Introduction

Artemis’ 2025 study estimates roughly $26T in economic stablecoin settlement for 2024 — already operating at payment-network scale. Payments, meanwhile, have functioned like a hidden tax: ~3% here, FX spread there, wire fees everywhere.

On stablecoin rails, that tax compresses toward fractions of a cent. When the cost of moving money collapses, business models rewrite themselves: platforms stop living off the swipe and start competing on value — savings, yield, liquidity, and credit.

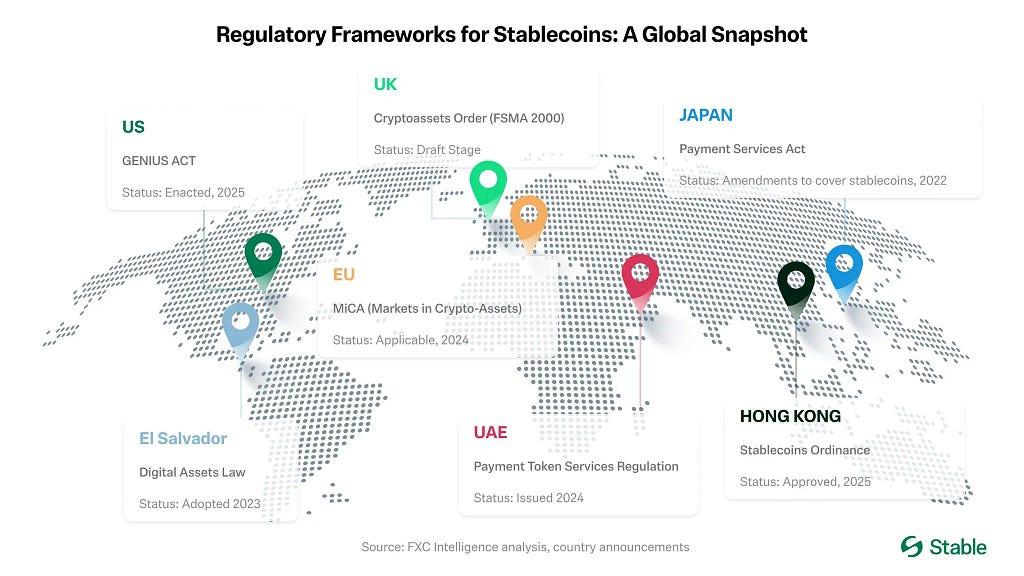

With GENIUS now law — and Hong Kong’s Stablecoin Ordinance setting a parallel regulatory playbook — banks, networks, and fintechs are moving from pilots to production. Banks are launching stablecoins or tight bank–fintech partnerships; card networks are adding stablecoins as a back-end settlement rail ; and fintechs are rolling out compliant stablecoin accounts, cross-border payouts, on-chain checkout with built-in KYC, and tax reporting. Stablecoins are moving from exchange collateral to standard payment plumbing.

The remaining gap is UX. Wallets still presume crypto literacy; fees vary by network; and users often need a volatile token just to move a dollar-pegged one. Gas-free stablecoin transfers — via sponsored fees, meta-transactions, or account abstraction — remove that friction. With predictable costs, better on/off-ramps, and uniform compliance primitives, stablecoins stop feeling like “crypto” and start behaving like money.

The Thesis. Stablecoin-centric chains already have scale and uptime. To become everyday money, they need consumer-grade UX, programmable compliance, and fee-invisible transactions. As those pieces click — especially gas-free transfers and stronger ramps — the competitive frontier shifts from charging for movement to competing on what surrounds the movement: yield, liquidity, safety, and simple, trustworthy tools.

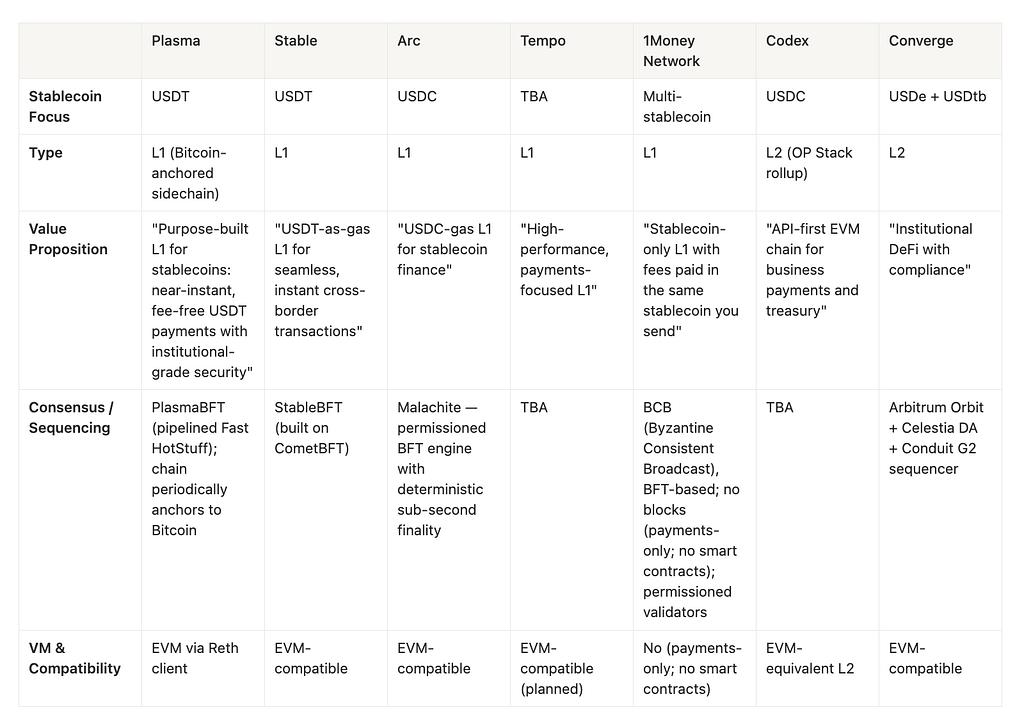

Below is a quick snapshot of standout projects leading the stablecoin / payment-chain category. In this article, I’ll focus primarily on on Plasma, Stable, and Arc — and the issuers, dynamics, and other participants behind this Stablecoin Rail Wars.

