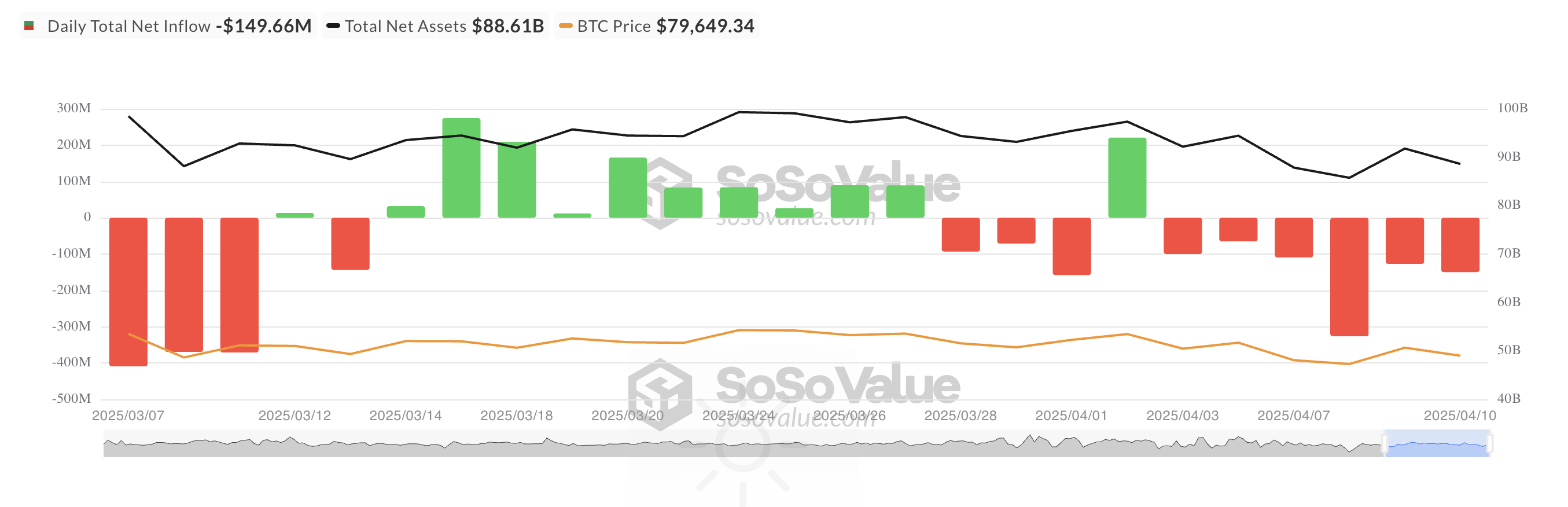

This week, the cryptocurrency market is trying to show courage, but institutional investors do not seem to accept it. Yesterday, the Bitcoin spot ETF recorded another fund outflow, marking the 6th consecutive day of capital outflow.

Despite the short-term rebound attempt across the market, continuous fund outflows show the cautious attitude of institutional investors. These consistent capital outflows indicate that investors are seeking safety or observing from the sidelines during volatility.

Bitcoin ETF Continues Consecutive Losses

On Thursday, the net outflow of Bitcoin ETF was $149.66 million, a 17% increase from Wednesday's $127.12 million.

This marks 6 consecutive days of fund outflows from Bitcoin spot ETF funds, emphasizing the weakened sentiment and growing caution among institutional BTC investors.

According to SosoValue, the Grayscale Bitcoin Mini Trust ETF $BTC recorded a net inflow of $9.87 million that day, raising the fund's historical net inflow to $1.15 billion.

In contrast, Fidelity's ETF FBTC recorded a net outflow of $74.67 million on Wednesday. The total historical net inflow to date is $11.4 billion.

