Get the best data-driven crypto insights and analysis every week:

Reaching New Scale: Ethereum Fusaka Upgrade

Key Takeaways:

Fusaka expands Ethereum’s scalability with higher blob capacity and a more efficient data-availability system through PeerDAS.

L1 throughput increases meaningfully with the higher 60M gas limit and execution-layer optimizations.

Improved fee mechanics and UX upgrades lay the groundwork for a more unified and cost-efficient L1–L2 ecosystem.

Fusaka Overview

Ethereum is set to undergo its next upgrade on December 3rd, 2025 at 21:49pm UTC (slot 13,164,544), dubbed the “Fusaka” hard fork. Fusaka combines the execution-layer upgrade Osaka and the consensus-layer upgrade Fulu, following the naming conventions of past forks.

Following Pectra in May, Fusaka marks a significant step in Ethereum’s scaling roadmap, enhancing Layer-1 performance, expanding blob capacity, improving rollup cost-efficiency, and delivering UX upgrades. It also introduces Blob Parameter Only (BPO) forks, a mechanism for safely increasing blob capacity as rollup demand grows. Earlier this year, the Ethereum Foundation outlined its “Protocol” strategy, centered around three long-term goals: scaling the L1, scaling blobs, and improving UX. Fusaka is the first upgrade fully aligned with this unified vision, marking an inflection point in how Ethereum plans to scale and improve accessibility going forward.

In this issue of State of the Network, we outline the key changes in Fusaka and the expected impact on Ethereum mainnet, Layer-2 rollups, transaction costs, and user experience ahead of tomorrow’s activation.

