Get the best data-driven crypto insights and analysis every week:

Tokenized Equities and the Rise of xStocks on Solana

Key Takeaways:

Tokenized equities remain nascent (<$1B) but represent a massive opportunity relative to the ~$145T global equities market.

High-throughput, low-cost blockchain infrastructure, clearer securities guidance and growing participation from fintechs, exchanges and DeFi protocols are enabling compliant issuance and utility.

Multiple models are emerging across the equities tokenization spectrum, from native issuance and custodial structures, to synthetic or derivative-based exposure.

xStocks on Solana remain early but show meaningful traction, with AUM rising roughly 9x since launch to ~$186M and on-chain activity expanding across active wallets and transactions.

Introduction

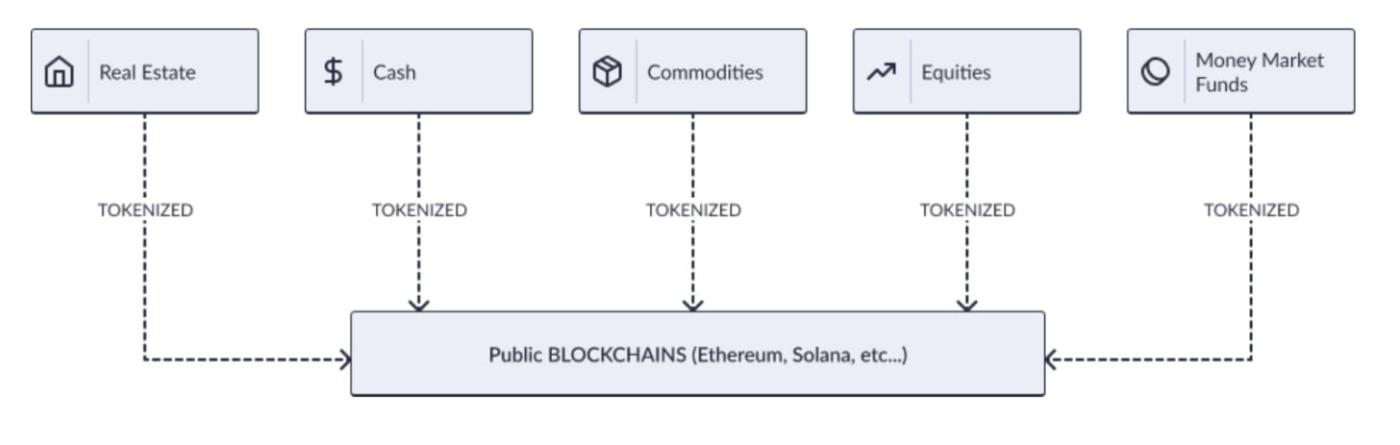

Tokenization, the representation of real-world assets and securities on public blockchains, has emerged as one of the most important structural trends as traditional finance and crypto converge. While still early in its adoption curve, the idea of “tokenizing all assets” gained significant momentum in 2025. What began with bringing dollars on chain has expanded into the migration of a wide range of financial instruments onto blockchain rails, from currencies and commodities like gold to private credit and money market funds.

Source: Coin Metrics Real World Asset (RWA) Report

The tokenization of equities is the next frontier in this multi-year shift. Programmability, democratized round-the-clock access, composability, and instant settlement remain compelling value propositions pulling these assets on chain. Growing regulatory clarity, coupled with maturing blockchain infrastructure, is now creating pathways for compliant and scalable equity issuance and movement on chain.

Recent developments like Kraken’s acquisition of Backed (the issuer of xStocks), Robinhood’s introduction of stock tokens in Europe, Galaxy’s tokenization of its Class A common stock and ongoing regulatory discussions all underscore the momentum behind bringing capital markets on chain.

In this issue of State of the Network, we explore how equity tokenization is taking shape on chain, outlining the current landscape, key participants, and the approaches emerging in the market. We then focus on how the custodial model behind Backed xStocks works and what on-chain data reveals about its early adoption on Solana.