Derivatives Market is Optimistic

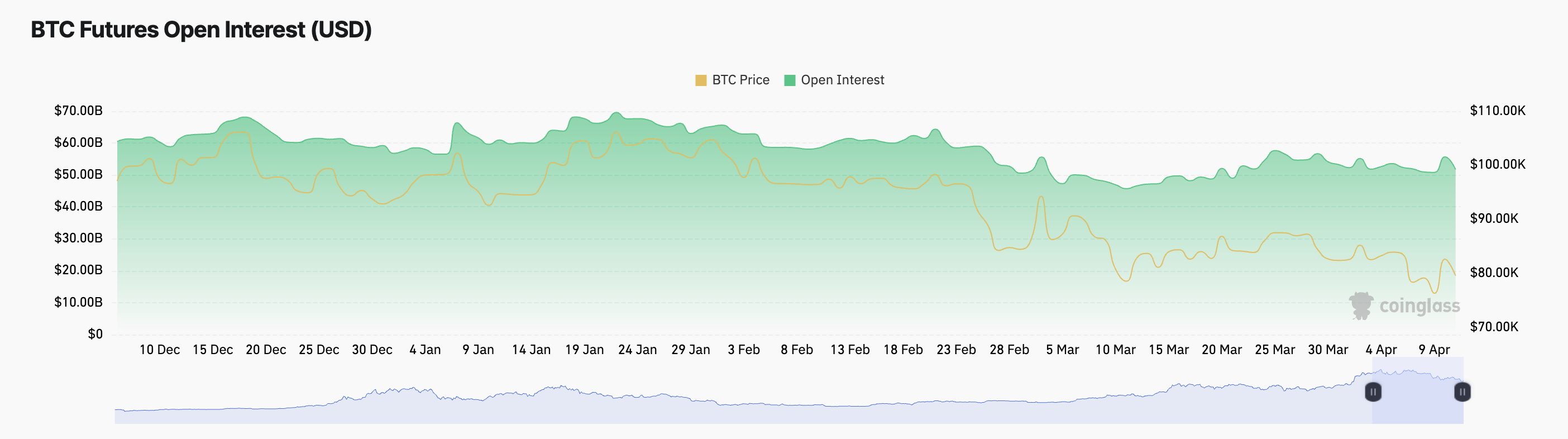

Meanwhile, BTC futures open interest slightly decreased with the overall market decline. At the time of reporting, it was $51.73 billion, a 7% decrease over the past day. This aligns with the 2% drop in BTC value and decreased cryptocurrency market activity.

The decrease in open interest during price decline suggests that traders are closing existing positions rather than opening new ones. This may indicate a consolidation phase or reduced volatility.

But the story doesn't end here.