Plasma

Plasma is a purpose-built blockchain designed to be the native settlement layer for USDT, optimized for high-throughput, low-latency stablecoin payments. By late May 2025 it was in private testnet, moved to public testnet in July, and launched mainnet beta on Sept 25, 2025

Plasma was first among stablecoin/payment chains to TGE and executed a high-impact launch: strong mindshare, record day-one TVL/liquidity, and strong partnerships from the start.

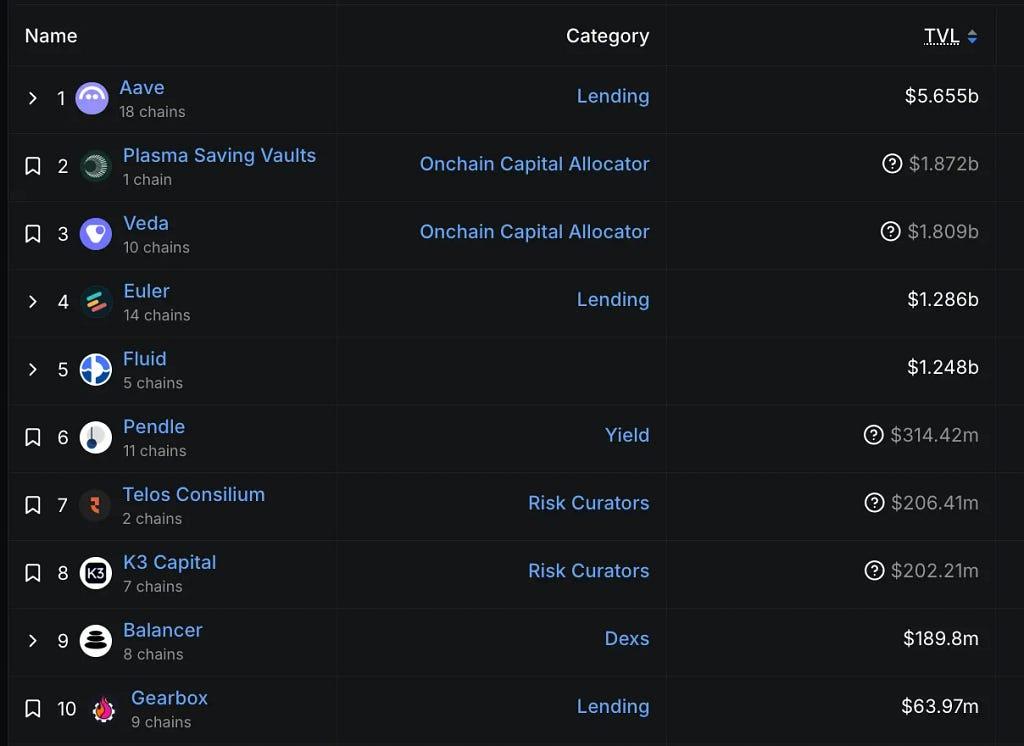

Since mainnet beta, momentum has been clear — by September 29 Aave deposits on Plasma topped $6.5B (second-largest Aave market), and by September 30 75k+ users had signed up for Plasma One. As of now, Aave on Plasma sits at $5.7B TVL per DeFiLlama — off the peak yet still #2 (vs. Ethereum $58.7B, Linea $2.3B). Traction spans Veda, Euler, Fluid, and Pendle, aided by day-one onboarding of leading DeFi projects.

There are critiques that early growth is incentive-led rather than organic. As CEO Paul has emphasized, relying on crypto-native users and incentives alone isn’t a sustainable model; the real test is forward utilization — which we shall watch closely.

GTM

Looking forward, Plasma is USDT-first. The go-to-market is emerging-markets first, aimed at emerging markets like Southeast Asia, Latin America, and the Middle East, where USDT’s network effects are already strongest and stablecoins are a must-have utility for remittances, merchant payouts, and everyday P2P. Executing that thesis means boots-on-the-ground distribution: corridor-by-corridor launches, agent networks, local onboarding, and regulatory timing. It also means drawing a clearer risk perimeter than Tron.

Plasma treats developer experience as a moat and argues that USDT needs a Circle-like developer surface. Historically Circle spent heavily to make USDC easy to build with, while Tether hasn’t, leaving a wide open gap for USDT apps if the rails are packaged correctly. Concretely, Plasma proposes APIs over the payments stack so payments devs don’t have to assemble rails themselves. Behind that single interface sit pre-integrated partners as primitives. Plasma is also pursuing confidential payments — privacy with compliance. The end-state is explicit: “make USDT very easy to build with”.

Taken together, this corridor-led GTM and API-first developer strategy converges in Plasma One — the consumer front door that operationalizes the plan for everyday users. On Sept 22, 2025, Plasma announced Plasma One, a consumer “stablecoin-native” neobank and card that brings saving, spending, earning, and sending digital dollars into a single app. The team pitches it as the missing interface for the hundreds of millions who already rely on stablecoins yet still grapple with local frictions — clunky wallets, limited cash ramps, and dependence on centralized exchanges.

Access is rolling out in stages via a waitlist. Headline features include paying from a stablecoin balance while continuing to earn yield (targeting 10%+), up to 4% cashback, instant zero-fee USDT transfers within the app, and card usage in more than 150 countries at roughly 150 million merchants.

