Cardano (ADA) surged 60% yesterday, crossing $1.10 after Donald Trump announced that ADA would be included in the U.S. cryptocurrency reserve. This massive rally has triggered strong bullish momentum, with key indicators like BBTrend and DMI confirming the strength of the uptrend.

However, ADA has since corrected below $1, and the excitement appears to be fading. Technical signals suggest that selling pressure is increasing. As traders evaluate whether ADA can maintain its upward trend or face deeper correction, key support and resistance levels will be crucial in determining the next move.

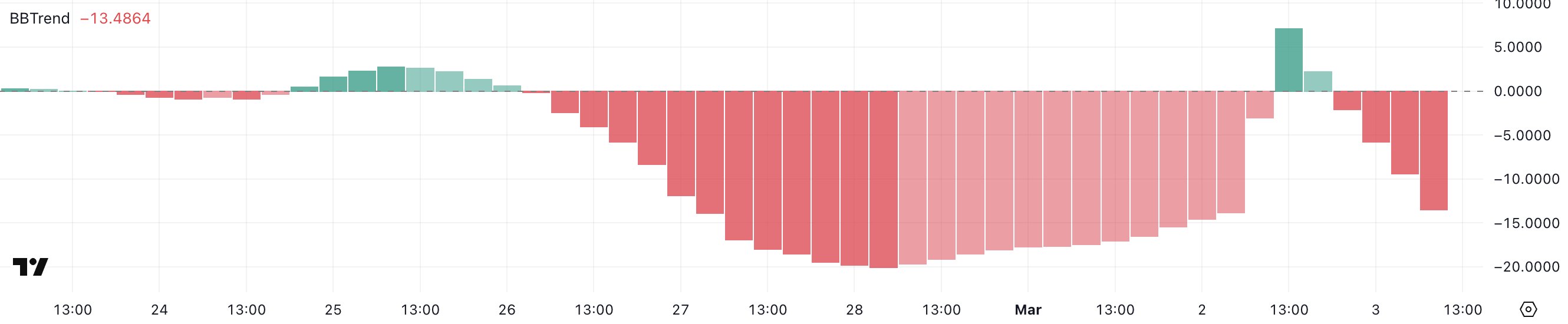

Cardano BBTrend Indicates Rising Selling Pressure

Cardano experienced a powerful price surge after being officially included in the U.S. cryptocurrency reserve. This sudden surge in demand pushed ADA's BBTrend indicator from -14.5 to 7.1 within a few hours, signaling a shift in momentum.

BBTrend is a volatility and trend-following indicator derived from Bollinger Bands, helping traders assess the strength and direction of price movements.

A BBTrend above 0 indicates an uptrend, while a reading below 0 suggests downward momentum. Extreme values like -10 or above 10 typically signal an overbought or oversold condition that is likely to correct soon.

After peaking at 7.1, ADA's BBTrend has since dropped back to -13.4, suggesting that the initial excitement over the U.S. cryptocurrency reserve inclusion has faded.

This sharp decline indicates that the bullish momentum has significantly weakened, and ADA may now face a period of correction or consolidation.

Such low BBTrend values typically coincide with strong selling pressure and could signal further downside, unless new buying interest emerges. If ADA fails to hold key support levels, the price may continue to decline, but a return to neutral territory on the BBTrend would signal stabilization.

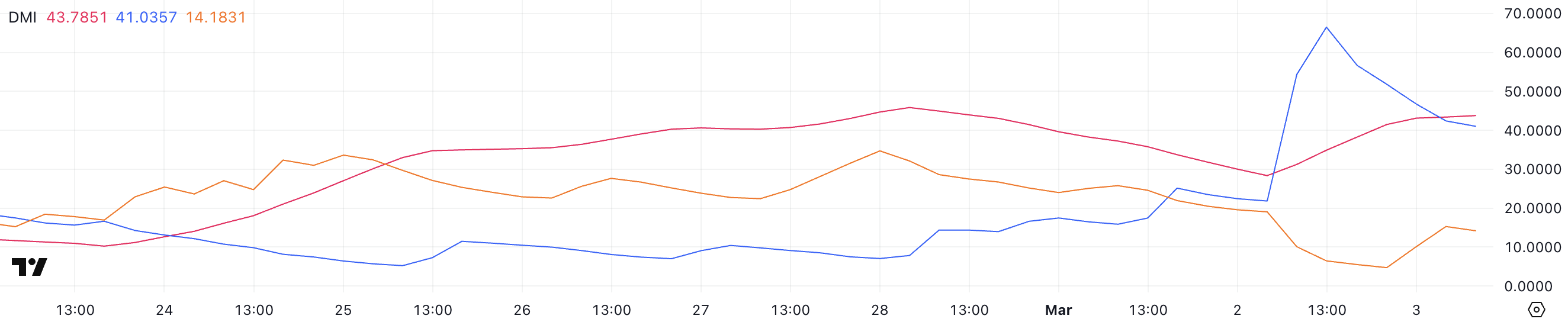

ADA DMI Suggests Buyers Still Dominant

Cardano has seen a significant increase in trend strength, as reflected in the Directional Movement Index (DMI). The Average Directional Index (ADX) has surged from 28.3 to 43.7 following the announcement of ADA's inclusion in the U.S. cryptocurrency reserve.

An ADX above 25 suggests a strengthening trend, and a reading above 40 typically indicates a strong and persistent movement.

ADX measures the strength of a trend, regardless of direction, and is an important indicator in evaluating the likelihood of a movement continuing or weakening.

Additionally, ADA's +DI (Positive Directional Index) has dropped from 66.5 to 41, indicating that the bullish momentum has faded. Meanwhile, the -DI (Negative Directional Index) has risen from 4.7 to 14.1, suggesting that sellers have started to fight back.

The combination of high ADX, declining +DI, and rising -DI implies that the trend remains strong, but the upside advantage is weakening, and selling pressure is increasing. If this trend continues, ADA may face deeper correction or consolidation, unless buyers regain control.

Will ADA Drop Below $0.80 Soon?

Yesterday, Cardano's price surged 60% to cross $1.10 after being included in the U.S. cryptocurrency reserve.

However, as the initial buying frenzy has subsided, a correction has occurred over the past few hours, and ADA has returned to the $1 level.

Technical indicators like DMI and BBTrend suggest that the uptrend is losing momentum, increasing the likelihood of a deeper correction. If ADA fails to hold the current levels and selling pressure intensifies, it could test the $0.90 support level.

A break below this level could open the door for further declines to $0.81 and $0.65, and a strong bearish trend could even pull ADA down to $0.50.

Conversely, if the bullish momentum regains strength, Cardano's price could resume its upward trajectory and test the $1.16 resistance level. A successful break above this area would signal a new bullish phase, with the potential to reach $1.32, the highest level since early December 2024.

Whether ADA maintains its uptrend or enters a correction phase depends on how traders react to the recent price surge and whether new buying interest can overcome the selling pressure.