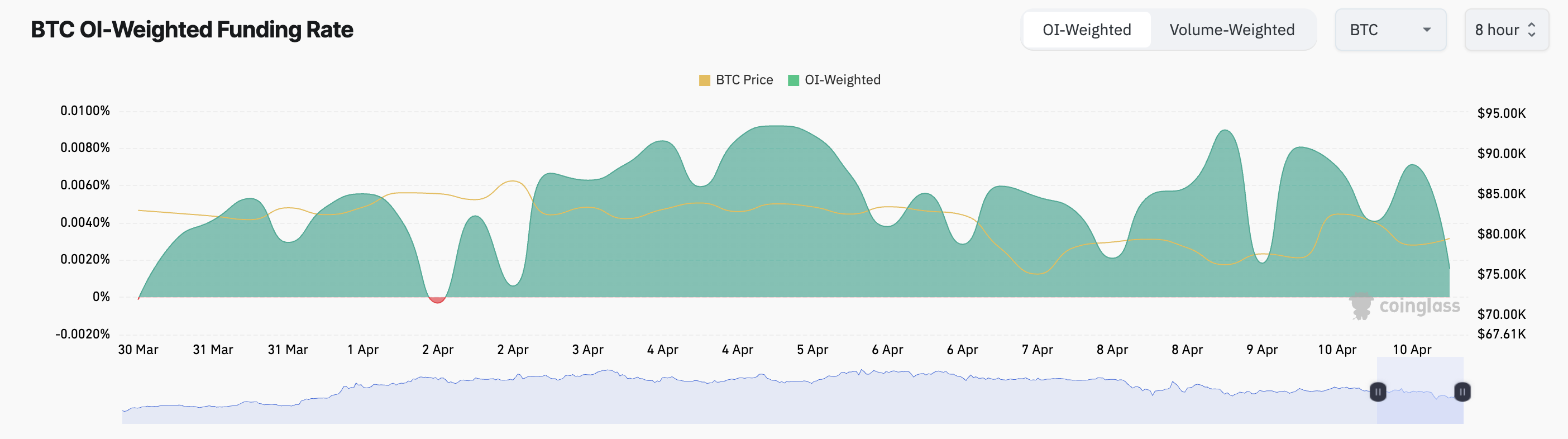

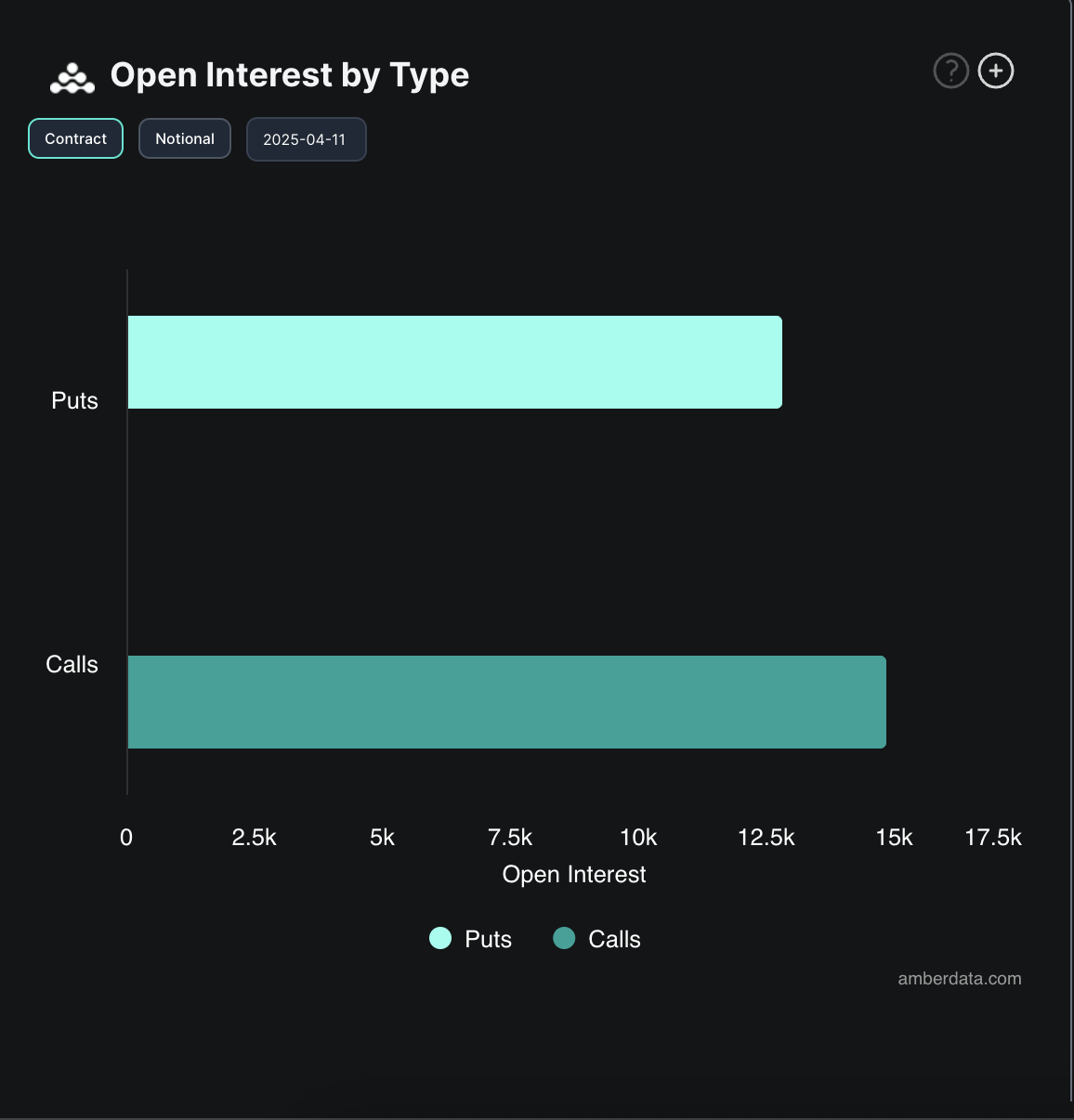

The funding rate remains positive, and demand for call options is high, which are all considered bullish signals.

At the time of reporting, BTC's funding rate is 0.0015%. The funding rate is a recurring payment exchanged between long and short traders in the futures market to align contract prices with the spot market. This positive funding rate indicates that long traders are paying short traders, suggesting that bullish sentiment is dominant.

In the options market, demand for call options is higher than put options, further reflecting a bullish bias for BTC.

The difference in ETF flows and derivatives activity this week suggests that traditional institutions are reducing exposure, while retail and leveraged traders are expecting a rebound.