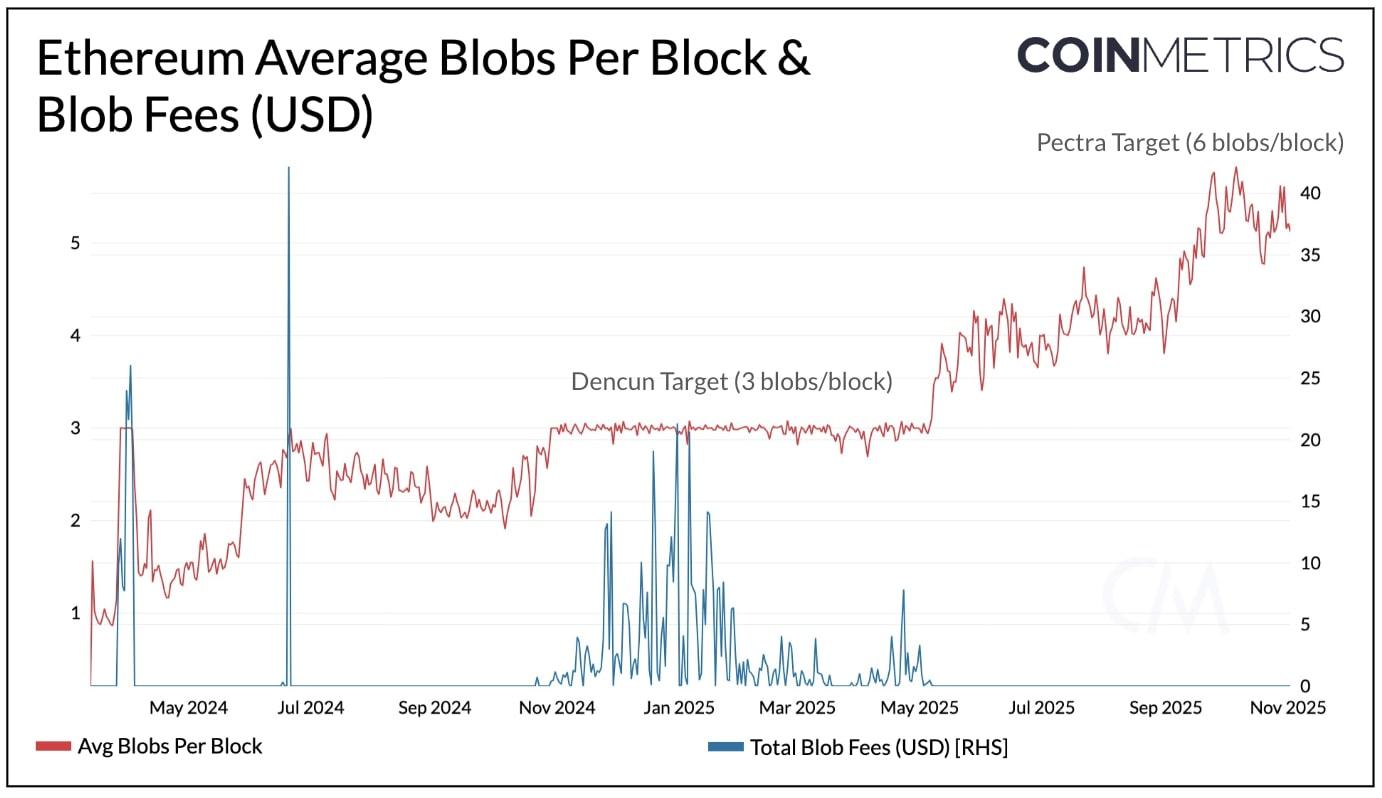

Scale Blobs

The Dencun upgrade last year introduced “blobs”, a cost-effective way for rollups to store transaction data on the Ethereum mainnet. Since then, blobs have seen substantial adoption thanks to rollups like Base, Arbitrum and Lighter. This has often driven blob usage close to saturation (currently near the 6-blob per block target), risking an exponential spike in fees for rollups. Higher data-availability (DA) demand makes blobspace the key bottleneck in Ethereum’s scaling path, with Fusaka directly addressing these constraints.

Source: Coin Metrics Network Data Pro

PeerDAS: Peer Data Availability Sampling

PeerDAS (EIP-7594) or Peer Data Availability Sampling is arguably the most significant upgrade in Fusaka directly aligning with the objectives of scaling L1 and blobs. PeerDAS introduces a more efficient way for Ethereum nodes to check that blob data is available. Instead of downloading the full content of blobs, nodes verify data availability by sampling small pieces of the data, providing the same security guarantees without burdening L1 consensus nodes.

Expected Impact:

Nodes only store ~1/8 of each blob, enabling far greater blob throughput without increasing hardware requirements.

Enables Ethereum to safely increase blob throughput, the core driver of rollup capacity.

Lower data-availability costs lead to cheaper L2 transactions and more reliable batch posting.

Lays the foundation for full danksharding and higher overall transaction throughput across the ecosystem. For instance, Base suggested in a blog post that post-Fusaka L2 scalability improvements would allow it to ‘double its chain throughput in 2 months.’