Tokenized Equities: Market Landscape, Growth Drivers and Models Gaining Adoption

Tokenized equities remain a small but growing segment within the broader real-world asset (RWA) ecosystem. Current estimates place the market at roughly $500M–$750M, far smaller than stablecoins, money-market funds, and tokenized treasuries. Relative to the ~$145T global equities market, today’s tokenized equity exposure is microscopic. Even 0.1%–1% penetration would translate into hundreds of billions to more than a trillion dollars of potential on-chain equity value.

Several growth drivers are propelling this vertical forward:

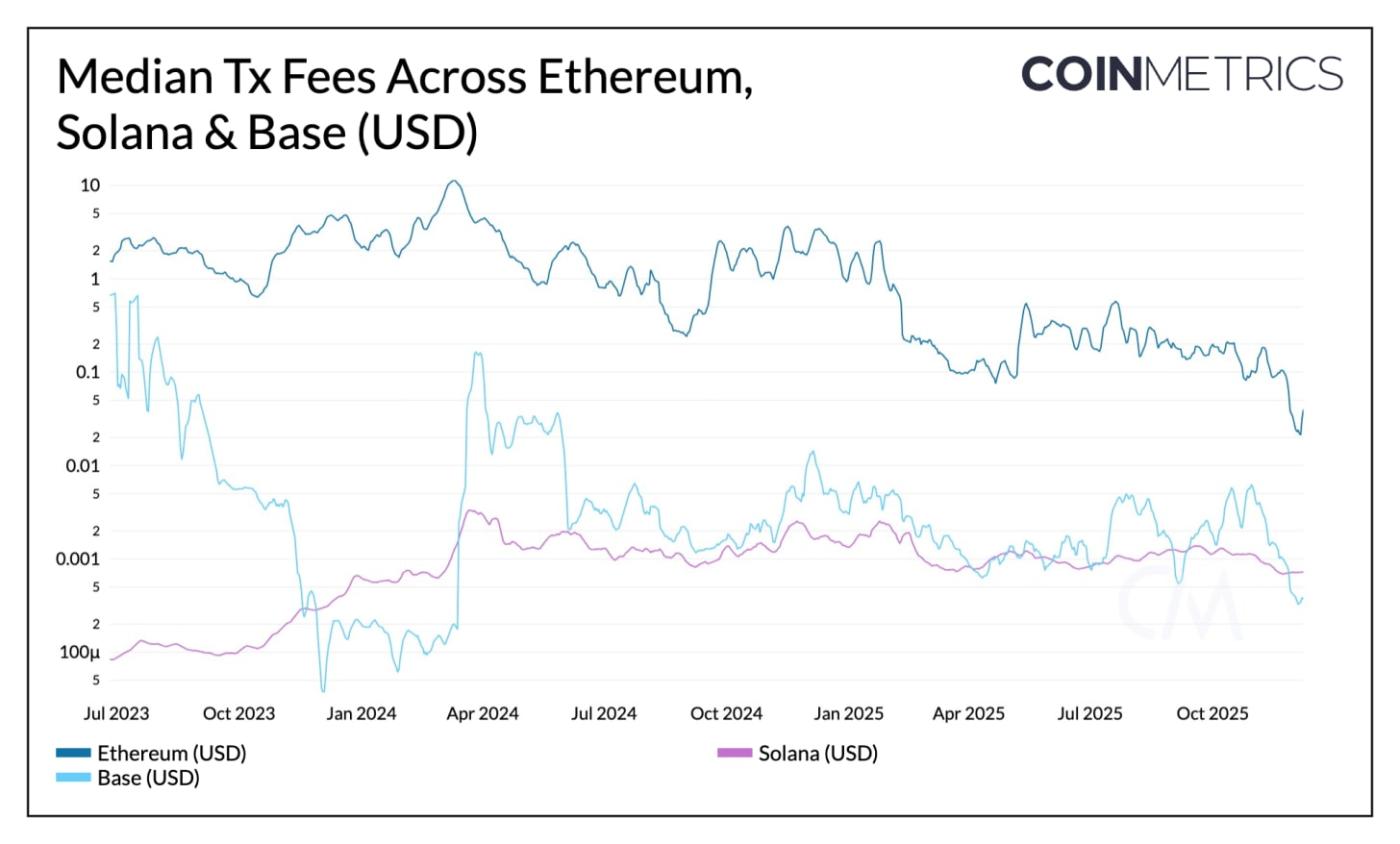

Technology and infrastructure maturity: High-throughput, low-fee chains like Solana, Layer-2 rollups (L2s) and scaling advancements on Ethereum now support near-instant, low-cost transfers.

