Welcome to the US Morning Crypto Briefing - We'll inform you about today's key cryptocurrency developments.

Find out why BTC's recovery path is under pressure, why a $1 billion liquidation shook the market, what Jamie Dimon and Max Keiser are saying about tariffs, and where Short-term holders stand after the recent adjustment.

Macro Uncertainty, $1 Billion Liquidation... BTC Recovery Test

With volatility rising across all markets, analysts have differing opinions on whether recent BTC selling indicates a deeper decline or is just a temporary correction.

Bitcoin dropped over the weekend—reflecting geopolitical tensions and uncertainty from Trump's newly proposed tariffs. However, some experts believe a rebound is possible.

Jeff Kendrick from Standard Chartered told BeInCrypto that despite Sunday's decline, Bitcoin is still performing relatively well and ranks third in returns after Microsoft and Google during the same period.

"Sometimes cryptocurrency movements on Sunday indicate the direction of the stock market on Monday. If that's the case, Monday might not be good. However, the forex market just opened, and the Australian dollar remains unchanged from Friday. If the forex market is correct, crypto selling will disappear, and Bitcoin is likely to return to Friday's closing price of $84,000." – Jeff Kendrick, Global Head of Digital Assets Research at Standard Chartered

Kendrick believes tariff concerns might be exaggerated and that Bitcoin could emerge as a hedge against US isolationism and fiat currency risks.

This perspective contrasts with statements by Kevin Hassett, Trump's top economic adviser. He claimed 50 countries have been contacted for tariff negotiations and tried to calm markets by suggesting consumer impact would be minimal.

However, Nick Puurin, founder of CoinBuro and crypto analyst, warns of a potential V-shaped recovery—especially considering over $1 billion in liquidations—but cautions this might be short-term.

"There's a real risk of a dead cat bounce. Macro is driving, and it's currently very unpredictable." – Nick Puurin, warning early-entering new investors via BeInCrypto

The path forward remains uncertain, but both analysts agree that macro conditions will be a primary force shaping cryptocurrency's future.

Dimon, Tariffs... Bitcoin Hedge Case

Adding caution, JP Morgan Chase CEO Jamie Dimon issued a strong warning in his annual letter to shareholders, emphasizing deeper structural risks facing the global economy.

"Increased spending on infrastructure, growing needs to restructure global supply chains and militaries could lead to higher inflation and interest rates than the market currently expects." – Dimon

He also referenced recent US trade policy changes, noting that "recent tariffs are likely to increase inflation and make many people consider the possibility of a recession more seriously."

Bitcoin pioneer Max Keiser argues that tariffs will strengthen Bitcoin's appeal as a hedge: "Everything liquidatable will move to Bitcoin. As global markets collapse, Bitcoin is outperforming everything else and becoming the safest asset," – Keiser, to BeInCrypto

