Author: Michael Nadeau, The DeFi Report

Compiled by: Tong Deng, Jinse Finance

Cryptocurrencies were supposed to enter a "golden age". But in the past few months, I have been unable to shake this persistent sense of concern.

This week, I will share a report explaining why this is the case.

Why I'm Concerned

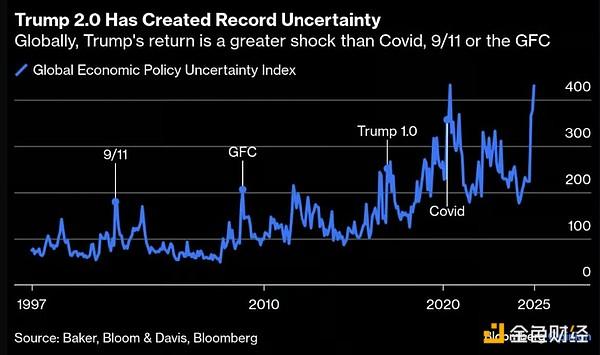

Previously, we shared our views on the key themes for 2025. Namely, the uncertainties related to inflation/tariffs, interest rates, fiscal spending/DOGE, the US dollar, global liquidity, and the business cycle.

Why? We wanted to have a thesis. We wanted it to be rooted in data and game theory/incentives.

In other words, we wanted to have conviction. Like this.

But as we sift through the data, we are unable to build conviction pointing to favorable conditions for the Altcoin market in the short to medium term.

My conviction is actually shifting in the other direction - we are in the late stages of this cycle.

Of course, we shared the "Bear Case" with you on January 15th. At that time, we felt the market had become quite frothy. So we started building cash positions. But we weren't ready to call it a "top" yet.

Seven weeks later, there is increasing evidence that the "top" may have arrived.

So let's continue discussing why I can't shake this "persistent sense of concern". We'll start from the specific crypto perspective, and then move on to the macro/economic issues.

Specific Crypto Issues

We've been in a bull market for over 2 years now. Things that were unimaginable just a few years ago (like government support for Altcoins) are now happening. But it feels bearish and "topping".

Trump. Is Trump's memecoin the start of a new paradigm for the industry? Will we see new innovations in memecoins that add utility for novel new capital formation strategies? We seem to be heading in that direction. But that's not the case. Instead, the President/his company has provided no communication or guidance to the public on Trump's plans - this has done immense damage to the industry. Why? Others are emulating his poor example (like Milei). Additionally, the lack of any attempt to bring utility to Trump has fueled the opponents and critics of our industry. It looks like a shaky scam. In my view, the pushback here hasn't even started yet.

Just last week, the SEC announced it would be dropping several cases against major Altcoin companies like Coinbase, Uniswap, and ConsenSys. This was very encouraging. But then Trump tweeted that he would be establishing a strategic Altcoin reserve, promising to include XRP, ADA, and SOL. There's a reason we don't cover XRP or ADA in the DeFi Report - they are zombie chains. Additionally, Elon/DOGE's mission is to clean up the excessive fiscal spending related to fraud, waste, and abuse. But are we going to use taxpayer money to purchase speculative centralized Altcoins? There's no ambiguity here - this is just stupid. And it undermines the good work that Elon and DOGE have done (which we'll cover later in this report). Many Altcoin investors were cheering this over the weekend, seeing it as a sign that "the cycle is still ongoing". We believe this is an illusion.

David Sachs. He should be the Altcoin czar. But do you think he knew Trump would tweet about a strategic reserve on Sunday? Apparently not. Additionally, it's clear the industry is not aligned on which tokens should be included in the reserve (or how regulation should operate). Getting on the path of new regulation is one thing, and we're optimistic about that. But proper execution is another matter, and that will take some time.

Kanye. Dave Portnoy. Now Eric Trump won't stop talking about Altcoins. When he does, he makes sure to use plenty of buzzwords like "revolutionary". For anyone who has been through a few cycles, this is a dangerous signal. We see a lot of these "cases" in the late stages of a cycle.

