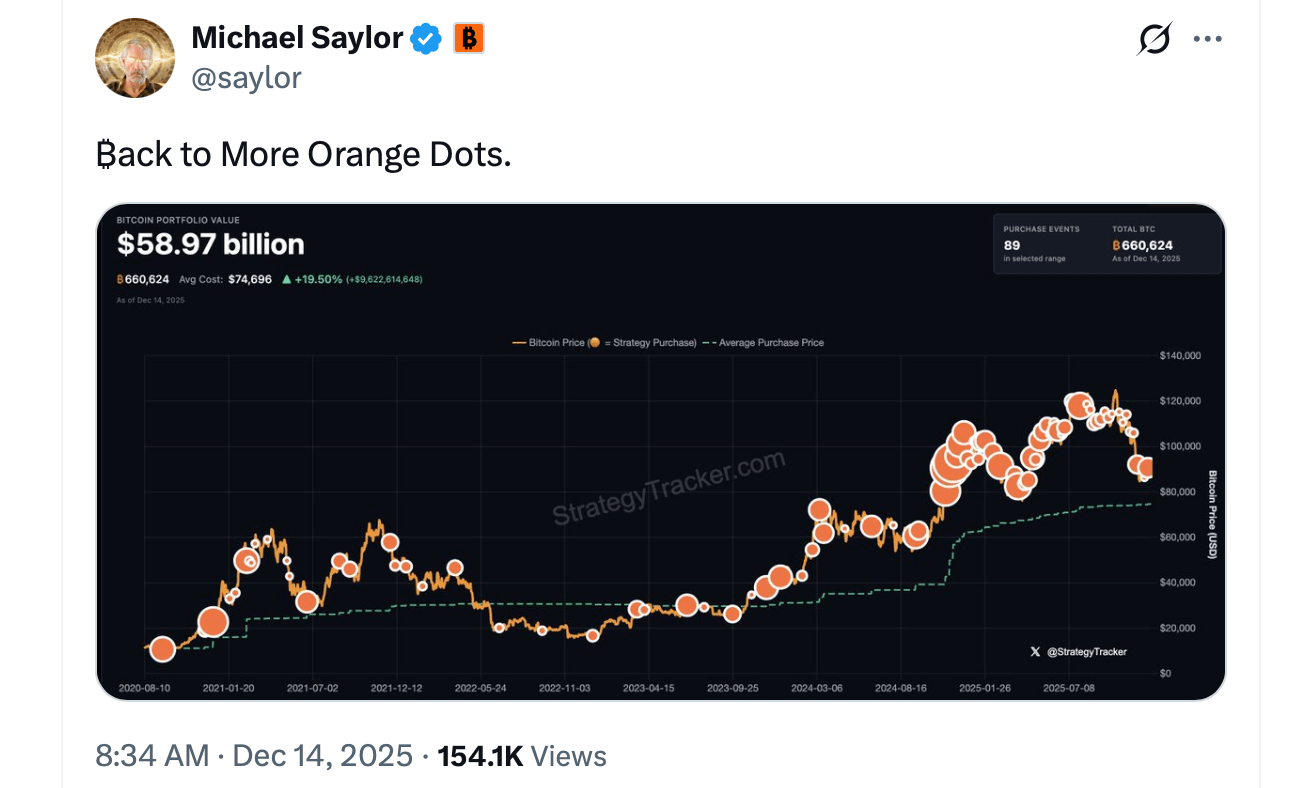

It looks like Michael Saylor’s Strategy is lining up a fresh bitcoin purchase announcement for Monday morning, after dropping a not-so-subtle hint on X on Sunday. The bitcoin treasury giant already sits on a hefty 660,624 BTC, and all signs suggest this train has no plans to hit the brakes.

Over the past month, Saylor has been posting images on X sprinkled with orange dots to signal newly scooped-up BTC, and on one occasion, a lone green dot appeared, tipping off the firm’s newly created U.S. dollar reserve. He preceded it with a similar message on Sunday morning, when he posted on X saying: “₿ack to More Orange Dots.” Typically, that kind of statement is followed by a Monday announcement, with Saylor and Strategy revealing a new BTC buy.

Strategy recently fired off a pointed letter to MSCI, pushing back against a proposed rule that could sideline bitcoin- or crypto-heavy companies from major equity indices. That MSCI dust-up hasn’t slowed the firm’s appetite for stacking large amounts of bitcoin. Nor has the company’s stock slump or the broader bearish mood hanging over the crypto economy, with BTC sitting more than 29% below its all-time high.

If history is any guide, Monday morning may deliver another orange-dot confirmation and a fresh addition to Strategy’s already towering bitcoin stack. For Saylor, price pullbacks, policy debates, and market gloom appear to be background noise, not stop signs.

FAQ 🟠

- What did Michael Saylor signal on X? He posted “₿ack to More Orange Dots,” a message that typically precedes a Strategy bitcoin purchase announcement.

- How much bitcoin does Strategy currently hold? The company controls approximately 660,624 BTC, making it the largest corporate bitcoin holder.

- Why is Strategy pushing back against MSCI? The firm objected to a proposed rule that could exclude bitcoin- or crypto-heavy companies from major equity indices.

- Has the market downturn slowed Strategy’s bitcoin buying? No, Strategy has continued accumulating bitcoin despite its stock decline and BTC trading more than 29% below its all-time high.