The share prices of publicly listed companies holding digital assets have continued to fall, and market confidence has continued to decline. According to data tracked by Architect Partners, the average share price of 15 digital asset holding companies fell by 15% last week.

Many of these companies went public this year, and currently more than 100 companies have included cryptocurrencies in their asset reserves, but some of them are facing the dilemma of insufficient product differentiation and high risks.

This model may be running out of steam: Digital asset holding companies are buying less Bitcoin, and the growth of total Bitcoin holdings has slowed. In addition, some investors are beginning to question whether investing in cryptocurrencies through these companies is more valuable than holding them directly.

An inevitable development?

This situation is not surprising: stock prices have soared too fast, promises have become too grand, and digital computing has become increasingly strange.

These emerging companies, publicly traded companies designed to buy cryptocurrencies and often doing little else, were supposed to offer investors a way to profit from the digital asset boom.

However, as share prices fall and market confidence wanes, the question is no longer whether the model is under pressure but increasingly how, and how quietly, it will unravel.

Even as risky assets from stocks to corporate bonds rallied ahead of an expected interest rate cut from the Federal Reserve, shares of digital asset finance companies were mired in a worsening sell-off and their tokens also tumbled.

Several DAT stock prices fell

Among the 15 DAT companies tracked by financial consulting firm Architect Partners, the average share price fell by 15% last week.

Examples abound. ALT5 Sigma Corp., which holds WLFI tokens issued by World Liberty Financial, a Trump-affiliated company, saw its stock price drop by about 50% in just over a week.

Kindly MD Inc., a healthcare provider that holds Bitcoin through its subsidiary Nakamoto Holdings, is down about 80% from its May high. Other so-called DATs tied to Ethereum and Solana have also fallen, dragging down the perceived value of the tokens on their books.

“In the U.S., there are too many of these companies and very little differentiation,” said Ed Chin, co-founder of Parataxis Capital, which recently invested in a South Korean bitcoin finance company.

Most of the more than 100 companies buying cryptocurrencies for their treasury reserves were founded this year, and many are small businesses that recently transformed overnight: they include Japanese nail salons, marijuana sellers and marketing agencies.

Still, in a sign that the frenzy hasn't completely subsided, some companies are still successfully riding the speculative wave. Eightco Holdings Inc. saw its stock surge more than 3,000% on Monday after announcing plans to buy Worldcoin and appointing Wall Street analyst Dan Ives to its board of directors.

For some, the appeal is clear: the shell of a public company offers exposure to cryptocurrencies, with potential upside leverage, wrapped in the familiar form of equity. In some cases, the model can still command a substantial premium.

But the trade is becoming crowded. Too many companies have rushed in with little to offer beyond their tokens, and as prices slide, confidence in maintaining those premiums is starting to falter.

Bitcoin hoarding by those who follow the MicroStrategy model

New data suggests the pattern may be losing momentum under its own weight: not only in market sentiment, but also in the actual pace of Bitcoin purchases.

According to CryptoQuant data, digital asset finance firms purchased only 14,800 bitcoins in August, a sharp drop from 66,000 in June. The average purchase size has also shrunk, falling to 343 bitcoins last month, an 86% drop from its 2024 peak.

