I'm not born with a bank card, but I've got a bank card addiction.

Written by: Pavel Paramonov, Founder of Hazeflow, a cryptocurrency research firm

Compiled by: Eric, Foresight News

My overall argument is that cryptocurrency cards are merely a temporary solution addressing two issues we all know: making cryptocurrency accessible to the masses and ensuring its global acceptance as a payment method.

Cryptocurrency cards are still cards after all. If someone truly believes in the values of cryptocurrency and thinks the future will be dominated by cards, then they may need to rethink their vision.

All cryptocurrency card companies will eventually disappear.

Cryptocurrency cards are likely to disappear in the long run, but traditional cards will not. Cryptocurrency cards add an extra layer of abstraction: they are not purely cryptocurrency applications; the issuing institution is still a bank. Yes, they have different logos, different designs, and different user experiences, but as I said before, these are just differences in abstraction. Abstraction makes it more convenient for end users, but the underlying processes remain the same.

Unlike L1 and Rollup companies, which are obsessed with competing with Visa and Mastercard in terms of TPS and infrastructure, this has been the industry goal for years: to "replace" or, more radically, "overthrow" the dominance of payment giants like Visa, Mastercard, and American Express.

Cryptocurrency cards cannot achieve this goal—they are not replacements, but rather create more value for Visa and Mastercard.

- These traditional institutions remain key gatekeepers, possessing absolute power to set rules and define compliance standards;

- Most importantly, they retain the right to block your cards, company, or even bank at any time.

Why is this industry, which has always pursued permissionless and decentralized practices, now handing over all power to payment processors?

- Your card is Visa, not Ethereum;

- Your card is from a traditional bank, not a MetaMask wallet;

- You are spending fiat currency, not cryptocurrency.

Most of the cryptocurrency card companies you love are just slapping a logo on a card. They survive on hype and will disappear in a few years, while digital cards issued before 2030 will be unusable by then.

The following section will explain how easy it is to make your own cryptocurrency cards today, and that in the future you may even be able to issue your own.

Same problem + more fees

The best analogy that comes to mind is Application-Specific Ranking (ASS). Sure, it's cool that applications can autonomously process transactions and profit from them, but that's only temporary: infrastructure costs are decreasing, communication technologies are maturing, and the economic issues are actually deeper, not shallower.

(If you are interested, you can refer to @mvyletel_jr 's excellent speech on ASS).

The same applies to cryptocurrency credit cards: while they support depositing cryptocurrency and converting it to fiat currency for spending, centralization and permissioned access remain the crux of the problem.

It is indeed convenient in the short term: merchants do not need to adopt new payment methods, and cryptocurrency transactions are highly discreet.

But this is merely a transition to the ultimate goal of cryptocurrency believers:

What's needed is: direct payment using stablecoins, Solana, Ethereum, or Zcash.

What is unnecessary is: indirect payment via USDT → cryptocurrency card → bank → fiat currency.

Each additional layer of abstraction means extra costs: spreads, withdrawal fees, transfer fees, and sometimes even custody fees. These costs may seem insignificant, but don't forget the power of compound interest: every penny saved is a penny earned.

Using a cryptocurrency card does not mean you don't need a bank account or are "bankless".

Another perspective I've seen is that people perceive using cryptocurrency cards as meaning they are unbanked or bankless.

This is clearly inaccurate. There is always a banking institution behind cryptocurrency cards, and that bank is obligated to submit some of your information to the local government—not all of it, but at least key details.

If you are an EU citizen or resident, the government has access to information such as your bank account interest income, large suspicious transactions, certain investment returns, and account balances. If the issuing bank is located in the United States, the government has access to an even wider range of information.

Surprisingly, from a cryptocurrency perspective, this has both advantages and disadvantages.

- The advantages are transparency and verifiability, but these rules also apply when using ordinary debit or credit cards issued by local banks.

- The downside is that it is not anonymous or pseudonymous: banks can still see your name instead of your EVM or SVM address, and you still need to complete KYC verification.

