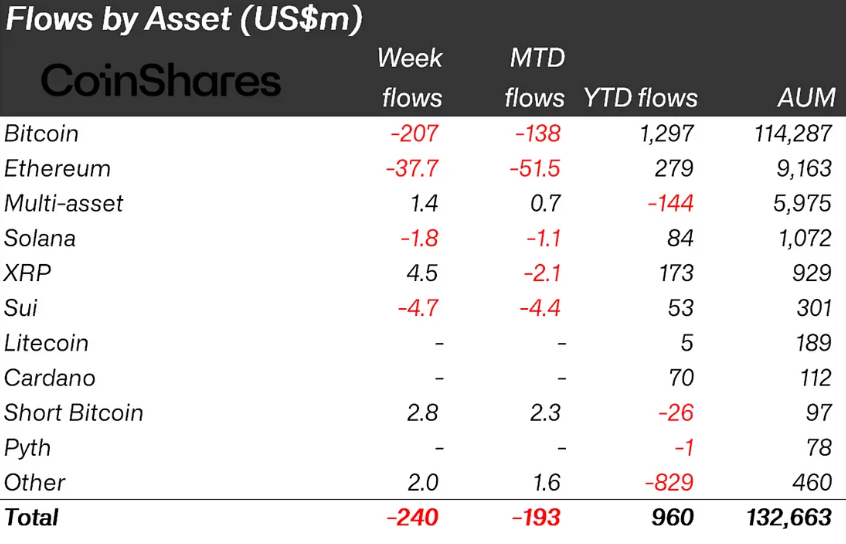

Cryptocurrency ETP (Exchange Traded Product) was severely impacted by an outflow of $240 million last week.

This result occurred as trade tensions escalated in the United States, with investors becoming cautious due to new import tariffs from President Donald Trump.

Cryptocurrency Outflow of $240 Million Last Week

According to the latest CoinShares report, cryptocurrency outflow reached $240 million last week, primarily due to concerns that trade disruption could hinder global economic growth.

"Digital asset investment products recorded an outflow of $240 million last week, which appears to be a reaction to recent US trade tariff news that could threaten economic growth." – James Butterfill of CoinShares mentioned.

Bitcoin alone recorded an outflow of $207 million, with inflows significantly decreasing to $1.3 billion compared to the beginning of the year.

Ethereum products also recorded an outflow of $37.7 million. Solana and Sui showed outflows of $1.8 million and $4.7 million, respectively.

This is in contrast to the previous week's report, which recorded an altcoin inflow of $18 million, ending a four-week loss streak.

This change in sentiment reflects increasing investor uncertainty across all asset classes. Sales were widespread, with the United States leading the outflow at $210 million. This supports the claim that President Trump's tariffs increased market uncertainty.

BeInCrypto reported that Trump is planning reciprocal tariffs. This plan was announced as part of the president's "America First" trade agenda and includes two main elements. The first is imposing a basic 10% tariff on all imports to the United States from April 5th, affecting almost all trading partners.

Secondly, higher "reciprocal" tariffs ranging from 11% to 50% target specific countries with large trade surpluses with the US or high barriers to US goods. These elevated tariffs will affect approximately 57 to 90 countries, starting from April 9th.

In this context, China will have a total tariff of 54%, with an additional 34% reciprocal tariff on top of the existing 20%. Meanwhile, the European Union will face 20%, Japan 24%, and Vietnam up to 46% tariffs.

Against this background, local media reported that China criticized the US for economic harassment.

"China condemns US unilateralism, protectionism, and economic harassment along with tariffs." – Analyst Jackson Hinkle mentioned.