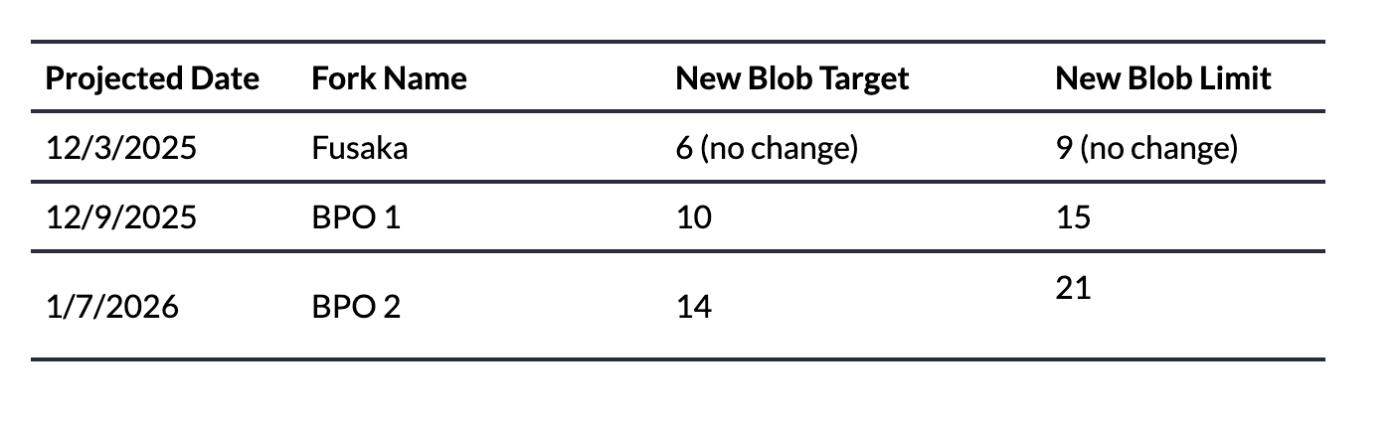

Blob Parameter Only (BPO) Forks

With PeerDAS reducing the bandwidth and storage required for nodes to validate blob data, Ethereum can now safely raise blob capacity. Fusaka introduces Blob Parameter Only (BPO) forks, for the purpose of raising the number of blobs per block over time. This allows Ethereum to adjust blob parameters without waiting for a full hard fork, giving the protocol a more flexible and responsive scaling tool.

Upcoming BPO Forks:

Expected Impact:

More DA bandwidth: increases rollup capacity from 6 blobs towards 128 blobs per block and lowers L2 transaction fees.

Flexible scaling: blob parameters can adjust dynamically as demand grows.

Incremental path forward: aligns with Ethereum’s roadmap for cheaper rollup execution and scalable data availability.