Business model

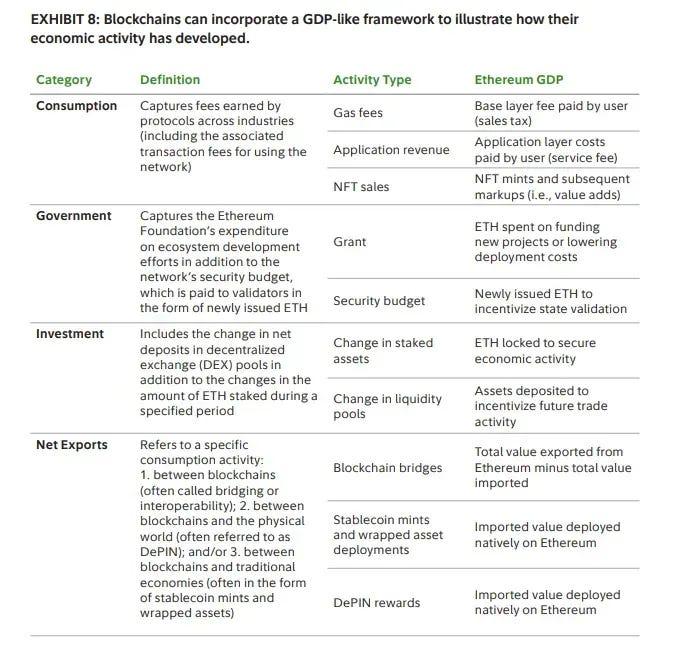

Plasma’s core pricing maximizes everyday usage while preserving economics elsewhere: simple USDT→USDT transfers are zero-fee, while everything else on-chain incurs fees. Viewed through a “blockchain GDP” lens, Plasma deliberately shifts value capture away from a per-transaction “sales tax” (gas on basic USDT transfers) toward application revenue. The DeFi layer then maps to the framework’s Investment bucket: seeding liquidity and yield markets. Net-exports still matter (USDT bridging in/out), but the center of gravity moves from consumption fees to service fees on apps and liquidity infrastructure.

For users, zero fees are not just savings; they unlock new use cases. Micro-transactions become viable when sending $5 doesn’t require a $1 fee. Remittances arrive in full rather than losing a cut to intermediaries. Merchants can accept stablecoin payments without surrendering 2–3% to invoicing/bill-pay software and card networks.

Under the hood, Plasma operates a protocol EIP-4337 paymaster that sponsors gas only for transfer() / transferFrom() calls of the official USDT on Plasma. The paymaster is pre-funded in XPL by the Plasma Foundation and uses lightweight verification to prevent abuse.

Stable

Stable is a dedicated Layer 1 stablechain optimized for payments using USDT. Built to address the inefficiencies of current infrastructure — unpredictable fees, slow settlement times, and overly complex user experiences.

Stable frame as a payments L1 “for USDT” and goes to market by partnering directly with payment service providers (PSPs), merchants, orchestrators, vendors, and neobanks. PSPs care because Stable strips out two of their biggest operational headaches: managing volatile gas tokens and absorbing transfer costs. Because many PSPs face a high technical barrier, Stable is running a “service shop” now — building integrations in-house — and will later enshrine those patterns in an SDK so PSPs can self-serve. For production guarantees, they’re introducing “enterprise block space,” a subscription for VIP inclusion at the top of blocks that gives deterministic, first-block settlement and smoother cost predictability during network congestion.

Regionally, the GTM follows existing USDT usage with APAC first — before expanding to other dominant USDT regions like LatAm and Africa.

Announced on September 29, Stable introduced a consumer app at app.stable.xyz aimed at net-new, non-DeFi users, positioned as a straightforward USDT payments wallet for everyday needs (P2P, merchants, rent) with instant settlement, gas-free peer transfers, and predictable fees paid in USDT — the app is currently waitlist-only. The Korea activation underscored early traction: Stable Pay surpassed 100,000 sign-ups captured directly at on-site booths in Korea (Sep 29).

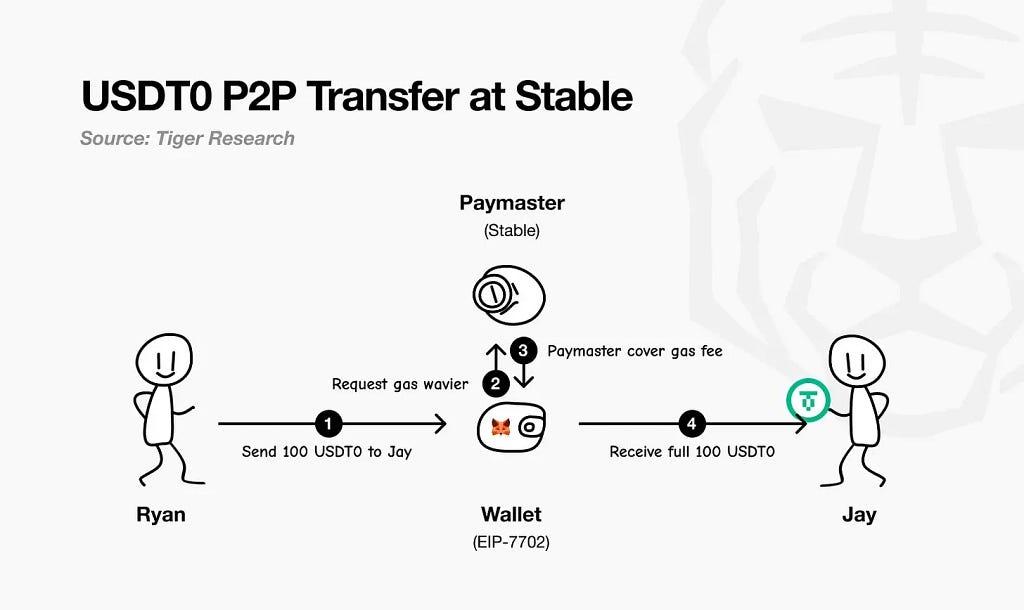

Stable enables gas-free USDT0 by using EIP-7702 to make a user’s existing wallet “smart” for the single transaction. It lets the wallet run custom logic and settle fees without any separate gas token — everything is denominated in USDT0.

As illustrated in Tiger Research’s flowchart, the sender initiates the payment; the EIP-7702 wallet requests a gas waiver from Stable’s paymaster; the paymaster sponsors and settles the network fee; and the recipient receives the full amount with no deduction. In practice, users only need to hold USDT0.

On top of this plumbing, Stable adds several differentiators: guaranteed blockspace to reserve predictable capacity and latency for enterprises; a USDT transfer aggregator that isolates and batches USDT0 transfers to maximize throughput; and forthcoming confidential transfers.

The business model puts distribution ahead of revenue in the near term, using gas-free USDT0 to win adoption and establish payment flows. Over time, monetization is expected to accrue primarily inside the consumer app, complemented by select on-chain mechanisms.

Beyond USDT, Stable sees material opportunities for other stablecoins. With PayPal Ventures invested in Stable in late September 2025. As part of that deal, Stable will support PYUSD (PayPal USD) natively, pushing distribution so PayPal users can “just use PYUSD,” with gas payable in PYUSD. PYUSD will be gas-free on Stable — extending the same operational simplicity that appeals to PSPs in USDT rails.

