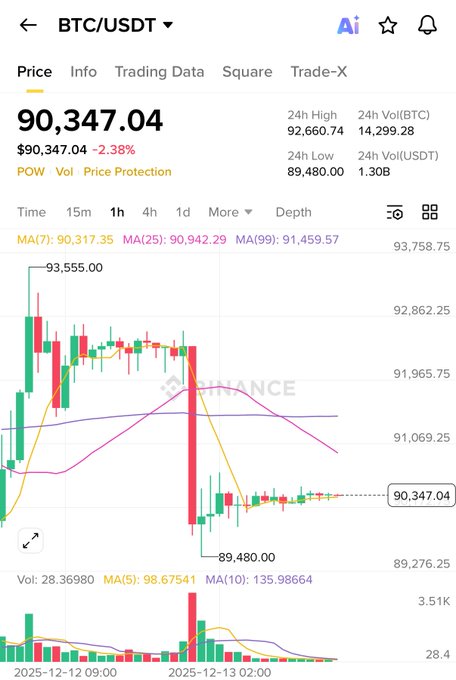

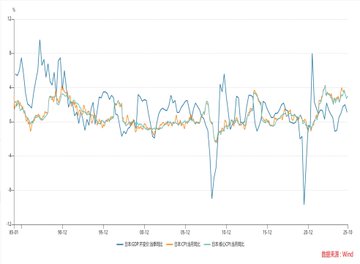

$BTC Can it hold $90,000? Currently, the BTC price is fluctuating between $90,000 and $91,000, with increased trading volume, indicating intensified competition between bulls and bears. Whether it can hold $90,000 in the short term depends mainly on two risk factors: 1. Will AI stocks continue to fall? Last night, the three major US stock indices fell, with the AI sector suffering the most: Firstly, Broadcom's earnings report was actually decent, but its gross margin was not good, failing to meet market expectations, resulting in a drop of over 11%. Secondly, Oracle announced that its 2026 capital expenditure budget has been increased from $35 billion to $50 billion. The market is worried that such heavy spending will not recoup its costs, leading to a 14% drop on Thursday and Friday. This reflects: Market concerns about a tech bubble and extreme sensitivity to investor sentiment. Therefore, once a negative signal is detected, investors rush to flee, immediately dumping their risky assets. Consequently, BTC, also a risk asset, was dragged down, falling below $90,000 overnight, resulting in numerous long positions being liquidated. Looking ahead, there are two possible scenarios: 1. AI stocks continue to correct → risk aversion intensifies → BTC is highly likely to fall below $90,000 again, and may even test the $84,000-$88,000 support level. 2. Anxiety eases → funds flow back → AI stocks rebound → BTC may also have a chance to rebound again, but the strength may be limited. Secondly, how much will the Bank of Japan raise interest rates? This brings us to the topic of **yen carry trades**. Previously, due to Japan's consistently low interest rates, borrowing yen was almost cost-free. ➡️Investors borrow yen → convert it to dollars → buy high-yield assets such as BTC and US stocks. ➡️This increases the number of participants in the market, making it more active. However, once the BOJ raises interest rates, yen carry trades will fundamentally become untenable. ➡️Rising borrowing costs in the Japanese yen and a stronger yen → Investors choose to sell BTC and US stocks → and buy back yen. ➡️This creates selling pressure and could even trigger a chain reaction of liquidations. As an aside, the Bank of Japan (BOJ) unexpectedly raised interest rates last August, causing the yen to surge by 10%, which in turn caused BTC to plummet by 18%, wiping out 60 billion yen in value. How do we view the Bank of Japan's interest rate hike now? The BOJ currently plans to raise interest rates by 25 basis points on December 18th and 19th, from 0.5% to 0.75%, and this expectation has already been priced in by the market. However, if the BOJ meeting hints at further rate hikes next year, it could trigger another round of sharp declines. There are already reports that the ultimate target for Japan's interest rate hikes may be 1.25%! Therefore, next week, pay close attention to two things: One is whether AI stocks will fall further, and the other is whether the BOJ meeting contains any unexpected developments. Remember, this is when market sentiment is most vulnerable, and it is often when opportunities are brewing. Be careful; keeping yourself at the poker table is more important than anything else.

This article is machine translated

Show original

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content