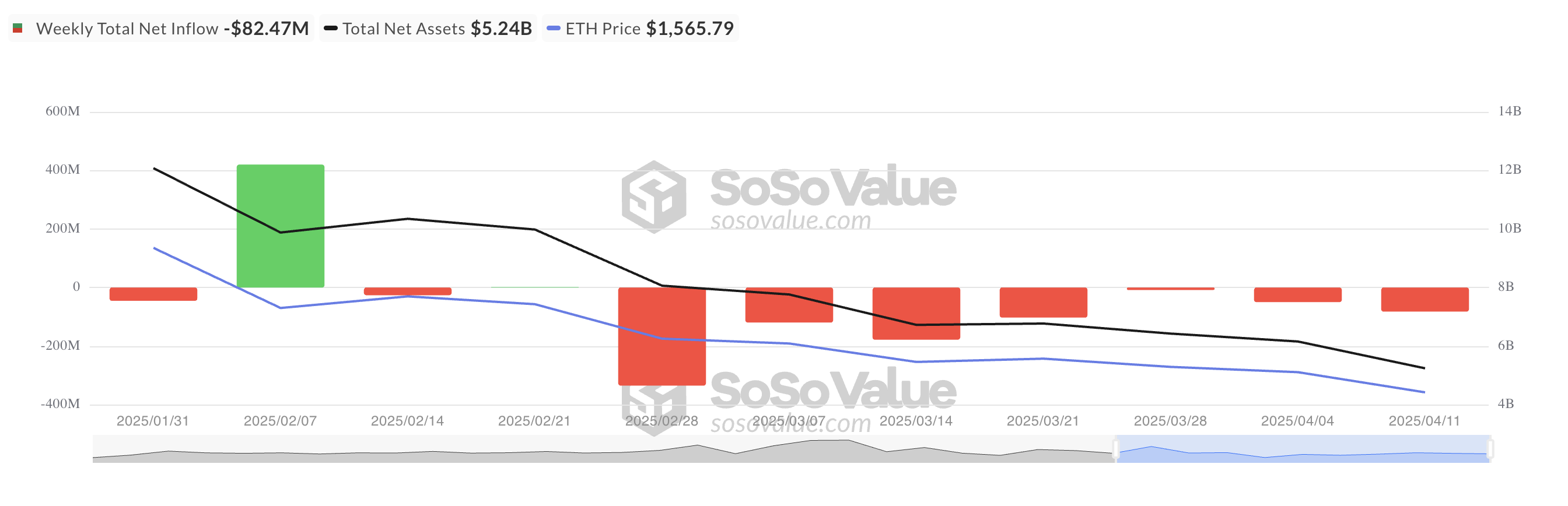

Ethereum ETF closes another week in the red, recording net outflows amid continued investor hesitation.

Notably, there have been no weeks with net inflows since the end of February, indicating a decrease in institutional interest in ETH-related products.

Ethereum ETF Faces Consistent Outflows

Ethereum-based ETFs have recorded net outflows for 7 consecutive weeks, emphasizing the ongoing institutional hesitation towards the asset.

This week alone, spot ETH ETFs experienced $82.47 million in net outflows, a 39% increase from the previous week's $49 million net outflow.

As institutional presence in the ETH market continues to decline, selling pressure on the coin has surged.

Over the past week, ETH's price dropped by 11%. The consistent outflow of funds backed by the coin suggests the downtrend may continue, increasing the likelihood of the price falling below $1,500.