World Liberty Financial. I don't know if this is a scam. But it sure looks like it. If you want to try to divert people's attention away from a scam, you can call it "World Liberty Financial". Putting all the jokes aside, the website simply provides a way to purchase WLF tokens. Seriously. There's nothing there. No business model. No utility. Just a bunch of people in suits and a link to buy WLF tokens. Truly revolutionary.

Pump.fun. This has been an interesting period. But it seems the speculative peak in Solana has passed.

This is starting to look more like the previous cycle's OpenSea (which never rebounded).

In both cases, transaction volume/on-chain activity is clearly correlated with the price of L1 assets. So what will trigger the next wave of activity in Solana to keep the casino hopping?

If you can see it coming, please let us know.

Hopium on the timeline. I keep seeing people talk about why we're still in the early stages of the cycle: regulation and SBR. What's the problem? It's priced in. When people make this argument, I want to cash out.

Sentiment. Notice how few people are now saying the market has topped? But people like Eric Trump are quite bullish.

Hacks and Fraud. The Bybit hack + memecoin trenches being exposed suggests the ratio of fraudsters/scammers to actual builders is getting out of balance - just like at the end of the last cycle. We think it's time for a much-needed cleansing (bear market).

Overall, Altcoins feel a bit "dirty" right now. Meanwhile, speculative activity is waning. We look for this trend in the late stages of a cycle.

Macro Specific Issues

In addition to the "topping" signals we're seeing in the Altcoin market, our concerns about the short to medium-term economic outlook are also deepening. We believe the risk of a recession is increasing. According to Scott Bessent in a recent Bloomberg interview, he stated that a recession will dominate "our economy" 6-12 months from now.

DOGE. Our view is evolving. The initial idea was that Musk could not have a significant impact on government spending. We've updated this view based on what we're now seeing, as Musk's disruptive behavior seems to be fully supported by Trump. This is not good for growth. Regardless of one's stance on cutting government spending, the massive deficits of the past few years have been driving the economy, while the Fed has been implementing quantitative tightening. Eliminating "fraud, waste, and abuse" is a good thing - but we also have to acknowledge that this is the spending of some people and the income of others in the economy. So we have to ask: what growth catalysts will offset this? We think deregulation will help, but policy changes + it taking time to work through the economy. In short, balancing the budget in the near-term = contraction. Note that the 25-year budget forecast shows the deficit declining by about $300 billion. Meanwhile, the recent sharp drop in GDP growth is mainly due to a slowdown in consumer spending growth and disruptions to net exports (the import-front-running effect related to tariffs).

Inflation / Tariffs. Our view is that concerns about inflation and concerns about the impact of tariffs have been greatly exaggerated. That said, our views will change as the facts change. Trump confirmed that a 25% tariff on all goods from Canada and Mexico will take effect today. He will also double the tariff on Chinese imports from 10% to 20%. This will certainly impact inflation and market uncertainty.

Rate cuts / Yields / Dollar. Our view is that the number of rate cuts this year will exceed market expectations, and the dollar will fall (due to concerns about economic growth). We remain confident in this - largely because we've seen this from Elon and DOGE. That said, this may be detrimental to risk assets. More on that below.

Fed / Liquidity. If fiscal spending declines, the market sells off, the Fed will need to take an accommodative stance. We think they will take an accommodative stance, but they may wait too long to react (inflation concerns will come into play). In this case, rate cuts may not be enough to offset the economic slowdown. Even if the Fed cuts rates, risk assets may still be impacted. This was not the case when the Fed cut rates at the end of last year. Some have pointed out that the TGA will be the next driver of liquidity since the reverse repo has been depleted. This may provide some short-term relief, but will need to be refilled immediately once the debt ceiling debate is over.

Business Cycle. In our report released on February 14, we shared some data (ISM, CAPEX spending, small business confidence, bank lending) that suggested a new business cycle was about to begin. We believe this is true. But we are concerned that the slowdown could lead to a larger market correction/recession before the recovery begins. Without DOGE/fiscal spending and tariff reductions, we would be more inclined to predict a smoother transition.