US Bitcoin ETF, $172 Million Outflow

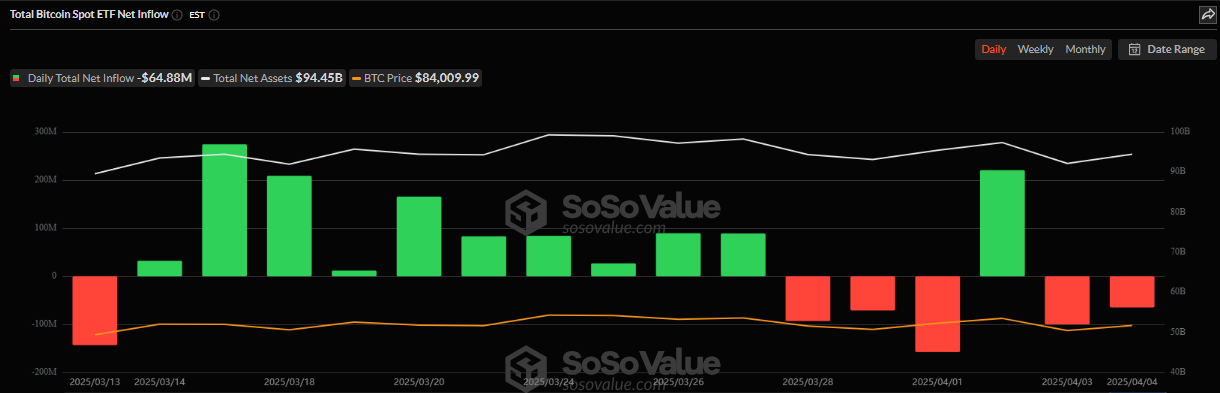

Meanwhile, institutional retreat was most prominent in the US spot Bitcoin ETF market. These financial products recorded a net outflow of $172.89 million last week, ending a two-week inflow period that had added nearly $941 million.

According to SoSoValue data, most redemptions occurred on 4 out of 5 days, reflecting the scale of investor anxiety.

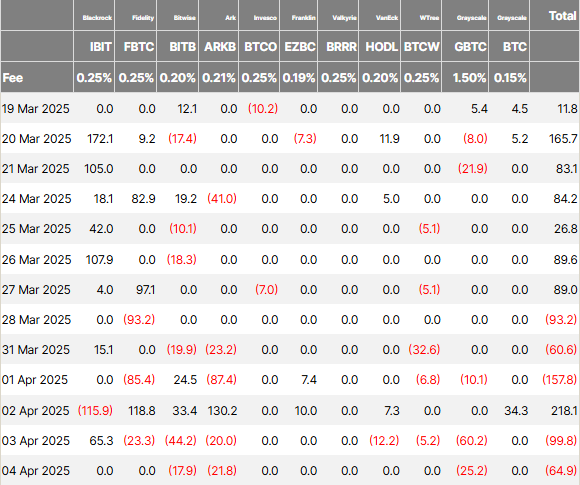

Farside Investors data shows Grayscale's GBTC led with $95.5 million in outflows, followed by WisdomTree's BTCW with $44.6 million.

Other ETFs including BlackRock's IBIT, Bitwise's BITB, ARK 21Shares' ARKB, and VanEck's HODL reported redemptions between $4.9 million and $35.5 million.

While there was a strong inflow of $220.76 million in mid-week on April 3rd, it was insufficient to offset losses on other days. Continuous outflows occurred from Monday to Friday, with Tuesday alone recording $157.64 million in redemptions.

Ethereum ETFs were no exception. Nearly $800 million in outflows have occurred for six consecutive weeks since February. Last week alone saw $49.93 million in redemptions from Ethereum funds, reinforcing the narrative of widespread risk aversion.

Some positive points still emerged. Franklin Templeton's EZBC, Fidelity's FBTC, and Grayscale's new spot Bitcoin trust recorded a total inflow of $61.8 million, suggesting selective institutional interest remains.

Ju Ki-young, CEO of CryptoQuant, mentioned the broad panic and emphasized that institutional flows still heavily depend on on-chain settlements.

"Ignoring on-chain data because of paper Bitcoin is a mistake. It is essential to understanding market supply and demand dynamics." – Ju Ki-young, CryptoQuant CEO, said on X (Twitter).

As the second week of the second quarter begins, investors are watching whether this adjustment is temporary. According to Standard Chartered Bank, Bitcoin could rebound on Friday. Meanwhile, sentiment suggests the potential for deeper structural changes in the cryptocurrency institutional narrative.