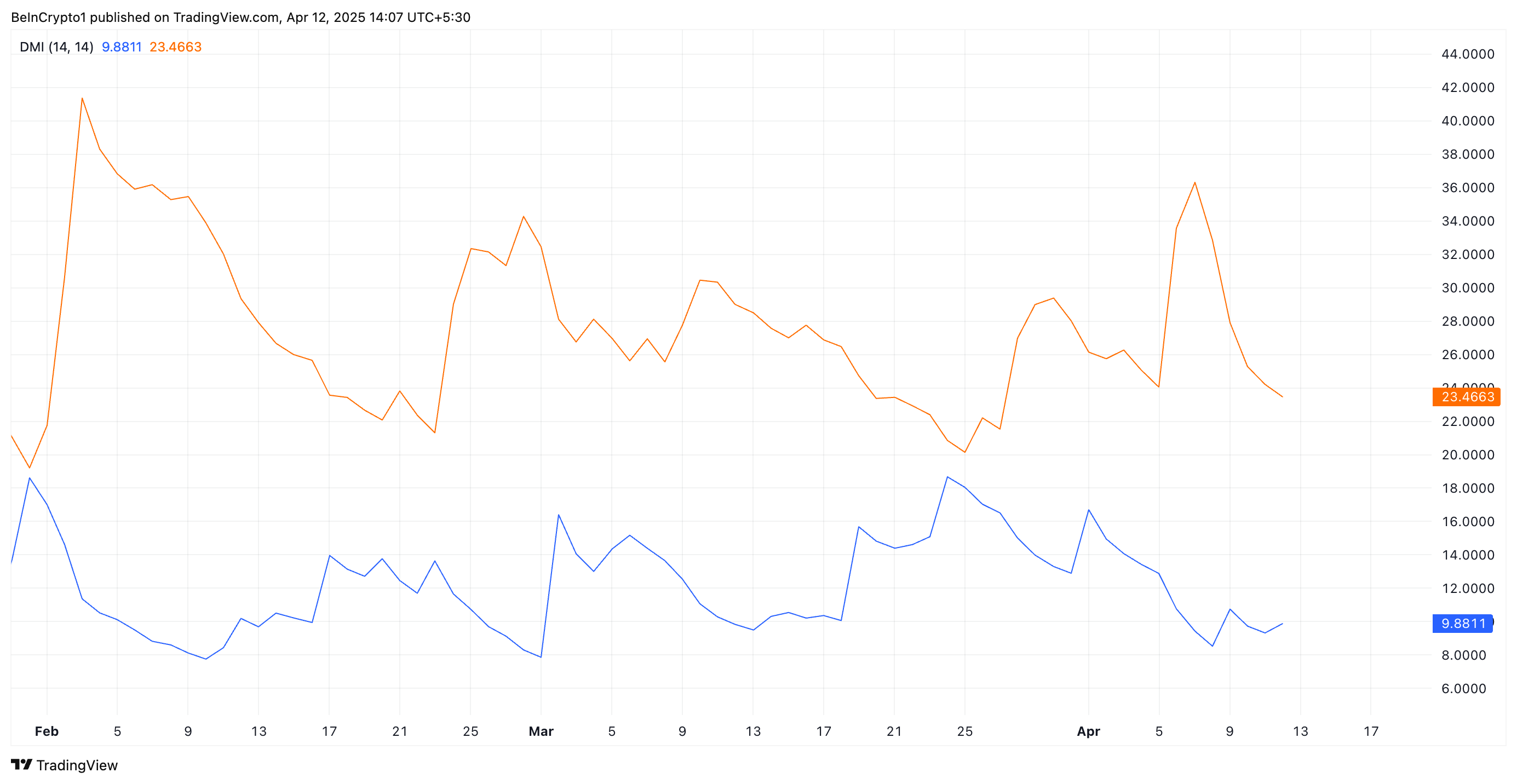

Price charts still show technical indicators in weakness, confirming increased selling pressure in the market. For instance, at the time of reporting, the positive directional index (+DI) is below the negative directional index (-DI) in ETH's Directional Movement Index (DMI).

The DMI indicator measures the strength of an asset's price trend. It consists of two lines, with +DI representing upward price movement and -DI representing downward price movement.

Similar to ETH, when +DI is positioned below -DI, the market is in a downtrend, with downward price movement dominating market sentiment.

Ethereum Price Could Fall Below $1,500

The lack of institutional capital could delay a significant ETH price rebound and further worsen short-term recovery prospects. If demand continues to decline, ETH could break out of its narrow range and follow a downward trend.

In this scenario, the altcoin could drop below $1,500, reaching $1,395.

However, if ETH experiences a positive shift in sentiment and a surge in demand, the price could rise to $2,114.