The entire group of Made in USA coins has remained relatively stable over the past week, despite the general volatility in the crypto market. This is especially noticeable as Christmas approaches, a time when low liquidation often reveals which projects are quietly building momentum.

Several US-origin Token are currently at key technical points, where even small fluctuations could reverse short-term trends. This article will list three noteworthy Made in USA coins ahead of Christmas 2025, characterized by improving price structures, increased risk of sharp declines, and technical patterns that suggest potential breakouts in either direction.

Cardano (ADA)

Cardano is one of the Made in USA coins that retail investors can keep an eye on leading up to Christmas 2025. The price of Cardano has dropped approximately 3.5% in the last 24 hours, bringing its total monthly decline to over 27%.

The recent Midnight update also failed to restore market optimism, with selling pressure continuing as the entire crypto market weakened.

Looking at the daily chart, Cardano has broken out of a bearish continuation pattern, a pole-and-flag. The previous accumulation area has also been broken, confirming that the sellers are still in control.

This maintains the scenario of a further sharp decline for Cardano, with the price target still pointing towards a potential drop of nearly 39% from the previous breakdown.

ADA price analysis: TradingView

ADA price analysis: TradingViewWant more Token analysis like this? Sign up for Editor Harsh Notariya's daily Crypto newsletter here .

The current key price level is $0.370. In recent weeks, this has been a strong support zone; however, the price is showing signs of moving towards this level. If ADA closes below $0.370, the risk of a further decline increases, with the next target potentially being $0.259, coinciding with the complete bearish scenario.

For Cardano price to stabilize, selling pressure needs to gradually decrease around the $0.370 mark. To negate the downtrend and regain upward momentum, Cardano needs to break above $0.489, followed by $0.517. These are important Fibonacci resistance levels that previously halted the uptrend, and a breakout above them would indicate a return of buying interest.

Until then, Cardano remains quite vulnerable this Christmas, especially if the entire Made in USA group continues to weaken.

Stellar (XLM)

Stellar is also at a crucial point among Made in USA coins ahead of Christmas, as price action will show whether long-term users will continue to create value for XLM in the short term.

XLM recorded a decline of approximately 2.5% in the last 24 hours, pushing the total decline for the month to nearly 18%. A closer look at user data further highlights this cautious approach.

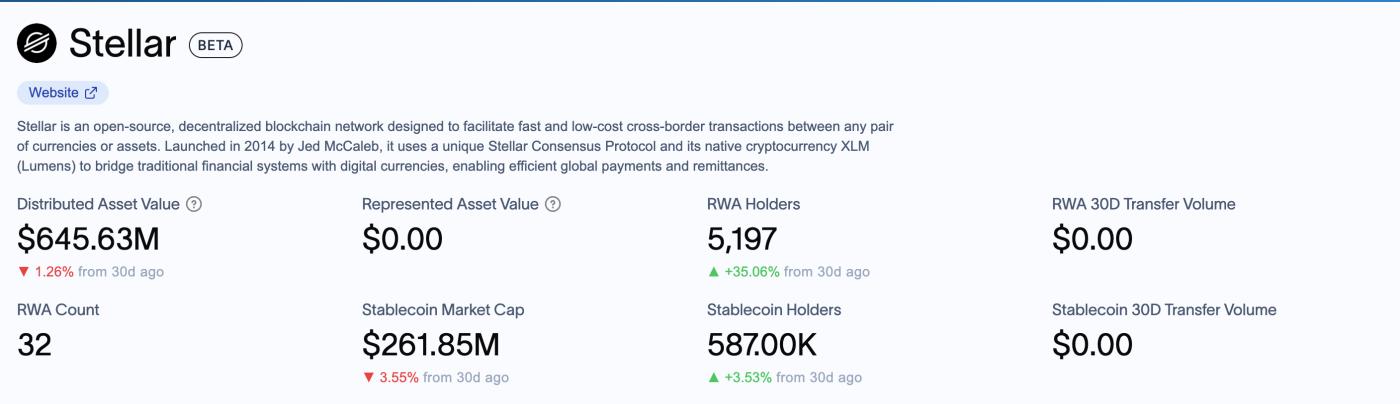

The number of RWA holders on Stellar has increased sharply over the past month, but the total value of assets stored on the network has decreased.

RWA performance on Stellar: RWA.XYZ

RWA performance on Stellar: RWA.XYZThe price movement also reflects this. From December 3rd, 2024 to December 9th, 2024, Stellar formed a hidden bearish divergence. The price created a lower high while the RSI indicator created a new higher high. The RSI (Relative Strength Index) shows the strength of the price momentum. Since the appearance of this divergence, XLM has continuously declined , confirming that the downtrend remains quite strong.

Currently, $0.231 is the nearest support level. This area has held the price quite well during previous declines. If the price holds above this level, selling pressure is likely slowing down, especially since trading during the Christmas season is usually less volatile. If XLM closes below $0.231, the new target will be $0.216, expanding the downside potential if the overall market continues to weaken.

Stellar price analysis: TradingView

Stellar price analysis: TradingViewFor the bearish structure to be broken, XLM needs to reclaim the $0.262 price level. This is the threshold where all upward attempts have been blocked since mid-November 2024.

If XLM surpasses $0.262, requiring a price increase of approximately 10%, it could be XEM as a signal that buyers are ready to defend higher prices. There is still hope for XLM as some analysts on X have identified buy signals for this coin.

However, until a breakthrough occurs, Stellar remains a Made in USA coin with a cautious trend, making testing this support zone extremely important during the Christmas season.

Litecoin (LTC)

Litecoin is one of the few Made in USA coins that has shown relative stability as Christmas approaches.

LTC has risen by approximately 1.5% over the past week, becoming a standout case among US cryptocurrencies. However, compared to the previous month, it is still down about 19%. This contrasting performance is quite consistent with recent fundamental factors. Reports indicate that large institutions and funds have been quietly accumulating around 3.7 million LTC , although interest from retail investors remains relatively low.

This accumulation hasn't created an immediate surge, but it explains why Litecoin hasn't experienced the same sharp decline as other similar coins. For projects originating in the US, stable demand from institutions like Litecoin is far more important than short-term price spikes, especially as the year draws to a close.

On the price chart, Litecoin is forming an inverse Vai-and- Vai pattern – often XEM a bullish signal. This pattern indicates that selling pressure is gradually weakening and buyers are slowly regaining their position. On December 9, 2024, this pattern attempted to break out but failed, causing the price of LTC to continue trading sideways instead of reversing sharply upwards.

LTC Price Analysis: TradingView

LTC Price Analysis: TradingViewThis pattern remains valid as long as Litecoin stays above $79.63. If the price falls below this level, the bullish structure will weaken and the recovery will be delayed. If it drops significantly below $74.72, the pattern will be completely broken and the possibility of further price declines will return.

To confirm the bullish signal, Litecoin needs a clear daily candle close above the neckline around $87.08. If this happens, the pattern will reactivate with a first target of $97.95 and potentially a maximum target of $101.69.

Until that happens, Litecoin – a US-based project (Token) – remains at a crossroads, caught between persistent accumulation from large institutions and cautious price sentiment ahead of Christmas 2025.