Restrictions still exist

Some might think that cryptocurrency cards are incredibly easy to activate: download the app, complete KYC, wait 1-2 minutes for verification, and top up with cryptocurrency. While this convenience is certainly a killer feature, it's not something everyone can enjoy.

Citizens of Russia, Ukraine, Syria, Iraq, Iran, Myanmar, Lebanon, Afghanistan, and much of Africa—regions where citizens without residency in another country cannot use cryptocurrency for everyday spending.

But wait, these are only a dozen or so countries where cryptocurrency cards are unavailable. What about the other 150+ countries? The key isn't the majority's eligibility, but the core value of cryptocurrency: equal nodes in a decentralized network, equal access to finance, and equal rights for everyone. Cryptocurrency cards fail to embody these values because they are not, in essence, true cryptocurrency.

Max Karpis incisively analyzed why "neobanks" was destined to fail (his core argument is that crypto-friendly new banks have no advantage over Revolut; the moat built by large enterprises at scale cannot be easily shaken by "former employees of big companies." If giants want to, they can open such a bank at any time and have a user base of tens of millions).

For reference, my first real experience using cryptocurrency for payment was when booking a flight on Ctrip. They recently added a stablecoin payment option, allowing users to pay directly from their wallets; of course, this service is available to all users worldwide.

This section presents real-world cryptocurrency application scenarios and actual payment examples. I believe the final form will be this: wallets will optimize the user experience for consumption and payment scenarios, or (less likely) evolve directly into cryptocurrency cards (if crypto payments are widely adopted in some form).

Cryptocurrency cards function similarly to liquidity bridges.

Another interesting phenomenon I observed is that self-custodied cryptocurrency cards function similarly to cross-chain bridges.

This only applies to self-custodial cards. Cards issued by centralized exchanges do not have self-custodial features, so exchanges like Coinbase do not need to mislead users by claiming that user funds are under their own control.

One important use of centralized exchanges (especially their issued cryptocurrency cards) is to provide reliable credentials for government funding verification, visa applications, and other similar purposes. When you use a cryptocurrency card linked to a centralized exchange account, you are technically still within the same ecosystem.

Self-custodied cryptocurrency cards are different: they operate similarly to liquidity bridges, where users lock crypto assets on Chain A and unlock funds (fiat currency) on Chain B (the real world).

This cross-chain mechanism in the cryptocurrency card field is like a shovel during the California Gold Rush—it is a valuable and secure channel connecting native crypto users with companies that want to issue their own cards.

Stablewatch astutely points out that these bridges are essentially "Card as a Service (CaaS)" models—the most overlooked core of all cryptocurrency card discussions. These CaaS platforms provide brands with the infrastructure to issue their own branded cards.