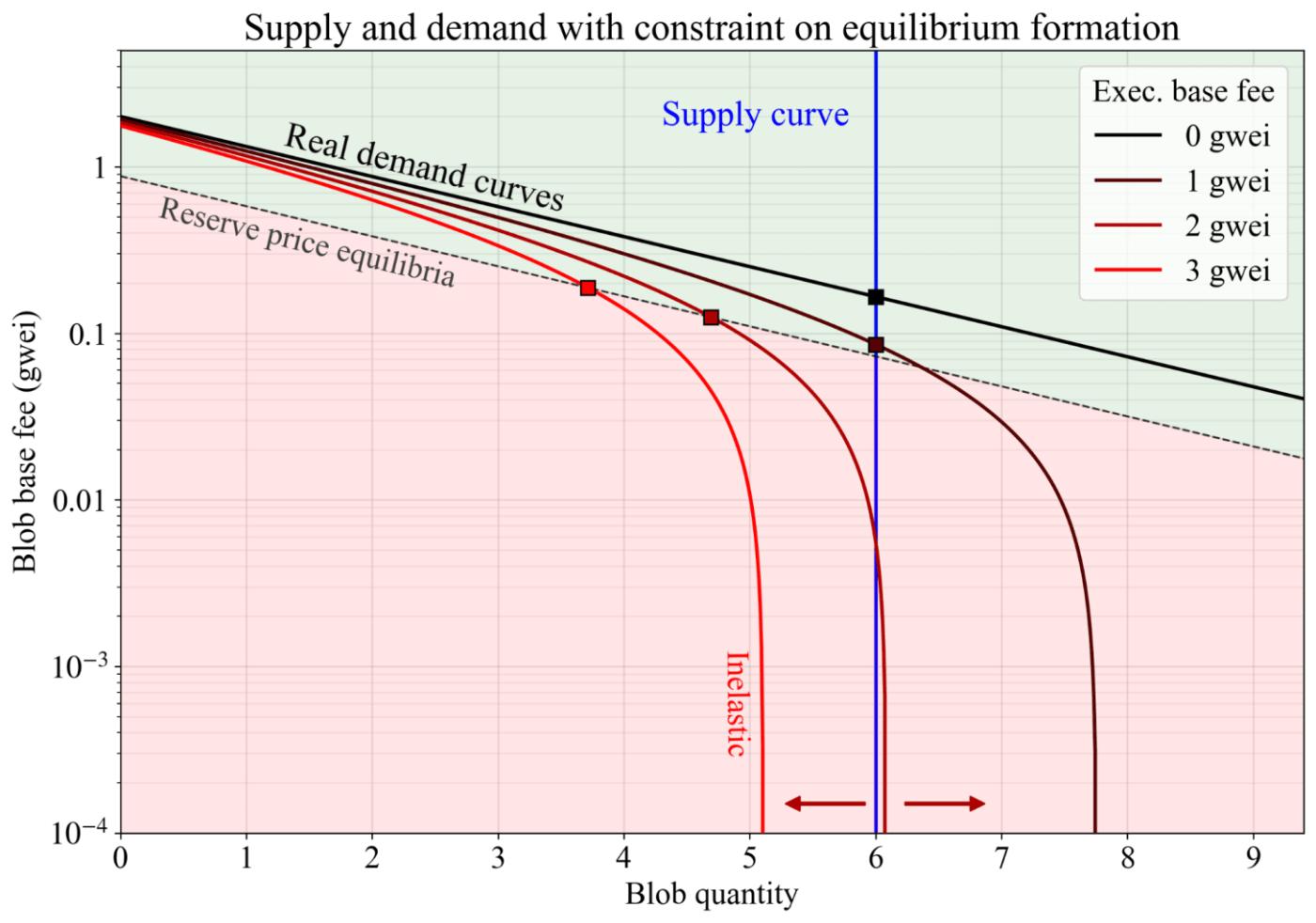

Blob Base Fee Tuning

As blob capacity expands, Ethereum’s blob fee market will play a larger role in coordinating rollup demand. Today, rollups spend almost nothing on blobs. Blob fees often remain at the minimum value of 1 wei because demand is relatively price-insensitive, and price does not always adjust smoothly to changes in usage. This causes the fee mechanism to remain in a “price-inelastic” range, limiting its ability to respond to changes in usage.

Fusaka introduces a lower bound on the blob base fee by tying it to a fraction of the L1 base fee. This prevents blob prices from collapsing to zero and keeps the fee-adjustment mechanism functioning as blobspace scales.

More stable blob pricing: prevents the fee market from getting stuck at the minimum price.

Predictable economics for rollups: ensures rollups pay a reasonable baseline for data availability without sudden or erratic fee jumps.

Minimal impact on user costs: even with the new lower bound, L2 data costs remain fractions of a cent and have negligible UX impact.

Sustainable long-term economics: compensates nodes for handling increased blob throughput, with blob fees contributing modestly to ETH burn today and potentially more over time as capacity expands.