Overall, the external sentiment of concern is quite high. Viewed from the contrarian perspective, this may suggest that things could improve. We still believe it is a time for caution. Although the Altcoin market has recently seen a pullback (BTC down 30%, SOL down 50%, other Altcoins down even more), we are not confident that the Altcoin market has bottomed. Why? Because the traditional markets have only just begun to correct. Notably, the traditional financial markets lead the economy. So further sell-offs could ultimately push us into a recession. If that is the case (possibly in Q2), we expect the Fed/Treasury to make major responses, but we don't currently feel it's necessary to chase the falling knife.

Portfolio Management

As mentioned, in addition to long-term holding of BTC, we have also been shifting towards cash. We are looking for opportunities to deploy into our favorite assets. The issue is, we haven't seen any 'juicy' opportunities yet.

We believe they will come. So now is the time to do deep research and compile a shopping list.

Remember, we've been riding the current bull market since the end of '22.

If you've only started getting into Altcoins in the last 6 months or so, here are our suggestions:

Be careful about chasing the falling knife. If you missed a big run-up, don't assume this is a 'buy' after a large correction. It might be. But the market may also turn against you. Altcoin attention is fickle. Most tokens will never come back. If you're going to make this mistake, it's best to do it with BTC.

If you 'bought the top', don't beat yourself up. Many new market participants encounter this. You're learning. What you learn today is likely to pay off in the future - but you need to stay engaged with the space. The key is to invest in assets you want to hold long-term.

Many retail investors enter Altcoins late in the cycle, exit in the bear market (missing all the best opportunities), and then re-enter late in the next cycle. Don't do this.

Watch your psychology. If you find yourself blindly agreeing with the bulls and getting irritated by the bears, you're more likely to make mistakes. Remember, people like Raoul Pal (who usually do well) were calling for ETH to hit $30k at a similar stage last cycle. Influential VCs may have portfolio projects with tokens yet to be launched. They have incentives to tell you the cycle is still strong. Try not to outsource your convictions to others who may have competing motives.

Focus on your income/job. Make sure you have some capital to weather corrections/bear markets.

Conclusion

Note that my preference is to shift towards cash. If everyone starts to unanimously believe prices will go down, this may indicate those market participants have also sold. This would point to higher bottoms/lows. Notably, there is record cash in the money markets currently:

Ultimately, as an investor, my job is to make the best decisions based on the best information available - and that is always evolving.

Some on-chain indicators point to a mid-cycle - so there is reason to support the bull case. But we've been irresponsibly long since the end of '22. The current risk/reward simply doesn't warrant staying in the market or deploying new capital. We believe it's wiser to take profits, move to cash, and wait for the 'juicy' opportunities.

Additionally, going forward, the concept of 'cycles' may not be as important.

From here, we can envision a scenario of further correction (BTC down to $65,000-$70,000, possibly lower, depending on the Fed's response time), then a few months of consolidation, and another leg up before the end of the year into 2026. If we see a major Fed response, BTC could run much higher in this scenario. This would follow the 21st century cycle - peaking in Q1 after the Coinbase listing.

After that, the sudden emergence of NFTs drove increased activity on Ethereum - leading to a fierce 'Altcoin season'. The problem with predicting Altcoins is, we've already seen some 'meta' plays (Meme coins, AI tokens). So what will be the next thing to drive a 'frenzy' of on-chain activity?

If the market has indeed peaked, then in our view, this would be a disappointing cycle. Our bull case was a $10 trillion market cap (BTC at $200k). The base case is $7.5 trillion (BTC at $150k). Not to mention the poor performance of ETH. Our sense is that many professional investors have been struggling - because in the last few years, you really had to get into BTC and SOL early to do well.

While this report is relatively sober, we remain very bullish long-term. The infrastructure is ready for the golden age, whereas the last cycle was not.

The reality is, the Altcoin industry is indeed entering a 'turning point'. Regulation and policymaking highlight the 'turning point' - marking the end of the 'installation phase' of new technology and the beginning of the 'deployment phase'.

At this juncture, Altcoins seem poised to inevitably go mainstream, with BTC reaching a $10 trillion market cap. But this may take longer than we imagine.

Finally, you may be wondering, at what price would we turn bullish again? That's hard to say. We'll re-evaluate as we go. Generally, we'd like to buy BTC when MVRV is near or below 1, and buy discounted Altcoins.