Itaú Unibanco Holding SA, Latin America's largest private bank, has advised clients to allocate up to 3% of their portfolios to Bitcoin for 2026.

The bank stated that Bitcoin is not a speculative asset, but rather a hedge against the potential devaluation of the Brazilian real.

Why does Itau want customers to invest in Bitcoin?

In a strategic report , analysts at the Sao Paulo-based bank argued that investors are facing two challenges: unpredictable global prices and volatile domestic exchange rates. They suggested that this situation necessitates a new approach to portfolio construction.

The bank recommends allocating 1% to 3% of your portfolio to Bitcoin to capture returns that are not tied to domestic economic cycles.

“Bitcoin is a distinct asset from traditional bonds, stocks, or domestic markets, possessing its own dynamics and profit potential. Thanks to its global and decentralized nature, Bitcoin also Vai as a hedge against currency risks,” according to the bank.

Itaú emphasized that Bitcoin should not become the primary investment in a portfolio. Instead, it should be a supplementary allocation, tailored to the risk appetite of individual retail investors.

The goal is to generate profits that are not heavily dependent on domestic economic fluctuations, while also providing some protection against currency devaluation and preserving long-term growth potential.

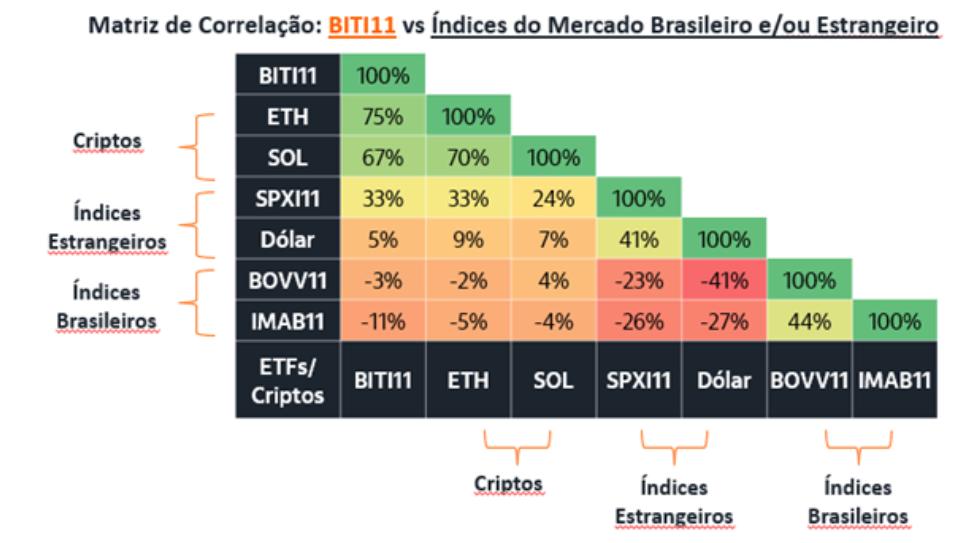

The bank also pointed out that Bitcoin has a low correlation with traditional asset classes . They argued that allocating 1%–3% helps diversify the portfolio without significantly increasing overall risk.

Bitcoin's performance compared to traditional assets. Source: Itau

Bitcoin's performance compared to traditional assets. Source: ItauThe report also emphasized that investing requires patience, discipline, and a long-term vision, rather than being influenced by short-term price fluctuations.

"Attempting to 'buy the Dip ' and surf the waves of Bitcoin or other international markets is very risky and often ineffective," the bank warned.

Itaú's maximum allocation ratio of 3% shows the bank is updating to the latest global guidance, narrowing the gap with major US banks.

Notably, many major US banks, such as Morgan Stanley and Bank of America , also recommend that clients allocate a maximum of 4% to this type of digital asset.

However, for Brazilian investors , the calculations are different.

Itaú argues that, in the context of increasingly shorter economic cycles and frequent global volatility, Bitcoin's "hybrid" nature makes it superior to traditional investment channels.

The bank argues that Bitcoin is both highly speculative and a global store of value . This combination offers a level of resilience that current bond investments can hardly provide.