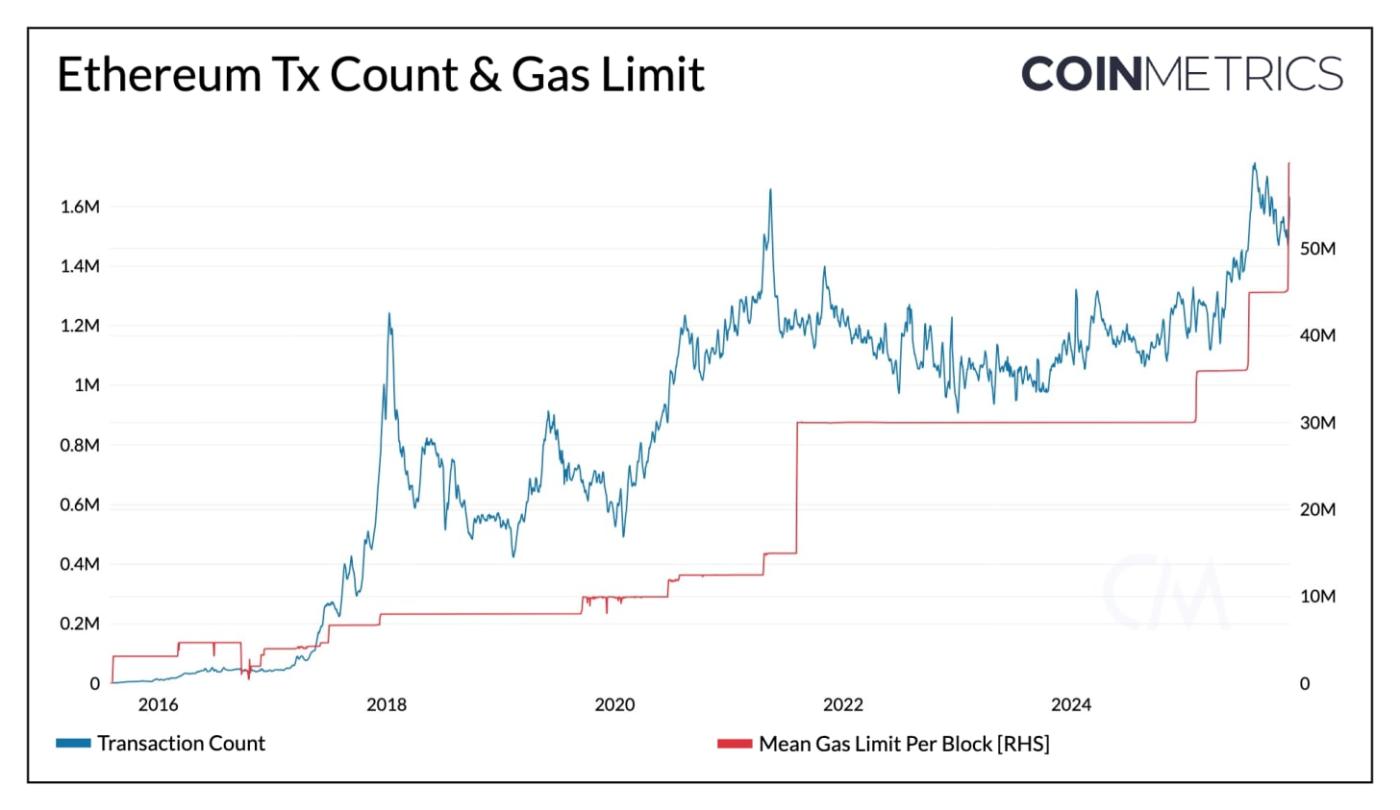

Scale L1

Fusaka also places tremendous emphasis on L1 scaling. It boosts Ethereum’s Layer-1 execution capacity through EIP-7935, which raises the protocol’s default gas limit to 60M. This directly increases the number of transactions that can fit in a block, allowing for higher throughput, less congestion and cheaper gas fees.

Source: Coin Metrics Network Data Pro

Expected Impact:

Higher throughput: More computation per block increases overall L1 capacity.

Supports more complex apps: Larger gas limit enables complex contract execution.

Less congestion under load: Extra headroom reduces congestion during demand spikes.