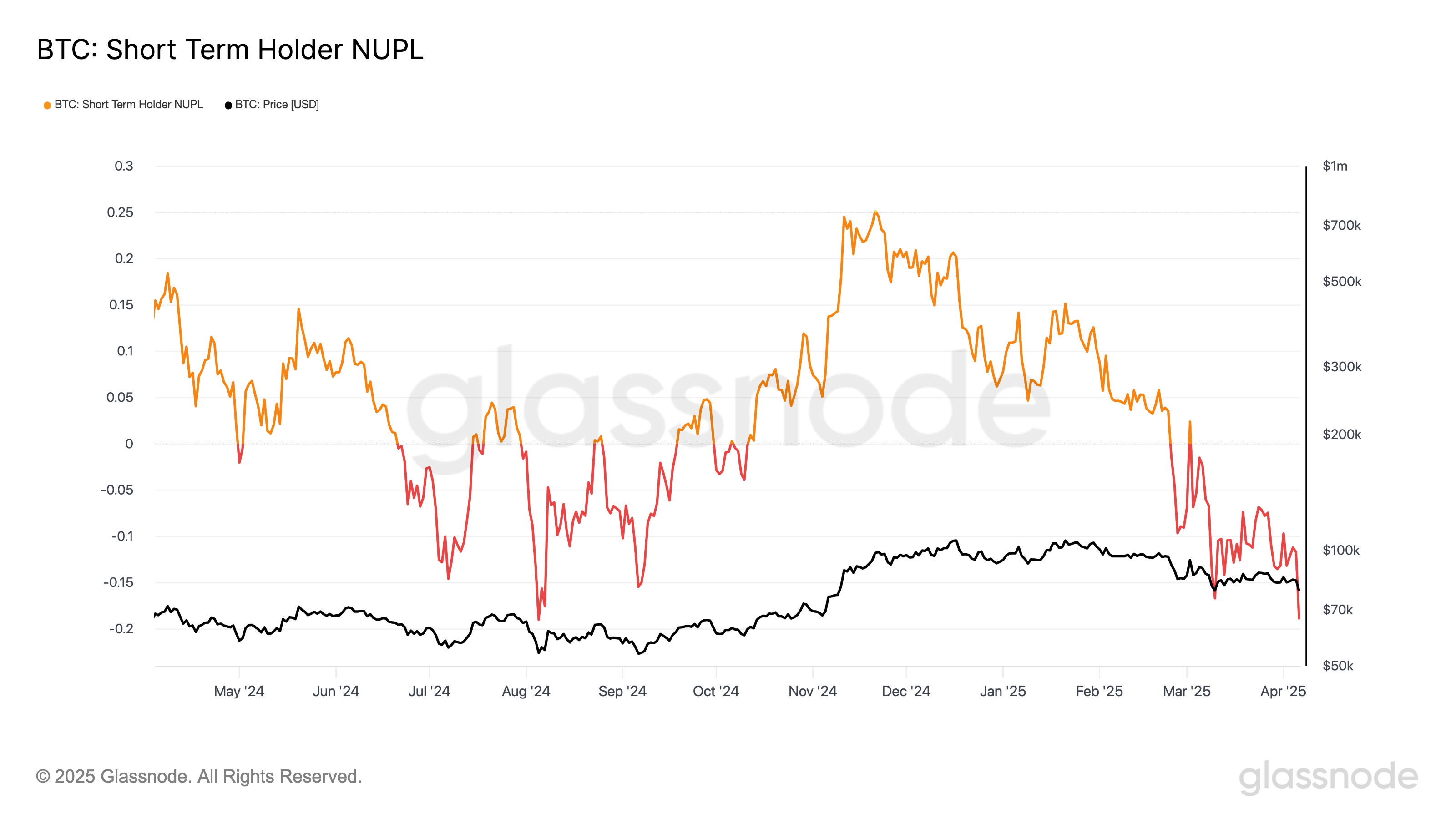

Today's Cryptocurrency Chart

The recent adjustment has brought Bitcoin's Short-Term Holder NUPL to its lowest level since August 2024.

Today's Key News

– SEC has initiated a comprehensive review of cryptocurrency policy under Trump's direction. This could potentially reconfigure how digital assets are classified under subtest.

– Major US economic events like FOMC minutes, CPI, and unemployment claims could impact BTC price this week, with inflation data and Fed signals shaping market sentiment.

– Analysts predict recent crypto decline by noting similarities to 2020's collapse. This could be a generational buying opportunity as Bitcoin drops below $80,000.

– Solana (SOL) crashed below $100, reaching a 14-month low, but strong investor support and key indicators suggest potential short-term rebound.

– Bitcoin dropped 7% below $75,000 with decreasing futures interest, but long-term holders maintain confidence, keeping a positive atmosphere.

– Crypto's "Black Monday" saw $1 billion liquidated over the weekend. Market cap dropped 10%, led by XRP and Ethereum. Analysts still see potential for short-term rebound.

– Justin Sun claims First Digital Trust's FDUSD-related misconduct is worse than FTX's collapse. He alleges asset theft without consent and offers a $50 million bounty to help investigate.