Providing data-driven, reliable investment insights in volatile markets.

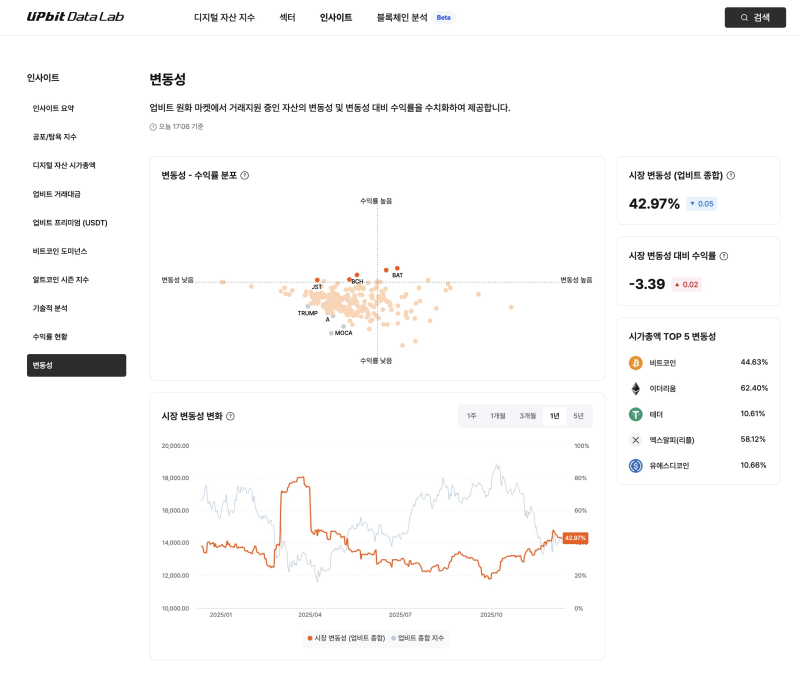

Dunamu announced on the 12th that it is providing various volatility analysis tools through Upbit Data Lab to check risk levels in a market environment where volatility has recently increased.First, the volatility indicator numerically displays the range of the Upbit Composite Index's returns over the past 30 days. By converting the standard deviation of daily returns to an annualized basis, it quantitatively displays the volatility of the overall cryptocurrency market.

Additionally, the volatility-return distribution chart visualizes the risk-to-performance ratio of individual assets, and assets with higher-than-average volatility-to-return ratios are highlighted with orange dots, allowing you to compare their relative positions against the market average at a glance.

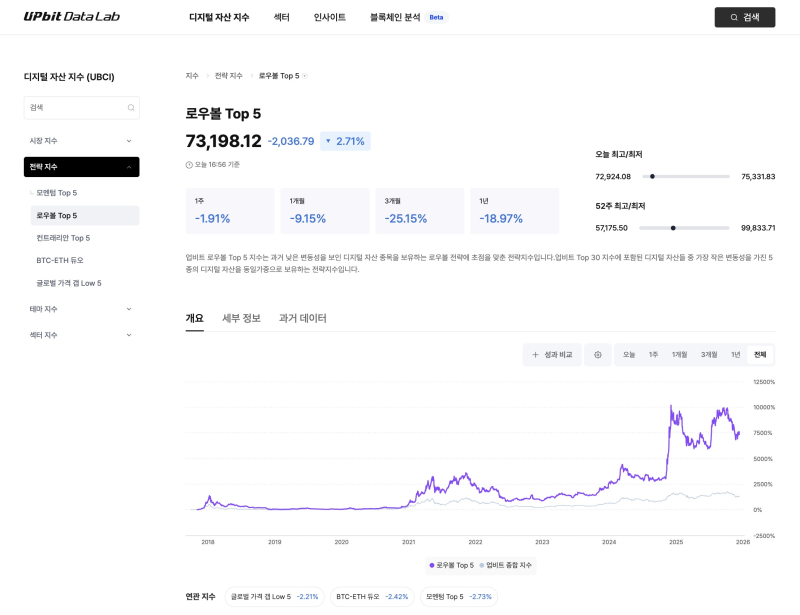

Additionally, Upbit also offers the "Upbit Low Volatility Top 5 Index," which selects assets with low volatility. The Low Volatility Index is a strategic index composed of the five cryptocurrencies with the lowest monthly volatility among the top 30 cryptocurrencies by market capitalization available for trading on Upbit's KRW market. The list of included cryptocurrencies is released at 9:00 AM on the 2nd of every month. This allows investors to quickly identify relatively low-volatility stocks at a given point in time and use it as a reference when constructing a portfolio that prioritizes stability.

Analysis of the low-volatility index revealed that a low-volatility strategy based on low-volatility cryptocurrencies outperformed the market average. From November 2017 to November of this year, the low-volatility index achieved an average annual return of 70.7%, more than double the market return of the Upbit Composite Index (33.8%). This demonstrates that, contrary to the prevailing belief that "higher risk leads to greater returns," a diversified investment strategy centered on low-volatility assets offers a better long-term risk-to-return ratio.

A Dunamu representative stated, "As the cryptocurrency market volatility has recently increased, the demand for data to quantitatively compare risk levels and asset characteristics is increasing." The representative added, "We will continue to focus on strengthening our data-based analysis environment to improve users' accessibility to information and understanding of the market."

Reporter Jeong Ha-yeon yomwork8824@blockstreet.co.kr