Regulatory clarity: Clearer guidance around tokenized securities, disclosures, and custody frameworks is a catalyst that could reduce friction for compliant issuance and trading of tokenized stocks.

Integration & distribution: Integrations and distribution through exchanges like Kraken and Bybit, composability with DeFi protocols and oracle infrastructure creating the necessary building blocks for issuance, transferability and utility on chain (use as collateral, earn yield or provide liquidity).

Source: Coin Metrics Network Data Pro

Together, these developments are forming an emerging stack: the issuers and financial institutions that create and collateralize the products (such as BlackRock and Backed), the infrastructure that enables distribution and utility (exchanges, DeFi protocols, and oracle networks), and the settlement rails that provide the execution environment (Ethereum, Solana, and Layer 2s).

Adoption is also taking place across a spectrum of models, from fully collateralized issuance to synthetic or derivative-based exposure. The table below breaks these models down:

Backed xStocks: Tokenizing Equities on Solana

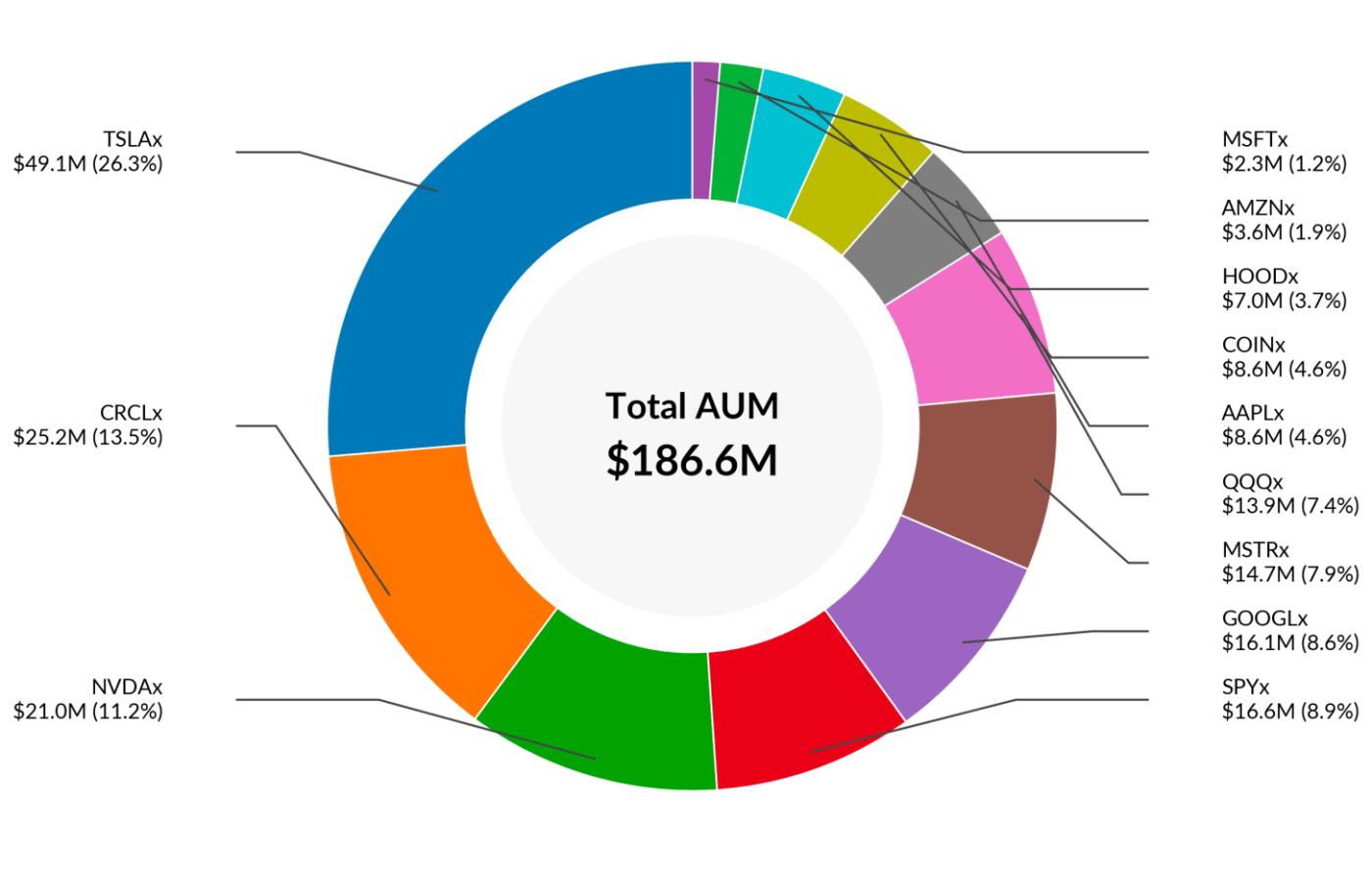

In June, Backed Finance introduced xStocks on Solana, bringing more than 60 U.S. equities and ETFs, including AAPL, NVDA, TSLA, and SPY, on chain as freely transferable SPL tokens. Exchanges like Kraken, Bybit and Gate.io have also listed these assets, enabling spot and futures trading for a global, non U.S. user base. Since launch, assets under management (AUM) have grown by more than 9x to roughly $186M.