Architecture

Stable’s consensus stack begins with StableBFT, a customized proof-of-stake protocol built on CometBFT to deliver high throughput, low latency, and reliability. The near-term path is pragmatic — optimize a mature BFT engine — while the longer-term roadmap shifts to a DAG-based design.

Above consensus, Stable EVM stitches the chain’s capabilities into everyday developer workflows. Purpose-built precompiles let EVM smart contracts call core chain logic securely and atomically. Performance is slated to climb further with StableVM++.

Throughput also hinges on data handling. StableDB tackles the post-block storage bottleneck by separating state commitment from persistence. Finally, the high-performance RPC layer abandons a monolithic design in favor of a split-path architecture: lightweight, specialized nodes serve distinct request classes to avoid resource contention and improve tail latencies. o real-time even as chain throughput scales.

Crucially, Stable positions itself as an L1, not an L2, arguing that real-world businesses shouldn’t wait on upstream protocol changes to ship payments features. Full-stack control — validators, consensus policy, execution, data, and RPC — lets the team prioritize payments-centric guarantees while retaining EVM compatibility so developers can port existing code. The result is an EVM-compatible, payments-oriented L1.

Arc

On August 12, 2025, Circle announced that Arc — its stablecoin/payment-focused L1 — would enter private testnet in the coming weeks, launch a public testnet in fall 2025, and target a mainnet beta in 2026.

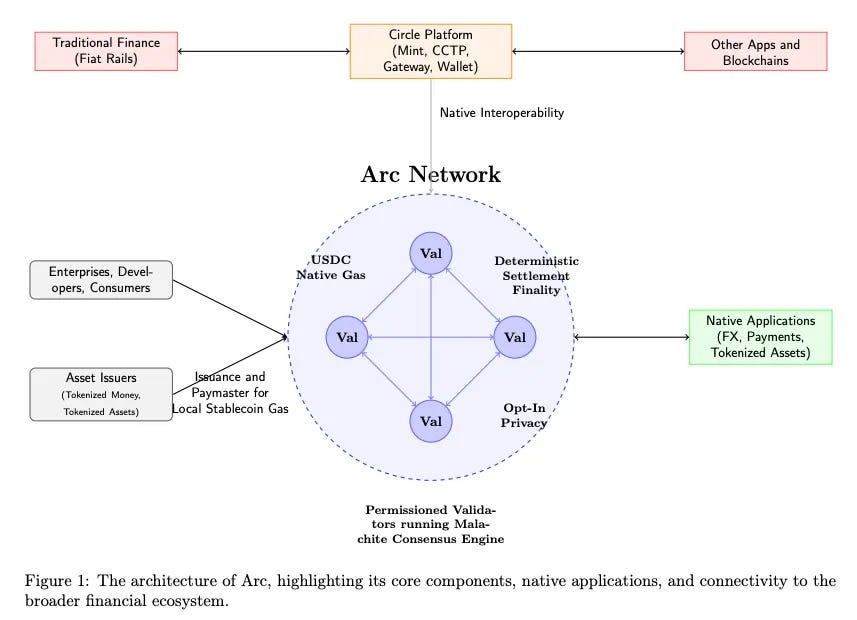

Arc has a permissioned set of validators (running the Malachite BFT engine) provides deterministic finality, fees are paid in USDC as the native gas, and an opt-in privacy layer.

It plugs directly into Circle’s platform — Mint, CCTP, Gateway, and Wallet — so value can move natively between Arc, traditional fiat rails, and other blockchains. Enterprises, developers, and consumers transact through apps on Arc (payments, FX, tokenized assets), while asset issuers can mint and act as paymasters to sponsor users’ gas.

Arc uses Malachite with a permissioned Proof-of-Authority validator set of known institutions.

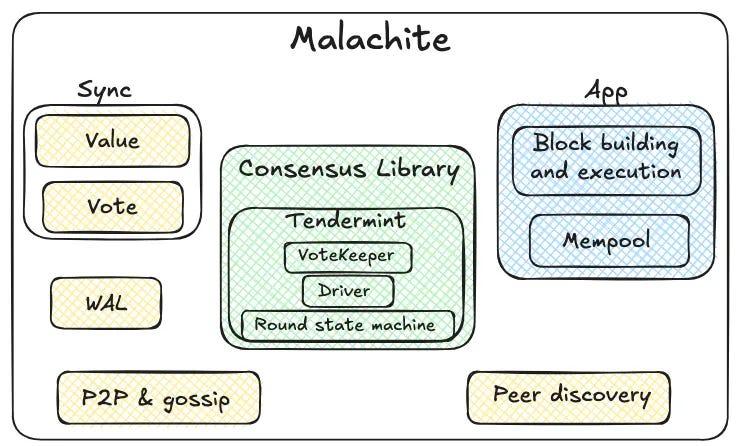

Malachite is a Byzantine-fault-tolerant consensus engine that applications embed to get strong agreement and finality across many independent nodes.

The green Consensus Library is the heart of Malachite. Inside it, the Round state machine implements Tendermint-style rounds (propose → prevote → precommit → commit). VoteKeeper aggregates votes and tracks quorums. The Driver orchestrates these rounds over time, ensuring the protocol keeps making decisions even when some nodes are slow or faulty. This library is intentionally general: it treats “values” abstractly so different kinds of applications can plug in.

Surrounding the core are reliability and networking primitives (yellow). P2P & gossip transports proposals and votes among peers; Peer discovery finds and maintains connections. WAL (write-ahead log) persists critical events locally so a node can crash and restart without violating safety. Sync has two paths — Value and Vote — so a lagging node can catch up either by fetching finalized outputs (values) or by acquiring missing intermediate votes needed to finish a decision that is in flight.

