Solana fell in the previous day as traders watched a key reclaim level, with momentum still negative and support zones in focus.

Notably, over the past 24 hours, Solana fell about 4.7% to $125.91, while trading within a daily range of $124.08 to $134.26. That range shows buyers tried to push prices higher, but sellers pushed back. It also shows buyers stepped in near the sub-$124s, keeping volatility high even after the first drop.

The move is also playing out in a market with real depth: SOL is sitting near a $71.15B market cap with roughly $5.60B in 24-hour volume. Over the past 7 days, SOL is down about 4.5%, and over the past 14 days, it is down about 0.8%. This range-bound activity shows Solana is caught between dip buyers and sellers who are still defending rebounds. Can Solana launch to higher prices?

Can Solana Test Higher Levels?

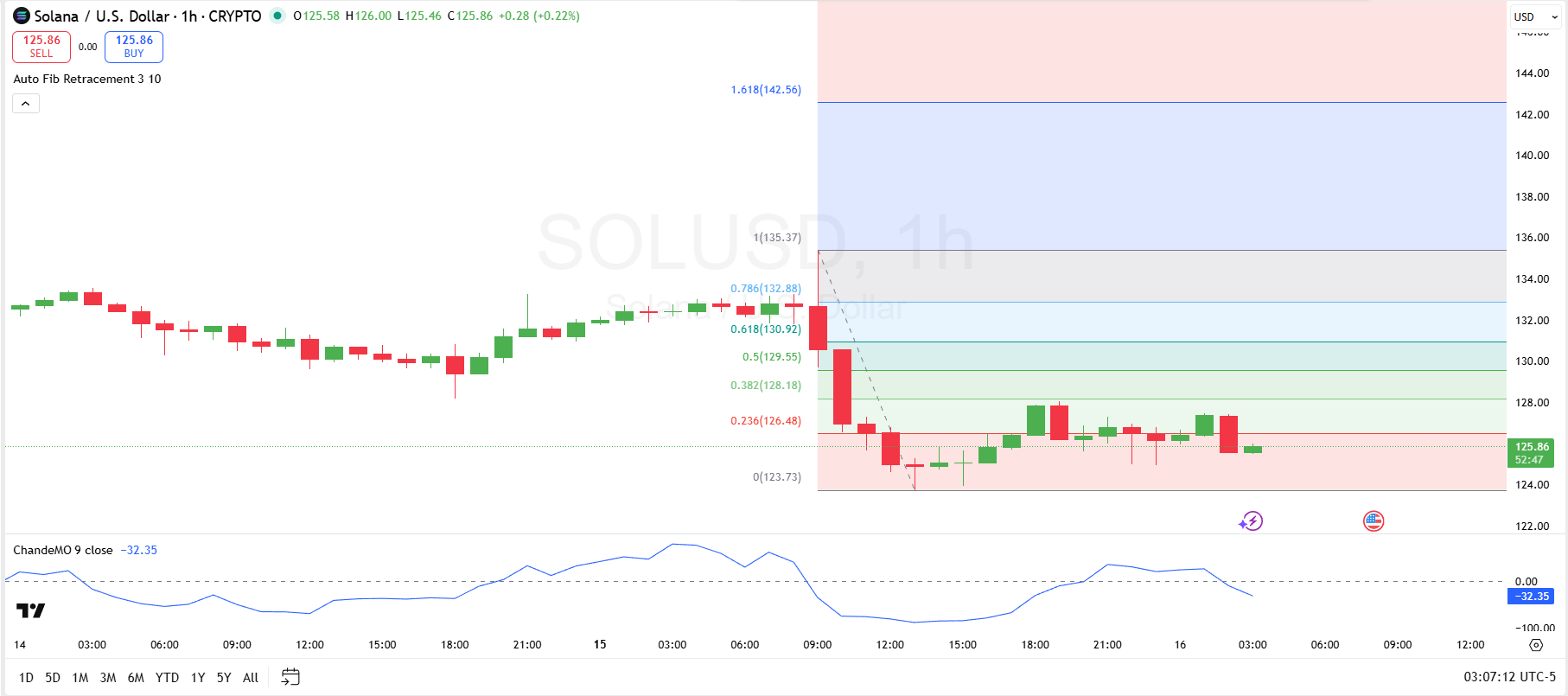

Looking at a TradingView chart, Solana is currently trading below the first Fibonacci retracement level at $126.48 (0.236), which suggests the sellers are still controlling the price. However, a green candle can be seen trying to head towards this resistance.

If price can reclaim $126.48, the next upside areas to watch are $128.18 (0.382) and $129.55 (0.5). A stronger recovery would then bring $130.92 (0.618) into focus, followed by $132.88 (0.786) and the prior swing high around $135.37 (1.0). On the upper extension side, $142.56 (1.618) stands out as a longer-shot target only if momentum fully flips bullish.

Momentum remains soft based on the Chande Momentum Oscillator (9), which sits near -32 and stays below the zero line. This points to bearish pressure still being present even though price action has started to stabilize. For the rebound to look more convincing, the oscillator would need to reverse toward zero, which would signal selling force is fading and buyers are regaining influence.

On the downside, the key support zone is around $123.73, with additional support psychologically near $124. If that area breaks cleanly, the next downside risk opens toward the $122 region.

Here’s Solana’s Entry Zone

Looking at social media commentary, analyst Kamran Asghar said on X that traders should “not get trapped” because he believes Solana is setting up a liquidity sweep. In his view, SOL could dip below $130 to trigger stop-losses (“grab stops”), then quickly reclaim that level.

He also called attention to a deeper downside scenario: a move into the $100 support area, which he labels as a “manipulation” phase on his setup. Asghar claimed that the zone would be the best entry area in his thesis, before any larger rebound attempt.

After hitting this entry point, he predicts SOL to surge and retrace into a distribution zone, then shoot into the area above $220. To reach $220 from $125.91, Solana would need to surge about 74.7%.