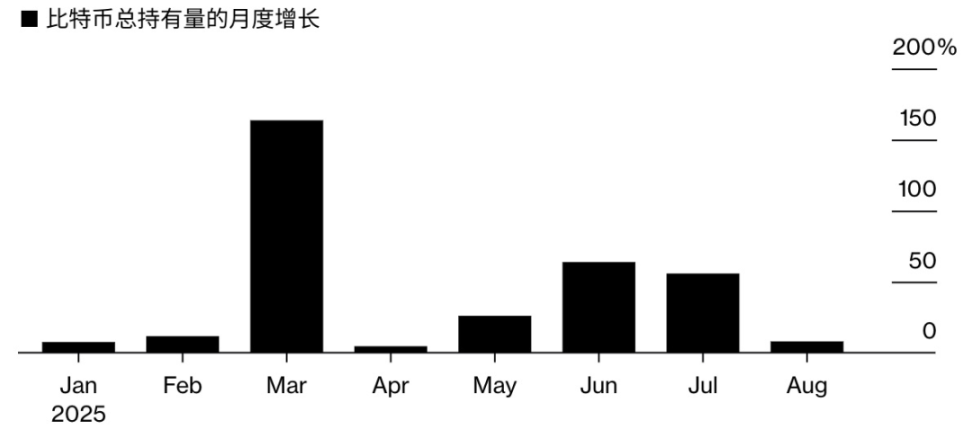

Meanwhile, the growth in total Bitcoin holdings has slowed significantly, with the accumulation rate among financial firms falling from 163% in March to just 8% in August.

In recent months, many DATs have ventured into more creative areas. Crypto lenders, brokers, and derivatives desks have created a tailor-made financing ecosystem for financial firms: Bitcoin-backed loans, token-linked convertible bonds, and structured payments.

For some, these tools offer speed and flexibility that banks can’t match. But for others, they turn the pursuit of income into a risky endeavor, adding new risks to volatile assets or forgoing upside potential for short-term gains, all within a shrinking margin of error.

Smarter Web Co., a London-based web design company that holds bitcoin, issued bonds tied to the value of the tokens rather than the British pound, meaning if bitcoin rises, so too will the amount owed to the company.

Smarter Web CEO Andrew Webley said only 5% of the company's treasury reserves are exposed to the instrument, which he believes is actually less risky than taking on fiat-denominated debt.

“If Bitcoin appreciates, as long as our stock outperforms Bitcoin, it will convert to equity,” he said. “If it goes down, we’re not overly exposed, and the worst-case scenario is we repay our debt. Our debt is denominated in Bitcoin.”

Once-troubled restaurant company DDC Enterprise Ltd. secured more than $1 billion in funding through debt, equity facilities, and shelf offerings, much of which remained unused. Its stock price plummeted after surging a few weeks ago. DDC did not respond to a request for comment.

Nasdaq's new rules

Nasdaq, where many of these companies are listed, has reportedly begun requiring some token-holding companies to seek shareholder approval before issuing new shares to finance token purchases. The stock offering model is a core way for DAT companies to raise funds without taking on debt.

Two of the best-known DAT companies, Strategy and its Japanese counterpart Metaplanet Inc., have seen their share prices plummet recently after booming over the past year, showing that even market leaders are not immune to shifting sentiment.

Some in the industry have begun discussing potential consolidation, particularly if weaker players continue to struggle and stronger ones begin to view their peers’ token holdings as acquisition targets.

Strategy failed to be included in the S&P 500 in Friday’s index rebalancing despite meeting the eligibility criteria. Its stock price has been largely stagnant since April, even as Bitcoin has rebounded, reducing its Bitcoin market capitalization multiple, known as mNAV, to about 1.5.

The Rise and Fall of MicroStrategy's mNAV Premium

Cryptocurrency lenders have also noticed the growing demand for flexible financing.

Two Prime, which offers bitcoin-backed loans, is one firm that has seen an uptick in interest from DATs, according to CEO Alexander Blume. The firm typically underwrites loans between $10 million and $500 million and currently has $1.25 billion in active outstanding loans.

It recently introduced a fixed-payment structure at maturity that eliminates the monthly interest obligation, a design designed to give borrowers more breathing room in volatile markets.

“Bitcoin finance companies are a growing area for us,” Blume said. “Over the past year, we’ve seen deals get bigger and bigger.”

Whether this new funding ecosystem will sustain the model or simply delay its demise is unclear.

For now, the next phase may not be a dramatic collapse, but rather a slow fade, with stock prices gradually declining and token purchases stagnating.

Some investors struggle to comprehend all this. Why buy cryptocurrency through a company fraught with expenses, risk, and equity dilution, rather than owning the tokens directly or through an ETF?

“I’ve been trying to convince myself to buy some of these DATs,” said Travis Kling, chief investment officer at Ikigai Asset Management. “I haven’t done it yet. I probably never will.”

To him, the whole setup feels like "the last gasp of a cycle that couldn't come up with anything more stupid."