Sunday's close shows that Bitcoin remains passive and directionless. Meanwhile, large-cap altcoins fall into three categories: those with live catalysts, those trading on rumors and those bleeding capital but not making headlines. XRP falls into the second category, Cardano into the first, and Shiba Inu into the third.

Liquidity remains selective. There is no significant risk-taking or coordinated movement across different markets, nor is there a sense of urgency from buyers. Prices only react when the structure, signal or narrative forces them to.

TL;DR

- XRP pulled attention from the man with the highest IQ, but liquidity went missing.

- Cardano lined up a 40% price rise signal and a network catalyst at the same time.

- SHIB lost over $100 million as buyers stepped aside.

XRP receives unexpected prediction from world's highest IQ holder

XRP is trading around $2.018 on Binance at the end of the week, down a bit on the day, but still in the same range it has been in since early November. If you look at the daily chart, you will see that there has been a stable sequence of lower highs since the October rejection near $3. There has also been some ongoing downside pressure.

The only thing that changed this weekend was the focus as YoungHoon Kim, who is known as the world's highest IQ holder, wrote a short comment saying that XRP "might have some movement this weekend." There is no time frame defined, really just some vague language about the token.

Previously Kim was tweeting about Bitcoin, but now his attention seems to have shifted to XRP and some other tokens.

Traders were confused about what "short-term" meant. Was he talking about seconds, hours or days? Some were openly wondering if the post was actually serving any purpose. Others agreed they were looking for longs anyway despite the chart not confirming it. The engagement itself was more popular than the information content.

XRP may show short-term movement this weekend.

— YoungHoon Kim, IQ 276 (@yhbryankimiq) December 13, 2025

The statement did not add any useful info from a market perspective. XRP did not break through the resistance. The volume did not increase. Open interest did not spike. There wasn't any visible follow-through candle on the daily chart.

As Sunday comes to a close, XRP is still stuck between a soft floor near $1.98-$2 and overhead pressure starting at $2.28-$2.34. The market has seen this zone reject prices a bunch during November. If it drops below that range, the historical support at the $1.82 area is going to disappear pretty quickly.