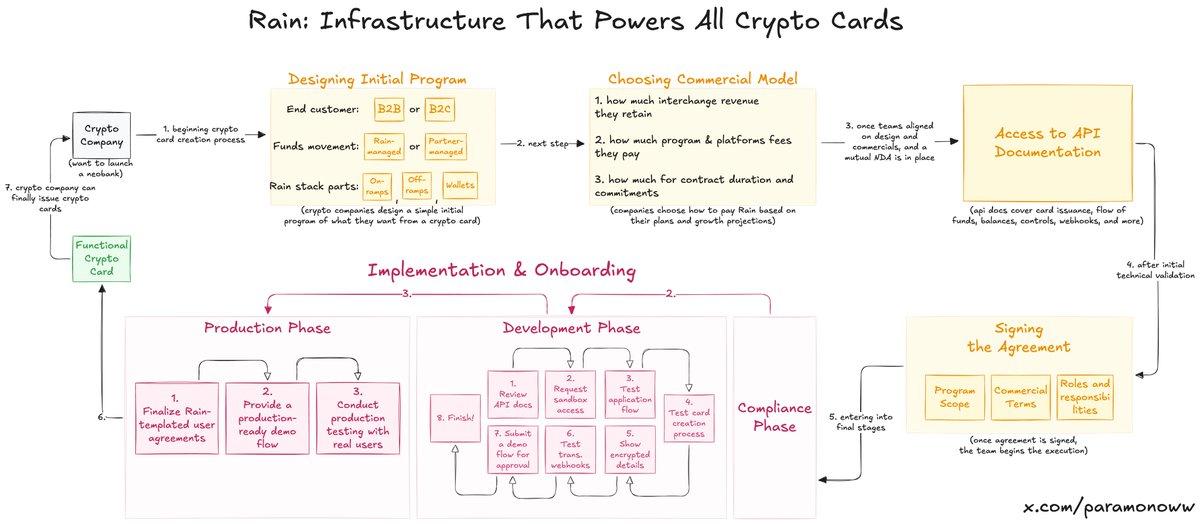

Rain: Where did cryptocurrency cards come from?

About half of your favorite cryptocurrency cards are powered by Rain, a technology you may have never even heard of. It's one of the most fundamental protocols in the new banking system, as it carries all the core functionality behind cryptocurrency cards. Other companies can simply slap their logo on it (that sounds harsh, but it's pretty close to the truth).

Rain makes it easy for businesses to launch cryptocurrency cards, and frankly, its infrastructure capabilities are even sufficient to sustain growth outside of the crypto space. So don't imagine the team needs to raise tens of millions of dollars to launch a cryptocurrency card—they don't need that money; they need Rain.

The reason I keep emphasizing Rain is that people have severely overestimated the investment required to launch cryptocurrency cards. Perhaps I will write a separate article about Rain in the future, because this technology is seriously underestimated.

Cryptocurrency cards lack privacy and anonymity.

The lack of privacy and anonymity in cryptocurrency cards is not an inherent flaw, but rather a problem deliberately ignored by those who advocate for cryptocurrency cards under the guise of so-called "crypto values."

- There is no universally applicable privacy feature in the cryptography field. Pseudo-privacy (pseudo-anonymity) does exist; we can't see the name, only the address.

- However, if you are someone like ZachXBT, Igor Igamberdiev of Wintermute, Storm of Paradigm, or anyone with strong on-chain analytics capabilities, you can significantly narrow down the range of address attribution.

Of course, the situation with cryptocurrency cards is far less close to pseudo-privacy than with traditional cryptocurrencies, because you have to complete KYC verification when you open an account (in reality, you are not opening an account, but opening a bank account).

- If you are in the EU, cryptocurrency card service providers will still submit some data to the government for tax or other government purposes.

- Now you've given regulators a new way to track things: linking cryptocurrency addresses to real identities.

Personal data will be the currency of the future.

Cash will still exist (it's the only anonymous payment method besides the seller being able to see you) and will remain in circulation for a long time. But eventually, everything will be digitized. The current digital system offers no benefit to consumer privacy: the more you spend, the more transaction fees you pay, but in return, the other party gains a deep understanding of your information—a truly profitable deal…

Privacy is a luxury, and this will be true in the realm of cryptocurrency cards as well. Interestingly, if we can achieve truly high-quality privacy protection that businesses and entities are willing to pay for (not the Facebook model, which requires user consent), privacy may become one, or even the only, currency in a jobless, AI-dominated world.

If failure is inevitable, why are Tempo, Arc Plasma, and Stable still being built?

The answer is simple: lock users into the ecosystem.

Most non-custodial cards opt for either an L2 solution (e.g., MetaMask chose Linea) or an L1 solution (e.g., Plasma's Plasma Card). Ethereum or Bitcoin are generally unsuitable for such operations due to their high costs and finality issues. While a minority of cards use Solana, I don't want to start a debate here, as they still represent a small percentage.

Enterprises choose different blockchains not only based on infrastructure considerations, but also on economic interests.

- MetaMask chose the Linea underlying architecture not because it was the fastest or most secure, but because Linea and MetaMask both belong to the ConsenSys ecosystem.

- I specifically cited MetaMask as an example precisely because of its adoption of Linea. As is well known, Linea is almost universally ignored and has no chance of winning against L2 solutions such as Base or Arbitrum.

But ConsenSys made a smart decision by embedding Linea into the core of its products—locking users into the ecosystem. They gradually develop habits through the high-quality UX of daily use. Linea attracts liquidity, trading volume, and metrics naturally, rather than relying on liquidity mining or forcing users to perform cross-chain operations.