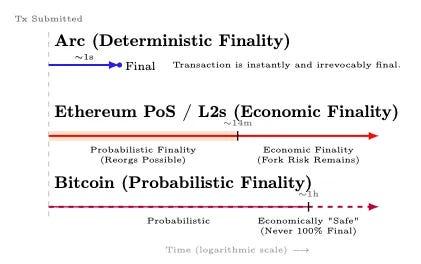

Arc offers deterministic finality in about ~1 second, where a transaction becomes instantly and irrevocably final once ≥2/3 validators commit (no reorg tail); Ethereum PoS and L2s provide economic finality after roughly ~12 minutes, progressing from an initial probabilistic period (reorgs possible) to “economically final” ; and Bitcoin exhibits probabilistic finality — confirmations accumulate over time, becoming “economically safe” around ~1 hour but never mathematically 100% final.

A transaction is either unconfirmed or 100% final ****when ≥⅔ validators commit it (no “reorg probability tail”). This aligns with PFMI (Principles for Financial Market Infrastructures) Principle 8 on clear final settlement.

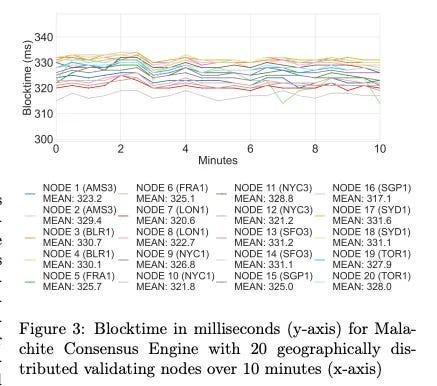

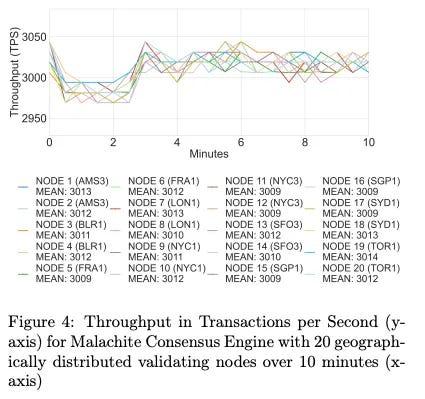

Performance wise, Arc achieved ~3,000 TPS with < 350 ms finality on 20 geographically distributed validators and >10,000 TPS and <100 ms finality on 4 geographically distributed validators.

Planned enhancements to the Malachite consensus engine include multi-proposer support, which could increase throughput by roughly 10x, and optional lower fault-tolerance configurations that can reduce latency by about 30%.

Meanwhile, Arc introduces opt-in confidential transfers designed for regulated payments: transaction amounts are hidden while addresses remain visible, and authorized parties can access values via selective-disclosure “view keys.” The aim is “privacy with auditability” — fit for banks and enterprises that need on-chain confidentiality without sacrificing compliance, reporting, or dispute resolution.

Arc’s design choices optimize for institutional predictability and tight integration with Circle’s stack — but those strengths come with trade-offs. A permissioned, PoA-style validator set concentrates governance and censorship power among known institutions, and BFT systems tend to halt rather than fork under partitions or validator failures. Critics argue Arc resembles a walled garden or consortium chain oriented toward banks rather than a credibly neutral public network.

But the trade-off is clear and reasonable for enterprise needs: banks, PSPs, and fintechs prioritize deterministic finality and auditability over maximal decentralization and permissionlessness. Over time, Circle has also indicated a path toward permissioned Proof-of-Stake, broadening participation to qualified stakers under slashing and rotation rules.

With USDC as native gas, an institutional RFQ/FX engine, deterministic sub-second finality, opt-in privacy, and deep integration across the Circle stack (CPN, Mint, Wallets, CCTP, Gateway, Paymaster), Arc packages the primitives enterprises actually need into one rail.

Stablecoin Rail Wars

Plasma, Stable, and Arc aren’t three contestants in a bake-off; they’re routes to the same promise — dollars that move like messages. Taken together, they surface the real battlegrounds: issuer blocs (USDT vs. USDC), distribution moats on incumbent chains, and permissioned rails that are reshaping enterprise expectations.

Issuer Blocs: USDT vs USDC

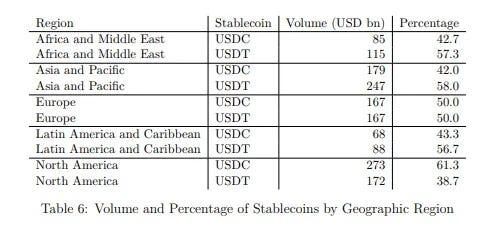

We’re watching two races at once: chain vs. chain and issuer vs. issuer. Plasma and Stable are clearly USDT-first, while Arc is Circle’s. With PayPal Ventures backing Stable, more issuers are piling in — each competing for distribution. As they do, issuers will shape these stablecoin chains’ go-to-market, target regions, ecosystem roles, and overall direction.

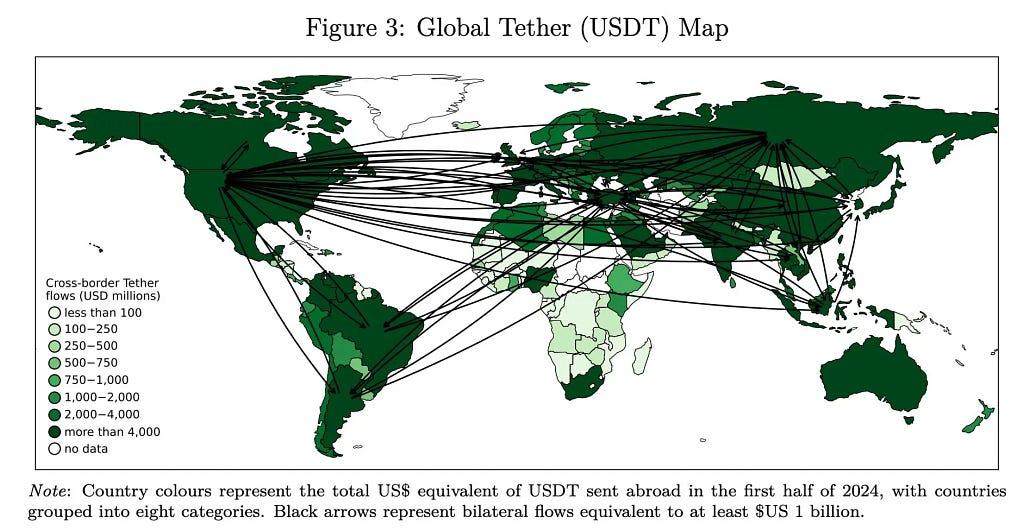

Plasma and Stable may prefer different GTM paths and initial target regions, but both should ultimately anchor where USDT already dominates. The map below shows global USDT flows in H1 2024. Darker country shading means more USDT sent abroad; black arrows mark the biggest corridors. The picture reveals a hub-and-spoke network with especially dense routes across Africa & the Middle East, Asia–Pacific, and Latin America.