Source: Coin Metrics Network Data Pro & Google Finance

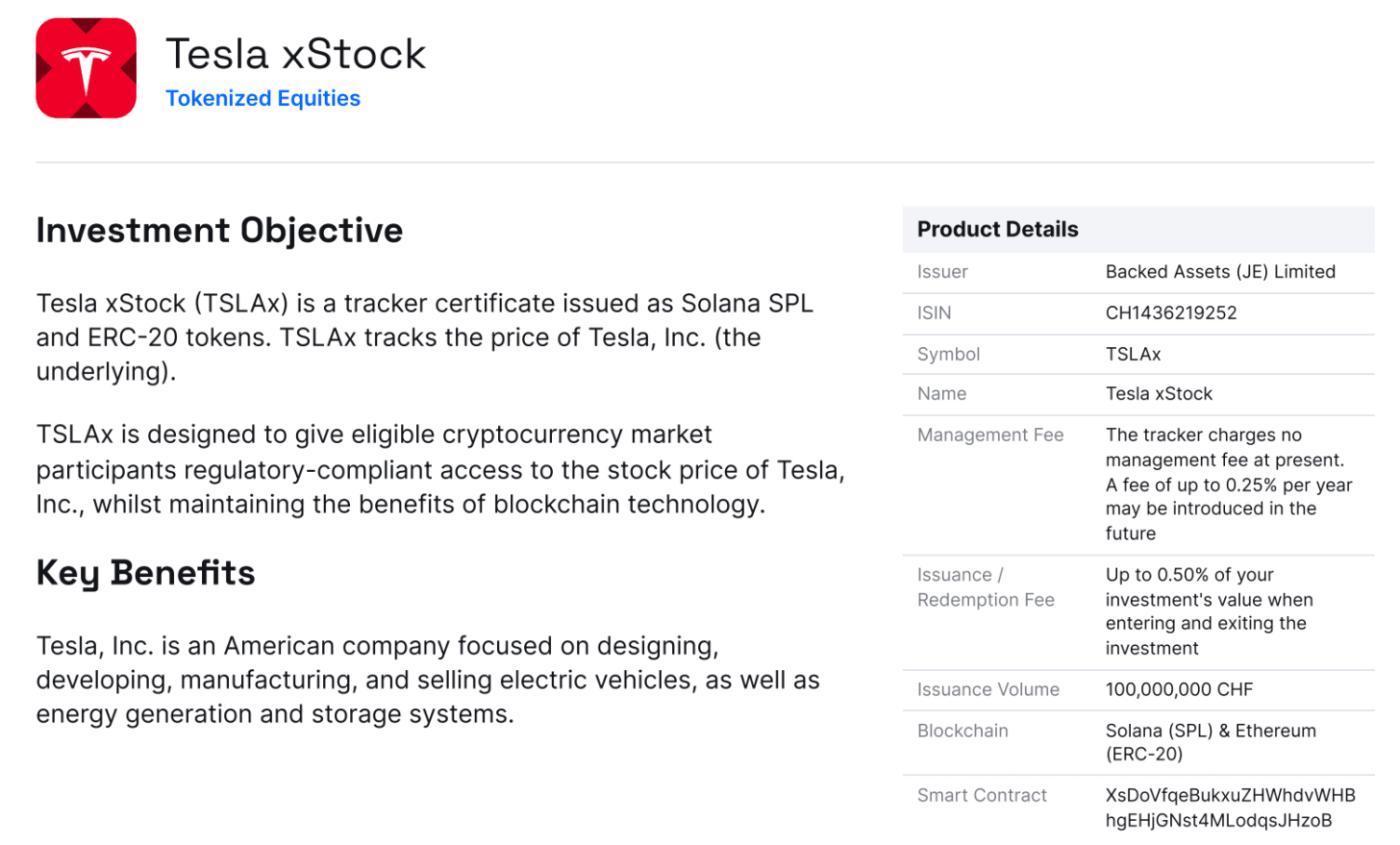

xStocks operate through a fully collateralized custodial model. They are issued by Backed Assets (JE) Limited, a Jersey based special purpose vehicle (SPV) owned by Backed Finance AG in Switzerland. Each token tracks a publicly listed equity or ETF on a 1:1 basis. The underlying shares are purchased through regulated brokers and held in segregated accounts with qualified custodians in Switzerland and the United States, ensuring each token supply is backed by an equivalent amount of collateral.

For example, this TSLAx factsheet provides information behind how shares of Tesla (TSLA) are tokenized. Tesla currently commands the highest AUM ($49M), backed by current supply of 107K tokens. Corporate actions such as dividends and stock splits are reflected through rebasing supply adjustments, allowing the tokens to continue tracking the underlying asset.

Source: Backed TSLAx Factsheet

Once issued, xStocks function like any other transferable on chain asset. They can move between wallets, settle almost immediately, and integrate directly with Solana’s DeFi ecosystem. This enables 24/7 access, fractional ownership, and composability across lending markets, automated market makers, and trading venues such as Kamino Finance, Raydium, and Jupiter.

While still early, xStocks mainly serve international users who face frictions accessing U.S. equities, while benefiting from on-chain transferability and settlement.

Adoption of xStocks on Solana

Having outlined the tokenized equities landscape and the mechanics behind xStocks, we now turn to how adoption is taking shape across exchanges and on the Solana blockchain.

