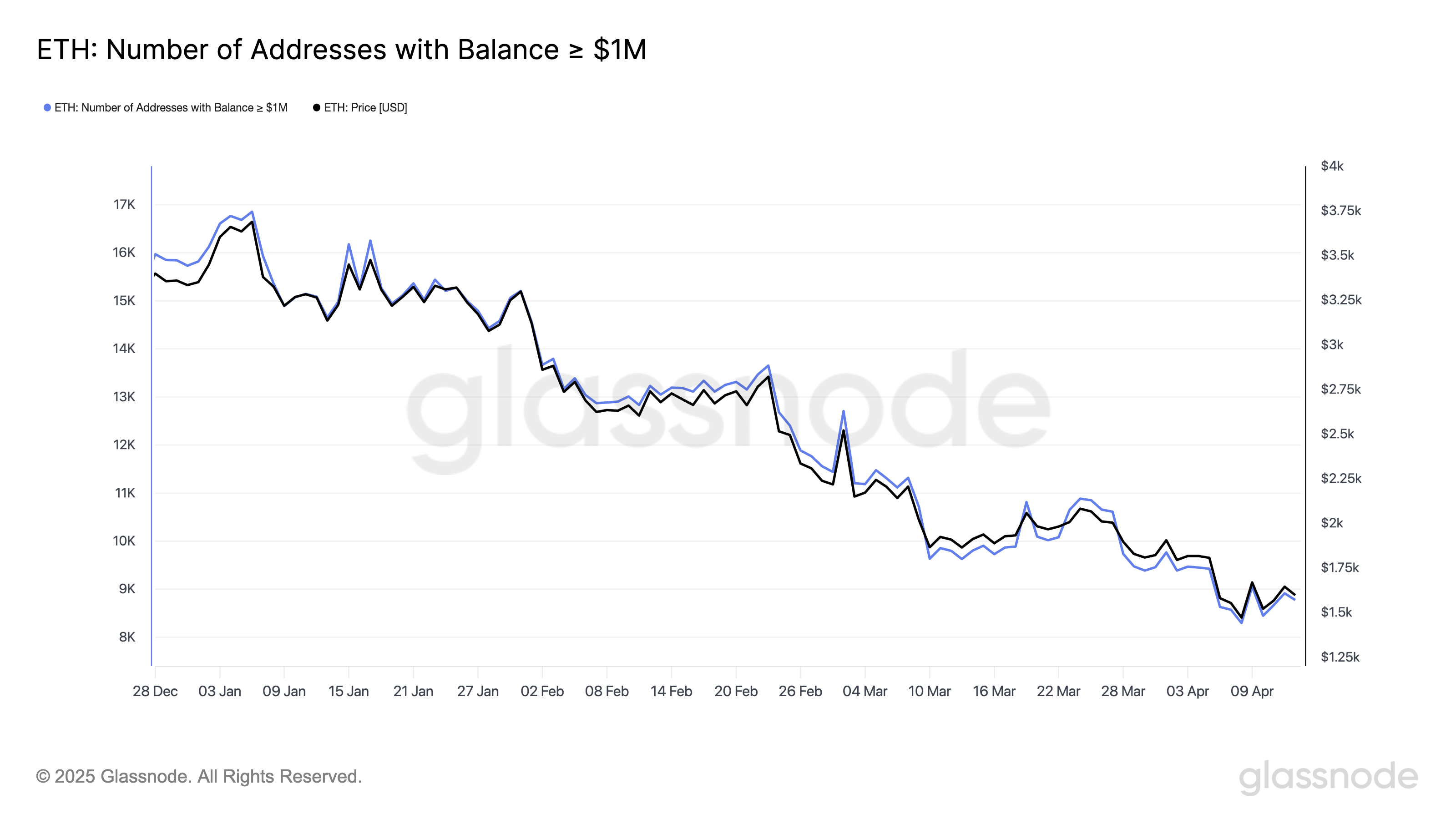

Nevertheless, poor performance has made investors hesitant. According to Glassnode data, the number of addresses holding over $1 million in ETH has sharply decreased compared to the beginning of the year. Last week, these addresses fell to their lowest level since January 2023, reflecting a significant decline in high-value investor confidence.

A closer look at recent whale activity confirms the decline. On April 14, a whale deposited 20,000 ETH, worth $32.4 million, to Kraken exchange, seemingly preparing for additional sales.

"The whale still holds 30,874 ETH ($50.7 million), with total expected profits of $100.4 million (+52.4%)." – Spotonchain mentioned.

Additionally, on-chain analysts revealed that an ICO investor from early 2015 continues to sell. On April 13, this whale sold 632 ETH worth approximately $1 million.

From early April, this investor has sold 4,812 ETH, amounting to about $8 million. The initial investment cost was merely $0.3 per ETH, and the whale still holds 30,189 ETH.

Moreover, another ETH whale that had been inactive for years has started selling. This address withdrew 3,019 ETH from HTX between August and December 2020. Then, the investor transferred assets to the current selling address three years ago.

On April 11, the whale first deposited 1,000 ETH to Binance. On April 13, the whale deposited another 1,000 ETH, raising concerns about potential sales.

"Fortunately, the whale only has 1,018 ETH left, so it won't exert significant selling pressure on the market." – Analyst statement.

The recent emergence of previously inactive whales is noteworthy. While their sales are still profitable, their activity suggests an intention to maintain this trend. According to Glassnode, only 36.1% of Ethereum addresses are currently profitable, indicating that the majority of holders are experiencing losses.

Meanwhile, Ethereum's current situation has led analysts to compare it to Nokia's decline in the late 2000s. According to BeInCrypto, analysts warn that Ethereum could fall and be replaced by more scalable and faster platforms like Solana (SOL).

Nevertheless, pessimism is not widespread. Many analysts still see the possibility of recovery, citing the upcoming technical upgrades and the market's undervaluation.