We see a similar pattern in another study: Tether’s USDT appears stronger across regions with more emerging markets while Circle’s USDC is more prevalent in Europe and North America. Note that this study covers only EVM chains (Ethereum, BNB Chain, Optimism, Arbitrum, Base, Linea) and excludes TRON, where USDT usage is very large, so the real-world USDT footprint is likely understated.

Beyond regional focus, issuers’ strategic choices also reshape their role in the ecosystem — and, in turn, the priorities of stablecoin chains. Historically, Circle has built a more vertically integrated stack (wallets, payments, cross-chain), while Tether has focused on issuance/liquidity and leaned on ecosystem. That split now creates room for USDT-focused chains (e.g., Stable, Plasma) to build more of the value chain themselves. At the same time, for multi-chain expansion, USDT0 designs to unify USDT liquidity.

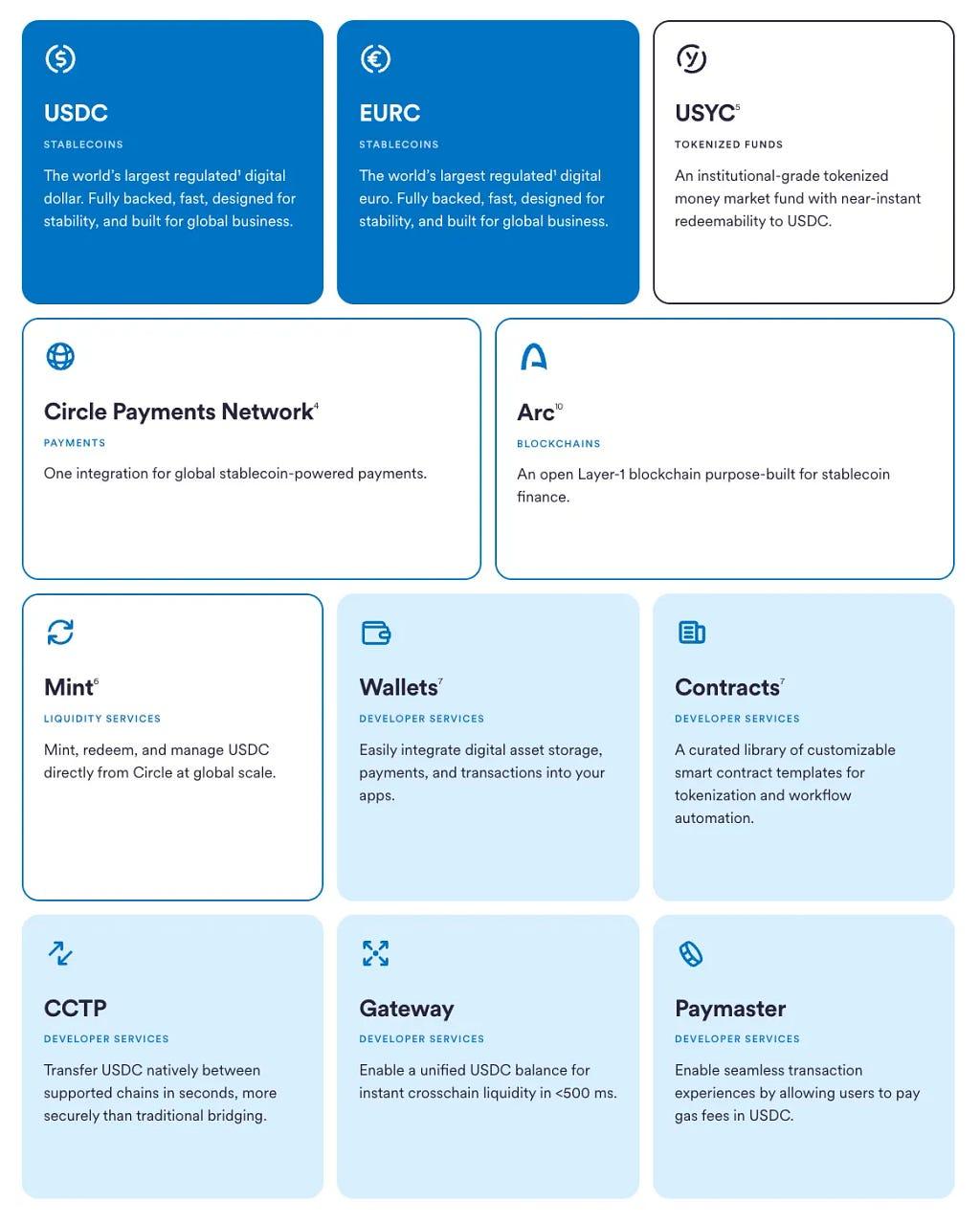

Meanwhile, Circle’s build-out has been deliberate and cumulative: it began with USDC issuance and governance, then pulled control closer by dissolving Centre and launching Programmable Wallets. Next came CCTP, shifting from bridge reliance to native burn-and-mint transfers that unify USDC liquidity across chains. With the Circle Payments Network, Circle connected on-chain value to off-chain commerc. Arc is the latest step. Flanking these pillars are issuer and developer services — Mint, Contracts, Gateway, and Paymaster (USDC-denominated gas) — which reduce third-party dependencies and tighten the feedback loop between product and distribution.