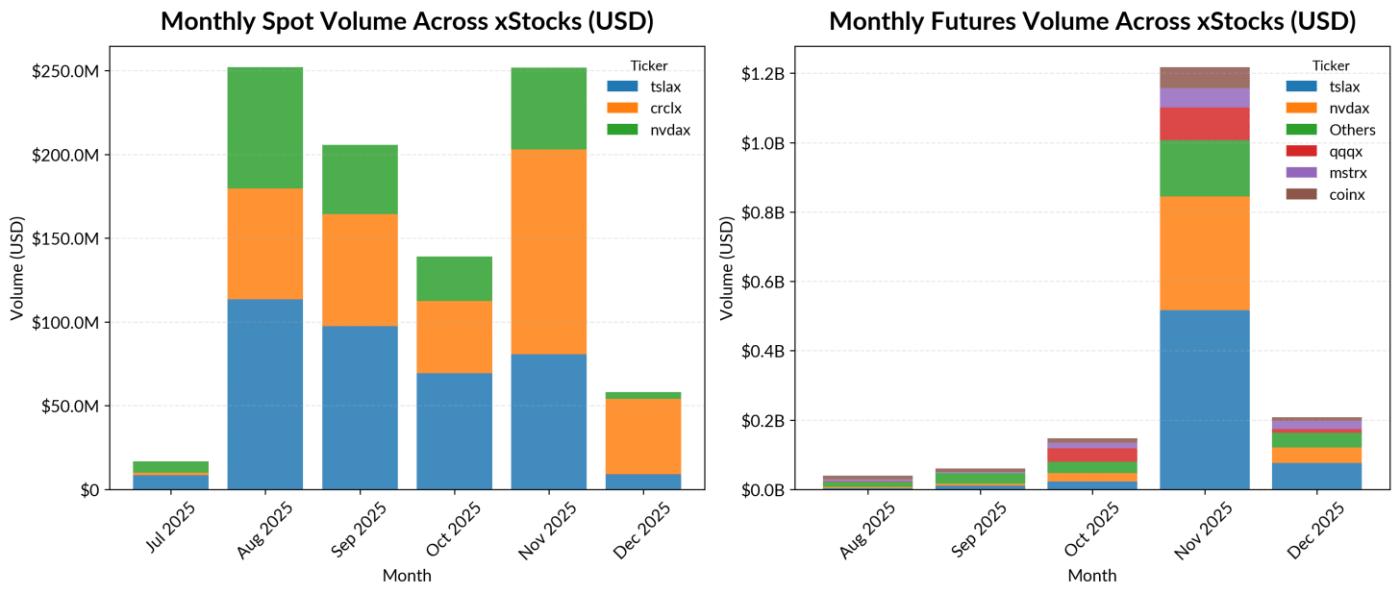

Exchange activity shows early liquidity formation. Spot and futures volumes remain modest and are concentrated in a small set of popular tickers such as TSLAx, NVDAX, and CRCLX, indicating that participation is still dominated by retail and speculative activity. November recorded more than $1.2B in futures volume as investors positioned around Q3 earnings for Nvidia and Tesla, coinciding with a spike in the VIX volatility index.

Source: Coin Metrics Market Data Feed

On chain, monthly active wallets interacting with xStock SPL rose meaningfully after launch, reaching roughly 175K wallets in July and stabilizing into an 80K–100K range through the fall. TSLA, NVDA, CRCL, and SPY account for about 58% of active wallets, indicating adoption is concentrated around a small set of high-interest tickers. This reflects a shift from initial discovery toward recurring on-chain use as wallets hold, transfer, or deploy these assets within DeFi.

Source: Coin Metrics Network Data Pro

Monthly transactions follow a similar pattern. After an early onboarding spike in July, activity normalized into a 400K–700K range and increased again in November. When scaled by active wallets, this corresponds to roughly 6–10 transactions per wallet per month, suggesting that xStocks are circulating with increasing regularity rather than being passively held.

Source: Coin Metrics Network Data Pro

Transfer-volume data provides additional context: the three largest xStock tickers, representing ~46% of active wallets, regularly record $10–20M in daily transfer volume, with cumulative volume exceeding $650M since September.

Conclusion

xStocks illustrate how tokenized equities can move from concept to reality when compliant issuance, technology readiness, and infrastructure integration align. Adoption today is still nascent and concentrated in a handful of names, but the combination of fully collateralized products, 24/7 on-chain settlement, and growing CEX and DeFi support shows how an on-chain equity market could develop over time.

At the same time, meaningful hurdles remain. Regulatory treatment is still the largest gating factor, with tokenized stocks sitting squarely within securities frameworks that differ across jurisdictions. Market-structure readiness is another constraint. Thin liquidity, off-hours volatility, and limitations of tracker-based products all pose challenges to scaling. And like any on-chain asset, operational risks, from custody to smart-contract reliability, will shape participation.

xStocks offer an early view of what tokenized public-market assets might look like in practice. Early but growing traction, demand for global access, and a path forward that depends on regulatory clarity, deeper liquidity, and more mature 24/7 trading infrastructure.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.