Cardano to rocket 40% if this signal validates

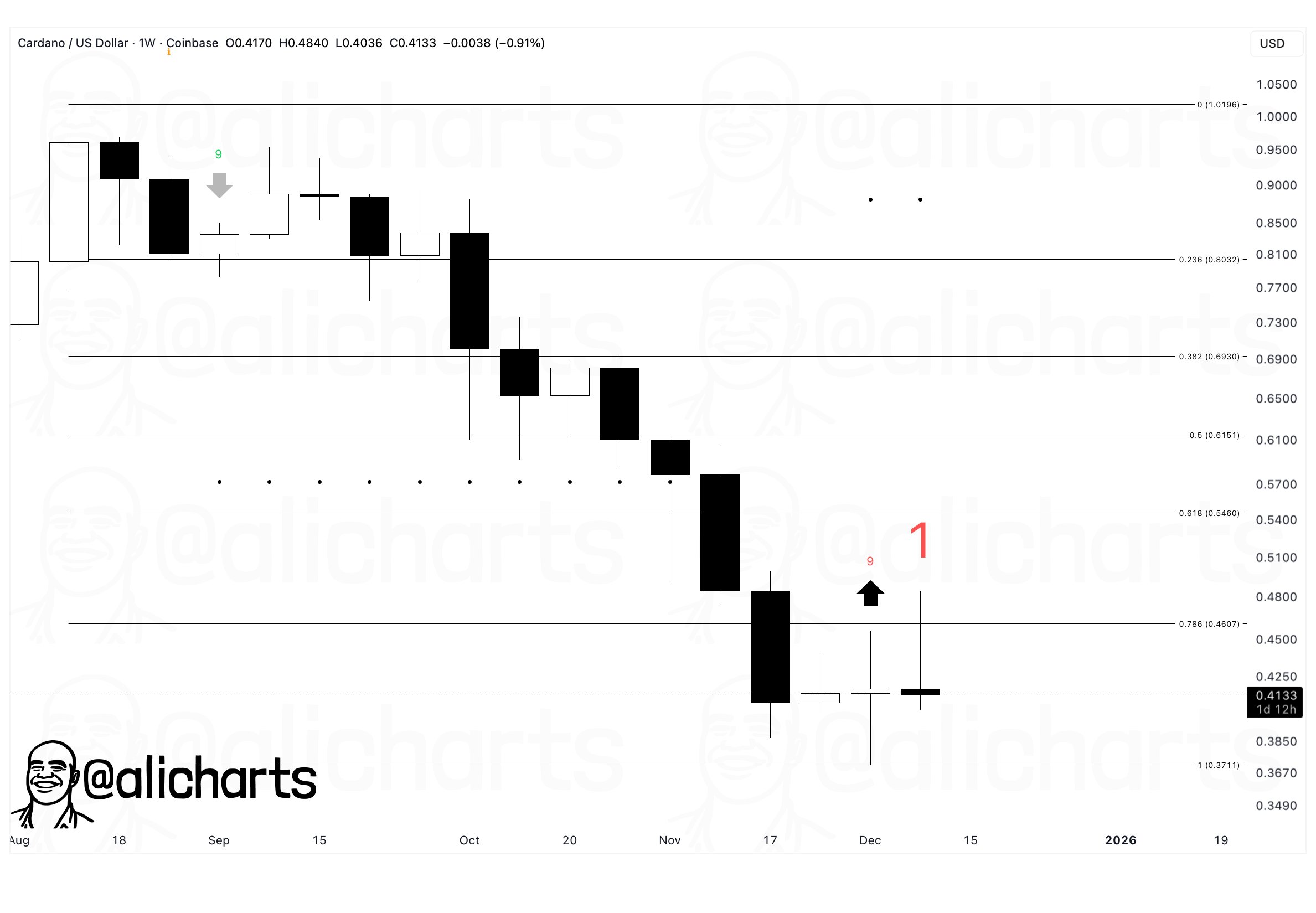

Cardano finishes the week in a very different position. On the weekly chart, a TD Sequential buy signal from Ali Martinez has shown up, and this usually happens when prices are near their lowest point, not when the trend is continuing. The signal itself does not do anything, but where it's placed is important.

For ADA, everything is now at $0.37. That level is just above the recent lows, and it is like the pivot point where stabilization meets continuation lower. If it holds above that, it will open a path toward the $0.46 region first, then $0.54, representing an upside of about 40% from current levels. If ADA loses it, the signal fails cleanly.

This technical signal comes at a time when the Cardano ecosystem is experiencing its most active week in months. This is due to the launch of NIGHT, the native token of the Midnight Network. NIGHT started trading live right away with support from some big names like Binance, Bybit, Kraken, OKX, KuCoin and Gate.

In just one day, NIGHT had racked up more than $1 billion in trading volume and pushed its market capitalization above $1 billion, making it one of the most actively traded assets on major exchanges.

That level of participation is important. It confirms real demand, not thin liquidity spikes. It also puts Cardano back on the map as an active deployment layer instead of a chain that is just wasting a top-10 spot.

ADA has not broken out yet, but it has stopped falling. If you look at the weekly candles, you will see that they are showing compression rather than acceleration lower. Buyers are not really aggressive, but sellers are not in the driver's seat anymore.

This is the kind of setup traders pay close attention to: a defined invalidation level, a clear upside target and a fundamental event that was not even on the radar a week earlier. If $0.37 holds, the chart does the rest of the talking.

Shiba Inu (SHIB) down $110 million in 24 hours: What's going on?

The Shiba Inu coin ends the week on a quiet note, without any major headlines or panic, but with some noticeable damage.

