The cryptocurrency market has fallen nearly 10% in the past 24 hours as interest in the U.S. cryptocurrency reserve has waned and Donald Trump has imposed new tariffs on Mexico, Canada, and China. This adds more pressure to a market that is already in correction.

Despite the downtrend, crypto whales have been buying ADA, CAKE, and RENDER, signaling accumulation during the price decline. ADA has fallen 16% in a day and is struggling to maintain support below $0.85, while CAKE has been one of the top-yielding protocols in recent weeks. Meanwhile, RENDER has fallen 33% over the past 30 days.

Cardano (ADA)

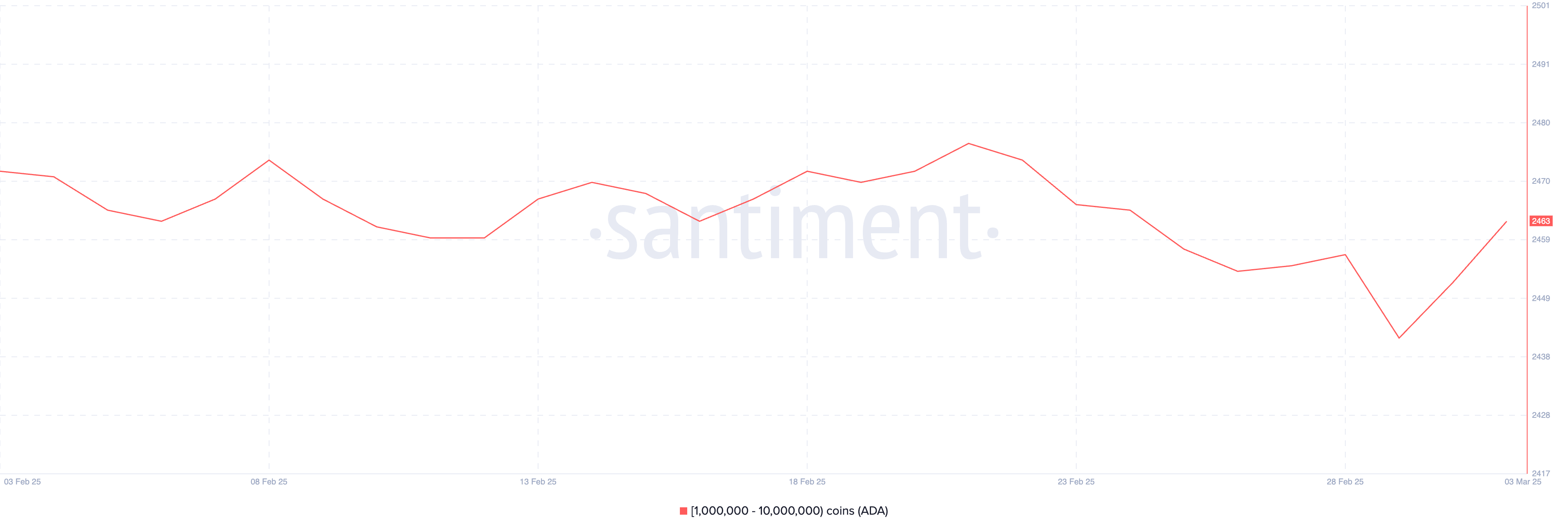

Crypto whales have been buying ADA during the recent market crash. The price of ADA has fallen 16% in the past 24 hours. The surge after being included in the U.S. cryptocurrency strategic reserve was short-lived, and the downtrend has been dominant.

However, the whales' accumulation signals confidence in ADA's long-term potential.

The number of whale addresses holding 1-10 million ADA increased from 2,442 on March 1 to 2,464 on March 3, confirming that whales have been buying more ADA as the price has declined.

This could signal future recovery, but ADA is still struggling to regain key resistance levels.

After briefly recovering $1, ADA is currently trading below $0.85 and is at risk of dropping to $0.70. The community is still uncertain about the reason for its inclusion in the U.S. cryptocurrency strategic reserve, which is adding to the selling pressure. If sentiment improves, ADA could return to an uptrend and test $1.10 or even $1.20.