This strategy is similar to what Apple did when it launched the iPhone in 2007: once users develop a habit within the iOS ecosystem, it becomes difficult for them to switch to other systems. Never underestimate the power of habit.

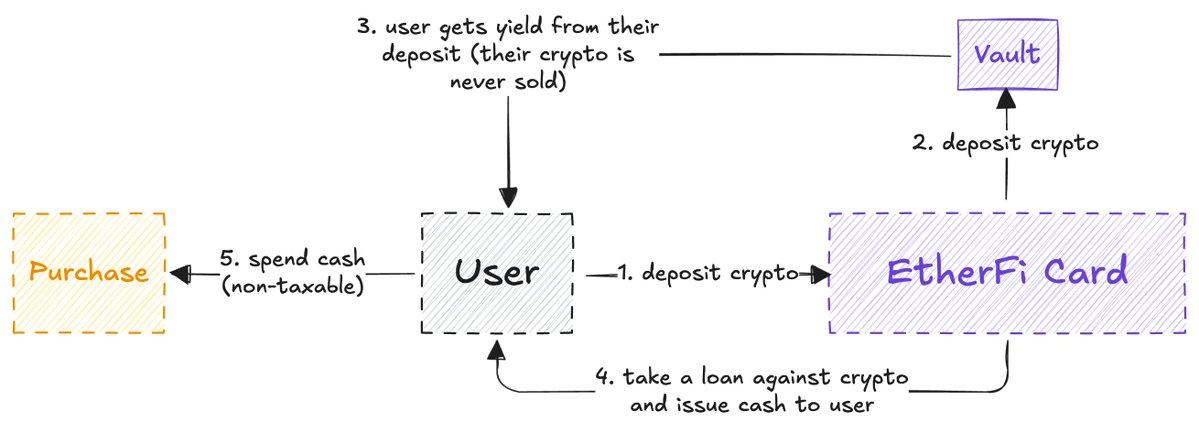

ether.fi may offer the only viable solution.

After careful consideration, I have come to the conclusion that EtherFi may be the only cryptocurrency card that truly embodies the spirit of crypto (this research was not sponsored by EtherFi, but it would have been fine even if it had).

Most cryptocurrency cards will sell the crypto assets deposited by users and then use cash to top up the account balance (similar to the liquidity bridge mechanism I described earlier).

ether.fi operates on a different model: the system never sells your cryptocurrency; they provide cash in the form of loans and use your cryptocurrency to generate returns.

ether.fi operates similarly to Aave. While most DeFi users are still dreaming of seamlessly collateralizing crypto assets to obtain cash loans, this service has already made it a reality. You might question, "Isn't this the same function? I can already deposit cryptocurrency and use a cryptocurrency card as a regular debit card, why bother?"

The problem is that selling cryptocurrency is a taxable activity, sometimes even more so than everyday purchases. And most cryptocurrency cards tax each transaction, so you end up paying more taxes to the government (again, using a cryptocurrency card doesn't mean you're out of the banking system).

ether.fi cleverly circumvents this problem—you don't actually sell crypto assets, but rather use them as collateral to obtain loans. This feature alone (along with USD-free transactions, cash back, and multiple benefits) makes ether.fi a prime example of the integration of DeFi and traditional finance.

While most cryptocurrency credit cards attempt to masquerade as liquidity bridges, ether.fi truly prioritizes crypto users over simply promoting cryptocurrency to the masses: they expose locals to cryptocurrency and guide them to spend it in front of the general public until the public realizes how cool this spending method is. Of all cryptocurrency cards, ether.fi may be the only survivor that has stood the test of time.

I like to view cryptocurrency cards as an experimental field, but unfortunately, most teams are just using narrative hype without giving the underlying systems and developers the recognition they deserve. Let's wait and see where progress and innovation will lead us. Currently, cryptocurrency cards show a significant trend of globalization (horizontal expansion), but lack the necessary vertical development, which is crucial for the early stages of consumer technologies like cryptocurrency cards.