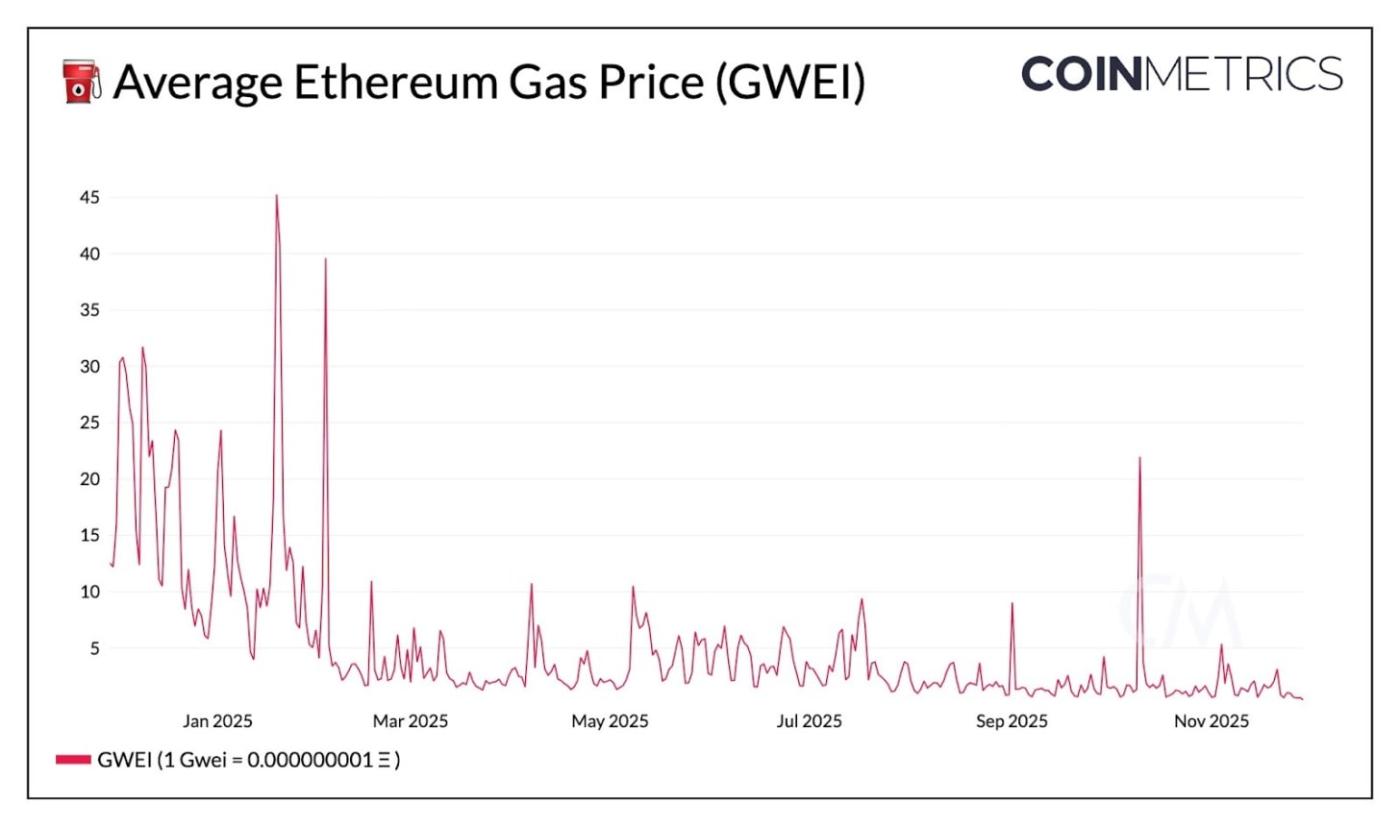

Helps keep fees low: Additional capacity supports the current low fee landscape (<0.4 gwei)

Source: Coin Metrics Network Data Pro

Beyond the gas-limit increase, Fusaka introduces refinements that make L1 execution more efficient and prepare the network for future scaling. A new cap on per-transaction gas usage prevents any single transaction from dominating a block and lays the groundwork for parallel execution. Updates to the ModExp precompile recalibrate gas costs and set clearer bounds for operations, keeping resource usage predictable as throughput grows. The networking layer is also streamlined by removing obsolete pre-merge fields, making syncing for Ethereum nodes faster and lighter.

Improve UX

Fusaka also introduces updates that improve usability for both users and developers. EIP-7951 adds native support for the secp256r1 elliptic curve, the signing standard used by Apple Secure Enclave, Android Keystore, and most consumer hardware. This allows wallets and applications to integrate familiar authentication flows (Face ID, Touch ID, WebAuthn) directly on Ethereum, reducing onboarding friction and strengthening security for both retail and institutional users.

These upgrades help modernize Ethereum’s developer and user interfaces, making it easier to build secure, mainstream-ready applications.

Conclusion

As Fusaka activates, the most immediate effects will be seen in lower rollup costs, higher blob throughput, and a meaningful expansion in L1 execution capacity. Over time, the combination of larger blobspace, lower costs, and steady improvements to L1 performance will shape the economics of L2 settlement, influence burn dynamics, and make the broader Ethereum ecosystem feel increasingly cohesive.

While the long-term value implications ultimately depend on how demand and adoption stack up, Fusaka establishes a clearer, more scalable foundation for Ethereum’s next phase of growth, one where L1 and L2 function more seamlessly together and the network becomes better positioned to support higher volumes of users, assets, and on-chain activity.

Coin Metrics Updates

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you’d like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.