PancakeSwap (CAKE)

CAKE has been on an uptrend in recent weeks. It has become one of the top-yielding protocols over the past 30 days. Increased market interest as BNB trading volume competes with Solana and Ethereum.

This surge has led crypto whales to increase their accumulation of CAKE in the past few days. The number of wallets holding 1-10 million CAKE rebounded from 26 on March 1 to 30 currently.

CAKE is currently maintaining a strong support at $1.35, which is a crucial level for it to sustain the uptrend.

If the momentum of BNB and CAKE recovers, it could test the resistance around $2, and with sufficient strength, it could rise above $2.60.

Render (RENDER)

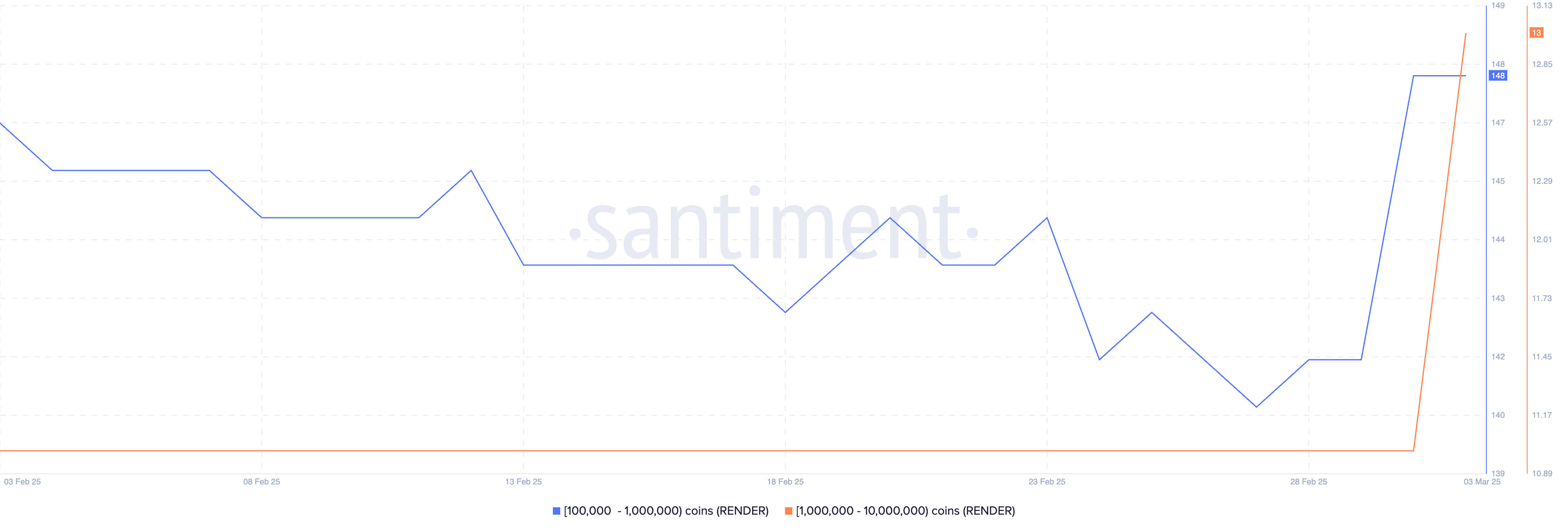

RENDER remains one of the leading AI cryptocurrencies, but like other sectors, it has faced difficulties in 2025, with the price declining 33% over the past 30 days.

The downtrend has impacted sentiment, maintaining high selling pressure. RENDER is currently at a critical juncture and needs a turnaround in momentum.

Despite the downtrend, crypto whales have been buying RENDER in the past few days, increasing their accumulation. The number of wallets holding 100,000 to 1 million RENDER increased from 153 on March 1 to 161 currently.

RENDER is currently testing the $3.30 support level. Losing this crucial level could lead to further correction. If an uptrend emerges, it could test the $3.90 resistance and attempt to break above the $4 level.