Incumbents Chains

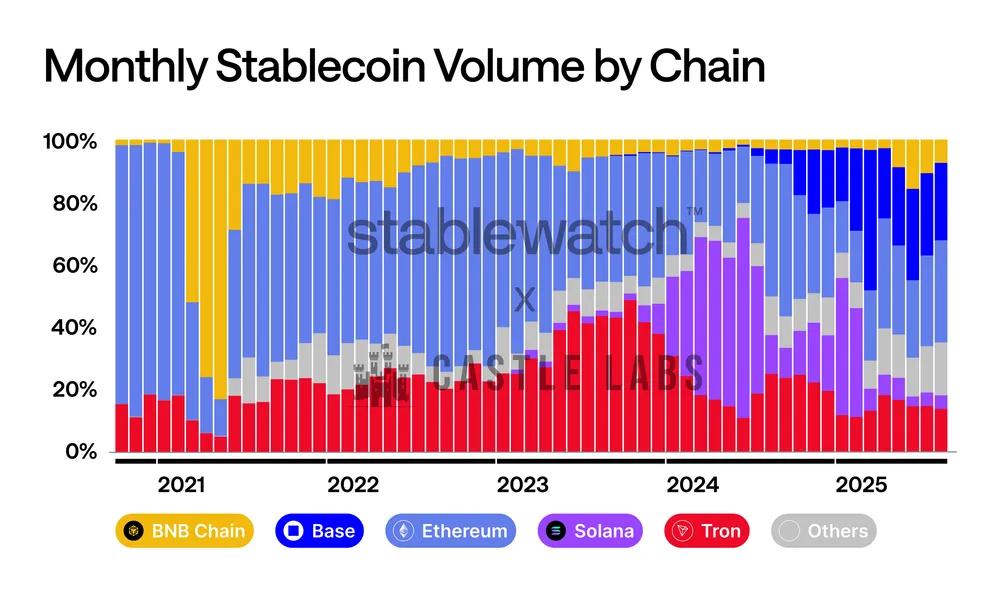

Stablecoin volume is a knife-fight and always has been. The Stablewatch chart shows the arc clearly: early dominance by Ethereum, a powerful rise by Tron, a Solana spike through 2024, and Base gathering momentum more recently. No chain holds a stable lead — even the biggest moats are contested month to month. With specialized, stablecoin-first chains entering, competition should intensify, but incumbents won’t cede share quietly; expect aggressive moves on fees, finality, wallet UX, and off-/on-ramp integrations as they battle to defend — and grow — their stablecoin volume.

At the end of Q3 2024, BNB Chain launched the “0-Fee Carnival” to promote stablecoin adoption across the network. The initiative, which was extended through Aug 31, 2025, partnered with 12 wallets, 8 centralized exchanges, and two bridges to eliminate user transaction fees.

On Tron, the direction is similar: Ideas around “gasless” stablecoin transfers were announced for a Q4 2024 rollout. Recently, Tron governance approved a cut to the network’s “energy” unit price (from 210 to 100 sun), lowering smart-contract execution costs and reinforcing TRON’s positioning as a low-fee settlement venue for stablecoins.

TON takes a different tack by hiding complexity inside the Telegram interface. In-app transfers of USDT (and TON) to contacts present as “zero fee” to the user — Telegram Wallet abstracts or absorbs costs within its closed loop — while withdrawals to the open chain still carry normal network fees.

On Ethereum L2s, the story is structural rather than promotional. The Dencun upgrade (EIP-4844) introduced blob space, slashing data availability costs for rollups and allowing them to pass substantial savings to users. Across major L2s, measured fees fell dramatically after March 2024.

Permissioned Rails

A parallel track to public chains is gathering speed: permissioned ledgers built for banks, market infrastructure, and large enterprises.

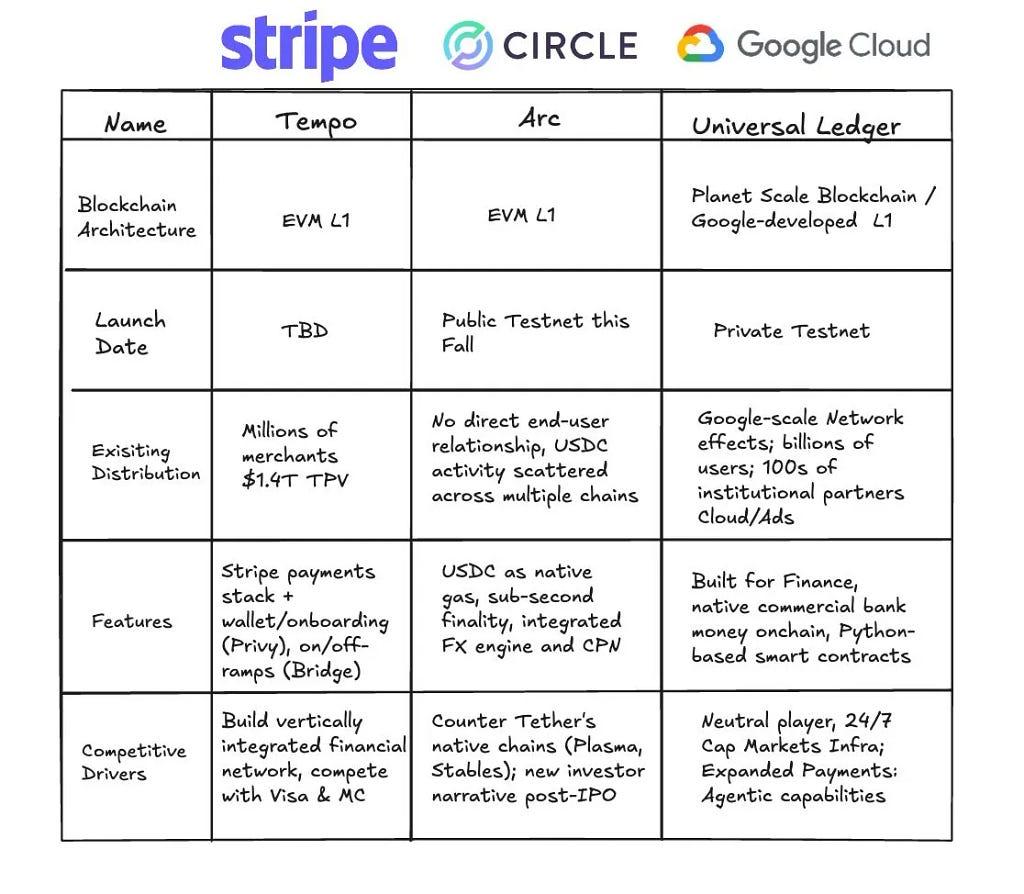

The newest — and most talked-about — entrant is Google Cloud Universal Ledger (GCUL), a permissioned Layer-1 that Google says is aimed at wholesale payments and asset tokenization. Public detail is still sparse, but Rich Widmann has framed GCUL as a neutral, bank-grade chain, and CME Group has already completed a first phase of integration and testing. GCUL is a non-EVM, Google-developed chain that runs on Google Cloud infrastructure with Python smart contracts. GCUL is far from a public blockchain as it assumes trust in Google and regulated nodes.