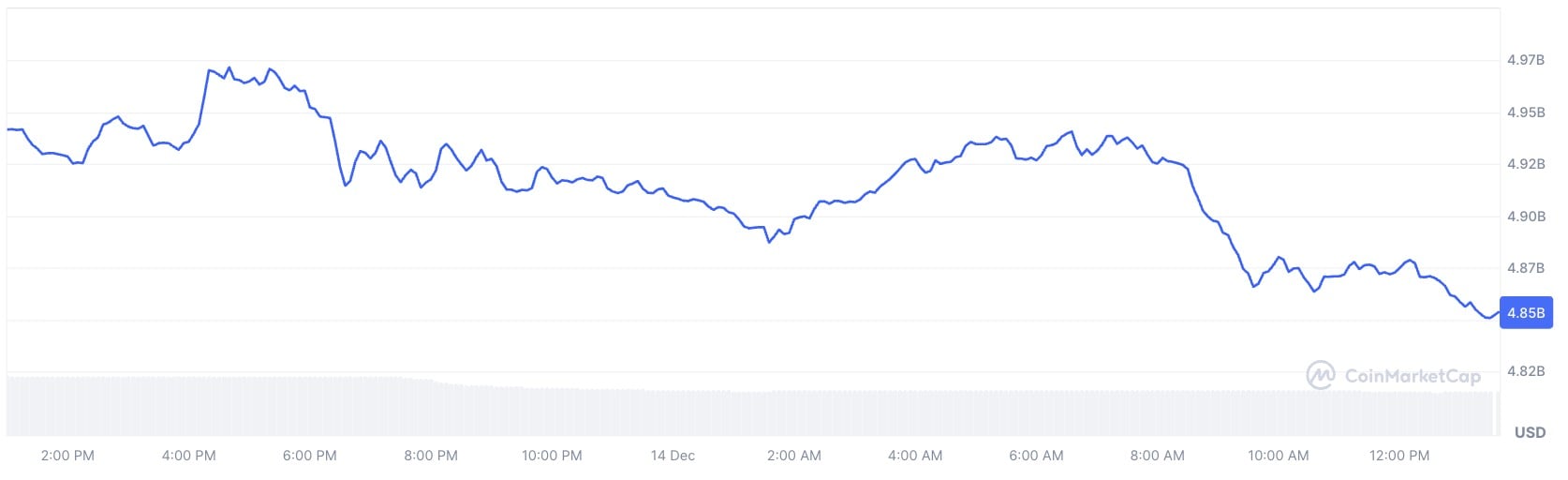

According to CoinMarketCap, SHIB's market capitalization dropped from $4.97 billion to $4.86 billion in just one day, wiping out around $110 million in value. The move was more of a controlled exit than a forced liquidation, which is why it did not unfold suddenly.

The volume confirms that bias. SHIB's trading volume for the day dropped to $77.86 million, which is a 27% decline. This pushed the volume-to-market-cap ratio to just 1.59%. That's not how accumulation works.

The market cap chart shows a slow decline during the day, then stabilizes at around $4.86 billion. This usually happens when buyers stop defending levels instead of when sellers rush to exit.

SHIB's problem is pretty straightforward. There is no active driver. While Cardano is getting some attention with its new token launch and XRP is in the spotlight, SHIB does not have any clear direction or impact. In that kind of environment, prices will drift lower until demand returns.

As Sunday comes to a close, SHIB is just weak. If things do not improve on the market, it could lose even more value.

Crypto market outlook

The week for crypto closes without fireworks, but not without information. Capital is choosing carefully, ignoring noise and rewarding only setups that combine structure with substance.

- Bitcoin (BTC): passive and range-bound — so, no leadership signal into the weekly close.

- XRP: locked near $2.02, but needs to reclaim above $2.28-$2.34 to change structure.

- Cardano (ADA): $0.37 is decisive, hold opens $0.46 then $0.54.

- Shiba Inu (SHIB): Capital leakage continues with volume confirming that buyers are absent.