If GCUL is a single, cloud-operated rail, Canton Network is the “network of networks” approach. Built around Digital Asset’s Daml smart-contract stack, Canton connects separately governed applications so assets, data, and cash can synchronize across domains with fine-grained privacy and compliance controls. The participant roster spans banks, exchanges, and market operators (e.g., Goldman Sachs and Cboe).

HSBC Orion, the bank’s digital-bonds platform, has been live since 2023 and hosted the European Investment Bank’s first GBP-denominated digital bond — a £50 million issue executed using a combination of private and public blockchains under Luxembourg’s DLT framework.

On the payments side, JPM Coin has been live for institutional value transfer since 2020, supporting programmable, intraday movement of cash on J.P. Morgan-operated rails. In late 2024, the bank rebranded its blockchain and tokenization stack as Kinexys.

The through-line across these efforts is pragmatic: keep regulatory guardrails and clear governance, but borrow the best from public-chain design. Whether delivered as a cloud service (GCUL), an interoperability fabric (Canton), a productized issuance platform (Orion), or a bank-operated payments rail (JPM Coin/Kinexys), permissioned ledgers are converging on the same promise: faster, auditable settlement with institutional-grade controls.

Conclusion

Stablecoins have crossed the threshold from crypto niche to payment-network scale, and the economics that follow are profound: when moving a dollar costs ~zero, the margin for charging to move money disappears. The market’s profit center shifts to what surrounds stablecoin movement.

The relationship between stablecoin issuers and chains is increasingly an economic tug-of-war over who captures the yield on reserves. As we’ve seen from Hyperliquid’s USDH case, Hyperliquid’s stablecoin deposits throw off roughly ~$200M per year in Treasury yield that accrues to Circle, not the ecosystem. By issuing USDH and adopting Native Markets’ 50/50 split — half to HYPE buybacks via the Assistance Fund, half to ecosystem growth — Hyperliquid “internalizes” that revenue. This could be another direction beyond “stablecoin chains,” with incumbent networks embracing their own stablecoins to capture value. The durable model will be ecosystems where issuers and chains share economics.

Looking ahead, confidential stablecoin payments are set to become standard for payroll, treasury, and cross-border flows — not by going “full privacy chain,” but by hiding amounts while keeping counterparties visible and auditable. Stable, Plasma, and Arc converge on that model: enterprise-friendly privacy with selective disclosure, compliance hooks, and predictable settlement, so money can move privately when it should and transparently when it must.

We’re going to see stablecoin / payment chains roll out more features tailored for enterprise needs. Stable’s “Guaranteed Blockspace” is a prime example: a reserved-capacity lane that keeps payroll, treasury, and cross-border payments clearing with steady latency and costs even at peak demand. Like cloud reserved instances but for on-chain settlement.

And with the next generation of stablecoin/payment chains, this unlocks far more opportunities for apps. We’re already seeing strong traction across DeFi on Plasma — as well as consumer fronts like Stable Pay and Plasma One — but the bigger wave is ahead: neobanks and payment apps, agentic wallets, QR-payment tooling, on-chain credit, risk tranching, and a new class of yield-bearing stablecoins and financial products built around them.

Dollars that move like messages.

Sources

https://www.visaonchainanalytics.com/transactions

https://app.stablewatch.io/blog/stablecoin-chains

https://x.com/justinsuntron/status/1961310821541458034

https://research.kaiko.com/insights/usdc-outpaces-rivals

The Future of Finance Belongs to Stablechains

The Infrastructure Revolution: Gas-Free USDT Transfers and the Future of Digital Payments

https://docs.stable.xyz/en/introduction/technical-roadmap

https://docs.stable.xyz/en/architecture/usdt-specific-features/overview

How Stable Powers The Real-World Wallet Stack

: : Stable: A Digital Nation of USDT, by USDT, for USDT

https://dune.com/layerzero/layerzero?OFT+Analyzer+OFT+Name_e3f7ef=USDT0-USDT0

https://defillama.com/protocol/usdt0

https://layerzeroscan.com/oft/USDT0/USDT0

: : [Issue] How Stable Can Be the Next Growth Catalyst of Tether

DeFiying gravity? An empirical analysis of cross-border Bitcoin, Ether and stablecoin flows

Rich Widmann’s post: https://www.linkedin.com/posts/rich-widmann-a816a54b_all-this-talk-of-layer-1-blockchains-has-activity-7366124738848415744-7idA/

https://cloud.google.com/startup/beyond-stablecoins?hl=en

0xResearch Plasma interview: https://www.youtube.com/watch?v=8Zd_MTSFojQ

Bitfinex Plasma interview: https://www.youtube.com/watch?v=xIpw_ODiMkc

Plasma: The Stablecoin Singularity: https://x.com/Kairos_Res/status/1932453898402292171

https://testnet.plasmascan.to/

Plasma MiCA whitepaper: https://drive.google.com/file/d/1kw2CfXp0SLPGkitm6v814vmTtWOQTYBw/view

https://x.com/Tiger_Research_/status/1967950793392394457

https://x.com/PineAnalytics/status/1968074503973429388

https://x.com/rongplace/status/1968025055985606704

https://dune.com/asxn_research/plasma-vault-deposits

https://www.plasma.to/insights/introducing-plasma-one-the-one-app-for-your-money

https://6778953.fs1.hubspotusercontent-na1.net/hubfs/6778953/Arc Litepaper — 2025.pdf

https://x.com/ConorRyder/status/1975567685086744841

https://x.com/i/spaces/1zqKVdndgMpJB

https://github.com/circlefin/malachite/blob/main/ARCHITECTU

Dollars That Move Like Messages: The Stablecoin Rail Wars in 2025 was originally published in IOSG Ventures on Medium, where people are continuing the conversation by highlighting and responding to this story.